Buying a House in Canada – Why I Can’t Wait To NOT Be a Homeowner

By the end of the summer I will no longer be a homeowner.

In many countries that statement would be a simple matter of personal finance. Selling an asset, paying off a loan (mortgage) and moving on to another living space.

But not in Canada.

No, in Canada selling our house means that my wife and I are making a massive change to our identities. A core shift in our very essence.

Many would say we are taking a careless step backward on the path to living a fulfilled “real adult” life.

Several friends and family will likely believe that we are crazy for tossing away “the best investment one can ever make”.

The absolute obsession with homeownership in Canada continues to astound me. The emotional connection between Canadians and their real estate has been well documented, but that doesn’t make it any more logical! Even though my wife and I have owned a home for years, this was much less because we subscribed to the traditional “own at all costs” mentality, and more due to the fact that rural Manitoba housing vs rent decisions are quite different than most places in Canada.

We’ll certainly miss some of the small luxuries (goodbye big garage) of our old home, but here’s some of the reasons why we believe selling our house will be a weight off of our shoulders.

1) Endless Fear of Hearing a Strange Noise

Is that the furnace taking its last breath?

Perhaps it’s the water treatment system deciding to spring a leak?

Is that rain I hear – is it possible our septic system is backing up?!

My dad loves fixing stuff. His day is not complete until he has improved the physical world around him.

I am not my dad.

My lack of handyman skills has now become a joke that I’m comfortable laughing at, but for years I was incredibly self-conscious about possessing nearly zero masculinity-affirming fix-it ability. You want someone to work hard doing menial chores such as cutting lawns, raking leaves, shovelling snow, or lifting heavy things from Point A to Point B – I got you covered.

Anything that requires technical skills or mechanical problem-solving ability… not so much.

Because my father’s handyman-dominant brain was not passed down to his oldest son, I lived in perpetual fear of things breaking when I owned a home. I never really got this “pride of ownership” thing. For me it was definitely more of a “fear of ownership”. I had so much of my net worth tied up in this one asset – that required constant maintenance – and I really had no idea what it was doing. “Learning by doing” constantly scared me as errors were quite costly.

Hiring any specialized help on something like an air conditioning unit always seemed to cost triple what was estimated, so that just exponentially added to my anxiety levels around maintenance.

Renting = not my problem!!!

2) Renting is Simply a Better Financial Decision Than Buying – in 2021 Canada.

I know… that’s a big statement.

It’s probably worth an article all on its own.

It will probably lead to crazy comments (as all real estate articles in Canada do).

But it’s quantifiably true.

We’ll get into the “fringe” elements of why owning can be so expensive in a second, but for now let’s just look at the direct dollars and cents comparison.

Before we get too deep into this, I don’t want to argue with you unless you have viewed the following content by some of Canada’s smartest personal minds.

i) Preet Banerjee compares renting a house and renting a mortgage and then explains why he is a renter.

ii) John Robertson (my vote for most underrated personal finance philosopher – and it’s not even close) tells you why he is a renter and presents the best rent vs buy calculator that I’ve ever seen.

iii) Here’s Ben Felix’s 5% rule in action. I personally believe that Ben is shooting a bit high on real estate estimates (today’s giant houses are not comparable to historical returns data he quotes), and a bit low on property taxes + maintenance costs. He also isn’t factoring in closing costs (which are a pretty big deal when you move the number of times the average Canadian does), nor the difference between renters insurance and home insurance. I do like his methodology, but the 5% rule of thumb for non-recoverable costs is pretty badly slanted towards real estate due to the factors mentioned above. I could probably live with a 6% rule – but find a 7% rule to be a much more true measure (speaking as a soon-to-be former homeowner of ten years).

iv) I’ve talked to many real estate experts who claim “the 1%” rule of thumb is a great filter for a potential landlord looking to add a revenue-generating property to their real estate portfolio. That means that if you can’t get at least 1% of your purchase price in monthly rent, then it’s not really worth considering the property. The flip side of that is that if you’re renting for substantially less than 1% of the purchase price of a comparable home – then you’re getting a good deal. Bryce over at Millennial Revolution explains his rule of 150 which comes to similar conclusions.

Those are all great looks at accurately comparing financial costs vs benefits of purchasing a house to live in.

So, let’s use them to look at a few options across Canada at the moment.

Toronto Real Estate

The average price of a property sold in the GTA in May of 2021 was $1,108,453 (a massive 28% gain over a year earlier) while the average rent is closer to $2,100 (down 14%).

- Our 1% rule of thumb says that a $1,100,000 house better get you $11,000 per month in rent – or it’s not a good buy.

- Using John’s or Preet’s calculators we see that renting is WAY ahead given these parameters.

- My modified Ben Felix 7% rule tells us that if we can rent for $6,466 – then it’s a pretty good deal to rent. If we stick to his original 5% rule, we need to rent for less than $4,618 to be a good deal.

- Bryce’s preferred rule of 150 means that the $2,100 rental average, would dictate a mortgage payment of $1,400 as a good measuring stick for if they should buy. A $1,400 mortgage (HAHA – good one) would correlate to a purchase price of roughly $350,000 (depending on a few variables.

Conclusion: By any measure… this makes no sense.

Buying a House in Calgary

Maybe this is just a Toronto thing. Let’s go to a city that has seen its housing market really fall on tough times as a result of the oil collapse, PLUS rent has actually gone up over the last year.

The average rent in Calgary is roughly $1,200 and the average cost of a property is $510,000. Those stats might be skewed a bit by average home type in the rental world vs average home type in the purchase world. Let’s say average rent for comparable might be $1,500.

- Our 1% rule of thumb says that a $510,000 house better get you $5,100 per month in rent – or it’s not a good buy.

- Using John’s or Preet’s calculators we see that renting is substantially ahead given these parameters.

- My modified Ben Felix 7% rule tells us that if we can rent for under $3,000 – then it’s a pretty good deal to rent. If we stick to his original 5% rule, we need to rent for less than $2,125 to be a good deal.

- Bryce’s preferred rule of 150 means that the $1,500 rental average, would dictate a mortgage payment of $1,000 as a good measuring stick for if they should buy or not. A $1,000 mortgage would correlate to a purchase price of roughly $230,000.

Home Prices in Halifax

Ok, enough of these “big city places”. We all know that house prices are way cheaper on the East Coast, so let’s run the numbers for Canada’s semi-hidden gem of a city.

The average rent in Halifax is about $1,600 per month and the average cost of property is $465,000.

If we adjust upward to $1,800 in allowing for comparable properties (I checked, you can rent a solid single-family unit for 1,800 in Halifax – even better in Dartmouth, Nova Scotia) then we get the following analysis.

- Our 1% rule of thumb says that a $465,000 house better get you $4,650 per month in rent – or it’s not a good buy.

- Using John’s or Preet’s calculators we see that renting is substantially ahead given these parameters.

- My modified Ben Felix 7% rule tells us that if we can rent for under $2,700 – then it’s a pretty good deal to rent. If we stick to his original 5% rule, we need to rent for less than $1,937 to be a good deal.

- Bryce’s preferred rule of 150 means that the $1,800 rental average, would dictate a mortgage payment of $1,200 as a good measuring stick for if they should buy or not. A $1,200 mortgage would correlate to a purchase price of roughly $280,000.

…that’s why I’m not afraid to be a renter the rest of my life and why I’m not worried about “hopping off” the property ladder.

If you’re still not convinced, here are a few more stats for you.

- Canada’s current price-to-rent levels are 574% higher than they were in 1970.

- Since 1970, Canada’s price-to-rent level has risen at roughly 21x as quickly as the USA’s.

- Canada’s current price-to-rent levels are substantially higher now than the USA’s was before their 2008/09 housing crash.

3) Opportunity Cost of Being Rooted Into Place

I grew up in a single house – owned by a homeowner. (My parents were unique in that my dad built his own house on a very cheap piece of rural land and never took out a mortgage. Feel free to try and copy that strategy in 2021.)

It was really nice. I get that there can be some very pleasant reasons to own the house/condo that you live in.

But let’s be honest about the big picture here – there are some large trade offs involved.

Buying a home makes you much less likely to move in order to accept a promotion or career opportunity. That’s impossible to quantify, but it’s a really significant consideration. One of the quickest ways to climb in any industry (or even make an advantageous jump to a new industry) is to be willing to move to where the opportunity is. The cost to your career of feeling as if you are anchored to the house you worked so hard to get into could be massive!

4) Our Brains Work Differently When We Think About Renting a Place to Live vs “Buying a Forever Home” – Lifestyle Inflation is Almost Inevitable.

Funny things begin to happen as we approach the leap from renter to homeowner. Suddenly, cost-benefit calculations we were doing about third bedrooms or fancy kitchens fly out the window… only the best will do for our “forever home” after all.

Weird mantras like, “We’ll grow into it,” begin to creep into our heads and suddenly we’re looking at fancy countertops, upgrading bathrooms, etc.

I’m not sure whether to blame HGTV and the homeshopping shows or what it is, but there is no doubt that most of us look at properties completely differently whether we are renting or buying. Keeping up with the Joneses becomes so much more important (is this what “being a real adult” is truly all about?) when you’re buying and furnishing a house.

One thing that we have learned from moving overseas is that we can be 98% as satisfied in a two-bedroom apartment as we were in our large bungalow. Now, I hear you that things might be different if you have a young family. I’m sure this equation changes substantially when adding children to the picture, but when you look at the smaller average house size that the larger families of yesteryear were raised in, it raises some interesting questions about how much room we all need to be happy.

5) “Drive Until You Qualify” = Too Much Driving

I have consistently found that we underestimate the cost of driving – in both lifestyle and dollars!

There have been many studies done on how spending time in the car can really impact your physical health in a myriad of ways. It doesn’t take a genius to figure out that the more time you spend sitting by yourself (often stuck in frustrating traffic) the less healthy and happy you are likely to be.

Maybe this work-from-home thing is going to reduce these financial and physical costs… but I have my doubts as to how many people this will actually affect a few months from now.

When calculating how much your commute will cost you, one needs to factor in depreciation and repairs, in addition to the price of gasoline (or perhaps electricity) and possibly parking. The government of Canada believes it costs about $0.59 per km to drive, while CAA posts similar estimates. At 260 work days per calendar year, every km you move further from your workplace will cost you over $300 per year! If you have two working adults that are both commuting in your household, it doesn’t take long for those numbers to really add up.

6) My House is Definitely NOT the Best Investment I’ve Ever Made

If the real estate boosters didn’t try to burn down this website after reading the rent vs own comparison earlier in this article, they will surely reconsider after reading this.

If I’ve heard it once, I’ve heard it two hundred times: “My house is the best investment I’ve ever made.”

While I have written extensively on this topic (and had to explain the point to many parents in the course of teaching personal finance over the years) there is simply no debating the following considerations about owning your home from an investment perspective. Note: We’re not talking about owning a rental property here – that’s a much different conversation.

- There are many reasons why the Holy Grail of investment advice is Thou Shalt Diversify. Tying up all of your cash (and then borrowing huge amounts of money that tie up all future earnings) is NOT diversification. Having your entire net worth determined by one building in one location is not a smart risk management decision.

- Why is it that when people borrow money to invest in the stock market (known as leverage) it’s considered inherently risky, but when people borrow 9x their downpayment on a house it’s considered “common sense”?

- When we think about how much money we’ve “made” on our home, we often forget to include all of the non-recoverable costs involved such as taxes, maintenance and repair costs, transaction fees to buy & sell, renovations that cost way more than they added resale value, etc.

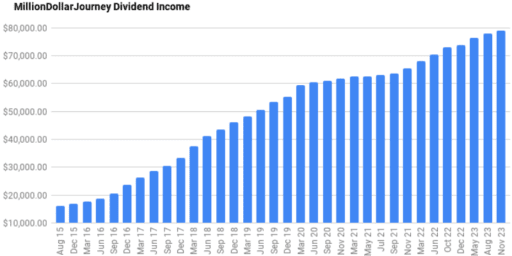

- The Case-Shiller Housing Index has stated that between 1928 and 2013, the average annualized rate of return for American housing was 3.7%. The average annual rate of return for American stocks was 9.5% during that time period. Canadian housing and stocks track much the same path.

- The National Association of Home Builders in the USA has stated that the average home in 1950 was 983 square feet, and by 2015 it had nearly tripled in size to 2,740 square feet! When you adjust for this fact, the actual increase in value per-square-foot of house is much smaller than the 3-4% number that is commonly tossed around in both Canada and the USA. Likely more in the 1.5-2% territory.

- If you think that the last few decades have been the “golden age of Canadian real estate” then you might be surprised to find out that since 1982, Canada’s house prices have only gone up an average of 1.7% per year (vs an average inflation rate of 2.46%).

- Even in super-hot real estate markets like Vancouver over the last couple of decades, stocks have still done better than real estate by a considerable margin.

- House values do NOT always go up – no matter what your friend in Toronto says. Go back and ask a Floridian in 2008 or a Calgarian in 2014.

Remember, these considerations are looking backwards at record return decades for Canadian real estate. We are now likely close to the top of that mountain (if not at the peak), so going forward…

Alternative investments to Canadian real estate:

View my recent post about how to buy stocks in Canada or our guide about Canada’s best dividend stocks if you want to learn more about beginner-friendly ways of investing your money into safe non-real-estate assets.

7) Freedom to Travel… Forever

Ok, so this one is likely somewhat unique to us.

I get that not everyone wants to spend years travelling without a fixed address.

That said, I think most Canadians would be amazed at how cheap it is to travel months on end if they don’t have to pay a mortgage back home, and don’t have to fly during the peak weeks of the year. I know that my wife and I were astounded when we went down the digital rabbit hole and found out just how many people were “slow travelling” 12-months per year for under $25,000 CAD.

I don’t think we’re quite as frugal as many of these veteran travellers, but after some pretty extensive research and many conversations with people actually living the “digital nomad” or “FIRE” lifestyle, we think we could pretty easily mix 6 months in relatively expensive countries like Canada, the USA, Western Europe, etc, with 6 months in cheaper countries centred on Eastern Europe and SE Asia, for $40,000 CAD.

Beyond the obvious fun of seeing more of the world, we love the idea that we will get to spend more time with friends and family that don’t live close to where our 9-to-5 jobs were in rural Manitoba.

AirBnb and competing rental platforms have really changed the game when it comes to attempting to live this “no fixed address” lifestyle. With monthly discounts and competition keeping prices low, finding a place to live for 1-3 months has never been so convenient or affordable. If you want to be responsible for someone’s pets, there are even more affordable travel opportunities available!

It’s OK to Own a Home – and It’s OK NOT to Own One Too!

It’s odd to say, but that makes it no less true: Owning your home in Canada is such an emotional decision tied to middle-class identity.

Because the decision is so important, no one likes to think that they chose the “wrong” path. Consequently, there are very few rational conversations to be had when it comes to home ownership. Like most issues that cut to the core of our identity, we usually choose our side, and then selectively look for arguments or data to support the decision we made.

I’ve been on both sides of the home ownership debate and the only thing that I can decisively say is that for some people owning a home makes sense – but for many others it simply does not.

Hey, if you are 80%+ sure that you’re going to be rooted in the same area for 10+ years, and you derive a lot of enjoyment out of handyperson fixes/renos, then the benefits of home ownership might make it the perfect choice for you.

That said, judging by all the “buy at all costs” talk I continue to hear from coast-to-coast, I think we really need to examine the bigger picture when it comes to home ownership.

And if you’re on the fence, I think it’s safe to say that as we emerge out of Covid isolation, there has never been a better time to become an ex-homeowner!

Don’t worry, there is still plenty of room on the bandwagon.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Thank you for the interesting article.

Just a note that home ownership doesn’t have to work like this, and hasn’t for us.

We live in Victoria BC. The assumptions on the rent vs. buy calculator you reference are 2% rent inflation and 2% home appreciation.

Here the rent increases have been far above 2% per year, and annual home appreciation has averaged 7% before adjusting for inflation over the last 30 years.

There is risk in everything, but if you have a suite like many do here, and get 7% in appreciation annually (yes, not guaranteed but past performance and all) then your down payment ROI is going to be far greater than any other return you could get when accounting for needing to pay to live somewhere and the low mortgage interest loan rates that you cannot match when borrowing to invest in stocks (which I am not interested in doing via my perception of the risk).

I think it comes down to doing the math for your specific market and understanding the incredible power of the tax free growth in your primary residence along with the helpfulness of suite rental income for carrying costs. I don’t mind paying someone to repair something if my home equity is increasing by 70k/year tax-free. It is a good business decision.

So, no worries if you don’t want to be a homeowner, but it is a powerful for of investing in our market and has given us financial freedom and freedom to travel via house swaps or renting out for longish periods of travel (pre-covid).

We became FI in our early 40s and house ownership was a big part of it.

Renting a place when you have two children in Toronto is very difficult. When I got divorced, that’s what I wanted to do, but it’s very, very hard to find a nice 2-3 bedroom place and if you do, rent is $3,500 to $5,000 a month. It wasn’t an option for me.

I don’t know Anita… I guess “nice” would be the subjective word there: https://www.point2homes.com/CA/2-Bedroom-Apartments-For-Rent/ON/Toronto.html

Nice wasn’t the right word – perhaps comparable was better. I agree with the concept of renting versus owning, but it’s in no way comparable in terms of space and neighbourhood when you have two or more kids. It’s not an apples to apples comparison.

I don’t understand why anyone would own rental property in Canada. It would be much smarter to sell the house for $1.1Million and invest that in index funds rather than get a pathetically small rent check, wouldn’t it? And if that’s true then over time rent will rise to match the true cost of the property as rentals are sold to home owners and rental properties go away. The supply and demand system always fixes price imbalances. So while it is a good decision to rent now, an efficient market will make artificially low rent dissappear in time until renting costs more than buying. Because renting being cheaper is unsustainable. It’s not really different than thinking Hertz could rent you a car for ten years for less than you could buy one. They would go out of business. But taking advantage of temporary market imbalances is very smart.

Because of low interest leverage and appreciation in high appreciation markets. If you buy a 1.1 million dollar house you are maybe putting in 250k. Your ROI on this will be higher in my market than it would be invested in stocks if past performance is the best indicator of future performance because the appreciation is at work on the 1.1 million dollar value rather than the 250k invested.

Well, it definitely looks like renting its cheaper than buying in Canada. Why are house prices going up so much so fast?

This was a well-researched, honest, and moderate take on home ownership. Good on you. Having held both opinions and lived both sides multiple times, you summed it all up really well. I enjoyed the read!

Thanks for the article, Kyle. It came at an interesting time for me: my wife and I are thinking about our next move after buying a condo back in 2018 in our early twenties. It has appreciated about 30%, and I want to sell soon and rent a family sized unit before we have kids. I can’t imagine a better scenario than collecting ~$200k in your mid-twenties and renting forever (while getting a huge head start on retirement, RESPs, index bunds, etc.) rather than sinking it into a million dollar house, but she’s not fully convinced. Home ownership as a necessity was ingrained in both of us growing up. I hope showing her this will get her on my side.

Let me know how it goes Jared!

Hello Kyle,

I am a renter (and CFP®) and agree with your points.

For many people, perhaps their home IS their best investment because their other investments were high-fee under-performing mutual funds, or they were active stock traders who bought high and sold low, or they owned GICs forever. Who knows. As one of the other commenters pointed out, a forced savings plan isn’t the worst thing for a lot of people.

Compare the trajectory of the S&P 500 with home prices in Canada and it’s not even close.

Finally, the biggest under-estimation people make when it comes to home ownership is the cost of maintenance, repairs, upgrades/renovations, and special assessments/special levies from their condo/strata board. Most people cannot foresee ever needing to put any money into their home ever again (Oh, we did a renovation last year for $50,000 so we are fine for 10 years), when in fact every structure is in a constant state of deterioration.

I could go on about affordability and people buying too much home, not being able to save for retirement, etc. but I’ll leave it here.

It’s great to have these conversations and for people to know that renting is an excellent choice in many situations.

Steve

Thanks for chiming in Steve!

This blog is full of true statements, but there is one key problem with this argument regarding the numbers. For people who read this column, it could be 100% correct. It’s ‘spreadsheet correct’ for some. Who are they? Those that rent well and invest the difference equally as well. But, a vast swath of Canadians aren’t interested in following a Personal Finance Blogger and don’t invest well. What do they do with what they have? They spend it.

For them, a house likely IS the best investment they ever made because it will be the ONLY investment they ever made (or at least the only one with enough wood behind the arrow that it makes a material difference in the end). Give the non-financial savvy person some money, and they spend it.

For those not interested, poor with math, or just too short-term centric in their thinking, buying a house is simply forced savings that they can live with and understand. Like rent, paying the mortgage is the first priority and they can naturally do that much easier than invest in anything. Within this group of non-financial thinkers you will find by age 60 A HUGE net worth difference between those that rented and those that owned. Perhaps it’s sad, but it is true.

The spreadsheet actually needs 3 scenarios – RENT and INVEST, RENT and SPEND, and OWN.

After 41 years in their fully paid for house, my parents sold in Vancouver for a ridiculous amount in 2016 and downsized. They generously gave my siblings and me what would amount to approx. $370,000 today hoping I would put it towards buying a condo so my mother could be assured I was “settled” before she died! Yep, it’s a generational thing…

Instead, I used the money to top up my RRSP and TFSA then invested almost the entire amount in Canadian dividend stocks which now earn almost $1,100 a month. That goes a long way towards the $1,800 p/m I pay in rent I to live here.

Two months ago the fridge in my apartment packed it in and within 5 hours my landlord had a new one installed. While I think rents in Vancouver are high (I’m in a 1 bedroom in a 1970s purpose-built rental high-rise so on the low end for this city), I have been lucky to keep my job during the pandemic and see my rent freeze without the yearly increase as an added bonus (though I know the increase is coming…). Homeowners are still on the hook for maintenance and rising property taxes.

Plus, when I finally get to start travelling again, I just lock my door and don’t worry about all those “strange noises” Kyle mentions and leave that to my building manager!

Very interesting anecdote VMM. While $1,800 might be a bit of a “budget rent” in Vancouver – that sounds like an incredible value to live somewhere that is in that high demand – and with such a great landlord! Kudos to you!

Hi Kyle, definitely a “budget rent” – no dishwasher, in-suite laundry, or Concierge but I manage!