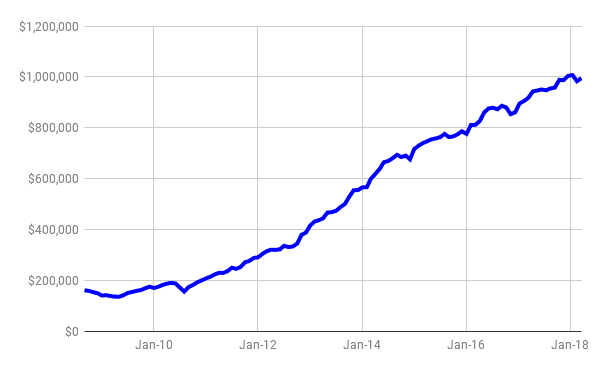

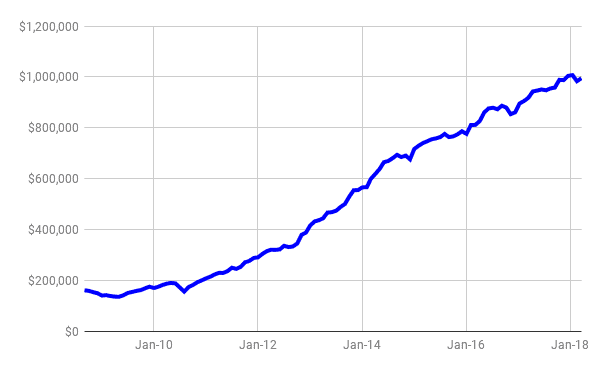

Net Worth Update March 2018 – Nobleea the Oil and Gas Engineer (+4.2%) ($995,244)

Welcome to the Million Dollar Journey March 2018 Net Worth Update – Team MDJ edition. A select group of readers were selected to be part of Team MDJ which was conceived after the million dollar net worth milestone was achieved in June 2014. Nobleea – the Oil and Gas Engineer, was selected as a team member and will post net worth updates on a quarterly basis. Here is more about Nobleea.

- Name: Nobleea

- Age: 39

- Net Worth: $995,244

- Day Job: Engineering manager at oilfield services company, Teacher (wife)

- Family Income: $135,000 (main job), $10,000 (part time job), $80,000 (wife main job)

- Goals: Million dollar family net worth before 40, Retirement from primary job at 50 (for me)

We live in Edmonton where incomes are decent and housing prices are fairly reasonable. Some may roll their eyes at the high family income and say that a million dollar journey is going to be pretty easy. I have a plan to retire at 50 and pursue other interests. My wife will likely continue working until it makes sense to retire with her DB pension as the penalties for early retirement are pretty severe.

Our 2017 bonus will get paid out in the next few months. It’s 20% of salary and was fairly unexpected given how tight things were at the company last year.

My wife returned to her job from maternity leave in September and is enjoying it. We ended up having to get a nanny for one day a week due to scheduling changes with the grandparents. We received the pension buyback offer for her maternity leave. It was 11K but after calculating return to get the incremental pension income it came with, we decided against it. We’ll take a look at the price again if interest rates continue to go up and/or if we end up needing a third maternity leave. There was a drop in the commuted value of her pension plan due to increasing interest rates which resulted in a non-cash hit to the NW.

We started an RESP for our son as soon as we could. Combined, the two kids have a total RESP balance of about $22,000 although the value is not included below. It is invested in TD e-series. Our oldest is 4 and youngest is 16 months. When the balance exceeds $30,000, we will move it to a self-directed brokerage to save on fees.

We rent out our garage suite to a great tenant. They are just starting their PhD at the university, so that could be up to 4 years of a high quality, steady tenant. The suite and house are designed such that we never really see each other, so there’s privacy for everyone. They have indicated they want to renew their lease in May when it is due and we’ll gladly oblige.

As mentioned in our last update, we’ve embarked on our first residential infill project. It’s something that I’ve always wanted to do and we’ve been planning on doing for a couple years now. Since the last update, we split and sold the lots to our builder in 2017, crystallizing some of the gains for that tax year. One of the houses has already been pre-sold with possession in May. The other will go on the market in April – hopefully for a late summer close.

We wanted to try this project to see what was involved, how much, if any, money we could make and how hard it would be. We for sure made/will make money, though not as much as I was planning on. I learned a lot, enjoyed the process and will certainly do it again in 2018. The net worth numbers below include an amount for infill equity which includes the cash we have in the project and the prorated profit from the house that has been already presold. I am actively looking for a new lot to start the process again.

The housing market is still ok here, we never saw a huge run-up like other cities, and despite what is heard about the oil industry, employment here is still pretty stable. As this is a first-time project for us (our partner has done this successfully many times), I am keeping track of hours spent on it as well as expenses by date in order to generate a true XIRR of our investment (how to calculate XIRR with excel) and hourly rate of my time. The lot sale was done as a partnership with me and my wife and we’ve set up a corporation to deal with things going forward.

In May 2009, when we started tracking net worth in earnest, the value was $136,377.

Net worth numbers (Quarter/Quarter):

Assets: $1,763,692 (+3.7%)

- Cash: $6,846

- Registered/Retirement Investment Accounts (RRSP): $244,439

- Non-Registered Accounts: $84,398

- Tax Free Savings Accounts (TFSA): $0 (0%)

- Defined Benefit Pension: $210,700

- Principal Residence: $1,130,000 (N/C)

Home Maintenance Account: $4,374- Infill Project Equity: $44,500

- Vehicles/Other: $38,330

Liabilities: $768,448

- Mortgage: $727,554

- Credit Cards: $12,402

Total Net Worth: $995,244 (+4.2%)

Some quick notes and explanations to common questions:

The Cash

Cash includes bank account balances in two accounts, plus any gift card balances. We use cash flow modeling to predict the maximum amount we can put towards debt/investments today without having a negative balance in the future, taking all one time or non-regular bills into account.

Loans and Credit Cards

The credit cards are paid off in full every month with no interest due. We put all our expenses on credit cards for cash back. As this can be a substantial amount some months, I believe it needs to have a line item in your monthly net worth as it is a liability at that snapshot in time. The large CC amounts are mostly for expenses related to the infill project.

Savings

TFSA’s will need to be replenished over the next 5 years. We cleared out the non-registered account for the downpayment on the teardown property. We are going to start putting $1,000 a month back into this in April.

Real Estate

We moved into our new build in July 2016 and have completed all landscaping. We have a 1BR suite located above our detached garage that is rented out.

Hello MDJ,

Just recently returned from a business trip to Edmonton. There is a good reason why the salaries are high there. Although with the main industry booming, i guess there will be scope for improvement/wage rise.

Do you honestly believe that with the kids you can retire in 10 years time, even if you double your net worth.

I am glad that you are not going crazy to be ultra frugal and counting pennies to reach your goals faster. What do you need credit cards, may I ask?

Hi Nobleea,

Nice to see a superb progress.

There are lots of parallels between yours and myne. I’m a little younger and earn less than you, and have only one child. My wife is also a public servant earning similar income as your spouse.

We’re also building a new home in South West Edmonton, for around $900K.

Where is your current home that’s worth over $1M? Very few properties, in Edmonton, are worth that much unless you have a rather large home!

We’re near Bonnie Doon. There are lots of newer places in central hoods that would surpass 1M and even 2M or 3M. Strathearn, Bonnie Doon, Crestwood, Parkview, Glenora, Laurier, Windsor Park, Belgravia, Grandview, a few areas around mill creek.

It’s not a super large home, about 2500 SF, but it’s on a 1/4ac lot, which is unheard of that close to downtown, and has a triple garage with a garage suite above.

What a small world, as you might be close to where we (currently) are!

We’re on 89th street, walking distance to Rutherford School.

That’s true, lots of homes are being demolished and some super nice homes are being built in our area.

So close, you must be very excited!

I was surprised about the credit card amount (my exact reaction is: Whoa, people spend $12K a month on credit cards and pay it off every month?) and then saw that it was related to the infill project.

Yes, I would guess our normal monthly bill would be in the 3-4K range.

There are some charges for the infill, and well as some charges on corporation set up, and new business initial inventory purchases.

Did you incorporate the house asset gain into the graph ?

Yes, it’s baked in to our net worth. We haven’t really added much asset gain in either of the houses we’ve owned. The first one the asset value was just increased by the amount of the renos we did. This ended up being extremely close to our final sell price, maybe under by 10K. The current house I’ve just put down our purchase price and haven’t inflated it. It’s a unique property – there’s nicer houses in the neighbourhood, but we have the best lot for sure. Honestly we could net anywhere from 950K to 1.3M on a sale and it would be impossible to tell how much until we actually list. There are no comparables.

Congrats on almost reaching the big “1M”! Thanks for the updates, they’re always fun to read. I’m wondering if you keep a breakdown of how your net worth is made up. I.e. which percentage comes from savings vs. market return etc. be it in equity investments or on your property(ies). I started tracking my own net worth about 3 years ago and to be honest I haven’t really put much effort into separating return vs. my own high savings rate. I’m thinking of it but not sure if it’s worth the extra hassle….

No, I don’t know the breakdown, though I could probably figure it out if necessary. I know the long term XIRR of most of our investments (save the DB pension plan, but I think that is listed in the annual summaries).

If I had to guess, I would say 20% of the growth is from market/asset gains with the rest being savings. The ratio will change over time until it is 100% coming from market gains when one is well in to retirement.

Nobleea,

How often to calculate your Net Worth total, and what program(s) do you use?

The graph provided appears to provide more than monthly updates.

– JC

I calculate it every month. The gridlines on the chart are every 2 years, so there would be 24 data points between each gridline.

I put together my own spreadsheet to track net worth.