Tax Minimization

All Categories

What is StudioTax? StudioTax is certified tax preparation software for Canadian personal income tax returns. It is provided by BHOK IT Consulting and is now…

Read Full Article >>Are you curious about how investing taxes are calculated on capital gains, dividends, and interest in Canada? I’m not a tax expert, but with tax…

Read Full Article >>Since writing my original “How to Buy Flow Through Shares in Canada” article over a decade ago, I’m consistently surprised at how many people are…

Read Full Article >>When I wrote about some low cost ways to convert your valuable US Dollars (USD) back into Canadian dollars (USD), there was a comment about…

Read Full Article >>Most Recent

Investing in Flow Through Shares in Canada

Since writing my original “How to Buy Flow Through Shares in Canada” article over a decade ago, I’m consistently surprised at how many people are…

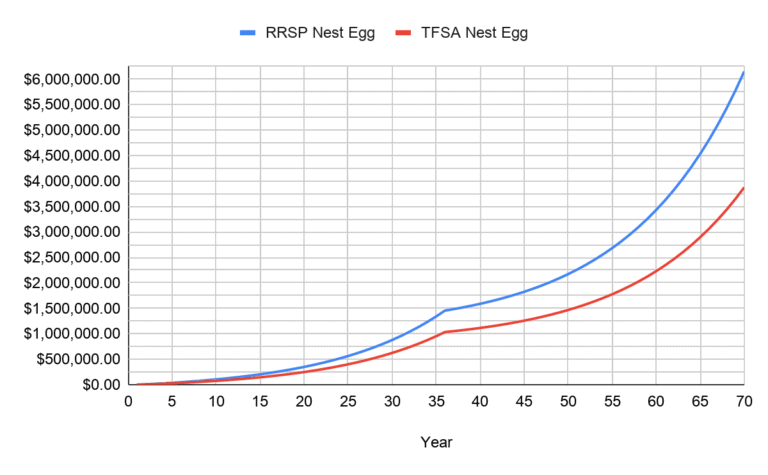

TFSA vs RRSP- Which One is Better?

Canadians have fantastic options when it comes to registered accounts. Registered accounts are beneficial for many reasons, the main reason being that they are tax…

Homeowners: Create Cash-Flow and Tax Write-Offs Using a Debt Conversion Strategy

Do you own a home? Do you make regular mortgage payments? There’s a good chance you’ve already spent tens of thousands paying mortgage interest –…

Capital Gains Tax when Converting Currency

When I wrote about some low cost ways to convert your valuable US Dollars (USD) back into Canadian dollars (USD), there was a comment about…

What is a Pension Adjustment (PA)?

Whether you’re a member of a defined benefit (DB) or defined contribution (DC) pension plan, you’ll receive a pension adjustment (PA) each year. It’s important…

Converting a Principal Residence into a Rental Property – The Solution!

This is a guest article from Kerry, a soon to be Chartered Accountant, who has tips for those who want to convert a principal residence…

In-Kind Transfers of Non-Registered Stocks to an RRSP/TFSA

I’m a bit late getting to this reader question as the RRSP deadline was at the beginning of this month (March 1, 2010), however, this…

Claiming Capital Loss from a Delisted Stock

With Nortel becoming delisted, there are thousands of investors out there still holding the delisted stock. So what happens next? How do you claim the…

How Capital Cost Allowance Works (CCA)

I’ve brushed on Capital Cost Allowance (CCA) before when discussing rental property tax deductions and the CCA schedule for the purchase of a computer in…

RRSP Tip: Carry Forward Your RRSP Tax Deduction

With the RRSP deadline right around the corner (March 2, 2009), this is a strategy that I’ve mentioned in passing a couple times, but never…

9 Ways I Reduced My Taxes Last Year

With 2008 done and over with, it’s that time of year to start thinking about the dreaded T word… taxes. On one hand, I enjoy…

Getting Organized for Tax Season

As the tax deadline is approaching, the procrastinators out there are scrambling to get their receipts in order to file their income taxes. Yes, I…

Differences in Non-Refundable Tax Credits and Tax Deductions

This is a pretty common question asked during tax season. What exactly is the difference between a non-refundable tax credit and a tax deduction? Tax…

"I've completed my million dollar journey...

Want some help with yours?”

Instantly download our free eBook on tips for how to organize your RRSP, TFSA, and other investments, in order to get the most out of your retirement at any age.