Best Pipeline Dividend Stocks In Canada 2026

It’s no secret that we’re big fans of Canadian dividend stocks here at MDJ, and while we have given some shine to Canadian energy stocks over the last couple of years, we have always just sort of tossed the Canadian pipeline stocks in alongside those big energy producers.

The fact is the Canadian pipeline stocks – often described as “mid-stream” due to their place in the supply chain – actually offer superior dividend cash flow relative to their energy producer cousins.

Their business model depends on taking on large amounts of debt to fund construction of massive infrastructure projects, and then passing along the cash flow that comes from essentially renting their infrastructure to big energy producers. In this way, the pipelines are somewhat similar to Canadian utilities stocks, as opposed to the producers they serve.

We’ll compare our top five Canadian pipeline stocks below, but before we get too in-depth I wanted to mention that our research relies heavily on the Dividend Stocks Rock analysis.

DSR is a dividend-growth research company that focuses on Canadian and American stocks. It’s run by my old friend Mike Heroux, and I know of no one who understands the underlying strengths and weaknesses of dividend cash flow better than he does!

Are Canadian Pipeline Stocks Worth It – Even With Climate Change?

Here’s the thing about Canadian pipeline capacity – they aren’t making any more of it!

If you’ve followed the news at all over the years, you’ve no doubt noticed that there is a major push (using both legal and illegal means of protest/vandalism) to limit Canadian government at all levels from approving new pipelines. While that means that there is obviously a cap on growth when it comes to Canadian pipeline stocks, it also means that current pipeline capacity is almost guaranteed to be highly utilized.

One thing we’ve learned from the recent chaos in Europe, is that while we might be bringing more and more renewable energy online, the overall appetite for any type of energy is insatiable. These Canadian pipeline stocks have several decades of productivity in front of them, and those efficient dividend payers can’t be ignored if you’re looking for stable cash flow.

Canadian Pipeline Stocks Performance Chart

Top 5 Best Pipeline Stocks in Canada

Below is a detailed breakdown of my top 5 picks for the best Canadian pipeline stocks:

Top Pick: TC Energy Inc. (TRP-T)

A decades-old corporate entity, TC Energy is a massive pipeline conglomerate. It has roughly 93,000 km of natural gas pipelines in North America, and another 5,000 km or so of oil pipelines. It’s also also trying to diversify into power-generation, and owns ten facilities.

As one of the hottest stocks in Canada this year, TC Energy is up big, even as markets around the world have fallen. One of the drawbacks in the price run up is that the dividend yield doesn’t quite “pop” as much as it once did, but it still clocks in at a respectable 4.9%

Earnings are strong and are obviously forecasted to stay that way. As long as natural gas and oil prices stay this high, producers have a massive incentive to get those fossil fuels out of the ground and get them to market. This gives Canadian pipelines a ton of leverage and makes sure they are running at capacity.

TC Energy suffered some negative press with the whole Keystone Pipeline fiasco of the last decade, but the company still has a $21 billion secured capital expansion plan underway, and doesn’t look to be slowing down any time soon.

With assets throughout North America, TC Energy is very oil-price resilient and can make money in almost any market condition (although obviously they’ll take the current favorable market any day). They company has proven that they understand how to reward shareholders, and they will continue to pass along free cash flow for the foreseeable future.

#2 Tourmaline Oil (TOU)

The two main reasons that we rate Tourmaline so highly are:

- It has proven to be incredibly efficient. In the last year they have managed to double revenue while cutting administrative costs!

- The long-term prospects of the natural gas market.

Tourmaline is about a pure-play in natural gas production + mid stream as you’ll find in Canada. I love the medium-term future for natural gas. I liked it before Russia’s natural gas had many restrictions put on it – so obviously that has made non-Russian sources even more valuable.

The company operates in the Alberta Deep Basin, the NEBC Montney Gas regions, and the Peace River Triassic Oil Basin. With thirteen plants in the Alberta Deep Basin alone, this company is directly tied to natural gas production and refinement.

In the first quarter of 2022 Tourmaline generated a record free cash flow of just under $1.5B. As usual, they chose to pass those earnings along to shareholders, by increasing the base dividend 11% – but also through a special one-time dividend of $1.25 per share. Got to love special dividends!

With a much cleaner balance sheet than competitor Keyera, the company’s relatively unleveraged position makes it a much safer long-term bet.

The only fly in the ointment is having to stomach a dividend yield at 1.2%. That said, if you think natural gas can maintain this momentum (I think it can) then the current P/E ratio of around 12x means Tourmaline is still in value bargain territory despite its impressive run YTD.

#3 Enbridge Ltd. (ENB-T)

Perhaps Canada’s best known pipeline company, Enbridge runs a wide variety of fluide transportation pipelines, and has been diversifying into natural gas utilities and renewables as well. The long-term plan is clearly to use cash flow to grow more in those “green renewable” areas.

Due primarily to negative news headlines, Enbridge’s stock was so beat up at the beginning of 2021 that I made it my Dogs of the TSX pick. Much like TC Energy, Enbridge suffered from negative press generated by the completion of their Line 3 pipeline, as well as some political friction between the Canadian Federal Government and Gretchen Whitmer over the Line 5 pipeline that passes through Michigan.

These negative headlines combined with the low price of oil and natural gas led to Enbridge’s depressed stock price yielding more than 8% in early 2021! Since then it has seen significant appreciation, so that the profitable pipeline now yields just under 6%. Even when looking at YTD in 2022, Enbridge is up about 19% – at a time when word markets are taking a real beating.

Earnings are on track to rise again, and the company has proven that it can grow efficiently. With the T-South Reliability and Expansion pipeline construction underway, along with the Spruce Ridge expansion, revenues and profits should continue to flow for this dividend all star.

Here’s DSR’s Mike Heroux on how he quantifies the safety (or lack thereof) of Enbridge’s dividend:

#4 Pembina Pipeline Corp. (PPL-T)

Based primarily in Western Canada, Pembina Pipeline Corp is another high-yield stock that income investors love. With 65-year worth of organic growth plus smart acquisitions, there is a lot to love with this gas-heavy pipeline.

For its first quarter in 2022 the company revealed an adjusted earnings record of $1 billion (compared to $835 million the year prior). Clearly increased fossil fuel demand has meant premium pricing for mid-stream companies.

The major news for 2021 was the failed takeover of another of Canada’s pipelines, Inter Pipeline. Infrastructure giant Brookfield came in with the hostile takeover bid, and ruined those plans.

That said, the company remains a cash flow machine, currently boasting a 4.8% dividend. Some have even speculated the company could be a takeover target in the medium term.

With shareholders realizing a 35% total return so far in 2022, there’s very little not to love.

#5 Keyera (KEY)

Primarily a natural gas company, Keyera operates over 5,000 kms of pipelines and has 15 natural gas processing plants. A strong player in the Alberta Oil Sands, the company’s long-term future is directly tied to that geography.

While the stock still hasn’t fully recovered from the 2020 crash, there is no denying the attractiveness of the 5.5% dividend. That said, Dividend Stocks Rock only rates the dividend safety of the stock a “2” due primarily to two reasons.

1) Keyera has a large (and growing) amount of debt on its balance sheet. The long-term debt has ballooned from $1.41B to $4.3B in the last five years.

2) Unlike companies like Enbridge and TC Energy, Keyera doesn’t rely on 20+ year contracts. This exposes them to the whims of the spot price market, more than other pipelines.

While the company is announcing capital spends of $1B per year, this stock is likely to either be a major winner, or a major laggard when compared to the other stocks on this list.

Best Canada Pipeline ETF – HOG

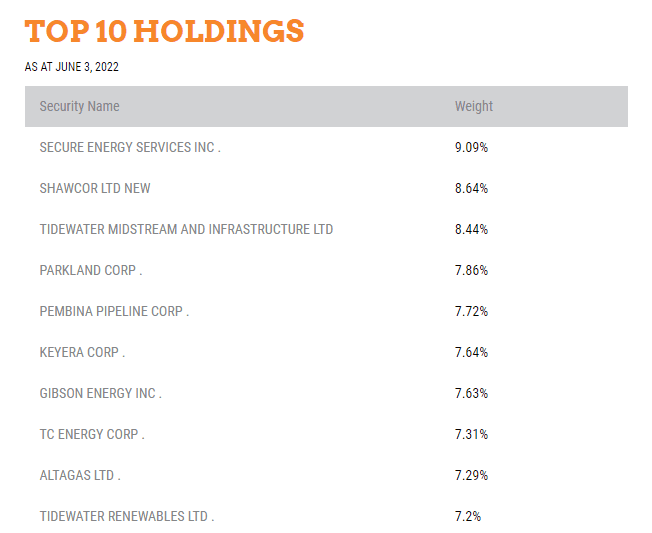

The Horizons Pipelines & Energy Services Index ETF (HOG) is Canada’s best pipeline ETF. Now it’s not a pure pipeline play per se, as it includes many energy services companies as well – but the more I learn about the overall industry, the more I actually like that diversification.

Here are the Top 10 Holdings of the Horizons Pipelines & Energy Services Index ETF.

With Enbridge coming in just after Tidewater.

You get instant portfolio diversification to these companies for an MER of .64%.

Personally, that’s a pretty high price to pay for managing a dozen or so companies. I’d rather pick a few of the pipelines with long-term track records, and hold those for the long-term. Given the mediocre 3.7% yield, there are simply better ways to get exposure.

That said, it’s an easy way to get instant diversification to this sector. So if you’re willing to pay for the convenience of that diversification, then HOG is your bet for a Canadian pipeline ETF. You can check our lists of the best ETFs in Canada and best Canadian dividend ETFs to see why we think HOG isn’t a good investment.

The Future of Canadian Pipeline Stocks

Mike Heroux has absolutely convinced me that Canada’s large cap pipeline stocks have the free cash flow to sustain the dividends for the foreseeable future.

It might be a different story if capacity was being added each year, and there was solid evidence that there was a reduced need for fossil fuels. The evidence just doesn’t support that theory however.

With natural gas being looked at as a “transition fuel” and the pipelines doing more and more research on efficient ways to transition to water or hydrogen, I think they are a much less riskier bet than the energy producers. (Remember, risky doesn’t necessarily mean “bad”. Those energy producers have proven to be dramatically undervalued – at least in the short term.)

All of this means that Canadian pipeline stocks continue to be a great choice for income-oriented buy-and-hold investors.