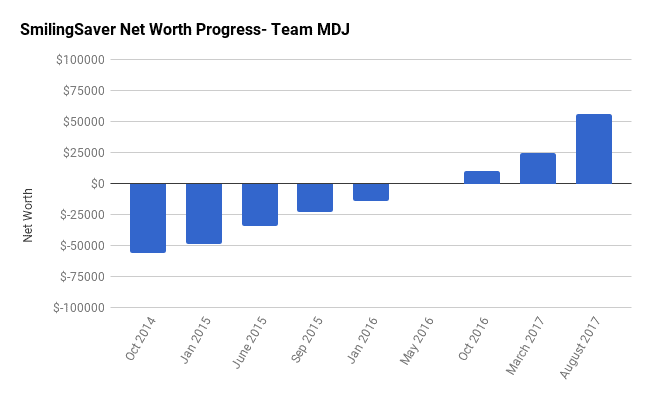

Net Worth Update August 2017 – SmilingSaver (+121%)

Welcome to the Million Dollar Journey August 2017 Net Worth Update – Team MDJ edition. A select group of readers were selected to be part of Team MDJ which was conceived after the million dollar net worth milestone was achieved in June 2014. SmilingSaver was selected as a team member and will post net worth updates on a regular basis. Here is more about him.

Profile:

- Name: SmilingSaver

- Age: 31

- Net Worth: $56,043

- Day Job: Engineer

- Family Income: My main salary: $95,000; Spouse salary: $ 45,000 (Full time)

- Goals: New Goal: Have Net Worth equal to the value of the primary residence Oct 2021.

- Notes: Married in May 2015. Wife graduated from school with a second degree in May 2015. Immigrated to Canada 16 years ago (full story here). Debt free May 2016.

Hello Everyone,

Well, I finally know what DINK feels like (Dual Income No Kids) which is working out well financially as we are able to put aside quite a bit of our income. Other than that, it is just a “chugging along” update. Since the big move as described a previous update, our car now rarely leaves our garage. We found a local urban market on our way to and from work. With a small detour, we can get fresh produce every day (or every second day) using our backpacks. That leaves us with one car trip to the Super store once every two weeks, and a trip to Costco once every 4-6 weeks.

Relocating to the west coast of Canada has had a number of benefits, one of them being that trips that would have cost a lot, are now way cheaper. In a short period of time, my wife and I have seen Whistler (and area), Vancouver Island and Seattle; all on a budget. This doesn’t include all the walking and biking we are doing in Vancouver to learn more about this city.

As to financials:

Big thanks to Matt’s comment on my previous update:

March 27, 2017, 2:27 pm

I was able to close down the LIRA account and transfer the funds to my RRSP. So we now have two RRSP accounts, one is “my” RRSP the other one is a “spousal” RRSP. The split is to get 25k in each account for first time home buyers. However, with the crazy home prices in Vancouver, I really don’t know if I will ever be able to afford a place in this city. Moreover, I don’t see a reason to jump to owning a place with the rent to buy ratio over 25. From what I read, around 10 is when one should start considering buying a property.

Now to the actual numbers:

Assets: $56,043 (+124.1%)

- Cash: $5,443 (+19.4%)

- Registered/Retirement Investment Accounts (RRSP): $27,860 (+1101.16%)

- Tax Free Savings Accounts (TFSA) : $22,740 (+25.4%)

Liabilities: $0 (0.0%)

- We do not have any liabilities: $0.0 (0.00%)

Total Net Worth: $56,043 (vs. $25,012.42 ) (+124%)

Some quick notes and explanations to common questions:

The Cash

Quick change: Now that my wife is working and no longer is a “student” we have to keep $3,000 in her checking account with the remainder kept in Tangerine Savings Account. It includes money that will be required for rent, cell phones, insurance, and minor emergencies.

Savings

- $22,740 in TFSA – Invested in Tangerine Balanced Growth Funds (check your TFSA contribution room).

- $27,860 both Questrade RRSP accounts (my thoughts on Questrade), invested in the basic 3 stocks couch potato index portfolio.

Well done! Good move on not buying in Vancouver. It’s only for people who like massive debt.

Great job of boosting your net worth! I can see that you are definitely hustling things to make things happen step by step!

Cheers!

BSR

Dear Smiling,

Congratulations on all you’ve accomplished and saved in such a short period of time. Looking forward to following you along on your journey.

Thank you so much for letting me know about the ability to transfer my $7K LIRA to my RRSP. I’m assuming that I don’t need any room in my RRSP to do so. One thing that I was told was that at 55 (and not 65), I could withdraw the money out of my LIRA (since it’s low value). I imagine if I transfer it to my RRSP that this will no longer be valid. While not required, it would be nice to generate a low/tax-free income from that money as early as possible.

Besos, Sarah.

Congrats on the increase in your net worth. With the sky high housing price in Vancouver and Toronto, it’s understandable to be more cautious when it comes to buying your first home. However, in terms of asset allocation, I still believe that diversifying them between real estate and the stock market is a prudent thing to do.

I started in pretty much the same place as you a bit more than 10 years ago and decided to buy a first home to help me develop the discipline to save when I own a home. When I built up enough equity in my home, I use the Smith Manoeuvre to diversify my assets into the stock market. So keep your investment options open and take advantage when you have the opportunity to increase your assets and net worth.

You should be able to move the LIRA funds into an RRSP because its under $10,000. Which should be easier down the road should you needs funds, and especially if there are account minimum fees.