Is Air Canada Stock A Good Buy in 2025?

If you’re considering investing in Air Canada stock in 2025, it is important to understand the company’s performance, market trends, and recent developments in the airline industry. Staying informed about Air Canada’s recent advancements and industry dynamics is crucial in determining whether it is a wise investment choice in 2025.

As an investor, it is recommended to analyze Air Canada’s financial performance, including factors such as revenue growth, profitability, and debt levels. Additionally, keeping an eye on the industry landscape, including travel demand, competition, and government regulations, can provide valuable insights into Air Canada’s future prospects.

If you’re looking to diversify your portfolio with more stocks that pay dividends, unlike Air Canada, we recommend exploring our article on Top Canadian Dividend Stocks. This resource offers insights into reputable companies known for their consistent dividend growth, providing investors with opportunities for stable income generation.

Want To Buy Air Canada Shares? Price, Performance & Analysis

- AC.TO Stock Price: 18.93

- Dividend Yield: N/A

- Price-to-Earnings (P/E) Ratio: 13.92

- 5yr Earnings Per Share Growth: -1.35%

- 5yr Dividend Growth: N/A

- Payout Ratio: 0%

Our Air Canada Stock Analysis

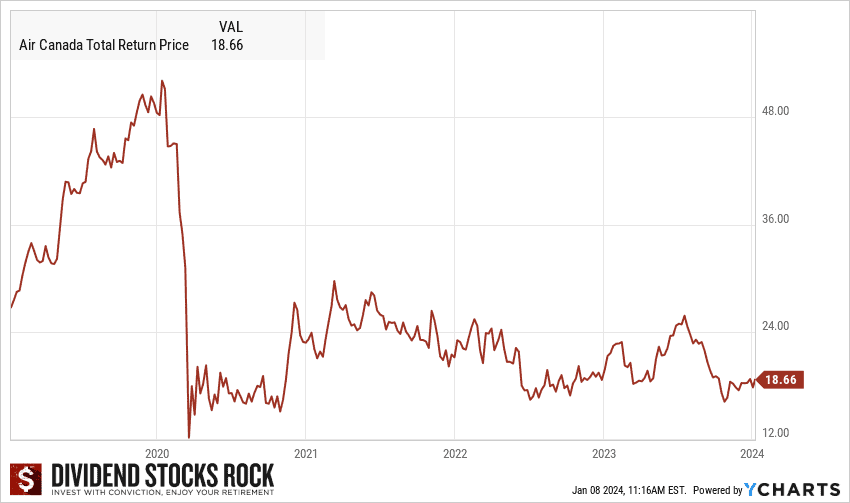

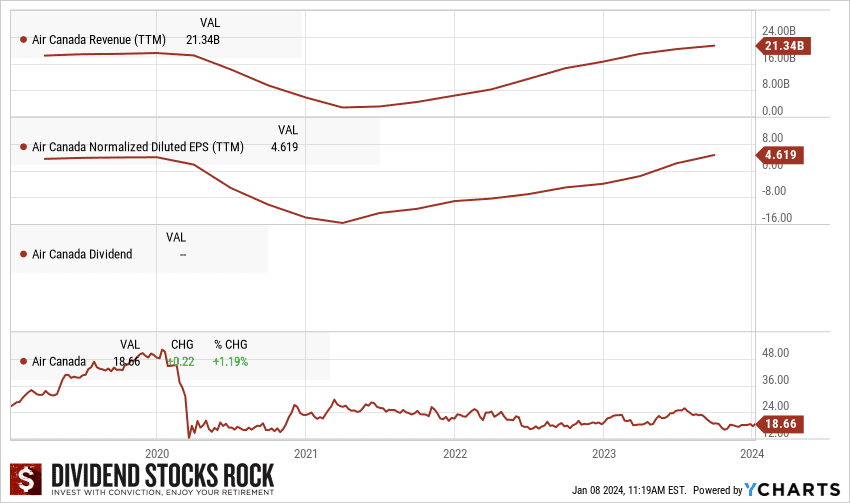

- Stock price is still recovering from the huge decrease in 2020, but revenues are up.

- Air Canada stock has surged over 50% year-to-date.

- In comparison, the S&P 500 has only seen a 13% increase while the TSX Composite has only grown by around 4% year-to-date.

- Overall airline industry is back to business with little to no restrictions remaining.

Our Air Canada stock analysis indicates that the current valuation of Air Canada presents an enticing buying opportunity for investors. Despite the numerous challenges experienced by the airline industry, Air Canada maintains a strong position as a dominant player in the Canadian market, making it an attractive choice for long-term investment.

While the company has faced significant hurdles, such as a notable decline in earnings resulting from the pandemic, we believe that Air Canada’s management team is capable of driving growth and implementing effective strategies. A recent positive development worth mentioning is the company’s successful repayment of a substantial loan, which demonstrates its commitment to financial stability and instills confidence in its future prospects.

If you are seeking long-term investment opportunities in Canada, we invite you to explore our comprehensive guide on the Top Long Term Investments in Canada.

How Can I Buy Air Canada Shares?

o purchase Air Canada shares, you can utilize any of the available Canadian online brokerage services. At MDJ, we prioritize guiding our readers in selecting discount brokerages that align with their needs. Our list of Top Online Brokerages in Canada is regularly updated to provide our readers with the best recommendations and current promotional offer codes.

Once you have successfully registered for an online brokerage account, buying Air Canada shares is a straightforward process. Use the search bar to find the ticker symbol “AC” and determine the number of shares you wish to purchase.

For example, if you plan to invest $500 in Air Canada shares and the current stock price is $20, you would enter “25” and select the “market limit” option. The online brokerage platform will present you with a confirmation prompt: “Do you want to buy 25 shares of AC at $20 each, totaling $500?”

Once you confirm the order, the online broker will handle the necessary transactions. Congratulations! You are now a shareholder of one of the leading airlines in Canada.

Best 2025 Broker Promo

Up To $2,000 Cash Back + Unlimited Free Trades

Open an account with Qtrade and get the best broker promo in Canada: 5% cash back when you fund a new account!

The offer is time limited - get it by clicking below.

Must deposit/transfer at least $1,000 in assets within 60 days. Applies to new clients who open a new Qtrade account by November 26, 2025. Qtrade promo 2025: CLICK FOR MORE DETAILS.

Air Canada Stock Past Performance

Over the past few years, Air Canada has faced significant challenges due to the impact of the pandemic, leading to a substantial decrease in earnings. Consequently, its stock price experienced a significant decline in 2020 and has remained relatively low even after a partial recovery.

However, there are positive signs as revenues have been on an upward trajectory since 2021 and are approaching pre-COVID levels. This recovery in revenues indicates a potential buying opportunity, as the stock price remains relatively low while the company’s financial performance improves.

As an investor focused on long-term positions, my priorities include identifying companies that demonstrate steady growth, consistent dividends, and undervalued stocks.

Although Air Canada does not meet the criteria typically associated with dividend investing, its remarkable revenue growth and market performance make it an appealing choice for investors seeking capital appreciation and future potential.

Additionally, Air Canada’s stock price has recently experienced a decline, presenting investors with a great moment to consider investing in a company with promising growth prospects.

Air Canada Stock Predictions

Air Canada stock has experienced significant turbulence in recent years due to the impact of the pandemic on the airline industry. However, there are potential opportunities for investors to consider.

The bull case for Air Canada stock is based on several factors. Firstly, the company has seen a notable increase in its share price, especially after successfully paying off a substantial loan. This demonstrates progress and financial stability for the company.

Air Canada is also well-positioned to capitalize on the pent-up demand for travel as restrictions ease and more people look to fly again. The company has a strong history of serving business travelers, and its international business travel is gradually returning to pre-pandemic levels. Additionally, Air Canada has expanded its offerings with initiatives like Rouge, providing cheaper airline options for travelers and potentially attracting a broader customer base.

Furthermore, Air Canada has made efforts to reduce costs over time, which has helped improve its financial performance. This is especially crucial given the potential impact of higher interest rates and inflation on the company’s costs. By maintaining competitive pricing, Air Canada aims to retain customers and stay ahead in the market.

With a strong market position, Air Canada benefits from a competitive advantage over its peers. The company is committed to improving fuel efficiency, reducing emissions, and driving long-term growth for investors. It has also focused on enhancing its financial strength, resulting in a solid balance sheet that provides stability and flexibility to weather the current challenges and pursue growth opportunities.

If you’re looking for more Canadian airline stocks, look no further than our guide on Investing in Canadian Airline Stocks.

Should You Buy Air Canada Stocks Right Now?

Air Canada reported a net income of $4 million in the first quarter of 2023, which may seem low, but represents a massive increase compared to the same quarter last year. For the last 2 quarters, Air Canada has been profitable, which is a great upturn from the massive losses resulting from pandemic restrictions. This positive trend makes Air Canada stock an attractive choice for investors looking for long-term opportunities in the airline industry.

Canada’s airline industry is dominated by a few key players, including Air Canada, WestJet, and Porter Airlines. Air Canada is the largest airline in the country and operates an extensive network of domestic and international routes. WestJet, now part of the Air Canada group, is another major player, offering both domestic and international flights. Porter Airlines focuses on regional routes within Canada and select destinations in the United States.

The future of the airline sector in Canada depends on several factors, including the pace of global economic recovery, the effectiveness of public health measures, and the willingness of travelers to return to air travel. The industry’s ability to adapt, innovate, and prioritize customer safety will be crucial in regaining passenger confidence and ensuring long-term sustainability.

Investing in the airline sector carries inherent risks due to its sensitivity to economic conditions, fuel prices, regulatory changes, and competitive pressures. Investors interested in the sector should carefully evaluate the financial health, market position, and strategic initiatives of individual airlines, such as Air Canada, before making investment decisions.

If you prefer a passive investing approach and want to reduce your portfolio risk we recommend considering our compilation of the Top ETFs in Canada for 2025. These options provide diversified exposure to different sectors and asset classes, enabling you to capitalize on overall market performance while potentially reducing risk in your investment portfolio.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?