bitcoin in Canada 2026: Should I Buy bitcoin?

We’ve had hundreds of Canadians email us or comment, “Should I buy Bitcoin?” throughout the latter part of 2020 and the beginning of 2021, and then over time it sort of dwindled out. The most recent hike in price, bolstered by American old-new President Trump, has sent Bitcoin’s price to more than $120,000, and has reignited the curiosity of Canadians.

Why is bitcoin and Other Crypto-Assets Soaring?

Following Trump’s victory, Bitcoin’s price experienced a substantial increase, surpassing USD $90,000 for the first time. This surge is attributed to investor optimism regarding the potential for more favorable cryptocurrency regulations under the new administration. With President Trump’s campaign promises to make the U.S. a “crypto capital” and establish a national Bitcoin stockpile, investors anticipate clearer regulations and increased institutional investment in the sector. This yielded a 35% increase since the November 5 election date.

In a notable development, President Trump announced the creation of the “Department of Government Efficiency” (DOGE), to be led by Elon Musk and Vivek Ramaswamy. This announcement led to a significant surge in Dogecoin’s value, with the cryptocurrency trading at 42 cents and reaching a market capitalization of nearly $60 billion. Since the beginning of the year, Dogecoin has surged by 353% and increased 106% since Trump’s election victory. It should be noted that this new government department has no actual connection to any sort of cryptocurrency.

That makes very little sense for traditional investors like myself, but I can see why people are drawn into the concept that the world’s richest and now probably strongest man on earth is pumping a particular lower-cap asset. Many adrenaline-fuelled speculators believe this rally will continue at least until the end of 2024.

In this article I’ll share my views on the cryptocurrency market, whether this should be a part of your portfolio, and what’s the best way to buy crypto in Canada.

How to Buy Bitcoin in Canada Safely

Given the fact that banking heavyweights such as JP Morgan have advised their customers that allocating 1% of their assets to cryptocurrency might be a sound move, and the number of techno wizards and institutional investors jumping on board has increased – there is no getting around the fact that there is an appetite for information on how to buy Bitcoin in Canada in the safest and cheapest way possible.

Best Way: Buying Bitcoin Directly Through Exchanges and Platforms

One of the safest methods to purchase Bitcoin in Canada is through regulated cryptocurrency exchanges such as CoinSmart, which remains our #1 recommended Canadian crypto marketplace. CoinSmart offers an intuitive user interface that is easy to use, even for newcomers, and supports a variety of cryptocurrencies like Bitcoin and Dogecoin.

CoinSmart also boasts same-day Interac e-Transfer funding with 0% fees for transfers over CA$2,000. Buying Bitcoin through CoinSmart incurs trading fees ranging from 0.2% to 0.4%, which are quite competitive in the market.

Using CoinSmart:

- Sign up for an account and complete the verification process.

- Fund your account via Interac e-Transfer, wire transfer, or bank draft.

- Navigate to the buy/sell screen and select Bitcoin (BTC).

- Enter the amount you wish to purchase and confirm your transaction.

Tip of the day: Avoid using a credit card to buy Bitcoin through CoinSmart to sidestep hefty fees of up to 6%.

Second Best: Other Platforms and Payment Methods

- Wealthsimple Crypto and MogoCrypto are additional platforms where Canadians can buy Bitcoin, albeit with higher fees.

- PayPal is another method that might soon be the easiest way to buy Bitcoin in Canada, though fees are projected to be around 5% or more.

- Credit cards can also be used on various exchanges, but the fees can be enormous.

Optional: Bitcoin Cryptocurrency ETFs in Canada

An alternative for investors who prefer not to buy Bitcoin directly is to invest in Canadian Bitcoin ETFs. These are fixed to Canadian Dollars, do not require you to do any special preparations such as opening a new broker account (if you already have one), and would be easier to report.

There are several Bitcoin ETFs, such as:

- Purpose Bitcoin Fund (BTCC)

- Evolve Fund Group’s Bitcoin ETF (EBIT)

- CI Galaxy Bitcoin ETF (BTCX.B)

The first Bitcoin ETF in the world was the Purpose Bitcoin Fund (BTCC), and despite its 1% MER fee, it has collected well over $3 Billion assets under management.

BTCC’s direct competitor – Evolve Fund Group’s Bitcoin ETF (EBIT) – launched a day later and has an MER of 0.75%, and is also easily traded.

A third Bitcoin ETF – the CI Galaxy Bitcoin ETF (BTCX.B) – and has an even lower MER of 0.40%. Many more applications are in the cryptocurrency ETF pipeline.

In addition to not needing to understand what a “cold wallet” is or any of the other nuances around how to directly buy bitcoins in Canada, Bitcoin ETFs can be held in an RRSP or TFSA (making them much more tax friendly than directly holding the assets).

From everything I’ve read, the companies behind these ETFs all state that they directly own Bitcoin through the Gemini Trust company (which acts as a custodian). This structure should reliably track the price movements of BTC, and it appears that the market has faith in the product to do so.

Buying Bitcoin ETFs:

- Open a discount brokerage account.

- Search for the ETF’s ticker symbol on the Toronto Stock Exchange.

- Execute the trade as you would with any other stock or ETF.

This approach offers a level of safety and convenience, especially for investors unfamiliar with the mechanics of trading cryptocurrencies directly.

What Is Bitcoin for Newcomers and Non-Techies

Bitcoin is either the perfect creation of the techno deities – that will one day rule us all – or it’s a semi-worthless piece of the internet that people just haven’t realized is worthless yet.

The truth is that fully understanding Bitcoin is beyond the scope of this article. There are some decent documentaries out there, and some great podcast episodes. (I recommend this one with Preet Banerjee.)

A friend of mine describes Bitcoin as “Someone took a bunch of Super Mario coins… but said that there’s only so many of them, so now they’re more than your car.” They’re not totally wrong.

Bitcoin is first and foremost the most well-known example of a digital or “crypto” currency.

Digital currencies are essentially computer programs that seek to become a means of exchange (like any other type of money). The theory goes, that if one day enough people believe in these digital currencies, and accept them as payment for goods, then at that point the currencies have a lot of value.

The aforementioned theory generally stems from the idea of, “Well hey, what is any money really? It’s simply the belief that you can use some sort of paper or small piece of inexpensive metal to buy whatever you need, and so therefore you will accept it as payment for your own time or possessions. If that’s true – and since we’ve now largely replaced the paper/metal part with credit cards and online transactions – why can’t digital currencies become a thing?”

The supporters of cryptocurrencies (some prominent examples of cryptocurrencies other than Bitcoin would be Etherium and Solana) would say that the ability of two parties to complete transactions without getting banks involved is a massive advantage when it comes to replacing our traditional system. In theory, Bitcoin cuts out much of the need for banks and banking fees.

The bank’s role is semi-replaced by something called a digital ledger. The idea is that every time a transaction takes place that uses a digital currency it creates a “block” of information. This block is then inserted on a “chain” (hence the term “blockchain”) and is available for everyone to see (without seeing the details of the two people doing the transaction).

This sort of public transparency is a type of guarantee against fraud and means that we can trace transactions for an infinite period of time. The digital ledger would exist on the cloud and once transactions were made, they could not be changed by any single person. The simple idea that authority over the entire system is decentralized is a feature, not a bug.

Where Does Bitcoin Come From?

Answer: Your computer, my computer, everyone’s computer.

The Bitcoin ecosystem was built in the late 2000’s by the legendary Satoshi Nakamoto. Who or what that entity is has been the topic of much speculation, and has become a part of Bitcoin folklore. To the best of my knowledge, no one has actually proven who this person or group of people actually is. The network is now maintained by thousands of people.

When the “God of Bitcoin” (recently revealed?) created their virtual gold, they only put so much of it in the digital ground. This scarcity is what most bitcoin buyers believe gives it its value. Your computer “finds” bitcoins by doing mathematical computations.

About 19.9 million of the 21 million bitcoins that were created have now been mined. Before you fire up your laptop trying to get your hands on one of the last chunks, just realize that you’re computing with massive supercomputers from around the world and it’s probably not worth your effort.

Is Bitcoin Becoming Institutionally Owned?

When Bitcoin was in its early years, it was supposed to be the “everyman’s decentralized currency”. Most used for illegal deals on the darknet and highly speculative holding by a small subset of techies who believed that it was digital salvation.

As it has grown in value, Bitcoin became more mainstream among retail investors. Then the 2017/2018 Boom-and-Crash happened and chased away the vast majority (if not all) of the large institutional investors. The big hedge funds, investment banks, multinational corporations, and other large pools of money essentially swore off of cryptocurrencies.

Fast forward to 2021 and we have Tesla, the world’s most revered (or hyped) auto manufacturer that has decided to exchange 1.5 Billion Dollars of its cash assets into the digital currency. PayPal, the payments giant, has decided to incorporate Bitcoin buying and holding in its platform. Square, another payment giant, is also storing some of its reserves in Bitcoin. Even a BANK, and not just any bank – but America’s old bank (BNY Mellon) – has started offering a bitcoin service.

The kicker being JP Morgan, one of Bitcoin’s most vocal critics which was also once considered the “Bitcoin killer” has advised customers to shift up to 1% of their portfolios into Bitcoin.

As more and more of these institutional investors have decided that they want a small amount of exposure to Bitcoin, the demand for the scarce digital resource has obviously shot through the roof. I am very interested to see what corporate boards and shareholders decide to do with their allocation the next time Bitcoin loses 60%+ of its value in a couple weeks.

For now, there is no question that the feedback cycle of institutional demand – generates huge positive press headlines – which spurs more retail speculation – drives the price even higher – thus reinforcing the institutional FOMO, has some powerful momentum.

Should I Invest In Bitcoin as Part of My Portfolio?

While Bitcoin has indeed gained massive institutional support and adoption, and all the jazz around it that could send it to the moon

I must say that I am not yet ready to fully embrace my non-existent inner Bitcoin fanboy for my own investment portfolio. I just want to point out that there are still MANY financial advisors and prominent investors who think Bitcoin is just the latest version of Dutch Tulips (here’s a great primer if you didn’t get the financial bubble reference).

Authorities such as Janet Yellen have persuasively argued that it will never become a medium of exchange, and every single country in the world has a strong economic incentive to make sure their fiat currencies stay paramount (while perhaps embracing the blockchain technology that cryptocurrencies are built on).

Moreover, bitcoin was built out to be an anonymous currency used by those who can’t do their business out in the open. I still have a sneaking concern that buying into this asset will somehow promote lowly people and dangerous governments to incite more crime.

What is a Bitcoin or Crypto High-Interest Savings Account?

BlockFi offers an 8.6% interest account for Bitcoin holders, approximately 3% better than any Canadian savings account. While this is an enticing option, investors should understand the risks. The crypto interest account space is still emerging and isn’t as regulated as traditional banking. However, platforms like BlockFi maintain that they have strong security measures in place.

Taxes and Legality of Bitcoin in Canada

One of the bigger surprises that Canadians who buy and sell bitcoin run into is that the government is fully involved – just as they would be with any other asset class.

For some reason there is this myth out there that cryptocurrencies have somehow transcended government control, and are not subject to the same taxes as you would be liable for if you bought and sold gold for instance.

The truth is that if you are trading Bitcoin in Canada you are going to owe capital gains taxes on the difference between what you purchased your bitcoins for and what you got when you sold them. The only exception to this would be using a Bitcoin ETF in a TFSA or RRSP.

If you used a Block Fi account to gain interest in your Bitcoin, then that is 100% taxable, just as any other form of interest income would be in Canada.

If you accept bitcoins as payment for a normal business service, then you’ll need to convert the value to Canadian dollars at the time of transaction in order to record and report official revenues to the CRA. Here is the official CRA guide on crypto and taxes.

Other Cryptocurrencies Worth Exploring

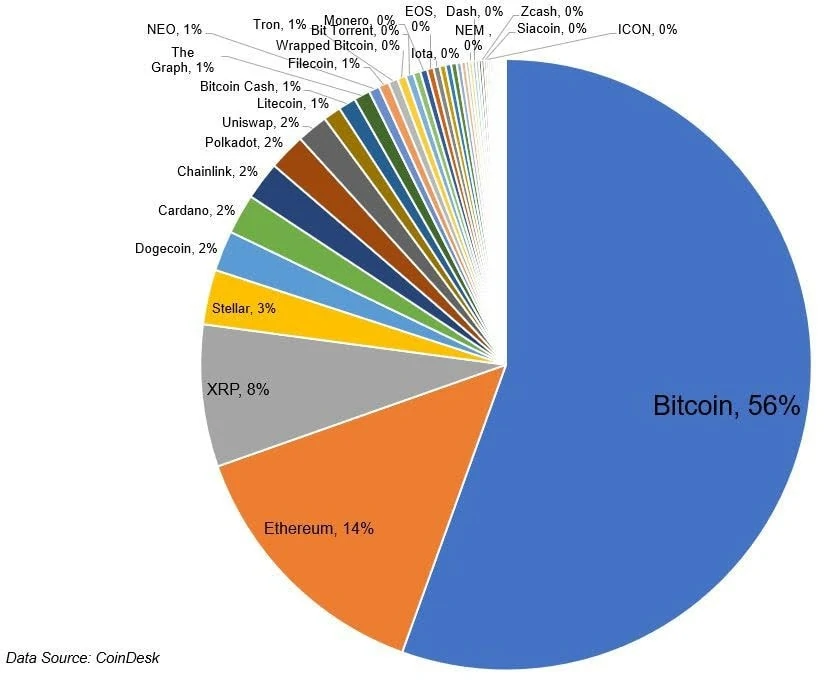

You might see many internet forums pumping the latest cryptocurrency fad (anyone else seeing a lot of Dogecoin ads these days?) but by far the second biggest cryptocurrency is Ethereum (ETH) which has some interesting technological features.

My understanding this is quite limited – but the fact this currency includes “smart contracts” which indicate future transactions based on whether certain conditions – are met makes it a good candidate to replace traditional financial contracts. The company was once considered a leader in innovating the underlying blockchain technology, but with so many other companies now competing for that title, the original advantage might be dissipating.

There is a lot of development based on Ethereum, and in terms of performance, it has closely tracked bitcoin in previous years (not so much since 2022). So if you have decided to build a small cryptocurrency egg nest, you may as well go and buy some ETH. Canada recently released the world’s first Ethereum ETFs.

Besides the, other popular cryptocurrencies include Dogecoin (DOGE), which has surged following announcements from influential figures like Elon Musk, as well as Solana is the “base currency” of all Memecoins, a particularly strange subset of crypto-currencies based on a joke.

Frequently Asked Questions About Bitcoin In Canada

Final Verdict – Should I Invest in Bitcoin?

Bitcoin may go up to $1m as some of its supporters adamantly claim, but I still favor basic index investing through all-in-one ETFs, Canada’s robo advisors, or Canadian dividend stocks.

Before ultimately making the decision on buying bitcoin or not, just please understand one thing:

At this point in time you are using your money to speculate on what will happen. You are looking at the names of horses at a horse race, reading the flyer that the racetrack gave you, and betting on a winner.

You are NOT investing. You are speculating.

Speculating can be very fun and very profitable – but it’s not investing.

Oh – and in this horse race, it’s entirely possible that every horse could win, but if history is any indicator, it’s much more probable that every horse will lose.

PSA: You can own Microstrategy (MSTR) in a registered account such as a TFSA, etc. It has outperformed both Bitcoin and NVDA over the last 4 years.

The business model is that they use their corporate structure to provide a “wrapper” for Bitcoin, offering different investment options with different risk/reward profiles: bonds for institutional/corporate funds (that can’t hold equities or bitcoin in their portfolio), stocks for general investors (suitable for restricted accounts such as TFSA s or other), and options (for those who want leverage on Bitcoin growth). Essentially, they are acting as a pipeline for the transition from a devaluing dollar to bitcoin as a non-debaseable currency.

As a corporation, MSTR is able to issue bonds (most recently $4B at 0% interest!) to increase their Bitcoin holdings. Even though this provides leverage, the company is no more than 25% leveraged against their BTC holdings. The volatility of Bitcoin is actually hugely desirable in the bond market, which has made all of their bond offerings oversubscribed.

To learn more, watch MSTR’s Q3 earnings call on Youtube, as well as any recent Michael Saylor interviews. To hash out questions and doubts, search the ticker on X.

Hmmm.. an employee at work described how her computer science daughter at university with her friends, were making up their own cryptocurrency online…and making money.

I looked at her and stopped myself from asking if this was legal. This was 1.5 yrs. ago. I won’t touching crypto / bitcoin. That little story turned me right off…. some folks are getting hosed out there.