Net Worth Update October 2013 (+1.64%) – Crossed $800k Threshold!

Welcome to the Million Dollar Journey October 2013 Net Worth Update. For those of you new to Million Dollar Journey, a monthly net worth update is typically posted near the end of the month (or beginning of the next) to track the progress of my journey to one million in net worth, hopefully by the time I’m 35 years old (end of 2014 – soon!). If you would like to follow my journey, you can get my updates sent directly to your email, via twitter and/or you can sign up for the Money Tips Newsletter.

Lets start off with one of the favorite topics here on MDJ – the stock market. Last month, it was all doomsday scenarios especially during a notoriously weak seasonal period for equities. However, October so far has been a month where the bulls have taken over, especially on the Toronto Stock Exchange which hit a 2 year high. The TSX has broken out with a 5.8% gain, the S&P500 kept ahead with a 5.1% gain, and the MSCI EAFE (international) index with a respectable 4.4% gain.

How has my portfolio performed during the month? Not so well compared to the index! Even though my RRSP has a large portion of U.S dividend stocks, it lagged the S&P500 by about 2.5%. My Canadian Dividend stocks portfolio lagged the Canadian index by about 1.9%, but it did reach an all time high of $133,000. My trading account had another strong month. My U.S non-registered trading account, which I use as my fun money account, has been performing very well this year where I have been trading mostly technology stocks.

In addition to our investments, our savings rate remains status quo. Savings has been our biggest driver of net worth growth over the years and likely to be the biggest driver going forward. The higher the savings rate, the faster financial independence comes as indicated in the post “how much do you need to save for early retirement?”

In the big picture, it’s the end of September and we are up 1.64% for the month and 16.61% for the year. We are up to $912k in assets and finally crossed the $800k net worth milestone with about 14 months left in the Million Dollar Journey deadline!

On to the numbers:

Assets: $912,200 (+1.48%)

- Cash: $4,500 (+0.00%)

- Savings: $20,000 (+0.00%)

- Registered/Retirement Investment Accounts (RRSP): $165,300 (+2.80%)

- Tax Free Savings Accounts (TFSA): $53,000 (+0.95%)

- Defined Benefit Pension: $46,900 (+0.64%)

- Non-Registered Investment Accounts: $180,000 (+1.69%)

- Smith Manoeuvre Investment Account: $133,000 (+3.91%)

- Principal Residence: $309,500 (+0.00%) (purchase price adjusted for inflation annually)

Liabilities: $107,100 (+0.28%)

- Principal Residence Mortgage (readvanceable): $0 (0.00%) (Paid off in 2010!)

- Investment LOC balance: $107,100 (+0.28%)

Total Net Worth: ~$805,100 (+1.64%)

- Started 2013 with Net Worth: $690,400

- Year to Date Gain/Loss: +16.61%

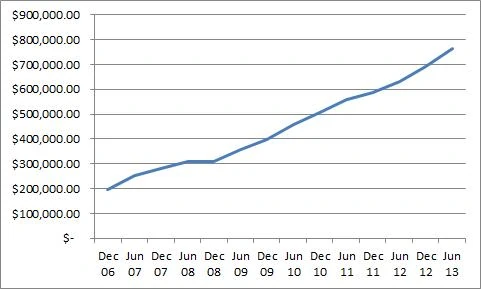

In my last update, readers suggested to chart my net worth progress over time. Below are the net worth values since Dec 2006 with data points taken semi annually.

- December 2006: $198,500

- June 2007: $254,695

- December 2007: $279,300

- June 2008: $310,483

- December 2008: $309,950 (rough second half)

- June 2009: $355,850

- December 2009: $399,600

- June 2010: $456,910

- December 2010: $505,800

- June 2011: $558,713

- December 2011: $585,228

- June 2012: $631,400

- December 2012: $690,400

- June 2013: $766,300

Some quick notes and explanations to net worth questions I get often:

The Cash

The $4,500 cash are held in chequing accounts to meet the minimum balance so that we pay no fees (accounting for regular bill payments – ie. our credit card bill). Yes, we do hold no fee accounts also, but I find value in having an account with a full service bank as the relationship with a banker has proven useful.

Savings

Our savings accounts are held with PC Financial and ING Direct. We usually hold a fair bit of cash in case “something” comes up. The “something” can be anything that requires cash such as an investment opportunity that requires quick cash or maybe an emergency car/home repair. We also need cash to cover any future tax liabilities.

Where Does the Savings Come From?

We don’t live a lavish lifestyle (how we save money), and we do not carry a mortgage or any other bad debt. The only debt we have is an investment loan (which pays for itself), so we end up pocketing a majority of our earnings. Our earnings come from salaries, private business income (via dividends to shareholders), and eligible dividends from publicly traded companies.

Real Estate

Our real estate holdings consist of a primary residence and REITs plus a rental property. The value of the principal residence remains valued at the purchase price (+inflation) despite significant appreciation in the local real estate market.

Pension

The pension amount listed above is the value of both of our defined benefit pension plans. I basically take the semi annual statement and add the contribution amounts (not including employer matching) on a monthly basis. The commuted value of the pensions are not included in the statements as they are difficult to estimate.

Updated 2013 – My wife has recently changed her job position which has resulted in switching from a defined benefit plan to a defined contribution plan. This amount will be added to the RRSP totals going forward.

Stock Broker Accounts

Another common question is which discount broker do I use? We actually have accounts with multiple institutions. I’m hoping to reduce the number of accounts that we hold in the near future. Here is a review of some of the more popular online stock brokers.

@FrugalTrader, no it is annual and online but they only seem to discuss the value of the monthly amounts I will receive when I retire. Any suggestions on how to calculate the present value of my DBP?

PS….can you remove my last name from my earlier post?

@Lisa, lucky you! I would go by the value indicated on your statements. Do you receive them semi annually?

@FrugalTrader, my DBP is non-contributory. Any ideas how I should calculate my DBP value on my net worth statement?

As someone else that is tracking their net worth to a million. I want to know if you calculate pre or post tax for RRSP, and DBP?

@Shaun, for me, it’s pre-tax. For my DBP, I only count the contribution amount, not the commuted value.

@JD, thanks for stopping by. As to how we accumulate the wealth, we earn good incomes and keep lifestyle inflation in check. We basically live off my full time income, and save my wife’s part time income and corporate income (websites and consulting). We are saving for financial freedom, which is when our passive income is enough to cover our monthly expenses. I would say that when our portfolio reaches the $1M mark combined with a bit of side consulting, we’ll be able to choose whether or not to stick with our salaried jobs.

With regards to a luxurious lifestyle, in my opinion, we’re already living it!

It blows my mind how you constantly post these increases – great job!

It looks like you’ve pumped about $40K into your NRIA and almost $30K into your RRSP this year?! The benefits of a couple that works three jobs and saves like there’s no end in sight? Just a guess – I don’t know many (any?) people that have that much to add to their savings. Obviously you have a day job, and this blog – how do you accumulate the wealth?

Out of curiosity, when will you have enough? Don’t get me wrong, I’m all for continuing to do what you do since it’s working for you. But is there a number where you would stop? Two million? Three? What would it take for you to make that step into the luxurious lifestyle, and what would that be for you?

@Billy: “…what memories you are creating that will be priceless to you when you’re old and decrepit? I mention this because people can get too hung up on money and there is more to life so it would be nice to see some balance rather than how you go without to save a buck.”

I’ll try to write something poignant instead of my usual scathing rants ;)

Living in a capitalistic society it is difficult to escape the velocity of money (“Greed is Good!” won a major award), but it can be done if you narrow your focus and ignore the noise.

I can only comment on my own choices (but frequently comment on others’), such as receiving an 8% raise every year (8 years running).

My co-workers look at this as more money, I view it as more time, thus reducing my work load every year by 8%. I now work barely 30 hours a week and have pretty much bottomed out; any and all subsequent pay raises will result in more money.

There will always be endless mountains of money in this world; your time, however, is severely limited and non-renewable.

What is of more value?

(No one on their death bed ever uttered regret of not working more!)

Speaking of which, I also work at a seniors residence a couple times a month (I would volunteer but it is union and they do not allow volunteers; my earnings go to charity). If you want a very raw and brazen eye-opener on the immediacy of which you should LIVE life, hang out with those who are near-death (and/or have lost some or all capacities). Interesting to note that to them, their working life and career achievements and status are all but meaningless, what matters most is family and friends.

A now-dead stock broker once told me that it’s all about a means to an end (i.e. it wasn’t his job or the money that was important).

As FT wisely echos, use money to add value to your life.

Happy Remembrance Day!

It is an exciting adventure and I’m jealous (I’m about the same age, but spent my time getting educated…5 university degrees between myself and my wife…so it’s fairly clear what the cost of our (extra) education has been to date).

Inspired by recent comments….Question….. you are amassing this great wealth…are you content with your life? Are you enjoying your health? How about a post dedicated to how you splurge, and what memories you are creating that will be priceless to you when you’re old and decrepit? I mention this because people can get too hung up on money and there is more to life so it would be nice to see some balance rather than how you go without to save a buck.

@Billy, thanks for stopping by. The good news is that anyone can build wealth if they make it a priority. I think one misconception about living frugally is that there is only sacrifice and no fun. The truth is that you can have it all (within reason). The trick is to spend money where it adds value to your life and refrain on spending on things that add little value. For us, we live a comfortable middle class lifestyle even while our means could leverage a luxurious lifestyle – it’s all about choices. That’s where we save the most, by keeping a sensible lifestyle and living well within our means. If you really want to indulge on how we splurge, we did a NYC trip last year, and a Disney trip with the kids this past spring.

You should do an article that highlights your holdings in your non-reg portfolio at some point.

Congrats, awesome! Its gonna feel nice when you go over 1 million…..