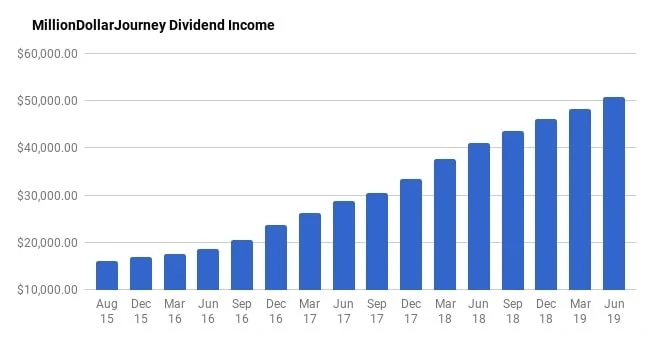

Financial Freedom Update (Q2) – June 2019 ($50,660 in Dividend Income)!

Welcome to the Million Dollar Journey June 2019 (Q2) Financial Freedom Update – the second update of 2019! If you would like to follow my latest financial journey, you can get my updates sent directly to your email, via Twitter or Facebook, and/or you can sign up for the monthly Million Dollar Journey Newsletter.

For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point where they are enough to cover our family expenses. That is, our goal is to reach $60,000 in passive income by the end of 2020 (getting close now!).

Here is a little more detail on how we came about the $60k per year in passive income:

Financial Goals

Our current annual recurring expenses are in the $52-$54k range, but that’s without vacation costs. However, while travel is important to us, it is something that we consider discretionary (and frankly, a luxury). If money ever becomes tight, we could cut vacation for the year. In light of this, our ultimate goal for passive income to be have enough to cover recurring expenses, and for business (or other active) income to cover luxuries such as travel, savings for a new/used car, and simply extra cash flow.

Major Financial Goal: To generate $60,000/year in passive income by end of year 2020 (age 41).

Reaching this goal would mean that my family (2 adults and 2 children) could live comfortably without relying on full time salaries (we are currently an one income family). At that point, I would have the choice to leave full time work and allow me to focus my efforts on other interests, hobbies, and entrepreneurial pursuits.

Previous Update

In the Q1 2019 update, we made some solid progress surpassing $48k in dividend income. I talked a little about the “cross-over point” which is the point at which your passive income grows enough to meet (or just about exceed) your recurring monthly/annual expenses. In essence, it’s the point where you reach financial independence or FIRE (financial independence/retire early).

It’s been quite the journey, but with annual expenses in the $52 to $54k range, we are getting very close to our cross-over point. While I don’t plan on retiring quite this early, it’s a reassuring financial backup plan if something were to happen that impacted our main income stream (ie. losing my job, poor health etc). It’s like being self-insured against financial risk.

Here is a summary of the last update:

March(Q1) 2019 Dividend Income Update

| Account | Dividends/year | Yield |

| SM Portfolio | $7,500 | 3.96% |

| TFSA 1 | $3,500 | 4.54% |

| TFSA 2 | $3,600 | 5.03% |

| Non-Registered | $3,300 | 4.42% |

| Corporate Portfolio | $20,600 | 3.73% |

| RRSP 1 | $7,000 | 2.75% |

| RRSP 2 | $2,700 | 2.37% |

- Total Invested: $1,332,522

- Total Yield: 3.62%

- Total Dividends: $48,200/year (+4.56%)

Current Update

Following the volatility in 2018, this year has been on a bull run thus far. While a bull market is great for net worth numbers, it also means it’s more expensive to buy quality dividend stocks.

Personally, I like to buy quality dividend companies when their valuations are attractive. In other words, when they are being sold off (ie. dip). In this quarter, I deployed capital into some of the following positions:

- iShares MSCI All Country World ex-Canada (XAW)

- Finning International Inc. (FTT)

- Suncor (SU)

- Scotia Bank (BNS)

- TD Bank (TD)

As dividends are the main focus of my passive income pursuit, there is a large dependence on the market. While there are merits to this investment strategy, there are also substantial risks – particularly dividend cuts.

In 2019 thus far, there have been significant cuts in two of my positions, SNC Lavalin (SNC) and Dorel Industries (DII.B). Fortunately, these were smaller positions within my overall portfolio.

The goal of the dividend growth strategy is to pick strong companies with a long track record of dividend increases. In terms of dividend increases, this year has proven to be lucrative for dividend growth investors.

So far in 2019, the Canadian portion of my portfolio has received raises from:

- CU.TO (7.5% increase)

- RCI.B (4% increase)

- MRU.TO (11% increase)

- CNR.TO (18% increase)

- XTC.TO (6% increase)

- BIP.UN (7% increase)

- BCE.TO (5% increase)

- SU.TO (17% increase)

- GWO.TO (6% increase)

- TRP.TO (8.7% increase)

- RY.TO (4.1% increase)

- MG (11% increase)

- BNS.TO (2.4% increase)

- CAR.UN (3.8% increase)

- TD.TO (10% increase)

- CM.TO (2.9% increase)

- ATD.B (25% increase)

- PWF.TO (5% increase)

- L.TO (6.8% increase)

- CP.TO (27.5% increase)

- WN.TO (1.9% increase)

- T.TO (3.2% increase)

- H.TO (5.0% increase)

- SLF.TO (5% increase)

- NTR.TO (12.5% increase)

- BMO.TO (3% increase)

While growth in dividends from buying has been ongoing this year, dividend raises have really made the difference resulting in over $1,100 in additional dividend income. The best part is getting these raises without having to do anything! To put this in context, an extra $1k in dividend income is like buying $25k worth of dividend stocks that pay a 4% dividend.

I must admit that there is great comfort in seeing dividends coming in on a consistent basis and even more gratifying in seeing a company raise their dividends.

Most of the new purchases were made in my corporate account which generates the bulk of the dividend income. For those looking for an update on my wife’s dividend account (represented as the non-registered portfolio in the table) which follows the Dogs of the TSX strategy, there has been very little change but you can see a full update here.

With this strategy, you typically buy the highest yielding blue chip stocks on the TSX (removing old income trusts) and ride it out for the year. The portfolio (another account with Questrade), generates a consistent dividend and is currently producing $3,360/year.

In our overall portfolio, here are the current top 10 largest holdings (besides cash):

- Emera (EMA);

- TransCanada Corp (TRP);

- Fortis (FTS);

- Bell Canada (BCE);

- Canadian Utilities (CU);

- Enbridge (ENB);

- iShares Core MSCI All Country World ex Canada Index ETF (XAW);

- Bank of Nova Scotia (BNS);

- Royal Bank (RY); and,

- Telus (T).

As you can see in detail below, over the last quarter we have increased our dividend income from $48.2k to $50.6k which represents a 5.10% increase quarter over quarter and within 84% of my goal ($60k) and 1.5 years to go. Here are the details.

June (Q2) 2019 Dividend Income Update

| Account | Dividends/year | Yield |

| SM Portfolio | $7,650 | 4.00% |

| TFSA 1 | $3,650 | 4.65% |

| TFSA 2 | $3,850 | 5.09% |

| Non-Registered | $3,360 | 4.42% |

| Corporate Portfolio | $22,300 | 3.78% |

| RRSP 1 | $7,100 | 2.71% |

| RRSP 2 | $2,750 | 2.35% |

- Total Invested: $1,390,022

- Total Yield: 3.64%

- Total Dividends: $50,660/year (+5.10%)

Through a combination of deploying cash and collecting those juicy dividend increases, this quarter has been fairly productive with a 5.10% bump in dividend income.

Not only do I enjoy watching the dividends flow into the account, I’m also a big believer in compounding returns. In other words, the dividend cash is deployed into more income-producing stocks which then further increases the income of the portfolio, which is then used to buy even more stock. See how compounding works? It’s only a matter of time before the snowball gains momentum and develops a mind of its own.

I welcome corrections/volatility as it gives investors in the accumulation phase a chance to buy quality companies (or index ETFs) at better prices, potentially increasing long-term returns.

If you are also interested in the dividend growth strategy, here is a post on how to build a dividend portfolio. With this list, you’ll get a general idea of the names that I’ve been adding to my portfolios.

If you want a simpler investing strategy that outperforms most mutual funds out there, check out my top ways to index a portfolio.

There you have it, halfway through 2019, and on track to hitting our cross-over point before the end of the year. I’m reading lots of opinions on a market correction (even a recession!?) in the next couple of years, and all I can say it bring it on! Pre-retirement investors should welcome corrections as an opportunity to build that long-term portfolio at lower prices and higher dividends.

FT , this is amazing post ! Thank you very much for sharing. Me and my wife we are in our late 20s. We finally paid all our student loans and starting to save money investing. My question is , how does your corporate acct work ? Did you incorporate yourself ? As of March 22nd, 2020. The Curtis definitely a great place to buy . Shall we wait it out a bit ? What’s your recommendation on this ? Thank you again !

man.. this is really great website to learn and so much contents! thanks for all these valuable information

Hi, excellent article and congrats on getting to this point in your journey.

I’m trying to decide between going with an asset allocation ETF like VBAL/VGRO/VEQT (in my RRSP/ TFSA) or similar ETFs from iShare or BMO vs going with a portfolio mainly focused on a dividend growth approach/ maximizing passive income via dividends; either with individuals funds or a collection of ETFs like VDY, etc. My question is how does dividend income from asset allocation ETFs (or split couch potato models with broad based Cad, US, global equity ETFs + self rebalancing) compare with approach focused on funds with high dividend yields- the latter approach is appealing to me with compounding advantages, stability of dividends during potential market downturns, etc. I guess I don’t quite grasp how a funds like VBAL or XGRO work to cover expenses during retirement compared to purely focusing on dividends as means of passive income to cover ones expenses. With asset allocation ETFs, do you have to sell some equity and realize capitals gains + use dividends derived from these funds to then draw a salary?

Thanks in advance!

HI MS, the traditional approach to retirement is to build your portfolio and withdraw a combination of dividends and capital (by selling assets). When selling assets, the ideal goal is to keep the portfolio sustainable by withdrawing no more than 4% per year. You can withdraw a fixed 4% every year, but then you are exposed to a sequence of returns risk. https://milliondollarjourney.com/the-biggest-risk-of-super-early-retirement-fire-sequence-of-returns.htm

Hi. Just found your website. Very interesting. I have a couple of questions. In one of your articles you say you are looking for stocks with dividends of 2 to 2.5 percent yet your dividend average is significantly higher in all your accounts. How is this accomplished? Question 2. Your portfolio holdings seem to be primarily in Canada. Given the small percentage of the world market Canada represents aren’t you worried about home bias? What percentage of your total holdings are in Canada? Finally can you recommend a good piece of software to track portfolios?

Thanks.

Hi Todd,

When I screen for stocks, I like dividend stocks with yields above 2.5%, and generally, in Canada, most of the strong dividend payers are well above that. I do have a slight home bias, in my personal portfolio, I am about 37% Canada. Definitely room for improvement. To track my portfolio, I use an Excel/Google spreadsheet.

How do i buy,(1 time purchase) 5,000 to 10,000 units of an all in 1 etf(vbal,xgro,xbal, etc.) when the trading volume appears to be 20,000 shares per day?market or limit order?

Definitely limit order Michael. A big bid like that all at once could move the price. You might want to spread it out over a couple of days as well.

Great list of stocks.

As an aside it appears in essence you’ve reached the average Canadian salary with just your dividend income. Puts things in perspective…amazing job!

“The team at Statistics Canada release regular updates on hourly the wages for occupations across the country. According to their latest numbers (January 2018), the average Canadian salary is $26.83/hour or $55,806.40 a year”

Thanks for the perspective Jared, we are fortunate indeed.

Hi FT, Thanks a lot for the great articles. I am planning to relocate to ON in two years – from a place where no tax on everything except salary, rental income and profit. I have been working so hard to study how I can leverage my net worth for my early retirement (mid 40). Now that I know 50K of actual eligible dividend can be tax-free, I will start spending more time studying the corporations listed in Canada (I used to invest in Asia Pacific markets and US market). I have subscribed to the newsletter. Thanks once again. SY

All the best SY and let us know if you have any questions.

Amazing ! You must have great discipline. Congratulations!

On your original post in 2017 on how to build such portfolio, you have listed some funds/ETFs sector wise.

I appreciate if you can update it annually. (if required).

Thank you

Thanks for the kind feedback MJ! Just reviewed that post in 2017 (https://milliondollarjourney.com/how-to-build-a-dividend-growth-portfolio.htm) and not much has changed from a Canadian perspective. At this point, for US exposure, I think investors are better off indexing with either XUU (cad) or VTI (USD).

Thanks GYM! I enjoy writing these updates as it gives me a chance to catch up on my tracking. What is your criteria before you add or start a new position?

Amazing!!! So inspiring to see your numbers and graphs. Thanks for sharing.

You’ll hit your crossover point in no time.. probably next quarter.

I bought some SU as well. Sucks about SNC I have that as well.