Financial Freedom Update Nov 2021 – Big Dividend Raises Edition

Welcome to the Million Dollar Journey November 2021 Financial Freedom Update – Big Dividend Raises Edition! If you would like to follow my whole financial journey, you can get my updates sent directly to your email, via Twitter and/or Facebook.

For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point where they are enough to cover our family expenses.

Here is a little more detail on our passive income goals:

How it all started – Original Financial Goal

Our current annual recurring expenses are in the $52-$54k range (after-tax), but that’s without vacation costs (and no mortgage payments). However, while travel is important to us, it is something that we consider discretionary (and frankly, a luxury). If money ever becomes tight, we could cut vacation for the year. In light of this, our ultimate goal for passive income is to have enough to cover recurring expenses, and for business (or other active) income to cover luxuries such as travel, savings for a new/used car, and simply extra cash flow.

Major Financial Goal: To generate $60,000/year (after-tax) in passive income by end of the year 2020 (age 41).

Reaching this goal would mean that my family (2 adults and 2 children) could live comfortably without relying on full-time salaries (we are currently a one-income family). At that point, I would have the choice to leave full-time work and allow me to focus my efforts on other interests, hobbies, and entrepreneurial pursuits.

Achieving Financial Freedom: I’m happy to report that we reached financial independence in 2020 – a little ahead of schedule. While the goal now is to continue building and reinvesting those dividends within the portfolio I’m finding that as the years go by, more focus is being put on indexing. Having said that, I haven’t sold any dividend positions in favour of index ETFs… yet.

Financial Independence Update – November 2021

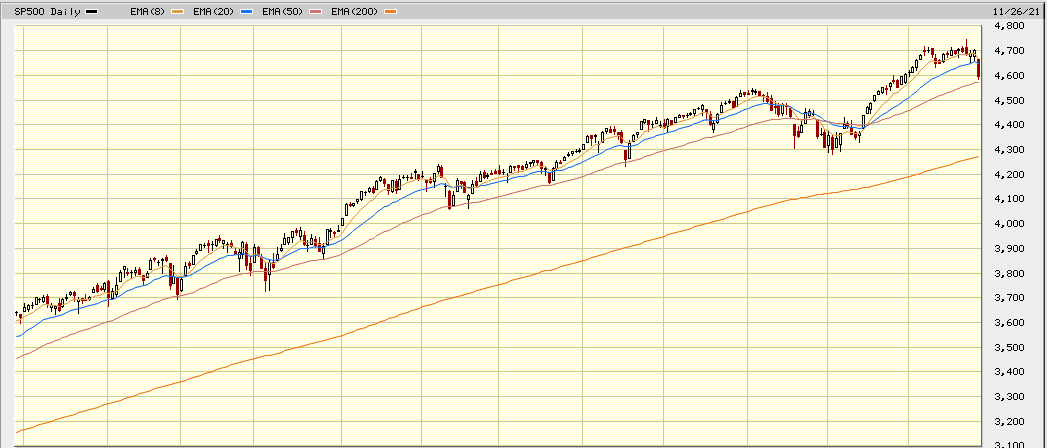

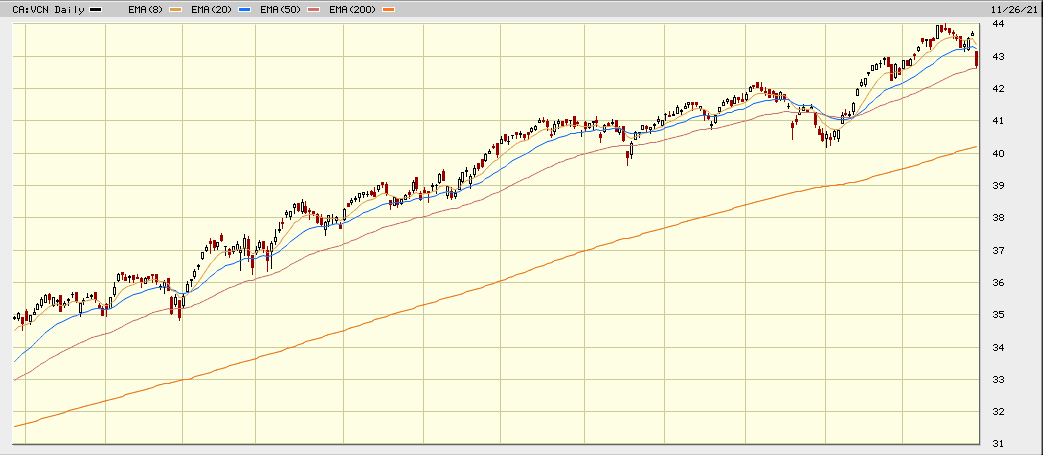

Here we go again, it’s like groundhog day where equity markets continue to make all-time highs which have been the theme of 2021. The S&P500 (an index of the largest 500 companies in the US) was floating around 4500 in the previous update a couple of months ago. This time around, while there has been a recent dip in the market (the new COVID strain being the catalyst), it now floats around 4,600 as of this post.

Not including dividends, the S&P500 has advanced about 23% and the TSX about 22% in 2021 thus far. While the extreme market returns are great for portfolio growth, it would be healthy for the markets to take a bit of a break – especially for investors still in the early days of accumulation.

As you may know already, while I stay invested through thick and thin, I’m always a little cautious over a prolonged bull market. So I still expect that we’ll get some sort of pull-back to the long-term moving average in the coming months. Perhaps it has already started?

As I’ve mentioned in many other updates, I like to buy quality dividend companies (and indexes) when their valuations are attractive. In other words, when they are being sold off (ie. dip). You can see some of my favourite Canadian dividend stocks here.

Thus far in 2021, I have deployed capital into the following Canadian dividend positions:

- Waste Connections (WCN)

- Brookfield Infrastructure (BIP.UN/BIPC)

- Algonquin Power & Utilities (AQN)

- Canadian National Railway (CNR)

- Brookfield Renewable (BEPC)

- Telus (T)

The goal of the dividend growth strategy is to pick strong companies with a long track record of dividend increases. This past quarter has been big for dividend increases (see stocks in bold below) and that doesn’t include the coming increases from the big banks!

2021 Dividend Raises

So far in 2021, the Canadian portion of my portfolio received raises from:

- CU.TO (1% increase)

- MRU.TO (11.1% increase)

- CNR.TO (7% increase)

- XTC.TO (5.3% increase)

- BIP.UN/BIPC (5.2% increase)

- MG.TO (7.5% increase)

- CNQ.TO (11% increase)

- NTR.TO (2% increase)

- BCE.TO (5% increase)

- TRP.TO (7.4% increase)

- ENGH.TO (18.5% increase)

- AQN.TO (10% increase)

- T.TO (5% increase)

- H.TO (5% increase)

- EMP.TO (15% increase)

- FTT.TO (10% increase)

- WN.TO (9% increase)

- L.TO (9% increase)

- CPX.TO (6.8% increase)

- NWC.TO (2.8% increase)

- WCN.TO (12% increase)

- POW.TO (10.6% increase)

- EMA.TO (4% increase)

- FTS.TO (5.9% increase)

- SLF.TO (20% increase)

- MFC.TO (18% increase)

- GWO.TO (12% increase)

- SU.TO (100% increase)

- CNQ.TO (25% increase)

Top 10 Holdings

Our top 10 holdings move around quite a bit. This time around, with the continued strength of the big banks, they are holding top spots in my dividend portfolio.

In our overall portfolio, here are the current top 10 largest dividend holdings:

- TD Bank (TD)

- Canadian National Railway (CNR)

- CIBC (CM)

- Bank of Montreal (BMO)

- Royal Bank (RY)

- Scotia Bank (BNS)

- Brookfield Infrastructure (BIPC/BIP.UN)

- Fortis (FTS)

- Emera (EMA)

- Enbridge (ENB)

*not counting index ETFs (they are my largest holding).

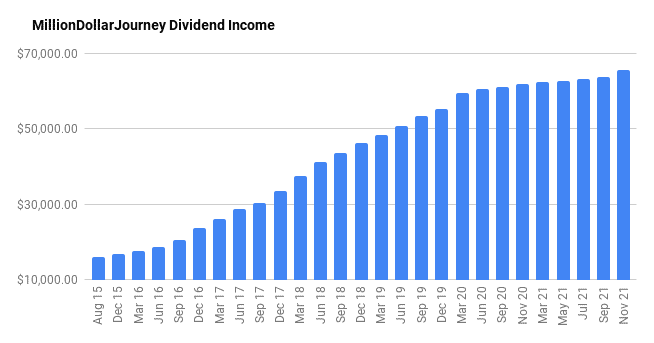

Dividend Income Update

As mentioned, there have been a number of healthy dividend increases and we managed to deploy some capital into dividend stocks. I look forward to the next update that will include big bank dividend increases!

As you can see in the chart below, even without the big bank dividend increases, we have increased our forward annual dividend income to $65,450! One of the larger reported increases in quite a while! Given enough time for portfolios to compound, slow and steady does work!

The dividends are counted from all of my accounts including non-registered (leveraged and non-leveraged), RRSPs, corporate account, and TFSAs.

Final Thoughts

Another market update in a manic bull market and to top it off, this time with robust dividend increases! With OSFI releasing the reigns on financial stocks, three large insurers have already had big increases (MFC, GWO, SLF), so I’m looking forward to what the banks will offer.

I’ve noticed that other dividend investors/bloggers are comparing their dividend income to a comparable income/hr. Depending on taxation in your area, in ON, $65.5k in dividend income is about equivalent to an $88.5k salary, which is about $44.25/hr. Not a bad way to psychologically frame passive income.

To put dividend income in further context, I wrote a post about withdrawing from your RRSP or TFSA where, with no other income in retirement, you can make up to $50k in dividend income (within a taxable investment account) and pay very little to no income tax (depending on the province).

If you are also interested in the dividend growth strategy, here is a post on how to build a dividend portfolio. With this list, you’ll get a general idea of the names that I’ve been adding to my portfolios.

If you want a simpler investing strategy that outperforms most mutual funds out there, check out my post on the best all-in-one ETFs in Canada. I’m a fan of indexing as the iShares XAW is my top individual holding.

Keep investing that cash flow and stick with a long-term plan. Your future wealthier self (sooner than you think!) will thank you for it.

Depending on taxation in your area, in ON, $65.5k in dividend income is about equivalent to an $88.5k salary. How do you calculate this?

Just want to thank you for all of your work – From a long-time reader.