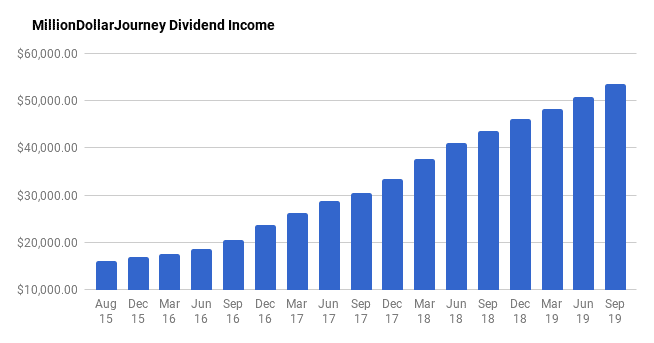

Financial Freedom Update (Q3) – September 2019 – Reaching the Cross Over Point ($53,400 in Dividend Income)!

Welcome to the Million Dollar Journey September 2019 (Q3) Financial Freedom Update – the third update of 2019! If you would like to follow my latest financial journey, you can get my updates sent directly to your email, via Twitter or Facebook, and/or you can sign up for the monthly Million Dollar Journey Newsletter.

For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point where they are enough to cover our family expenses. That is, our goal is to reach $60,000 in passive income by the end of 2020 (getting close now!).

Here is a little more detail on how we came about the $60k per year in passive income:

Financial Goals

Our current annual recurring expenses are in the $52-$54k range, but that’s without vacation costs. However, while travel is important to us, it is something that we consider discretionary (and frankly, a luxury). If money ever becomes tight, we could cut vacation for the year. In light of this, our ultimate goal for passive income to be have enough to cover recurring expenses, and for business (or other active) income to cover luxuries such as travel, savings for a new/used car, and simply extra cash flow.

Major Financial Goal: To generate $60,000/year in passive income by end of year 2020 (age 41).

Reaching this goal would mean that my family (2 adults and 2 children) could live comfortably without relying on full time salaries (we are currently an one income family). At that point, I would have the choice to leave full time work and allow me to focus my efforts on other interests, hobbies, and entrepeneurial pursuits.

Catching Up

In the previous Q2 2019 update, we made some solid progress surpassing $50k in dividend income. I wrote a little about how we were getting close to the “cross-over point”. This is the point at which your passive income grows enough to meet (or just about exceed) your recurring monthly/annual expenses. In essence, it’s the point where you reach financial independence or FIRE (financial independence/retire early).

With our annual expenses in the $52k-$54k range, keep reading to see if we have reached the coveted cross over point.

Here is a summary of the last update:

June (Q2) 2019 Dividend Income Update

| Account | Dividends/year | Yield |

| SM Portfolio | $7,650 | 4.00% |

| TFSA 1 | $3,650 | 4.65% |

| TFSA 2 | $3,850 | 5.09% |

| Non-Registered | $3,360 | 4.42% |

| Corporate Portfolio | $22,300 | 3.78% |

| RRSP 1 | $7,100 | 2.71% |

| RRSP 2 | $2,750 | 2.35% |

- Total Invested: $1,390,022

- Total Yield: 3.64%

- Total Dividends: $50,660/year (+5.10%)

Current Update

Let’s get the good stuff out of the way – we have finally reached the coveted cross-over point! A number of years ago (in 2014) after hitting the million dollar net worth milestone, I made the switch to focus on passive income growth over net worth growth. The strategy was to leverage our wealth in pursuit of financial freedom.

While it was a slow start, the train has been building momentum over the last few years, and today, finally achieving a big milestone by generating enough passive income to meet our recurring expenses. While nailing the cross over point is satisfying, my passive-income goal of $60k will provide a bit of a buffer, and hopefully will be achieved sometime in the next 12 months.

While I plan to work in some capacity for the foreseeable future, achieving financial independence is like the ultimate financial insurance as we are a single income family.

If you are interested, I have created a presentation about my financial freedom journey for the Canadian Financial Summit. The video will be free to view for the first 48 hours.

Onto the investments – even with all the talk about a looming recession indicated by the inverted yield curve, 2019 has been fairly kind to the markets with the TSX recently touching all-time highs.

While a bull market is great for net worth numbers, it also means it’s more expensive to buy quality dividend stocks. However, no matter what the market, there are always pockets of opportunities.

Personally, I like to buy quality dividend companies when their valuations are attractive. In other words, when they are being sold off (ie. dip). In this quarter, I deployed capital into some of the following Canadian positions:

- Capital Power (CPX)

- Park Lawn Corp (PLC)

- Bank of Montreal (BMO)

- CIBC (CM)

- Great-West Life (GWO)

- iShares MSCI All Country World ex-Canada (XAW)

- Finning International Inc. (FTT)

- Suncor (SU)

As dividends are the main focus of my passive income pursuit, there is a large dependence on the market. While there are merits to this investment strategy, there are also substantial risks – particularly dividend cuts.

In 2019 thus far, there have been significant cuts in two of my positions, SNC Lavalin (SNC) and Dorel Industries (DII.B). Fortunately, these were smaller positions within my overall portfolio.

The goal of the dividend growth strategy is to pick strong companies with a long track record of dividend increases. In terms of dividend increases, this year has proven to be lucrative for dividend growth investors.

So far in 2019, the Canadian portion of my portfolio has received raises from:

- CU.TO (7.5% increase)

- RCI.B (4% increase)

- MRU.TO (11% increase)

- CNR.TO (18% increase)

- XTC.TO (6% increase)

- BIP.UN (7% increase)

- BCE.TO (5% increase)

- SU.TO (17% increase)

- GWO.TO (6% increase)

- TRP.TO (8.7% increase)

- RY.TO (4.1% increase)

- MG (11% increase)

- BNS.TO (2.4% increase)

- CAR.UN (3.8% increase)

- TD.TO (10% increase)

- CM.TO (2.9% increase)

- ATD.B (25% increase)

- PWF.TO (5% increase)

- L.TO (6.8% increase)

- CP.TO (27.5% increase)

- WN.TO (1.9% increase)

- T.TO (3.2% increase)

- H.TO (5.0% increase)

- SLF.TO (5% increase)

- NTR.TO (12.5% increase)

- BMO.TO (3% increase)

- EMP.TO (9% increase)

- CAE.TO (10% increase)

- RY.TO (2.9% increase)

- CM.TO (2.9% increase)

- BNS.TO (3.4% increase)

- FTS.TO (6.1% increase)

While growth in dividends from adding to new and existing positions has been ongoing this year, dividend raises have really made a large difference resulting in over $1,500 in additional dividend income. The best part is getting these raises without having to do anything! To put this in context, an extra $1,500 in dividend income is like buying $37,500 worth of dividend stocks that pay a 4% dividend. That’s an extra $37,500 that I don’t need to generate from savings!

I must admit that there is great comfort in seeing dividends coming in on a consistent basis and even more gratifying in seeing a company raise their dividends.

Most of the new purchases were made in my corporate account which generates the bulk of the dividend income. For those looking for an update on my wife’s dividend account (represented as the non-registered portfolio in the table) which follows the Dogs of the TSX strategy, there has been very little change but you can see a full update here.

The dividends in this account are starting to accumulate, so it will be soon time to deploy into an existing or a new position.

With this strategy, you typically buy the highest yielding blue-chip stocks on the TSX (removing old income trusts) and ride it out for the year. The portfolio (another account with Questrade), generates a consistent dividend and is currently producing $3,450/year.

In our overall portfolio, here are the current top 10 largest holdings (besides cash):

- Emera (EMA);

- Fortis (FTS);

- TransCanada Corp (TRP);

- Bell Canada (BCE);

- iShares Core MSCI All Country World ex Canada Index ETF (XAW);

- Canadian Utilities (CU);

- Enbridge (ENB);

- Bank of Nova Scotia (BNS);

- Royal Bank (RY); and,

- Telus (T).

As you can see in detail below, over the last quarter we have increased our dividend income from $50.6k to $53.4k which represents a 5.47% increase quarter over quarter and within 89% of my goal ($60k) and 1.25 years to go. Here are the details.

September (Q3) 2019 Dividend Income Update

| Account | Dividends/year | Yield |

| SM Portfolio | $7,750 | 4.00% |

| TFSA 1 | $3,720 | 4.59% |

| TFSA 2 | $3,900 | 4.86% |

| Non-Registered | $3,450 | 4.26% |

| Corporate Portfolio | $24,500 | 3.87% |

| RRSP 1 | $7,300 | 2.65% |

| RRSP 2 | $2,810 | 2.31% |

- Total Portfolio Value: $1,465,526

- Total Yield: 3.65%

- Total Dividends: $53,430/year (+5.47%)

Through a combination of deploying cash and collecting those juicy dividend increases, this quarter has been fairly productive with a 5.47% bump in dividend income.

Not only do I enjoy watching the dividends flow into the account, I’m also a big believer in compounding returns. In other words, the dividend cash is deployed into more income-producing stocks which then further increases the income of the portfolio, which is then used to buy even more stock. See how compounding works? It’s only a matter of time before the snowball gains momentum and develops a mind of its own.

I welcome corrections/volatility as it gives investors in the accumulation phase a chance to buy quality companies (or index ETFs) at better prices, potentially increasing long-term returns. From what I am reading, an inverted yield curve usually indicates a recession within the next couple of years.

If you are also interested in the dividend growth strategy, here is a post on how to build a dividend portfolio. With this list, you’ll get a general idea of the names that I’ve been adding to my portfolios.

If you want a simpler investing strategy that outperforms most mutual funds out there, check out my top ways to index a portfolio.

Even with all the news of a coming recession, all I can say is bring it on! Pre-retirement investors should welcome corrections as an opportunity to build that long-term portfolio at lower prices and higher dividends.

In case you missed it in the article above, I have created a presentation about my financial freedom journey for the Canadian Financial Summit.

Fantastic progress, FT.

Should we (or perhaps are you) concerned about having all of your eggs in one basket? I mean, all the funds in just one brokerage!

Hi Bob! We have a number of brokerage accounts; Questrade, CIBC, BMO and iTrade. Too many really. But each brokerage is insured up to $1M CIPF.

OK, so it’s not just me. It erks me paying $9.95 in my BMO account to purchase index ETFs that I can buy for pennies is Questrade.

Hi FT,

Wow, great work. You might have mentioned this somewhere but do you drip your Canadian dividends? So you know what they are, but then quite simply they drop back into the stocks they were derived from to bulk up your holding? I think you imply this when you talk about compounding?

I’m thinking of moving my tfsa’s and my non-registered (if I get there) to Canadian dividend stocks. As I understand it this maximizes my tax efficiency on the revenues. More reading to do, I know.

Thanks!

Hey Chris!

Thanks! I do not DRIP my dividends, I collect the cash and re-invest where the opportunities are. Also, there is no tax benefit of Canadian dividends within your TFSA. Before looking to Canadian dividends, make sure you are internationally diversified, then consider your Canadian dividends as your Canadian allocation. Keep those international holdings in your RRSP/TFSA, then your Canadian dividends outside (assuming that your rrsp/tfsa is maxed out).

This is a very impressive dividend income! Our focus currently is capital growth in RRSPs, but I’m starting to think about a shift to dividend income.

Thanks Kari! If you have a long timeline until retirement, I would suggest to focus on total return, rather than just dividend income. However, if you plan on retiring soon, then spending only the cash flow/dividends is a safe bet!

Well Done!

I’m curious what is your corporate portfolio?

Hey Josh, thanks! Our corporate portfolio is composed of Canadian dividend stocks, and a US index ETF.

What strategies have you used or plan to use to mitigate the dreaded OAS ”Recovery Tax” (aka claw back) when you plan to start collecting OAS at/and/or beyond 65?

Since I have a spouse, I don’t think that we’ll have to worry too much about the OAS clawback. More info here:https://milliondollarjourney.com/how-i-plan-to-withdraw-from-my-accounts-to-fund-early-retirement.htm

Congratulations on your progress.

Receiving $50K in dividends from a non registered account (taxable account) nets you much more than earning $50K in salary as there are no payroll taxes and income can be split on joint accounts.

Throw in the dividend tax credit on eligible dividends and you have so much more in pocket.

I noticed that a lot of the dividends are from Canadian companies. In all likelihood these dividends are eligible dividends (higher gross up than non eligible dividends).

If both were not working & had no other income then each of you could earn upwards of $45K for a total of $90K+ from eligible dividends (from taxable account) which would be completely tax free. This amount varies by province .. around $47,900 tax free in Ontario. Around $56K tax free in BC if memory serves me correctly.

Best wishes.

Hey Spock!

Thanks for the tax tips, and yes, I’m aware of the tax advantages of eligible dividends. As you mentioned, this is compounded if you have a spouse with proper account structure.

Congratulations and thank you for sharing your inspiring journey.

I get 2% yield on my VGRO. Good grief.

Oh well. It is cool to watch your numbers grow. Congrats.

Nothing wrong with indexing. In fact, our family RESPs, my wife’s RRSP, and the international portion of my RRSP are indexed.

FIRE = Annual Expenses x 25

It’s that simple. $1.5M minimum in investments and you are set for your annual $60K goal.

Your overall portfolio is Canada heavy no?

Thanks, RK

Hello Rahim, I’m about 35-40% Canada (personal), but looking to continue increasing US/international exposure.

As you become more and more focused on dividends (or distributions), how about switching from XAW (wonderful product) to dividend-oriented equivalents ?

I’m managing some money for my retired parents and decided to ZDV (Canada), ZDY (US) and ZDI (Int) in equal part resulting in a yield of 4.2% paid monthly. I choose BMO’s ETF for their monthly distributions but Ishares and Vanguard have similar ETF’s that would work just as well.

Hi Linda!

I already own a lot of XAW, and will continue to add to increase our US/international exposure. As mentioned above, we use a combination of dividend and index ETF investing.