Net Worth Update February 2014 (+12.1%)

Welcome to the Million Dollar Journey February 2014 Net Worth Update. For those of you new to Million Dollar Journey, a monthly net worth update is typically posted near the end of the month (or beginning of the next) to track the progress of my journey to one million in net worth, hopefully by the time I’m 35 years old (end of 2014 – yes this year!). If you would like to follow my journey, you can get my updates sent directly to your email, via twitter (where I have been more active lately) and/or you can sign up for the MDJ Newsletter.

With the stock market taking a breather at the end of January, the bulls came roaring back to continue making all time highs in the S&P500. The S&P500 retreated -3.2% in January but turned around and impressively gained 4.7% in February. The TSX (via XIU.TO) and the MSCI EAFE (via XIN.TO) also moved up with a 3.8% and 4.65% gain respectively.

With the pullback in late January, I transferred another $5k from my HELOC to my dividend portfolio and added to a few positions. I also transferred some cash from my “managed” RRSP account into my self directed RRSP to help clean up my portfolio. The goal is to fill my RRSP with US and foreign assets.

How did my portfolio do this month? As they say, a rising tide lifts all boats, so my investments did well in February. Our combined RRSPs returned +2.24% (mostly US stocks and international), our leveraged Canadian dividend portfolio gained 4.45%. Mind you, not all of the 4.45% is organic because of the cash transfer into the account.

Another big change to the net worth statement is that I have included my corporate investment account and added future tax liabilities. The future tax liabilities include future taxes owing for our RRSP (30% of total), leveraged dividend portfolio (20% of capital gain), and the corporate investment account (23% of total). I took the middle of the road approach for the tax rates used as I typically minimize taxes owing as much as possible. For example, I only withdraw as much from the corporate account in the form of dividends so that no personal tax is owing (after all personal tax deductions).

For the leveraged dividend portfolio, I do not plan on ever selling, but you never know what the future may bring. If I do sell, then capital gains tax is owed. Finally, for the RRSP, my plan is to withdraw from the RRSP accounts during years when income are very low, thus a low resulting tax rate.

In the big picture, for the February 2014 update we are up 12.12% for the month and 15.53% for the year thus far. We are up to $1,180,385 in assets and $955k in net worth with about 10 months left in the Million Dollar Journey deadline! With the deadline looming, there is about $45k left to go until the big $1,000,000 financial milestone!

On to the net worth numbers:

Assets: $1,180,385 (+22.31%)

- Cash: $4,500 (+0.00%)

- Savings: $20,000 (+0.00%)

- Registered/Retirement Investment Accounts (RRSP): $179,000 (+2.29%)

- Tax Free Savings Accounts (TFSA): $63,500 (+0.79%)

- Defined Benefit Pension: $48,100 (+0.63%)

- Non-Registered Investment Accounts: $194,000 (+2.11%)

- Smith Manoeuvre Investment Account: $152,500 (+4.45%)

- Corporate Investment Account: $200,000 (new)

- Principal Residence: $318,785 (+0.00%) (purchase price adjusted for inflation annually)

Liabilities: $224,600 (+99.38%)

- Principal Residence Mortgage (readvanceable): $0 (0.00%) (Paid off in 2010!)

- Investment LOC balance: $118,000 (+4.75%)

- Future Tax Liability: $106,600 (new)

Total Net Worth: ~$955,785 (+12.12%)

- Started 2014 with Net Worth: $827,300

- Year to Date Gain/Loss: +15.53%

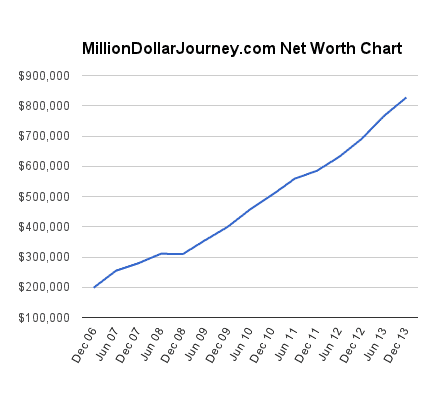

Readers suggested to chart my net worth progress over time. Below are the net worth values since Dec 2006 with data points taken semi annually.

- December 2006: $198,500

- June 2007: $254,695

- December 2007: $279,300

- June 2008: $310,483

- December 2008: $309,950 (rough second half)

- June 2009: $355,850

- December 2009: $399,600

- June 2010: $456,910

- December 2010: $505,800

- June 2011: $558,713

- December 2011: $585,228

- June 2012: $631,400

- December 2012: $690,400

- June 2013: $766,300

- December 2013: $827,300

Some quick notes and explanations to net worth questions I get often:

The Cash

The $4,500 cash are held in chequing accounts to meet the minimum balance so that we pay no fees (accounting for regular bill payments – ie. our credit card bill). Yes, we do hold no fee accounts also, but I find value in having an account with a full service bank as the relationship with a banker has proven useful.

Savings

Our savings accounts are held with PC Financial and ING Direct. We usually hold a fair bit of cash in case “something” comes up. The “something” can be anything that requires cash such as an investment opportunity that requires quick cash or maybe an emergency car/home repair. We also need cash to cover any future tax liabilities.

Where Does the Savings Come From?

We don’t live a lavish lifestyle (how we save money), and we do not carry a mortgage or any other bad debt. The only debt we have is an investment loan (which pays for itself), so we end up pocketing a majority of our earnings. Our earnings come from salaries, private business income (via dividends to shareholders), and eligible dividends from publicly traded companies.

Real Estate

Our real estate holdings consist of a primary residence and REITs plus a rental property. The value of the principal residence remains valued at the purchase price (+inflation) despite significant appreciation in the local real estate market.

Pension

The pension amount listed above is the value of both of our defined benefit pension plans. I basically take the semi annual statement and add the contribution amounts (not including employer matching) on a monthly basis. The commuted value of the pensions are not included in the statements as they are difficult to estimate.

Updated 2013 – My wife has recently changed her job position which has resulted in switching from a defined benefit plan to a defined contribution plan. This amount will be added to the RRSP totals going forward.

Stock Broker Accounts

Another common question is which discount broker do I use? We actually have accounts with multiple institutions. I’m hoping to reduce the number of accounts that we hold in the near future. Here is a review of some of the more popular online stock brokers.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

As young guy I have been following your blog since 2009. I started with nothing and today can proudly say that with your insightful information and displined methodology to finance which closely matches my own personal financial believes, I own 5 rentals, and grow yearly at a rate of 20%. I am reaching 300k and I am only 27. Your blog should be studied as a personal finance course straight from kindergarten. You have proved that you don’t have to be a rockafellar to be a millionair. Unlike my own parents, with your help I am guaranteed to be wealthy and retired before 55. Thank you, and don’t stop spreading the wealth (knowledge) even after you surpass 1 million.

Thanks for the kind feedback. Looks like you are well underway to financial freedom – congrats!

I’ve been following MDJ since probably around 2006 and I always wondered if the money you’ve been making from this site was included in your net worth updates or not. I’m sure some of it was as you probably took some money out of the corporation as income on an annual basis, but I figured there must be more of it! There’s probably a bunch more too seeing as this is only the corporate money you’ve decided to put in the corporate investing account, not all your corporate assets.

I’m glad to see you are going to hit your goal. You did a fantastic job at taking something that almost seems insurmountable for the average person and accomplished it in record time. Congrats! All your hard work paid off.

Awesome job FT, love the progress, the only issue once you reach 1million$ is – will you be hungry for the next 1-5million$? :) At 35, that’s a amazing accomplishment. Congrats

T

It is a pretty impressive record. What are your plans once you reach your goal? Are you likely to remain invested and keep going? You must have been pretty adventurous with your investments in the past to achieve these figures.

@FT I think you should keep the corp trading account. If anything I’d wonder why it wasn’t added sooner. To me the question is pretax vs net of tax. The future tax liability – is this for all assets, what rate was used and how was it estimated? Whether it’s pretax or net of tax depends on personal preference. The corp acct is definitely an asset and should be included but I just think some may have been caught off guard with the addition of it as well as the estimated tax liability.

And like you’ve mentioned in previous posts, this is only a milestone, not the end goal. Maybe after you reach the milestone you could comment on the next goal, passive income large enough to cover 100% of living expenses. Since it’s unlikely to be accurately predictable as a net worth figure, maybe you could do updates in terms of passive income level. You could do a % of required passive income on a monthly or annual basis and maybe adjust annually for inflation. Something like “In March, my passive income was $____ and that’s ____% of the monthly passive income to cover my monthly expenses. And year to date that’s ____% of the annual which is _______ (ahead or behind) of the annual goal of ____% of passive income required to cover expenses.” Any thoughts?

I think it’s better late than never. They are assets. Was the $200 K 100% from corporate income or is that after some corporate investment gains too? I think most of the concern is that there isn’t much information about the corporate amount. Maybe if there was more information and if the previous years of accumulating were commented on, it would seem like it was less out of the blue and more of a gradual organic thing.

Although it’s more complicated, I think it’s more accurate to add cars (maybe $1000 less than the Canadian Black Book value) and current market value real estate (ask a realtor once a year in June) minus realtor fees and legal fees. So if you added those, you might already be at the $1 M mark anyway.

@Dwilly, at least you put a smiley face after your comment. :)

@Mike, I can see how it appears deceptive. However, I have been looking to add this to the balance sheet since my Dec 2012 update (https://milliondollarjourney.com/net-worth-update-december-2012-1-75-year-end-summary-and-giveaway-winners.htm) and mentioned again in January 2013 (https://milliondollarjourney.com/net-worth-update-january-2013-4-53.htm). I’ve been waiting to have the cash in a trading account before declaring. Why the delay since 2012? Mostly procrastination, but I agree that the timing could be better.

Do you guys think that I should remove the corporate trading account from the net worth statement?

Congrats on being so close to your goal. I must admit that as someone who has read the blog from the beginning that this does seem like a bit deceptive. It was clear to everyone reading that you were going to fall just short of your goal and that is ok, it is after a “journey” and it is not like if you missed the target by a couple of months there were any consequences. Now, seemingly out of the blue you have an extra 200K and will hit the goal with months to spare (and good for you). I guess a better question to ask is why did you hide this asset? It is not like it was a trivial amount. If you own the corporation there is no reason not to have reported it all this time. Once again, Congratulations.

“@Fraud Revealer, I was waiting for a comment like yours, I’m surprised that it hasn’t been posted earlier.”

In fairness, I called you a sandbagger a long time ago. :)