Is Algonquin Power Stock A Good Buy in 2026?

When considering an investment in Algonquin Power stock, it is essential to evaluate the company’s performance, market trends, and recent developments in the renewable energy sector. Keeping yourself informed about Algonquin Power’s recent advancements and industry dynamics is vital in making an informed investment decision.

If you’re interested in diversifying your portfolio with dividend-paying stocks, Algonquin Power is worth considering.

For more information on dividend investing, we recommend exploring our article on Top Canadian Dividend Stocks, which offers insights into reputable companies known for their dividend growth.

Want To Buy Algonquin Power Shares? Price, Performance & Analysis

- AQN.TO Stock Price: 8.53

- Dividend Yield: 7.02

- Price-to-Earnings (P/E) Ratio: 11.10

- 5yr Earnings Per Share Growth: 5.22%

- 5yr Dividend Growth: 8.91%

- Payout Ratio: 61.04%

My Algonquin Power Stock Analysis

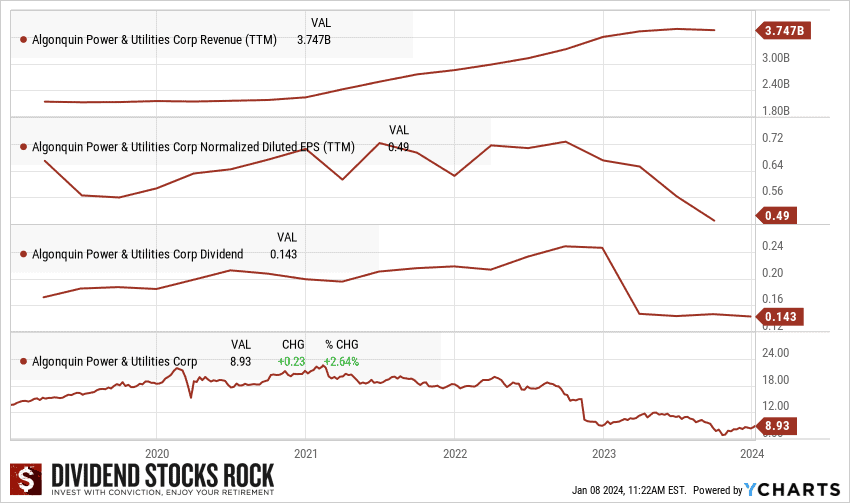

- Revenues are up just south of $1 billion in the last quarter.

- Up 5.7% while the TSX Composite has only grown by around 4% year-to-date.

- Dividend cut at 40% announced at early 2023.

- Highly leveraged position caused significant losses due to rising interest rates in 2022.

My analysis of Algonquin Power & Utilities suggests that the current valuation presents a compelling buying opportunity for investors. Despite facing challenges in recent years, Algonquin Power maintains a strong position in the utilities sector, making it an attractive choice for long-term investment.

While the company has encountered obstacles, such as the impact of higher interest rates, we have confidence in Algonquin Power’s management team and their ability to navigate these challenges.

Algonquin Power’s recent decision to cut its dividend is a noteworthy development that reflects the company’s proactive approach to addressing its financial challenges. The utility company faced significant losses, primarily driven by its highly leveraged position when interest rates began to rise. By reducing the dividend, Algonquin aims to allocate more funds towards debt reduction and capital investment, which can lead to improved financial stability and resilience in the face of market uncertainties.

As a long-term investor, I understand the importance of taking decisive actions during challenging times to position a company for sustainable growth. While a dividend cut may be disappointing to income-oriented investors in the short term, it signals a responsible and prudent strategy by Algonquin’s management. This move demonstrates their commitment to safeguarding the company’s financial health and reassuring investors about its future prospects.

If you are looking for more dividend stocks, specifically in the energy sector then look no further than our guide on the Best Energy Dividend Stocks in Canada.

Why Is Algonquin Power Stock Down?

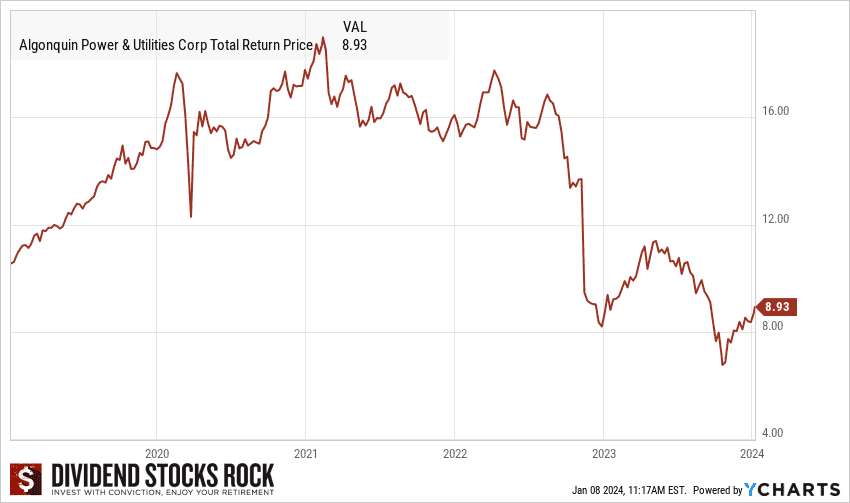

Utility stocks are typically considered safe investments known for their consistent dividends. However, Algonquin stock proved to be an exception last year, leading to significant losses for investors who sold in late 2022. This is due to their highly leveraged position that they recently undertook, which had high interest costs as the rates went up.

Unlike typical utilities, Algonquin pursued a more aggressive capital plan, resulting in a higher leveraged balance sheet. This strategy might have been acceptable during a prolonged period of low interest rates. However, the sudden shift to a rising interest rate environment, driven by the Bank of Canada’s hawkish stance to combat inflation, caught many companies, including Algonquin, off guard.

Initially, the market expressed nervousness when Algonquin Power announced its acquisition of Kentucky Power late last year. However, in a surprising turn of events, when the acquisition fell apart in April, the stock actually rose. Investors perceived the termination as a positive move, indicating the company’s commitment to financial discipline and safeguarding shareholder value, especially during a period of rising capital costs.

The unexpected interest rate hikes adversely affected heavily leveraged companies, particularly those exposed to variable interest rates, like Algonquin. Consequently, both the company and its investors had to readjust their growth expectations. As part of this reset, Algonquin recently decided to cut its dividend by 40%.

The higher interest rate environment also impacted overall stock valuations, as fixed-income investments like bonds became more attractive to investors seeking capital preservation. This resulted in a general decline in stock valuations across various sectors.

How Can I Buy Algonquin Power Shares?

To purchase shares of Algonquin Power, you can use various Canadian online brokerage services. At MDJ, we prioritize selecting discount brokerages that align with our readers’ needs. Our regularly updated list of Top Online Brokerages in Canada provides readers with the best recommendations and current promotional offer codes.

After successfully registering for an online brokerage account, buying Algonquin Power shares is a simple process. Use the search bar to find the ticker symbol “AQN” and determine the number of shares you wish to purchase.

For instance, if you plan to invest $500 in Algonquin Power shares and the current stock price is $10, you would enter “50” and select the “market limit” option. The online brokerage platform will present you with a confirmation prompt: “Do you want to buy 50 shares of AQN at $10 each, totaling $500?”

Once you confirm the order, the online broker will facilitate the necessary transactions. Congratulations! You are now a shareholder of Algonquin Power, a prominent player in the renewable energy sector.

Best 2026 Broker Promo

Up To $5,000 Cash Back + Unlimited Free Trades

Open an account with Qtrade and get the best broker promo in Canada: $250 when you invest $1,000!

The offer is time limited - get it by clicking below.

Must deposit/transfer at least $1,000 in assets within 60 days. Applies to new clients who open a new Qtrade account by March 31, 2026. Qtrade promo 2026: CLICK FOR MORE DETAILS.

Algonquin Power Stock Past Performance

In recent years, Algonquin Power has encountered significant challenges, primarily due to the impact of increased interest rates, resulting in a notable decrease in earnings. Consequently, its stock price witnessed a substantial decline in 2022 and has since remained relatively low, despite a partial recovery.

However, there are encouraging signs as revenues have been on an upward trajectory since early this year. This recovery in revenues creates a potential buying opportunity, with the stock price still relatively attractive as the company’s financial performance improves.

In response to the challenges it faced, Algonquin Power recently announced a plan to cut its quarterly dividend by 40% and target US$1 billion in asset sales. While this dividend cut might seem concerning to some investors, as a long-term dividend investor, I view it as a strategic move by the company’s management to strengthen its financial position and ensure sustainable growth.

I am confident that Algonquin’s strategic initiatives, coupled with its ongoing revenue recovery, make it an appealing choice for investors seeking sustainable growth and potential returns over the long haul.

As a long-term investor, I prioritize identifying companies that exhibit steady growth, consistent dividends, and undervalued stocks. While Algonquin Power may not currently meet the traditional criteria for dividend investing at this stage due to its decreased dividend, its impressive recovery last quarter makes it an appealing option for those seeking future potential.

Additionally, for investors with an increased risk appetite and a commitment towards investing in renewable energy, the recent decline in Algonquin Power’s stock price presents a great entry price and the potential for a bargain opportunity.

Algonquin Power Stock Forecast

Algonquin Power reported a net income of $365 million in the first quarter of 2023, almost three times compared to the same quarter last year. This is a good sign considering the previous 3 quarters had resulted in net losses for the company. This upward trend highlights the company’s resilience and potential for long-term growth, making Algonquin Power stock an appealing choice for investors seeking opportunities in the renewable energy sector.

Algonquin Power operates in the renewable energy industry, which includes sectors such as wind, solar, and hydroelectric power. The company has established a strong presence in the market and is actively involved in generating clean and sustainable energy.

Given the present conditions, the utility stock is trading at a slight discount and boasts a dividend yield of approximately 5.4%. With a reset growth plan and a more sustainable, reduced dividend, Algonquin stock has the potential to deliver satisfactory total returns over the next five years.

Investing in Algonquin Power offers the potential for both financial returns and positive environmental impact. While currently, it may not be considered a favorable buy, we believe in its long-term potential. The company’s commitment to sustainability, along with its strategic initiatives to expand its renewable energy capacity, contribute to its attractiveness as a long-term investment option.

If you’re looking for other renewable energy stocks, check out our guide on the Best Renewable Energy Stocks in Canada. Despite the current challenges, we remain optimistic about Algonquin Power’s future growth and positive contribution to the renewable energy sector.

Investing in one asset may be considered risky so if you prefer a passive investing approach and want to diversify your portfolio with exposure to various sectors and asset classes, we recommend exploring our compilation of the Top ETFs in Canada for 2026. These ETF options provide diversified investment opportunities and allow you to benefit from broader market performance while managing risk.