Investing In Gold In Canada 2026

As one might expect in a market pullback (and geopolitical crisis) we’re getting many requests about how to invest in gold in Canada, as well as how to invest in commodities (which we covered not so long ago).

The awkward truth is that while you’d think this would be gold’s time to shine (see what I did there) investing in gold – through a gold ETF or by purchasing physical gold – is not proving as profitable as one might assume during a market downturn.

In this article we’ll give you all the details on why people invest in gold, the different ways you can add gold to your portfolio – and why it may actually not be the best choice after all.

Why Invest In Gold?

The theory behind investing in gold is that the precious metal has simply been the most consistently valuable means of payment/savings for several millennia.

That long-term value hold, plus the concept of scarcity, (there is only so much of it that can ever be created) gives gold its perceived value. Historically, when people are scared away from other types of investments (stocks, cash, bonds, etc) they often turn to owning gold. This means that people usually invest in gold for the following reasons:

1) They believe it will go up in value. In other words – they are speculating that they can sell it for more than they paid for it.

2) They’re pessimistic about the investment returns for any asset, and they hope that since gold has held value for so long, it will continue to do so no matter what. They’ll buy gold for now, and if other assets look better later on (when things have “calmed down”) then they can always sell it and move on.

All cards on the table, I’m not a huge fan of either one of these theories, and definitely prefer Canadian dividend stocks or keeping it super simple with a Canadian all-in-one ETF if you’re building wealth for the long term.

How to Invest in Gold in Canada

There are several different ways to invest in gold in Canada: buy physical gold (there are two ways to do this), invest in gold company shares, invest in gold ETFs, or invest in gold futures.

1. Buy physical gold from banks or the Royal Canadian Mint

The old school way to buy Gold is to actually purchase physical bars of gold bullion and/or gold coins. Canadian banks, the Royal Canadian Mint, or a variety of private retailers can facilitate these purchases if you’re so inclined – but a word of caution here: Possessing your own physical gold can be quite risky as it’s impossible to track if it’s ever stolen from you.

A quick search reveals that as of mid-August, 2023, buying a 1 oz gold bar from the Royal Canadian Mint (via TD) will cost you $2,690.96. You can buy this gold bar online from the TD website and pick it up at any TD branch, or have it shipped to you in Canada for free.

You can also purchase gold coins from The Royal Canadian Mint – and some of them are actually usable money (although I’ve never tried paying at the grocery store with one before, and I don’t know why you would when a “10 dollar” gold coin costs almost $300).

It should be pointed out that while a gold bar is theoretically useful in the event of a complete global meltdown (and I’m still not sure about this one), in the meantime, it will be much harder to buy and sell than a Gold ETF would be.

2. Buy gold Exchange Traded Receipts (ETRs) or Precious Metal Certificates

If you want to own some actual gold but don’t want to invest in, say, a state-of-the-art home security system, you can purchase a precious metal certificate from big banks such as RBC, CIBC, or Scotiabank. These certificates are basically title deeds for precious metals. They prove that you own a certain amount of gold, but it’s stored securely by the bank.

The Royal Canadian Mint offers Exchange Traded Receipts (ETRs) which are similar to precious metal certificates, but can be traded on the Toronto Stock Exchange (Royal Canadian Mint CDN Gold Reserves, ticker symbol MNT).

3. Invest in gold company shares

If you’re less interested in being able to get your hands on actual bullion and more interested in general investing, you could consider buying gold company shares. These come in two varieties: mining company shares and royalty company shares. Royalty companies provide mining companies with the financial backing they need in order to build a mine and extract a gold deposit.

The Toronto Stock Exchange (TSX) is home to many gold companies including Franco Nevada Corp (FNV), Barrick Gold Corp (ABX), Agnico Eagle Mines Ltd (AEM), Kirkland Lake Gold (KL), and Kinross Gold Corp (K). You can find a gold company in our best Canadian mining stocks article.

Just remember that while the value of these gold companies will obviously be somewhat dependent on the price of gold, they are individual companies at the end of the day. They come with unique costs, assets, management, etc. Consequently their future profits might prove to be quite different from one another.

4. Invest in gold ETFs

The easiest way to invest in gold in Canada is definitely to buy a Canadian Gold ETF. Several Gold ETFs are free to trade with our favourite online brokerage, Qtrade. Read our Qtrade review or sign up by clicking the button below:

The Best Gold ETFs in Canada

The easiest way to invest in Gold in Canada is through the Horizons Gold ETF (HUG).

This is because HUG is absolutely free to buy and sell through Qtrade. To compare pricing on ETF trades, options, and other types of investing, checkout our Best Online Brokers in Canada Comparison.

HUG gives you exposure to our favourite shiny metal through gold futures contracts (sometimes referred to as “paper gold”). These futures contracts track the price of gold, through the Solactive Gold Front Month Rolling Futures Index. My favourite part is the 0.29% MER – quite low for a Gold ETF.

Some other gold ETFs that you might want to compare:

The IShares S&P/TSX Global Gold Index ETF (XGD) is Canada’s largest gold miner’s ETF and gets indirect exposure to gold through investing in the shares of gold mining companies. These companies have underlying fundamentals that can be valued, and usually pay out some form of dividend. Consequently, some investors prefer this structure to the bullion- or futures-based gold ETFs. Its MER is 0.61%.

The BMO Equal Weight Global Gold Index ETF (ZGD) is another gold miner’s ETF, but this one tracks a broader index and has more non-Canadian content. If you buy units of ZGD you’ll be investing in companies from South Africa to Brazil, as well as Canada. This fund is noteworthy because it automatically reinvests companies’ dividends (as opposed to XGD which pays them out). Its MER is 0.60%.

The IShares Gold Bullion ETF (CGL) is our final Gold ETF pick, and it represents the most direct way to invest in gold, as it actually holds physical gold bullion. It also has an MER of 0.55%.In case you are curious, none of these are featured in our list of the top 45 ETFs in Canada. We do recommend HUG if you specifically want to invest in gold, but if your goal is to maximize returns – there are better choices on the market.

5. Invest in Gold Futures

Advanced investors could also consider investing in gold futures or options. If you choose to invest in this way, what you’re essentially doing is placing a bet on the future price of gold. While both gold options and gold futures are derivatives, gold options can give the investor more flexibility.

You can explore options or futures by opening a margin account with your online broker. However, you can save yourself some headaches by simply investing in the Horizons Gold ETF, which tracks the performance of the Solactive Gold Front Month MD Rolling Futures Index ER.

Is Buying Gold a Good Investment?

Gold has not been a good investment in the past.

This goes against the sort of “common sense wisdom” that many people have passed along over the years.

The numbers just don’t lie though.

Stock market historian Jeremey Siegel’s research has proven that a dollar invested in gold back in 1802 would be worth about $100 today.

Wow – a 10,000% return you might think – that’s pretty spectacular.

Here’s the thing though – that same dollar invested in the US stock market would have grown to roughly $35 Million Dollars today!

It turns out that gold might be ok at storing value over the long term. Some market historians will make the interesting claim that adjusted for inflation, gold will purchase the same amount of goods today that it did two thousand years ago.

The problem is that it doesn’t do much. It just sits there looking shiny.

Companies make profits, pay dividends, own physical assets, invent new more productive technologies, and generally are really good (as a group) at building value.

That’s enough to retain value, but not enough to build value.

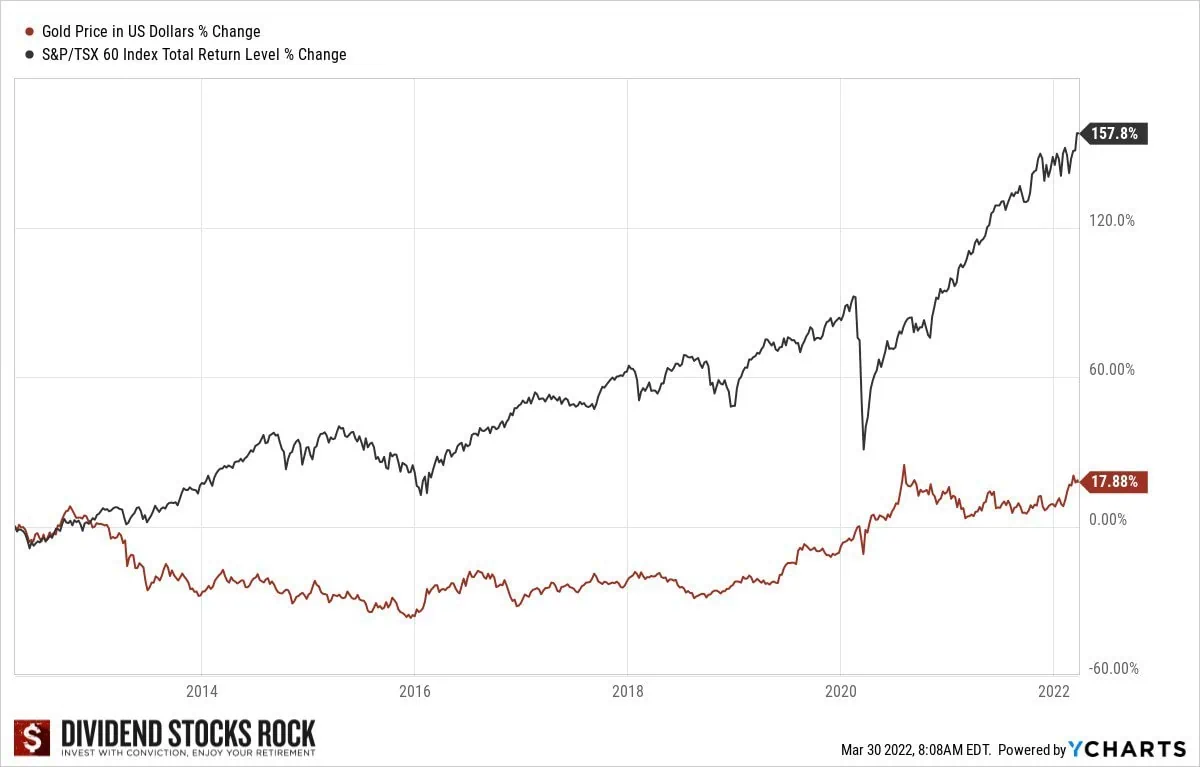

Here’s how gold has done versus the average in the Canadian stock market – and remember, this includes the juicy dividend payments that our Canadian dividend kings churn out year after year.

Gold Investing FAQ

Should I Invest In Gold Today?

Gold may be one of the oldest investing tools still in circulation, but it’s certainly not the best or most reliable. Even its one redeeming investment quality – its ability to store value – is quickly losing steam. In fact, folks that advocate for buying bitcoin are using the exact same arguments that gold bugs have been using to argue for investing in gold for years! Those arguments just don’t hold up.

While gold is likely to retain some value over time, the fact is that a solid investment portfolio has vastly more growth potential in the long run. Our official verdict: you’re better off taking a look at the other low-risk investments available in Canada. Gold may glitter, but low-risk investments with guaranteed profits outshine it every time.

I kind of expected more from MDJ on this article. They figured out that gold is a store of value, not an investment, but didn’t complete the intellectual journey. If you are hedging against a bear market there are other (better) options. Gold is for “very bad case scenarios,” but it doesn’t have to be a global meltdown. What about runaway inflation and the stock market suspends trading? In this case you want physical gold. What about a localized war/rebellion? If you have no access to your online accounts, 10 oz of gold in your pocket as you walk across a couple borders is a much better safety net than an etf somewhere.

What if your PM seizes your bank accounts because they decided (after the fact) the political cause you supported was the wrong one?

Two of these scenarios sound far-fetched and they are perhaps unlikely in Canada, but we do share the artic circle with a country who has a reputation for invading neighbors! Gold (and silver) can be traded for local currency in nearly every country in the world. I don’t advocate having a lot, but ask yourself “if my currency was worthless and my family had to start over with the clothes on my back wouldn’t it be great to even have just $5k in precious metals?” or “If I lost access to my online accounts for x period of time, what do I need to not suffer to much?”