Tax Minimization

All Categories

What is StudioTax? StudioTax is certified tax preparation software for Canadian personal income tax returns. It is provided by BHOK IT Consulting and is now…

Read Full Article >>Are you curious about how investing taxes are calculated on capital gains, dividends, and interest in Canada? I’m not a tax expert, but with tax…

Read Full Article >>Since writing my original “How to Buy Flow Through Shares in Canada” article over a decade ago, I’m consistently surprised at how many people are…

Read Full Article >>When I wrote about some low cost ways to convert your valuable US Dollars (USD) back into Canadian dollars (USD), there was a comment about…

Read Full Article >>Most Recent

Canada Federal Budget 2025: What It Means for You

Canada’s 2025-2026 federal budget came out this week, and while the general consensus seems to be “nothing major to see here,” there were a fair…

US vs Canada: Trump Tariffs Lead to Trade War

With so many Canadians plugged into the latest Trump Tariff news, I felt that I needed to get an updated trade war column out as…

Best Financial Advisors in Canada

In trying to do your homework and separate the best financial advisors in Canada from the rest, you’re going to run into a lot of…

The Ultimate Tax Guide to Inheriting a Cottage in Canada

The worst time to worry about paying inheritance tax on the family cabin is after your parent(s) have passed away and your family is just…

Canadian Election: Taxes, Tariffs, and Housing

With Canada’s federal election just days away, the headlines have been dominated by taxes, tariffs, housing strategies, and party leaders throwing shade at each other.…

Second Citizenship, Offshore Investing & Expat Money Strategies for High Net Worth Canadians

For high-net-worth Canadians, the idea of obtaining a second passport isn’t just about escaping winter or avoiding long immigration lines, it’s about financial flexibility, risk…

Tax-Loss Harvesting in Canada

Tax-loss harvesting helps Canadians minimize the taxes that they pay on investment gains made outside of their RRSP and TFSA. What Canadian doesn’t want to…

Best Personal Finance Courses in Canada

I need to be clear right off the bat that I’m a bit bias when it comes to recommending the best financial literacy courses in…

Canadian Financial Summit 2024

It’s that time of the year… the leaves are falling, pumpkin spice lattes are brewing, and for MDJ’s Kyle Prevost – it’s back to the…

13 Top Tax Breaks for Seniors in Canada

There are a ton of tax breaks for seniors in Canada compared to other age groups. It’s almost like our tax code tells us the…

Selling a Business to Retire in Canada

I’ve been on a real small business/CCPC kick here at MDJ over the last month, and my end goal was always to get to a…

Investing Inside a Corporation for Retirement in Canada

Before you jump into the details of investing inside of a corporation for your retirement, it’s likely worth taking a few minutes to read my…

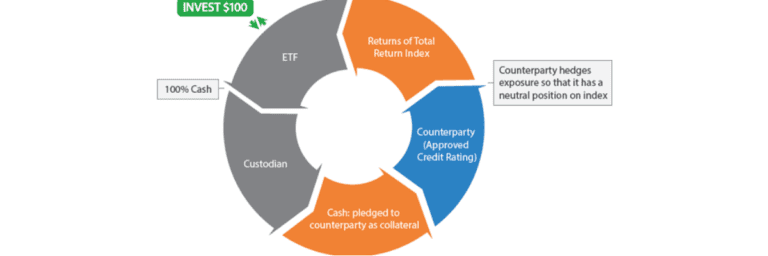

Best Swap ETFs in Canada: Horizons Total Return Funds

In writing about corporate and expat investing over the past couple of years, I’ve come to realize just what an advantage using Canadian swap-based ETFs…

StudioTax Review 2025

What is StudioTax? StudioTax is certified tax preparation software for Canadian personal income tax returns. It is provided by BHOK IT Consulting and is now…

Canada’s 2024 Budget – New Taxes on Capital Gains

Canada’s new tax rules on capital gains mean that you’re now likely to pay more taxes if you own a cottage, pass away with an…

Salary vs Dividends in Canadian Corporations: Paying Yourself as a Small Business Owner

In preparation for our dividends vs salary comparison for Canadian small business owners, we took a broad look at Canadian corporate taxes last week. I…

CCPC Taxation: Canadian Corporations for Small Business Owners

I’ve been getting a lot of questions recently in regards to Canadian corporations and taxes for small business owners that have a CCPC (Canadian-Controlled Private…

What is Income Splitting?

Income splitting is a tax-saving strategy that divides a stream of income between family members (usually two spouses). The goal is to apportion as much…

"I've completed my million dollar journey...

Want some help with yours?”

Instantly download our free eBook on tips for how to organize your RRSP, TFSA, and other investments, in order to get the most out of your retirement at any age.