Net Worth Update September 2013 (+1.19%)

Welcome to the Million Dollar Journey September 2013 Net Worth Update. For those of you new to Million Dollar Journey, a monthly net worth update is typically posted near the end of the month (or beginning of the next) to track the progress of my journey to one million in net worth, hopefully by the time I’m 35 years old (end of 2014 – soon!). If you would like to follow my journey, you can get my updates sent directly to your email or you can sign up for the Money Tips Newsletter.

Lets start off with one of the favorite topics here on MDJ – the stock market. With all the doomsday market scenarios ongoing in the news (tapering anyone?) and on twitter, September was a pleasant surprise for investors. Over the past month, the S&P500 returned 2.73%, the MSCI EAFE (international) index gained 3.4% while the TSX was flat with a 0.05% gain – all including dividends. From what I’m reading, the market still has a negative bias, particularly with news of a U.S Government shutdown and the effects on the market. For me, it’s business as usual investing in strong, dividend paying businesses for the long term but only buying when their valuations are attractive.

How has my portfolio performed during the month? Even though my RRSP has a large portion of U.S dividend stocks, it lagged the S&P500 by about 1%, mostly due to the fact that it still has a significant portion of Canadian and bond indices. However, on a bright note, my Canadian Dividend stocks portfolio beat the Canadian index by about 1.5%, reaching an all time high of $128,000. My trading account also had another strong month. My U.S non-registered trading account, which I use as my fun money account, has been performing very well this year where I have been trading mostly technology stocks.

In the big picture, it’s the end of September and we are up 1.19% for the month and 14.73% for the year. We are up to $898k in assets and $792k in net worth with about 15 months left in the Million Dollar Journey deadline!

On to the numbers:

Assets: $898,900 (+1.08%)

- Cash: $4,500 (+0.00%)

- Savings: $20,000 (+0.00%)

- Registered/Retirement Investment Accounts (RRSP): $160,800 (+1.77%)

- Tax Free Savings Accounts (TFSA): $52,500 (+0.96%)

- Defined Benefit Pension: $46,600 (+0.65%)

- Non-Registered Investment Accounts: $177,000 (+2.31%)

- Smith Manoeuvre Investment Account: $128,000 (+1.59%)

- Principal Residence: $309,500 (+0.00%) (purchase price adjusted for inflation annually)

Liabilities: $106,800 (+0.28%)

- Principal Residence Mortgage (readvanceable): $0 (0.00%) (Paid off in 2010!)

- Investment LOC balance: $106,800 (+0.28%)

Total Net Worth: ~$792,100 (+1.19%)

- Started 2013 with Net Worth: $690,400

- Year to Date Gain/Loss: +14.73%

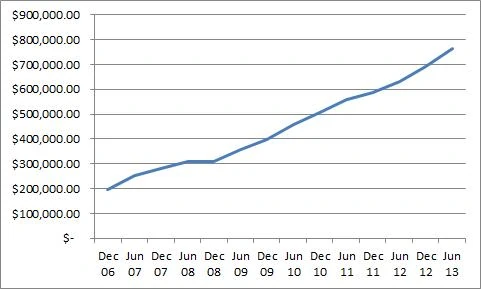

In my last update, readers suggested to chart my net worth progress over time. Below are the net worth values since Dec 2006 with data points taken semi annually.

- December 2006: $198,500

- June 2007: $254,695

- December 2007: $279,300

- June 2008: $310,483

- December 2008: $309,950 (rough second half)

- June 2009: $355,850

- December 2009: $399,600

- June 2010: $456,910

- December 2010: $505,800

- June 2011: $558,713

- December 2011: $585,228

- June 2012: $631,400

- December 2012: $690,400

- June 2013: $766,300

Some quick notes and explanations to net worth questions I get often:

The Cash

The $4,500 cash are held in chequing accounts to meet the minimum balance so that we pay no fees (accounting for regular bill payments – ie. our credit card bill). Yes, we do hold no fee accounts also, but I find value in having an account with a full service bank as the relationship with a banker has proven useful.

Savings

Our savings accounts are held with PC Financial and ING Direct. We usually hold a fair bit of cash in case “something” comes up. The “something” can be anything that requires cash such as an investment opportunity that requires quick cash or maybe an emergency car/home repair. We also need cash to cover any future tax liabilities.

Where Does the Savings Come From?

We don’t live a lavish lifestyle (how we save money), and we do not carry a mortgage or any other bad debt. The only debt we have is an investment loan (which pays for itself), so we end up pocketing a majority of our earnings. Our earnings come from salaries, private business income (via dividends to shareholders), and eligible dividends from publicly traded companies.

Real Estate

Our real estate holdings consist of a primary residence and REITs plus a rental property. The value of the principal residence remains valued at the purchase price (+inflation) despite significant appreciation in the local real estate market.

Pension

The pension amount listed above is the value of both of our defined benefit pension plans. I basically take the semi annual statement and add the contribution amounts (not including employer matching) on a monthly basis. The commuted value of the pensions are not included in the statements as they are difficult to estimate.

Updated 2013 – My wife has recently changed her job position which has resulted in switching from a defined benefit plan to a defined contribution plan. This amount will be added to the RRSP totals going forward.

Stock Broker Accounts

Another common question is which discount broker do I use? We actually have accounts with multiple institutions. I’m hoping to reduce the number of accounts that we hold in the near future. Here is a review of some of the more popular online stock brokers.

Great to see your net worth surging over the last 7 years. I’m aspiring for the same results in the years to follow :)

Congratulations, nice work! I am keeping track of blogger net worth and I have you 3rd on my list. Best wishes on continued gains in the future. $1 million dollars is not far away not. Maybe 2-3 years away.

Awesome work. We might have the same assets, but I have more debt :(

You win. :)

Keep up the great gains each month FT, you are an inspiration to many of us.

@Tyler, thanks for the encouragement. The plan is to continue to write as long as the readers find value in what I have to say. :) Keep the comments coming!

Keep It up FT

Not only do you talk the talk but you walk the walk too.

Too many people just want to “spend a million” but not wanting to “save a million”.

You inspire us bud. Thanks a Bunch.

P.S. I hope you continue to keep up the blog after you hit your mark and not just disappear completely… :(

Also, I know you’ll hit at least 5 to 10 Million Net worth or maybe more in your lifetime cause the first million is always the hardest.

Thanks for the kind feedback guys!

@liquid, it looks like you are well underway. I wish I had a $150k portfolio when I started out, it’s only now that I’m getting portfolio numbers in that range! Keep it going, you’ll hit the 7 figure net worth faster than you think.

Congrats FT :) That’s almost a 5 figure gain in one month, pretty cool. I’m trying to become a millionaire by the time I turn 35 years old too. So far I’m at roughly $191K so about where you were 7 years ago. I’m trying to follow in your footsteps haha :D

Great progress, MDJ. I love reading your Net Worth updates. Keep it up!