Best All-in-One ETFs in Canada 2025

Canada’s all-in-one ETFs (also called portfolio ETFs) have been the single most important investment product innovation since I’ve started writing about this stuff nearly two decades ago.

The Vanguard, iShares, and BMO all-in-one ETFs are the perfect marriage of index investing strategy, convenience, asset allocation math, and behavioural safeguards.

These ETFs – which are actually a collection of smaller ETFs – are so diverse that they actually include several of the Best ETFs in Canada, representing the largest companies and fixed income securities from all around the world.

If you want a second opinion on all-in-one ETFs, Stocktrades.ca is a Canadian platform that lets you easily compare between more than 5,200 different ETFs. They’ve got numerous investing and analysis tools, as well as a monthly newsletter, so you can check them out if you want an even more detailed analysis on these products. By clicking the link above, you’ll be eligible for a 33% discount on all their services.

Best 2025 Broker Promo

Up To $2,000 Cash Back + Unlimited Free Trades

Open an account with Qtrade and get the best broker promo in Canada: 5% cash back when you fund a new account + unlimited free trades for the rest of the year.

The offer is time limited - get it by clicking below.

Must deposit/transfer at least $1,000 in assets within 60 days. Applies to new clients who open a new Qtrade account by November 26, 2025. Qtrade promo 2025: CLICK FOR MORE DETAILS.

Best All Equity All in One ETFs

| Ticker Symbol | Name | MER | What is inside this All In One ETF? |

| XEQT | iShares Core Equity ETF Portfolio | 0.20% | 4 ETFs (thousands of underlying stocks) |

| VEQT | Vanguard All-Equity ETF Portfolio | 0.24% | 7 ETFs (thousands of underlying stocks) |

| ZEQT | BMO All-Equity ETF | 0.20% | 6 ETFs (thousand of underlying stocks) |

Best Balanced Risk All in One ETFs

| VBAL | Vanguard Balanced ETF Portfolio | 0.24% | 7 ETFs (thousands of underlying stocks and bonds) |

| XBAL | iShares Core Income Balanced ETF Portfolio | 0.20% | 8 ETFs (thousands of underlying stocks and bonds) |

| ZBAL | BMO Balanced ETF | 0.20% | 7 ETFs (thousands of underlying stocks and bonds) |

Best Conservative Low Risk Income All in One ETFs

| ZCON | BMO Conservative ETF | 0.20% | 7 ETFs (thousands of underlying stocks and bonds) |

| VCIP | Vanguard Conservative Income ETF Portfolio | 0.25% | 7 ETFs (thousands of underlying stocks and bonds) |

| XINC | iShares Core Income Balanced ETF Portfolio | 0.20% | 8 ETFs (thousands of underlying stocks and bonds) |

To sum up the benefit of these all in one ETFs:

For only $20 per $10,000 invested, every Canadian can now instantly invest in over 10,000 companies (94%+ of the world’s stock and bonds markets), and 900 bonds, in under 90 seconds. With brokers like Qtrade Canadians now have access to free ETF purchases and extremely discounted fees.

The Path to the Canadian All In One ETF

There have been four revolutions when it comes to low cost “couch potato” index investing in Canada.

1) The idea of “owning the entire market” – and thus earning the market’s average return – means that investors no longer have to lose money by trying to pick stocks in their spare time. The index fund is born.

Yay passive investing!

2) Instead of using a mutual fund model to benefit from active investing, Canadian investors now get to go on a stock exchange and purchase an ETF – which is a much less costly product. ETFs continue to trend downwards in price.

3) Robo advisors – or automated wealth managers – begin to appear. These platforms combine many of the advice components we would normally associate with traditional financial advising, with evidence-backed passive investing using our cheap-and-getting-cheaper ETFs to create ready-made portfolios. Check our Wealthsimple review, Justwealth review and best Canadian robo advisors article for more information.

4) While robo advisors cut fees dramatically from traditional model levels, major ETF providers like Vanguard soon realized that there was still a little more fat to trim when it came to presenting investors with a one-stop-portfolio-shop. Consequently the “portfolio ETF” or all in one ETF was born. For a very low annual fee investors could now simply open their Canadian online brokerage account and purchase one ETF over and over again – without worrying about rebalancing or stock picking.

As we open 2025, we see that “one ticket portfolio ETFs” or “asset allocation ETF” – or all in one ETFs (as we prefer to call them) are quickly gaining steam as the ideal low-cost solution for those who don’t need any financial advice. Mark Noble, the Executive Vice President of ETF Strategy at Horizons ETFs recently pointed out that in just two years, we’ve seen all in one ETFs garner $4.5 Billion of Canadian investments.

Use our Table of Contents to jump to the part of the article you’re most interested in. If you want to go even more in-depth into this topic and understand how to best incorporate all-in-one ETFs into your overall investing strategy, then download our free ebook.

What is an “All-in-One ETF” or “All-in-One Portfolio”?

If you’re wondering what the heck an all-in-one ETF portfolio is, then you’re not alone. Over the past two years it has become one of the most common questions that we get asked at MDJ.

The basic idea is that some of Canada’s largest ETF providers decided that they didn’t want the robo advisors having all the fun when it comes to super simple investing solutions for the average Canadian.

One of the big value propositions of a robo advisor is the idea that a couch potato investor (aka index investor, passive investor, etc.) no longer had to worry about rebalancing their various types of Canadian ETFs.

Gone were the days of doing a little math to figure out if you were still hitting your asset allocation targets when it came to bonds, Canadian equities, and international equities. It was the new era where you just put your money in one place, and let the automated solution do the work for you. So Vanguard, BMO, iShares, and Horizons ETFs put together products that are basically a few different ETFs, inside of a big umbrella ETF.

In order to understand what is actually inside these ETFs let’s take an in-depth look at the Vanguard Growth ETF Portfolio (VGRO), one of the most popular of these new “asset allocation all-in-one ETFs”.

VGRO seeks to give Canadians a quick and easy way to invest for the long-term. Consequently, the asset mix skews towards the riskier side of the risk/return spectrum, with 80% of your money being invested in equities/stocks/shares and 20% being invested in bonds/fixed income.

If you were to invest $1,000 in this all-in-one ETF, your thousand bucks would then roughly be automatically split up into the following investments (*all data as of September 2024*):

- $363 into the Vanguard US Total Market Index ETF

- $242 into the Vanguard FTSE Canada All Cap Index ETF

- $147 into the Vanguard FTSE Developed All-Cap-ex-North America Index ETF

- $54 into the Vanguard FTSE Emerging Markets All-Cap Index ETF

- $115 into the Vanguard Canadian Aggregate Bond Index ETF

- $40 into the Vanguard Global ex-US Aggregate Bond Index ETF CAD-hedged

- $39 into the Vanguard US Aggregate Bond Index ETF CAD

Now, within those ETFs, there are obviously many different companies represented. Let’s take a look at the ETF that makes up over a third of the portfolio, the Vanguard US Total Market Index ETF (VUN).

Out of your initial $1,000, you now have $363 going into the massive world of the USA stock market (a total of 3,656 stocks). Here’s a partial look at what your investment dollars will eventually end up purchasing:

- Apple Inc: $22.25

- Microsoft Corp:$20.69

- NVIDIA Corp: $18.62

- Amazon Inc: $11.14

- Meta (Facebook): $7.62

- Alphabet Inc (Google): $6.39

- Berkshire Hathaway Inc: $5.63

- Eli Lilly & Co: $5.48

- Broadcom Inc: $5.05

A pretty diverse group of companies, that ultimately only make up about 28% of this specific ETF, which is only 32% of your overall all-in-one portfolio!

You really do get almost everything in one package.

Let’s take a look at the fixed income portion of our asset allocation ETF and dive into the Vanguard Canadian Aggregate Bond Index ETF (VAB). Out of your initial $1,000, $115 will be used to automatically purchase a wide variety of Canadian bonds that break down as follows:

- Provincial/Municipal Bonds in Canada: $42.67

- Federal Government of Canada Bonds: $34.04

- Bonds for Agencies (such as Hydro Quebec): $12.42

- Bonds for private industrial companies (such as Apple Inc.): $11.04

- Bonds for financial Institutions in Canada (such as TD Bank): $10.93

- Bonds for Utility Companies (such as Bell Canada): $2.88

- Other Bonds/Cash Products: $1.15

To sum up your bond allocation: Your lending money mostly to Canada’s provincial and federal governments, with a smattering of other large Canadian entities tossed in, and a very small percentage of large foreign owned entities. If you care about bond ratings, the average bond rating of this large collection (more than 1,200 separate bonds) is AA.

As you can see, your $1,000 monthly investment (taking all of 90 seconds to make through your discount brokerage account) will instantly diversify your money into investments of more than 13,500 companies, and 1,200+ bonds.

Not bad for 90 seconds of work…

Discount Broker | Robo-Advisor | |

Best For | Best for DIY Investing | Best for Passive Investing |

Fees | FREE to buy and sell several all-in-one ETFs | Charged as a percentage of your investment portfolio. In the .35% to .8% range once the underlying investments (ETFs) are taken into consideration. |

Style | Hands on. You’re in the driver’s seat. | Hands off. You decide on a strategy (with the help of an automated survey and an advisor).Your investments will be re-balanced according to passive index investing principles. |

Services | No one to ask for help. You are effectively on your own. |

|

User Friendliness | As complicated as you want to make it. One-off index buy or a daily rebalance/trading – up to you. | The easiest way to turn a part of your paycheque into an excellent investment portfolio. Simply setup an automatic contribution to your robo account, and then focus on your leisure time. |

RRSP + TFSA + RESP | YES! | YES! |

Promo | 5% Cash Back + Unlimited Free Trades | $100-$500 Instant Cash Back |

Sign Up |

Investors Do Better With All-in-One ETFs than Managing Their Own Portfolio

We’re going to get to our all-in-one ETF vs rebalancing individual ETFs vs robo advisors comparison in just a second, but first I wanted to draw your attention to a potentially much more important aspect of automated investing.

There’s a key fact to understand when it comes to understanding human beings, basic math, and investment returns: We really suck at passively sticking to a simple index investing strategy.

As Millionaire Teacher author Andrew Hallam and many others have written about over the years, human beings are generally pretty good at sabotaging their investment returns EVEN AFTER they commit themselves to being couch potato investors.

If you want more evidence that we’re really bad at following the basic passive investing rules that we set out for ourselves, there was a report released in 2017 called “Abusing ETFs” that used German data to paint a picture of investors being tempted to overweight one index ETF over another. The temptation to try and “bet a little more” on your home country’s stock market, or emerging market stock markets, or to “tweak” your bond risk profile for example, is just a little too great.

This is the logical extension of what we’ve seen for so many years with the mutual fund industry. Every single study I’ve read on mutual fund investors shows that the average mutual fund investor routinely realizes returns that are roughly half of what their mutual funds returned over the past 10+ years.

This seems impossible, right?

I mean, if a person is invested in mutual funds, shouldn’t they get the average return of those mutual funds?

The problem is that people are tempted to put more money into funds when news reports tell them everything is great, and everyone is making money in the stock market.

Then when those news reports turn negative, people either invest less, sell their mutual funds and “go to cash”, or decide to invest in a fund that is “doing better right now”. They often do this on the advice of their financial advisor.

Of course, the end result of this “strategy” is that you end up buying most when the market is approaching or at peak, and then buying the least (or even cashing out) when the market is approaching or at a low point.

While index ETFs offer a better overall product than mutual funds, they don’t offer to cure your behavioural biases for you. Our brains are still wired the same way those mutual fund investors’ brains were. We’re still tempted to think that we can skew our market returns just a bit higher by “putting a little more here than there”. Of course we’re wrong much more often than we’re right.

The all-in-one ETF portfolios (and robo advisors for that matter) take this temptation out of our hands. This might be their most valuable feature!

Note: If you’re a little unsure about what active investing vs passive investing means, the basic idea is that passive investors believe that simply owning small pieces of every company or bond in a given market – then cutting fees as low as possible – is a much better bet than trying to pick which stocks/bonds will do better than others (which is called active investing). Pretty much every long-term mathematical study on investment returns agrees that the average investor is much better off with index investing than trying to pick their own stocks.

Robo advisors, all-in-one ETFs, and DIY ETF portfolios, are all different ways of index investing. Index investing is often referred to as couch potato investing.

All-in-One ETF MER Fee Comparison

When we look at comparing the costs of all-in-one ETFs vs robo advisors vs DIY couch potato portfolios vs mutual funds, we must first understand what the acronym MER means.

A quick refresher: MER stands for Management Expense Ratio.

It is usually shown as a percentage of between .05% and 3%.

To understand how much an investment costs you to hold each year, you multiply this MER percentage by the amount of money that you have in that product. It’s worth noting that while many of us math-challenged folks see the numbers .05% and 3% as both being small and relatively comparable to one another, 3% is actually sixty times more than .05%!!!

If you are paying 60 times more for your investments than the person next to you, it doesn’t take a genius to explain that you’re going to have much less investment money in your pocket.

Ok, so now that we have MER down, let’s take a look at what the different types of investments will cost us to hold on to each year.

1) All-in-one ETF portfolios: .18%-.27% MER

We’ll have a more precise all-in-one ETF comparison below, but generally you’re looking at roughly a .25% MER in order to invest in these funds. That means that each year, you’re paying $25 per $10,000 invested.

2) DIY Couch Potato Portfolios: .13%-.2% MER

You might be asking yourself: Wait a second, if Vanguard or BMO just lets me see what is in their all-in-one portfolios, then why can’t I just construct these portfolios on my own?

Well, you can – it’s just a pain in the butt, and you won’t save a lot of money unless your portfolio is fairly large.

To illustrate, let’s take a look at our Vanguard Growth ETF Portfolio (VGRO) example.

Here are the MERs of the respective underlying ETFs that make up the all-in-one product.

- Vanguard US Total Market Index ETF: MER of .16%

- Vanguard FTSE Canada All Cap Index ETF: MER of .05%

- Vanguard FTSE Developed All-Cap-ex-North America Index ETF: MER of .23%

- Vanguard FTSE Emerging Markets All-Cap Index ETF: MER of .24%

- Vanguard Canadian Aggregate Bond Index ETF: MER of .09%

- Vanguard Global ex-US Aggregate Bond Index ETF CAD-hedged: MER of .39%

- Vanguard US Aggregate Bond Index ETF CAD: MER of .22%

Not all of these ETFs are weighted evenly, so to create your own copy of VGRO, you’d be paying about .15% MER. Of course this doesn’t take into account transaction costs (we’ll get there), behavioural considerations, and your time spent rebalancing the portfolio each year.

To put it another way – if we ignore time cost and transaction cost completely – on a $1 Million portfolio, the difference between creating your own identical index portfolio and investing your million bucks in VGRO would be about $1,000 per year. On a $100,000 portfolio, it’d be about $100 per year.

Note: For super detail-oriented investors, it might be worth looking into how foreign withholding taxes work in regards to ETFs. If you are willing to do some homework and hold specific individual ETFs in your RRSP, you may be able to reduce the small amount of tax that you will be paying on your USA dividends (not on USA capital gains) if you go with an all-in-one ETF. This is a relatively small consideration, and I’ve only met a handful of folks willing to do this much math on an individual ETF level.

3) Robo Advisors: .4%-.8% MER

Remember that when investing through a robo advisor you have to add their management fees to the underlying MER of the funds themselves. So to compare to our example above, you’re looking at the robo advisor charging you .3%-.6% for their services, PLUS the .15% that our underlying ETFs will charge you.

Now remember, this isn’t truly an apples-to-apples comparison. Robo advisors do things that your all-in-one portfolios don’t, such as:

- No Transaction Costs

- Financial Advice

- Tax Loss Harvesting

- Loyalty Perks

- Automated Contribution Options

- Easier Account Opening

BUT – in exchange for those really nice features, you’re going to pay about $60 per $10,000 that you have invested. On a $1 Million portfolio, that means you will pay $3,500 more per year with a robo advisor than you would with an all in one ETF. With a $100,000 portfolio, that narrows to $350 per year difference (again, excluding transaction costs).

4) Mutual Funds: 1.5%-3.5% MER

When comparing the mutual funds in Canada, it’s important to note that there is a large range, but overall, we have the highest mutual fund fees in the world!

Let’s compare our new favourite all-in-one-ETF (VGRO) to a similar big mutual fund portfolio in Canada… say the Investors Growth Portfolio (Series A) from IG Wealth Management. As of December 2021, this mutual fund had an MER of 2.75%, and invested in several different equity funds in order to get diversification to 423 companies from all around the world.

That MER is more than TEN TIMES larger than the MER of our all-in-one portfolio!

You would be paying $27,500 per year to hold this fund in your $1 Million portfolio versus the $2,500 you would be paying with VGRO.

To be fair to the mutual fund world, part of this MER fee goes to pay a financial advisor. In theory, that financial advisor should be able to provide you with valued financial advice AND there is a chance that this mutual fund could have better returns than your index portfolio.

In practice, we know that unless you have an investment portfolio larger than $1 Million, most large wealth management companies won’t pay a ton of attention to you.

We also know that only somewhere between .5% and 10% of mutual funds (depending on which study you read, and what asset class you’re referring to) beat their comparable market index over the long-term AND we have very little idea of how to predict which of those mutual funds will be able to do that.

You might take away from this that I’m not big on mutual funds and think you can cut your MER costs down with index ETF investing.

You’d be correct.

Transaction Costs of All-in-One ETFs vs Robo Advisors vs Stock Picking vs Mutual Funds

There is one more key consideration when it comes to comparing the costs of Canadian investment vehicles: Transaction costs to buy or sell the investment.

Robo advisors and mutual funds do not have transaction costs. You do NOT pay a small amount each time you buy or sell investments with them.

The same cannot be said for online discount brokerages such as Questrade, Qtrade Investor, or TD Direct Investing. See our full comparison of Canadian discount brokerages. Discount brokerages will usually charge a per-trade fee ranging from $4.95-$9.95. They may also include Electronic Communications Network (ECN) fees – which are $0.01-$4.95. See our Questrade Review for a detailed look at ECN fees.

What that means is that every time you buy or sell a share of a company, you have to pay that transaction fee. When you are managing a portfolio of $1 Million+ those five dollar fees represent a negligible overall percentage of your nest egg. When you are just getting your portfolio off the ground however, those trade costs can add up in a hurry, and end up costing you substantially more money than an extra percentage of your overall portfolio.

The great news is that Qtrade – our #1 Canadian online broker – allows you to buy and sell ETFs for free. Consequently, there are no transaction costs if you use Qtrade!

Canada’s All-in-One ETFs vs Robo Advisors

The best comparison when it comes to the Canadian market and of these new all-in-one ETFs are robo advisors.

You can see in our above fee comparison, the dollar difference between building your own portfolio of index ETFs and purchasing an all-in-one Portfolio ETF. The only real difference there is your fees, and the amount of time you spend rebalancing your own portfolio. It’s close to an apples-to-apples comparison.

The same can’t be said when we look at all-in-one ETFs vs robo advisors.

By far the biggest advantage that robo advisors have is that they are the easiest possible way to take your paycheque and turn it into a diversified investment portfolio.

You might not think that’s a big advantage, but I’ve helped enough people over the years to know that one of the biggest obstacles to getting people to actually invest their money, is the procrastination of setting up a discount brokerage account, and to actually purchase shares of stock or units of an ETF.

If we are being completely vulnerable and honest, it can be very intimidating the first time you open that trading screen and realize you are about to click “buy” after doing the math on how many units of an ETF to purchase.

Once you have done it a couple of times and get used to sending money from your chequing account to your brokerage account, it gets much less intimidating – but that initial obstacle is juuuuussssst enough to prevent 80-90% of the people I try to help from getting started with index investing. While all-in-one ETFs make investing easier, they don’t get rid of this annoying obstacle.

Robo advisors are great at getting rid of this obstacle!

Best 2025 Canadian Robo Advisor Promo:

Up To $500 in Cash

Open an account with Justwealth and get the best robo advisor promo offer in Canada*.

Justwealth has the best portfolio performance out of all Canadian robo advisors + the best promo offer. Get it by clicking the button below:

* Based on investment amount ** Applies only to New clients who open and fund a new account. *** Justwealth Review: more details.

Vanguard All-in-One ETFs

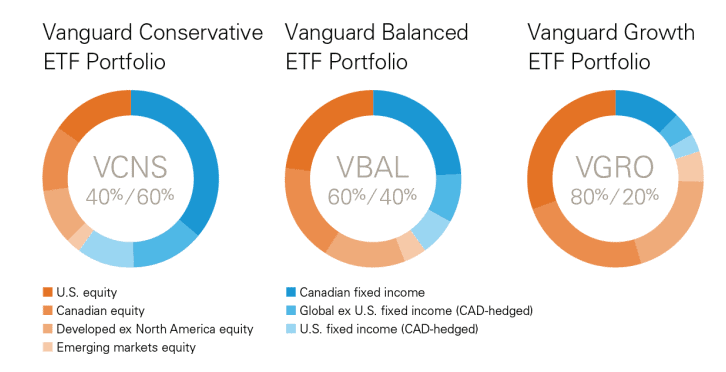

The leader in low-cost index investing was the first company out of the gates, as the Vanguard all-in-one asset allocation ETFs were the first of their kind in Canada and charge a straight MER of .25% across all five of their all-in-one ETF options. Vanguard builds their portfolio ETFs by including specific weightings of their line of ETFs including:

- Vanguard US Total Market Index ETF (VUN)

- Vanguard FTSE Canada All Cap Index ETF (VCN)

- Vanguard FTSE Developed All-Cap-ex-North America Index ETF (VIU)

- Vanguard FTSE Emerging Markets All-Cap Index ETF (VEE)

- Vanguard Canadian Aggregate Bond Index ETF (VAB)

- Vanguard Global ex-US Aggregate Bond Index ETF CAD-hedged (VBG)

- Vanguard US Aggregate Bond Index ETF CAD (VBU)

The chart below illustrates the differences between the five Vanguard all-in-one portfolio options. The chart includes updated data as of January 2025:

| Fund name | Ticker | Management fee | MER | 12 Month Yield |

|---|---|---|---|---|

| Vanguard All-Equity ETF Portfolio | VEQT | 0.22% | 0.24% | 1.85% |

| Vanguard Balanced ETF Portfolio | VBAL | 0.22% | 0.24% | 3.09% |

| Vanguard Conservative ETF Portfolio | VCNS | 0.22% | 0.24% | 2.34% |

| Vanguard Conservative Income ETF Portfolio | VCIP | 0.22% | 0.24% | 2.46% |

| Vanguard Growth ETF Portfolio | VGRO | 0.22% | 0.24% | 2.10% |

If Vanguard’s all-in-one ETFs sound good to you, but you want to know more, we’ve got you covered. Check out our full VBAL review, VGRO ETF Review as well as our VEQT ETF Review.

Blackrock iShares All-in-One ETFs

Shortly after Vanguard used their in-house ETFs to create a suite of all-in-one ETFs, Blackrock/iShares followed suit and released their two all-in-one portfolio ETFs: XGRO and XBAL.

Technically these two products were reboots of older portfolio ETFs that had been around since 2007, but were not popular due to their high MER. They differ from Vanguard’s offerings in that they have a slightly lower MER, no international bond exposure, and slightly less exposure to Canadian equities vs their American counterparts. The two portfolio options are made up of the following ETFs:

- ISHARES CORE S&P TOTAL U.S. STOCK (ITOT)

- ISHARES MSCI EAFE IMI INDEX (XEF)

- ISHARES S&P/TSX CAPPED COMPOSITE (XIC)

- ISHARES CORE CAD UNIV BND IDX ETF (XBB)

- ISHARES CORE MSCI EMERGING MARKETS (IEMG)

- ISHARES CANADIAN SHORT TERM CORPOR (XSH)

- ISHARES BROAD USD INVESTMENT G (USIG)

- ISHARES US TREASURY BOND ETF (GOVT)

| Fund name | Ticker | Management Fee | MER | Trailing Yield 12 months |

|---|---|---|---|---|

| iShares Core Balanced ETF Portfolio | XBAL | 0.18% | 0.20% | 2.11% |

| iShares Core Moderate Allocation ETF | AOM | 0.15% | 0.15% | 2.15% |

| iShares Core Growth ETF Portfolio | XGRO | 0.18% | 0.20% | 1.88% |

| iShares Core Conservative Balanced ETF Portfolio | XCNS | 0.18% | 0.20% | N/A |

| iShares Core Income Balanced ETF Portfolio | XINC | 0.18% | 0.20% | N/A |

Blackrock iShares definitely have some solid all-in-one ETFs on offer. To get into more details of what iShares ETFs offer, what they could yield, and how much they cost, read our full XEQT ETF Review. To see how iShares compares to Vanguard’s portfolio ETFs, check our direct Vanguard vs. iShares comparison.

BMO All-in-One ETFs

Not one to be left behind, the Bank of Montreal (BMO) wasted very little time in packaging their ETF offerings together to create three BMO all-in-one ETF portfolios. If price is your main comparison tool, then you might want to note that BMO has the cheapest Canadian all-in-one ETFs at only .20% MER across all three asset allocation ETF options. Here’s a look at the underlying ETFs that BMO uses to make up their all-in-one ETFs.

- BMO Aggregate Bond Index ETF (ZAG)

- BMO S&P 500 Index ETF (ZSP)

- BMO Government Bond Index ETF (ZGB)

- BMO MSCI EAFE Index ETF (ZEA)

- BMO S&P/TSX Capped Composite Index ETF (ZCN)

- BMO Mid-Term US IG Corporate Bond Hedged to CAD Index ETF (ZMU)

- BMO MSCI Emerging Markets Index ETF (ZEM)

| Fund name | Ticker | Management Fee | MER |

|---|---|---|---|

| BMO Conservative ETF | ZCON | 0.18% | 0.20% |

| BMO Balanced ETF | ZBAL | 0.18% | 0.20% |

| BMO Growth ETF | ZGRO | 0.18% | 0.20% |

| BMO All-Equity ETF | ZEQT | 0.18% | 0.20% |

Horizons All-in-One ETFs

The newest entry into the Canadian all-in-one ETF market is Horizons all-in-one-ETFs. Due to the unique swap-based structure of their ETFs, Horizons is able to keep fees relatively low. Here’s a look at their current lineup of all-in-one-ETFs and their respective MERs (you’ll notice that, unlike the other three ETF providers in Canada, Horizons all-in-one ETFs differ in their respective MERs).

- Horizons Conservative TRI ETF Portfolio (HCON) – .18% MER

- Horizons Balanced TRI ETF Portfolio (HBAL) – .20% MER

- Horizons Growth TRI ETF Portfolio (HGRO) – .28% MER

The underlying ETFs that Horizons purchases in order to makeup their portfolio ETFs are:

- HORIZONS CDN SELECT UNIVERSE CL A UNIT

- HORIZONS S&P 500 INDEX ETF CL A UNIT

- HORIZONS US 7-10 YR TREAS BD CL A UNIT

- HORIZONS NASDAQ-100 INDEX ETF CL A UNIT

- HORIZONS INTL DEVELOPED MKT CL A UNIT

- HORIZONS S&P/TSX 60 INDEX ETF CL A UNIT

- HORIZONS EURO STOXX 50 INDEX CL A UNIT

- HORIZONS US 7-10 YR TREASR BD CL A UNIT

- HORIZONS S&P 500 CAD HEDGED CL A UNIT

These ETFs are slightly more complex to understand due to their swap-based nature than the first three groups of all-in-one-ETFs that we looked at.

Personally, due to their increased complexity, somewhat odd weighting of treasuries vs bonds, lack of exposure to developing markets, and just the relatively low volume traded daily, I don’t see these current Horizons all-in-one-ETF asset allocation ETFs as a serious contender versus the other excellent options out there.

For a more in depth analysis, read my Horizon ETFs article.

Comparing iShares vs BMO vs Vanguard vs Horizons Canadian All In One ETFs

When comparing the iShares vs Vanguard vs BMO vs Horizons all-in-one Portfolio ETFs, it’s important to understand this fact first and foremost:

They are all excellent choices for your portfolio – just choose one!

If comparing these products is going to – in any way – delay you from opening a discount brokerage account and get started investing, then just go with Vanguard, and get started today!

Every single one of these all-in-one-ETFs offers the following:

- Instant diversification to thousands of companies and hundreds of bonds/treasuries

- Incredibly low costs

- Super stable, safe companies that have been around for decades

- Very high odds that your returns will beat those of actively managed mutual funds

All of that said, if you really want to dive into choosing the absolute perfect all-in-one-ETF for you, I’d look at the following areas to compare:

- MER

- The asset allocation percentages relative to your investing goals

- Home-country bias (might there be too much of a Canadian focus?)

- Great diversification vs Incredible diversification (some of these products offer slightly more exposure to developing countries, etc)

TD One-Click ETF Portfolios

In 2020, Canada’s 2nd largest bank decided to join the all-in-one ETF party with their “TD One-Click ETF Portfolios”. While they are very solid products, I’m not sure they’ll move the needle as far as challenging the leaders that we noted above.

However, one major positive that we took away from seeing yet another major financial player join the all-in-one ETF movement, is that these products aren’t just here to take part – they’re here to take over.

| Fund name | Ticker | Management Fee | MER |

|---|---|---|---|

| TD One-Click Conservative ETF Portfolio | TOCC | 0.25% | 0.28% |

| TD One-Click Moderate ETF Portfolio | TOCM | 0.25% | 0.28% |

| TD One-Click Aggressive ETF Portfolio | TOCA | 0.25% | 0.28% |

Much like the other all-in-one ETF competitors, the three TD One-Click options offer consumers an instant portfolio of assets from around the world. The ETFs that TD has chosen are:

- TD Canadian Aggregate Bond Index ETF (TDB)

- TD Global Technology Leaders Index ETF (TEC)

- TD International Equity Index ETF (TPE)

- TD U.S. Long Term Treasury Bond ETF (TULB)

- TD Select Short Term Corp Bond Ladder ETF (TCSB)

- TD U.S. Equity Index ETF (TPU)

- TD Active Global Income ETF (TGFI)

- TD Canadian Equity Index ETF (TTP)

- TD Canadian Long Term Federal Bond ETF (TCLB)

- TD Active U.S. High Yield Bond ETF (TUHY)

- TD Q Canadian Low Volatility ETF (TCLV)

- TD Q Global Dividend ETF (TQGD)

- TD Q Global Multifactor ETF (TQGM)

- TD Q U.S. Small-Mid-Cap Equity ETF (TQSM)

And then those ETFs are obviously balanced differently depending on your desired asset allocation.

For example, while the TD One-Click Conservative ETF Portfolio (TOCC) has you in 63% fixed income (with the majority of that in Canadian domestic bonds) and the remainder in stocks, the TD One-Click Aggressive ETF Portfolio (TOCA) will funnel you into only 5% fixed income, and 95% equities from around the world. Interestingly enough, that 5% bonds are all American treasuries.

Overall, I honestly find the TD all-in-one ETFs to be needlessly complicated, with up to 15 component ETF in each “One-Click Portfolio”. This is likely also the reason for their slightly higher MERs.

They’re in no way a bad product – in an absolute sense they’re much superior to the mutual fund options for instance – it’s just that compared to the rest of Canada’s all-in-one ETFs I’d probably place TD’s offerings at the bottom of the totem pole.

The Best All-in-One ETFs for your TFSA and RRSP

The ultimate question that most Canadians have when it comes to their investment choices is which is the best one for their TFSA or RRSP. Again, the rule of thumb here is: all of these products are better than the typical Canadian mutual fund!

The real decision on which all-in-one ETF belongs in your portfolio has more to do with your specific risk profile, than the product itself.

If you are tolerant of risk (not an easy question to answer), have a long investment window, and will not panic when your portfolio’s value goes down by 30% in a given year, then I’d go with more of a growth portfolio.

If you’re approaching retirement or can’t sleep at night if you lose more than 15% of your portfolio in a given year, then I’d recommend more of a balanced or conservative portfolio.

Now, a lot of people will point out that if you use an all-in-one ETF you lose the advantage of putting a US ETF into your RRSP and getting back the 15% withholding tax that is charged to dividends.

While that’s technically true, it’s important to remember that we’re talking about 15% tax on the relatively small 1.3%-ish dividend yield that your US stock allocation is going to have. For the vast majority of Canadians, the small savings isn’t worth the paperwork required, and the rebalancing that you have to pay attention to.

Honestly, unless you want to read 5+ Canadian personal finance books for fun, then I’d argue keeping it simple and just buying the same all-in-one ETF across all accounts makes a lot of sense. If you want to really get into this stuff, then obviously optimizing your portfolio with my list of Best Canadian ETFs or Best Canadian Dividend Stocks starts to become more attractive.

Best All-in-One Growth or Equity ETF – VEQT (Vanguard All Equity ETF)

I love what VEQT does for Canadians. It’s a very simple all-equity ETF that instantly diversifies your investment dollars into thousands of small, medium, and large companies from around the world. Some might argue that the 30% allocation to Canadian stocks is a bit high for a home country bias, but I’m fine with it. Here’s a look at what’s under the hood of the Vanguard All Equity ETF.

- Vanguard US Total Market Index ETF 40%

- Vanguard FTSE Canada All Cap Index ETF 30%

- Vanguard FTSE Developed All Cap ex North America Index ETF 23%

- Vanguard FTSE Emerging Markets All Cap Index ETF 7%

I personally love this all-in-one ETF because I am fortunate enough to still have a relatively long investment horizon, and my pension is sufficient to represent a fixed-income part of my portfolio. If your appetite for risk is not the same as mine, one of the following ETFs might be a better option.

Best All-in-One Balanced ETF – VBAL (Vanguard Balanced ETF Portfolio)

Admittedly this balanced (60% equities, 40% fixed income) all-in-one ETF comparison is more difficult for me than the growth one was.

Truth be told, it is really hard to separate VBAL vs XBAL vs ZBAL.

I default to Vanguard’s offerings (despite their slightly higher MER, that will cost you $5 more for every $10,000 invested) because I love supporting the company that has been there, innovating on behalf of index investors for decades. I also prefer VBAL over XBAL and ZBAL because it has some global bond exposure that others don’t have. That said, all three are excellent products.

Best All-in-One Conservative ETF – VCNS (Vanguard Conservative ETF Portfolio)

There are even more “income based” conservative portfolios out there, such as the Vanguard Conservative Income ETF Portfolio, but if we’re comparing straight apples-to-apples “40/60” conservative portfolios (40% equities, 60% fixed income) then we have to look at VCNS vs ZCON vs HCON. The Blackrock iShares all-in-one ETF suite does not currently include a similar conservative portfolio.

The argument here mirrors the one above. I again default to Vanguard for the exact same reasons as above. You could certainly go with either the Horizons or BMO offerings if you prefer to save a cup of coffee worth of fees, and don’t see value in getting more bond diversification.

Why All-In-One ETFs are Ideal for Young Investors

All-in-one ETFs are a great option for investors of all ages and experience. However, they are particularly ideal for young investors, individuals in their 20s or even early 30s who are just starting to get into investing. Here’s why.

To start with, you don’t have to have a lot to invest. Using an all-in-one-ETF you can create a pretty diverse portfolio with relatively low investment amounts. Many young investors are struggling with student debt, looking to buy a house, just starting out in the workforce etc. So knowing that you can begin to invest with smaller amounts of money makes all-in-one ETFs a very manageable option for anyone new to investing.

Secondly, the low fees really come into play here. I’ve mentioned earlier how all-in-one ETFs have much lower fees than the typical mutual fund. Granted, every investor would rather pay lower fees, however, this tends to be a more important factor among young investors who likely don’t have as much money to invest/use as more mature investors. The lower fees make all-in-one ETFs less intimidating.

Another point that makes all-in-one ETFs particularly attractive to young investors is the passive investing aspect. Investing can be daunting to those just starting out so the ability to just leave it to grow is an easy solution for many young Canadians.

The Best All-in-One ETFs for Canadian Expat Investors

As MDJ’s own Kyle Prevost decided to go overseas to begin his international teaching career, he wanted me to add a section about his findings for all-in-one ETFs in regards to non-resident Canadian expats.

Essentially, he found that for Canadian expats, using the Horizons all-in-one ETFs (Horizons Conservative TRI ETF Portfolio, Horizons Balanced TRI ETF Portfolio, and Horizons Growth TRI ETF Portfolio) became a pretty big deal due to the fact that expatriate Canadians can get hit pretty hard on the dividend withholding tax side of things.

By using Horizons’ unique swap-based ETFs, expat investors can “magically” turn their dividends into capital gains, and consequently get a solid chunk of their dividends back.

If you’re like Kyle and residing in a country that has no capital gains tax, you can efficiently build a non-registered investment portfolio that has absolutely no taxes owing on it. No taxes to the Canadian government (even though you are using Canadian ETFs and a Canadian brokerage account) and no taxes to your new home country’s government.

If you’re worried about owing taxes when you come home to Canada, then you will be happy to know that Canada will not tax your portfolio’s capital gains if you are a tax resident of another country. When you come home, the Canadian government will start “keeping track” of your non-registered portfolio from the date you arrive back in the country. Only growth in your ETFs and/or stocks from that point on will count as a capital gain.

So if you’re living and working outside of Canada, definitely give the Horizons all-in-one swap-based ETFs another look!

All-in-One ETF Interviews with Dan Bortolotti, Andrew Hallam, and Erin Allen

If you’re hungry for even more all-one-ETF content then check out these three interviews about ETFs from the Canadian Financial Summit.

Canadian All In One ETF FAQ

Canadian All In One ETFs: Final Thoughts

Looking ahead to 2025, it’s clear that a lot of passive investing advocates like Hallam, Bortlotti, Prevost, and Bogle have gotten in way more right than wrong over the last decade.

If you read my first all-in-one ETFs article back in 2019 and followed the advice to stick with a portfolio ETF – especially an all-equity option – you’ve probably done really well. In fact, a $10,000 investment in VEQT six years ago would now be worth just under $20,000 if you had reinvested dividends along the way.

Trying to jump in and out of the market seldom works. Simplicity, on the other hand, tends to pay off. If you want more proof of this fact, Google the “Mind the Gap” series by Morningstar. It details how year-in, and year-out many investors’ overall returns are suffering from market timing.

The sheer simple nature of Canada’s all-in-one ETFs is tough to beat when you consider how little time and effort most Canadians want to spend on research and rebalancing. It’s a hands-off strategy that still helps you stay invested for the long haul.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Thank you for the very detailed insight.

I have a tax related question: for non-registered Investments – if I purchase XGRO, for example, and then, at a later stage in life, closer to retirement / end of life expectancy, I decide to reduce the risk, how would I do that using an all-in-one ETF without triggering a massive tax bill? Hypothetically – say I have $500k worth of XGRO, but I now want to reduce the risk of that entire portfolio and switch to XBAL. I would have to pay tax on whatever growth there will have been, wouldn’t i?

Your feedback will be greatly appreciated.

Hi Howard,

It depends on what your marginal tax bracket was. You could sell a little bit each year. The most efficient way (but it would add slight complexity) would be to figure out how much room you have left in your current tax bracket – then sell the amount that would generate that capital gain. Then use that amount to purchase a pure bond ETF or HISA ETF (thus proportionately it could very quickly get you down to the same equity-bond mix as XBAL would). So, if you had $10,000 left in your current tax bracket, you could sell the amount of the ETF that would generate a $20,000 capital gain (only 50% of that is taxable), and then buy a HISA ETF with that amount. Alternatively, for tax efficiency, you could just switch to more fixed income ETFs in your registered accounts?

I have a question about the all-in-one ETF. Would it hurt or be inefficient to buy for instance, both VEQT and VDY and maintain a certain % allocation for both of these ETFs in my registered accounts?

I am really trying to come to a good grasp of if VEQT can totally replace the need to buy any other ETF altogether? Thanks!

If you buy VDY in addition to VEQT, what you’re going to end up with is more of your money “overweight” in Canadian stocks – and specifically in the high-dividend sectors of Canada. Maybe that’s what you want – but it’s not great from a diversification perspective. A lot of happy folks out there just VEQT-everywhere-and-forget-it.

Thanks, I guess the dividend is great with VDY, but I do want to be diversified. What boggles me is that VGRO is another all in one ETF but it’s price is lower than VEQT.I wonder why!

I wouldn’t pay much attention to per-unit prices Ekta. Those are just a product of how many “slices” or “pieces” the pool of assets (stocks and bonds) gets split into. It’s not all that relevant to investment decisions.

Thanks Kyle!

I am curious what you think about investing in all in one ETFs like VGRO or VEQT and also invest in an ETF that tracks the S&P500. CAD version of the ETF that tracks S&P 500. I have a feeling they will have overlapping allocation, but curious about your thoughts

Hi i have USD funds with Wealthsimple. what do you recommend for all-in-one ETF?

Hello there,

I have been reading a lot about how all in One ETF can be better than a mutual fund and been thinking (probably overthinking) whether I should move my RRSP holding from Manulife ML Mawer Balanced Fund d7 (fund code 5452) to an all in one ETF in my self directed account. The fund has given a decent return of 5% annual compound rate of return since I started in 2018. The reason for my hesitant is that I am not very good in managing my portfolios actively. However, if I am just moving this money to an ETF and forget about it, I don’t see any issues with it. I am in early 50s. Any thoughts on whether I should leave the fund as is or move to a specific all in one ETF? Some dividend and growth would be helpful. Not sure if anyone has gone through this situation who can share their thoughts/experience. Thanks.

Hi Mac,

So when I looked up the Manulife Mawer Balanced Fund 5452 it says that it’s a basic 60-40 balanced portfolio (which is what I expected). The equivalent all-one-one would be VBAL or XBAL. The return on those two ETFs has been about 7% over the last five years. You also would have paid WAY less in investment fees- like the Mawer fund is going to charge you 700% or 800% more in fees!

Thank you, XBAL or VBAL is what I was thinking too. If I need some growth, I am wondering if I should buy some XGRO/VGRO in addition to XBAL/VBAL or just stick to the latter.

Just need some clarification here. Does all-in-one ETF mean we just pick one of those ETF, say XBAL,(based on the risk tolerance) and keep investing? Or do we pick each one, such as XBAL, XGRO, XCNS, etc.? What do most people do? Thanks.

Just pick one and keep buying until you’re retired and ready to sell!

Thanks Kyle, great site and ideas!

The TD “One Click” ETFs were euthanized in April 2023

Good article. I am warming up to the idea of ETF’s. I am curious though about the return on the ETF’s you mention as it is only around 2%. That is a pretty low return. So how does this significantly grow one’s portfolio, especially if you don’t have a 30+ year investment timeline?

Which ETFs specifically are you referncing Fran? Over what time period?

For example the 12 month return for:

VGRO – 2.10%

VEQT – 1.85%

I am 58 years old and have been mostly investing in stocks and bonds. I like the idea of an all in one ETF, but why is the return so low?

Not sure where you’re grabbing these numbers from Fran. I’ve got the 1yr on VEQT at about 30%?

I think Fran is referring to the dividend yield. It’s noted in the far right hand column of your charts above.

Great article,

I am long XEQT, just a quick question. XEQT has a slightly higher yield and slightly lower MER than VEQT.

Is there a reason you feel VEQT to be the better for Canadian investors? The slightly higher home country bias maybe?

They are very very similar Kieren. I like VEQT because of the home country bias as you suggested – but honestly, even more so just because I like rewarding the company (Vanguard) that revolutionized index investing for the entire world.

The TD One-Click ETFs no longer exist. They have been replaced by a simpler set 0f asset allocation ETFs- TCON, TBAL and TGRO. Each of the new TD asset allocation ETFs uses one bond ETF and three equity ETFs with varying weightings. The newer TD ETFs also feature reduced fees.

Hello. Good article. I was rather confused, though, to see management fees listed alongside each of the Vanguard, Blackrock and BMO multi asset ETFs, in addition to their MERs. Surely any management fees depend upon the platform used? For example, Questrade has none for self-directed investing.

Hi Alastair – the management fees are part of the MER. The MER often includes very small other expenses in regards to trading costs with the fund itself. To make it simple, the MER is the only number that really matters to individual investors.

Thank you the explanation Kyle. While the multi-ETFs do appeal, the current MER of my 7 ETF portfolio (with a robo-advisor) is 0.09%. The only real benefit I get from them is regular RRIF payments where they liquidate the assets necessary to make the monthly payment. I am considering simply moving my portfolio to Questrade, using the free PASSIV app to track any significant deviations from my overall allocations, use its one-click rebalancing when necessary, and liquidate assets once a year to fund an annual RRIF withdrawal to my savings account instead. I’ll miss the convenience of simply getting a monthly income without any action needed one my part but it’s not a benefit worth $4,000 a year for staying with the robo.

Yeah, if you have a million dollar portfolio, that % on assets starts to add up in a hurry hey Alastair? What you could do is go with the DIY option now, and then if you reached a point where you had drawn down a substantial portion of your assets and were finding that logging into an online broker “late in life” wasn’t proving to be a lot of fun – you could always switch back right? At least I think you could… I don’t see why not – just never talked to anyone that has done it. Now that I think about, how much would that convenience be worth for you? I’m just hypothesizing about recommendations to the “average” retired Canadian who might have more in the 200-500K territory. At that level, the simplicity of the robo might actually be worth it? Certainly better than just keeping it HISAs and GICs like many do.

Thanks Kyle. You’re absolutely right. I’m fine with DIY for now so I should move and pocket my savings on the robo fees. (No one got rich by wasting money!) but at $300 per month spread between my wife and I they are still pretty reasonable if I should have to go back to them if I decide I value the convenience later in life. On the topic of all in ones, they also have the benefit that there’s only holding then where you have to track the adjusted cost base in non-registered accounts.