Financial Freedom Update – September 2016 (+9.7%)

Welcome to the Million Dollar Journey September 2016 Financial Freedom Update. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point where they are enough to cover our family expenses. All within the next 5 years. If you would like to follow my journey, you can get my updates sent directly to your email, via twitter (where I have been more active lately) and/or you can sign up for the Money Tips Newsletter.

In my first few Financial Freedom updates, I talked about what life has been like since becoming a millionaire, why I like passive income, and our family financial goals going forward.

Here is a summary:

Financial Goals

Our current annual recurring expenses are in the $50-$52k range, but that’s without vacation costs. However, while travel is important to us, it is something that we consider discretionary (and frankly, a luxury). If money became tight, we could cut vacation for the year. In light of this, our ultimate goal for passive income to be have enough to cover recurring expenses, and for business (or other active) income to cover luxuries such as travel, savings for a new car, and simply extra cash flow.

Major Financial Goal: To generate $60,000/year in passive income by end of year 2020 (age 41).

Reaching this goal would mean that my family could live comfortably without relying on full time salaries. I would have the choice to leave full time work and allow me to focus my efforts on other interests, hobbies, and capitalistic pursuits.

Financial Numbers

So now that I’ve declared my financial goal, where do I stand now? Here are the annual dividends generated by account (June 2016):

Account Dividends/year SM Portfolio $5,359.99 TFSA 1 $1,726.20 TFSA 2 $2,072.05 Non-Registered $350 Corporate Portfolio $5,200.10 RRSP 1 $3,564.26 RRSP 2 $375.25 Total Dividends: $18,647.85/year

Since June, there have been a few changes to our financial situation – but one major one. On the steady state side of things, we are still living off my government salary, so we are particularly paying attention to our spending (here is a breakdown of our expenses in 2015). In terms of big financial changes – in the last couple of updates, I mentioned that Mrs. FT has since volunteered and substituted in a private pre-school and seems to be ready to leave her healthcare position for a part-time career in teaching young children. As I may have given it away in my post on creating an investment account for the kids, she has taken the leap and has left her professional license behind.

On the other side of the coin, simply having a high paying job sometimes just isn’t good enough. I’m a believer in following your interests as I believe that life is too short to be unhappy with your work on a daily basis.My wife graduated with a professional degree in a health care field that offered a relatively high salary.

It was all well at the beginning, but it became less appealing once the kids were born. As her career interest faded, it eventually impacted her overall happiness. So together we made the big decision to leave her professional career behind and figure out how to make it work financially on one government salary.

Now, lets talk a bit about my passive income strategy – generating dividend income. As dividends are the main focus of my passive income pursuit, there is a large dependence on the market. While there are merits to this investment strategy, there are also substantial risks – particularly dividend cuts. The goal of the strategy is to pick strong companies with a long track record of dividend increases.

My leveraged Smith Manoeuvre dividend income has increased slightly since the last update due to adding to my Canadian Pacific Railway (CP) position. With the dividends from this portfolio continually churning out cash, there is enough cash to go shopping for a new position or add to an existing one. There are also a number of not-so-strong names in this portfolio which I will look at pruning going forward.

As it has been the trend for this year, I’ve continued to deploy some stale corporate cash into dividend stocks which has resulted in the biggest contributor to dividend income growth ($5,200 annually -> $6,600 annually). In this account, I’m trying to stick with the biggest and best names in the Canadian dividend space with top 6 largest holdings in (besides cash):

- TransCanada Corp (TRP);

- Bank of Nova Scotia (BNS);

- Canadian Utilities (CU);

- Fortis (FTS);

- Agrium (AGU); and,

- Telus (T).

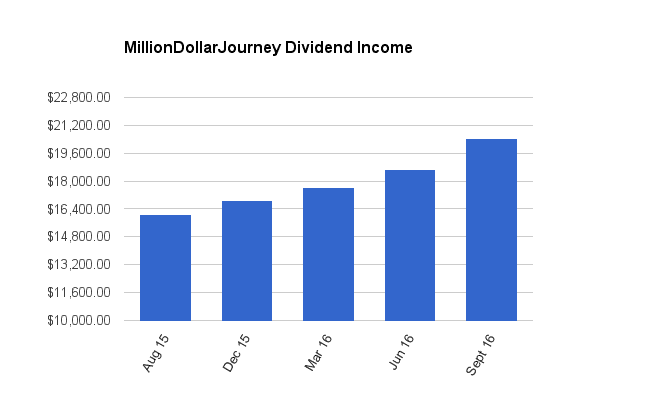

September 2016 Dividend Income Update

| Account | Dividends/year | Yield on Cost |

| SM Portfolio | $5,380 | 4.11% |

| TFSA 1 | $1,776 | 4.64% |

| TFSA 2 | $2,190 | 4.88% |

| Non-Registered | $240 | 1.57% |

| Corporate Portfolio | $6,600 | 3.74% |

| RRSP 1 | $3,900 | 3.54% |

| RRSP 2 | $375 | 1.82% |

- Total Invested: $536,667

- Total Yield on Cost: 3.81%

- Total Dividends: $20,461/year (+9.7%)

I’m happy to announce that we hit the $20,000 annual dividend milestone this year. We still have a long way to go, but for the most part we are moving in the right direction. There is a substantial amount of cash to deploy in both my “non-registered” account and in my “corporate portfolio”. You may notice that RRSP 2 is also fairly minimal in dividends, that’s because that is my wife’s RRSP, and it is 100% indexed.

If you are also interested in the dividend growth strategy, here are the Canadian dividend stocks with the longest history of dividend increases. With this list, you’ll get a general idea of the names that I’ve been adding to my portfolios.

Let me know if you have any questions by leaving a comment.

Hey FT — is your portfolio all stocks?

Any bonds?

Hi Andrew, yes mostly stocks. The only bonds are a small percentage in my RRSP, my spouses RRSP and family RESP.

Well done. Nice to see you setup another goal.

Do you find if it has changed your investment approach?

I like your new goal of ” To generate $60,000/year in passive income by end of year 2020 (age 41).”

but this goal to generate $60,000/year in passive income to cover your $60,000/year expenses will make sense if you will live forever, if you are like more people that some day will die, you can achieve your goal faster, maybe with $30,000/year in passive income and you can use $30,000/year from your capital, that way it can last for another 33 to 40 years, any feedback will be appeciated

Thanks for the feedback Ariel. Yes, I can see using capital in my later years but since I still have young children, and hopefully a long life ahead of me, I’d rather be on the conservative side. But yes, theoretically I could use capital and create a plan to die broke for higher income.

$20,000 in dividend income is a great start. My wife and are fortunate enough to have built up a $1M portfolio that churns out $38K gross ($30K net) and we are still under 40. We are going with mostly dividend ETFs and some broad indexes. The fees are acceptable for us since the ETFs will be rebalanced over time and they eliminate single-security risk. Can’t wait for January’s TFSA contribution!

Totoro-

Do you need the dividend income? If not the Horizon swap-based funds reduce the tax drag of passive business income rates. At the expense of counterparty risk plus a swap fee for non-Canadian funds. This is the direction I am moving for similar corporate funds.

That sounds very complicated. I will attempt a google mission and thanks for your reply. I would like the dividend income and I don’t see much point in accumulating more given that the houses will be paid down and appreciate over time anyway and enough is enough.

Totoro-

Do you need the dividend income? If not the Horizon swap-based funds reduce the tax drag of passive business income rates. At the expense of counterparty risk plus a swap fee for non-Canadian funds. This is the direction I am moving for similar corporate funds.

Totoro, it sounds like you are in a strong financial position. Technically, if you could sell your company now for cash, you could have a comfortable retirement. For ETF portfolio ideas, check out this post:

https://milliondollarjourney.com/a-simple-low-cost-diversified-etf-portfolio.htm

Thanks FT. We are not able to sell the business for at least four more years for some complicated reasons. At that point we will be able to access the qualifying small business corporation capital gains exemption so things should be fine, but we don’t count on it. It is a retail business and subject to competitive forces. Right now my main focus is maximizing the potential of the retained earnings including the flow through of eligible dividends (I think!).

Always an inspiration. Great work FT!

Mark

Thanks Mark!

Hi FT,

Thanks for the update, always pleasure reading it. I do have a question, what’s your networth at now dollar wise? I know you are focused on the passive income and divided income but thought it be nice to know.

Thanks FT.

Hi DL, there have been a few readers who have asked for an update. I’ll get a post together.

I’d be really interested in knowing more about how you’ve invested through your corporate account. I have a bunch of retained earnings I’m looking to invest for dividend returns (taxed in my hands). No past experience with this so a bit nervous!

Hi Totoro, was there anything in particular you wanted to know? If you are just starting out, what about a simple ETF portfolio instead? The portfolio would still pay you dividends, just not quite to the same degree.

An ETF portfolio might be a good way to start. I have $500,000 though and this makes up 1/6 of our retirement portfolio which is a large percentage and some of the rest is in mortgaged rental properties and active businesses so not accessible or completely certain until sold. So it feels like a huge decision. I know, inflation is eating away at the retained earnings but I was not sure if we would use it to buy another business or not until about a month ago when I decided that early retirement was a better option for me. Plus I had a hard time figuring out whether to withdraw and invest or invest through the corporation. And I analyze things to death so it takes a long time to make a decision!

By the sounds of it, you are pretty diversified already and indexing 1/6 of your portfolio doesn’t sound like a big risk to me. You could always “scale in” with your portfolio investing through buying in over time rather than lump sum upfront. If you need some cash on hand to buy another asset, you could keep that piece aside, and invest the rest.

The risk is lack of income generation given that I will retire – I’m mid 40s and that is a long way until 60. Market timing is impossible I know but the market does seem high. We are diversified and the mortgaged properties are cash flow positive, but the principal pay down amount and the tax we pay on the principal pay down and expenses reduce this cash flow to about $2000/month and if interest rates rise it could be 0. Once the properties are paid off this will turn into $12,000/month after expenses with a current market value of 2.3 million – so long term is taken care of with this alone but that doesn’t happen for 15-20 more years. One business could be sold for about 2 million currently, but there are always risks that can reduce this amount in future. The other probably can’t be sold as it is a professional practice. I think probably the best thing to do is to divide the amount by 12 and invest 1/12 over time. What simple ETF portfolio would you recommend?

totoro,

your best bet is a classic couch potato portfolio.

The Canadian Couch Potato Site is excellent and has in-depth information.

The second excellent source of learning is Andrew Hallam’s book “Millionaire Teacher”. Between those two sources, you should be able to figure out a way to start.

I would personally invest everything at once (since as you say, you can’t time the market) and bank on rebalancing between bonds and stocks if markets come down.

Conservatively, your 500k should generate 15k/year (I like to personally use a 3% rule rather than 4%). I would also say that dividends is something people are in love with in the blogosphere but what really matters is total returns. There is nothing wrong with selling assets at a 3% rate. There is no intrinsic, long-term advantage dividends have over that…

Thanks so much for your reply. The only thing is that I’m investing retained earnings and not personal funds. My corporation is taxed at the maximum tax rate on all passive income (over 40%) so I’m looking to understand how to generate and receive eligible dividends primarily which will flow through and be taxed personally I believe. My personal tax rate in retirement will be much lower than the corporate rate. Not sure the ETF strategy works exactly as it does not appear to focus on dividends over overall value gains? Dividend investing appears to be somewhat different but I may be mistaken as I haven’t been able to clearly understand this yet.