Alternative Investing in Rare Earth & Technology Metals

While on Million Dollar Journey we generally recommend straightforward investments like Canadian dividend stocks and index investing using Canadian ETFs, there is always some interest in people who want to try their hand and active management.

We wrote about investing in gold before, as gold investing positions itself as one of the most popular ways to invest in Canada, and concluded that in the long term, the stock market outperforms it in a big way. With that being said, gold can be counter-inflationary, and many followers of the “Permanent Portfolio theory” believe that it’s not a bad idea to invest a small portion of your portfolio into it.

Investing in rare earth metals and strategic technology metals serves the same purpose as gold investing. This type of unique diversification even makes more sense nowadays considering the complex geopolitics and microchip boom, propelled by Trump’s $500bn AI infrastructure investment and China’s export ban of such strategic metals.

Please note, this is an alternative investment which is:

- Unregulated – there aren’t many people worldwide that buy those metals for investing purposes, 99.99% of global trade is between large manufacturers.

- Meant for those with a large portfolio who are looking to diversify.

- Volatile – the prices of these metals can easily go up 100% in any given year, or drop by 50%.

What Are Rare Earth Metals?

Before you invest into rare earth metals, it’s important you understand what they are, how rare they are, and what their significance is. Rare earth metals refer to a group of 17 elements: Scandium, Yttrium, and the 15 Lanthanides (Lanthanum, Cerium, Praseodymium, Neodymium, Promethium, Samarium, Europium, Gadolinium, Terbium, Dysprosium, Holmium, Erbium, Thulium, Ytterbium, and Lutetium).

Despite their name, they’re not always “rare” in the traditional sense of the word. Some of them, like Cerium, are actually as abundant as Copper. However, these elements typically appear in low concentrations (often less than 0.1% in minable deposits) and are intermingled with each other, making mining, extraction, and production very costly and specialized (only a handful of mining companies in the world have the knowledge and mining assets to produce them).

What are Strategic Metals?

Aside from the precise definition of the 17 rare earth metals above, the more investable assets are generally referred to as strategic metals. Strategic metals are also called technology metals. This category of important industrial metals includes elements like Gallium, Germanium, Indium, Dysprosium, Terbium, Hafnium, Tantalum, Beryllium, Rhenium, and even Silver. All of which have super significant high-tech applications, and consequently are rapidly rising in demand.

Most of these metals are by-products of mining more common resources (for example, Gallium often comes from processing Bauxite for Aluminum), making production difficult, specialized and expensive.

Demand For Rare Earth and Strategic Metals

The most interesting thing about both rare earth metals and strategic metals – other than their scarcity – is the increasing demand. Modern technology simply cannot function without them, and demand continues to grow as the tech boom continues. Here’s a few quick examples of technologies that are pushing an endless demand for the rare earth metals identified above:

Smartphones: Depend on several technology metals. Indium and Gallium are key ingredients in touchscreens, providing the clarity and responsiveness that consumers expect. Meanwhile, Germanium is essential for optical systems and high-speed integrated circuits. The smartphone industry giants like Apple, Samsung, and Huawei are always pushing for thinner, more powerful, devices and they do so through usage of these strategic metals.

Microchip Manufacturers: Rely on these materials to create faster and smaller semiconductors. Intel, TSMC, and Samsung invest billions of dollars in research each year in research to improve chip performance, with a huge reliance on Gallium Arsenide (GaAs) and Indium Phosphide (InP) for superior electron mobility and efficiency.

Aerospace and Defense Companies: Heavily consume certain strategic metals. Hafnium and Tantalum, for instance, are crucial for a plane’s heat resistance and strength, making them indispensable for jet engines and military hardware. Companies like Boeing, Lockheed Martin, and Rolls-Royce require these metals to produce cutting-edge aircraft and defense systems that can withstand extreme conditions. There are no substitutes for rare earth metals in this field, as the aircraft would become far less durable if they were to use other elements instead.

Geopolitics and Price Impact

One of the most compelling factors driving the surge in demand for both rare earth and strategic technology metals is the fact that China – which has consistently held the lion’s share of refining capacity for gallium and germanium – recently imposed an export ban on several of these elements.

That move is triggering what could possibly be a major disruption for American and other Western tech manufacturers. It also artificially keeps demand high as China is flexing their muscle as a semi-monopoly in the space – thus raising the price for everyone.

While this will limit supply, President Trump’s record-breaking $500 billion AI infrastructure investment, topped by tens of billions to be invested by Microsoft, Amazon, and Google into such infrastructures, will increase the demand for such metals.

Companies like Intel, Qualcomm, and Apple are already scrambling to secure reliable stockpiles, while defense contractors like Lockheed Martin and Raytheon are looking to diversify their supply to ensure continuity of production lines.

Any gap in the availability of gallium or germanium, for instance, could disrupt the manufacturing of high-speed chips and cutting-edge sensors.

Moreover, Trump’s election has reignited the strategic emphasis on “Made in America” and the drive for self-reliance in key sectors. The administration’s repeated references to national security threats has led federal agencies and the private sector to ramp up spending on everything from raw rare earth ores to refined strategic metals. But it may take years until the US is able to produce those elements at a quantity that is a match to their grandiose plans.

As US and China escalate their tit-for-tat trade restrictions, the resulting market imbalance intensifies competition for any available supply.

Investing in Rare Metals

If you read to this point, then you probably understand the thesis behind investing in those rare metals. But surely, you still have some concerns about investing into a physical asset stored thousands of miles away from you.

Frankly, if there was a stock or ETF that properly tracked an index of these rare earth metals – and conveniently traded on the Toronto Stock Exchange, I would have been all for that. Unfortunately, there is nothing like that on the market today. For a metal like Uranium, for instance, you have the Sprott Physical Uranium Trust Fund (U-U.TO) which does a decent job in tracking the underlying price, but for Gallium, Germanium, Indium, Dysprosium and the likes, there’s nothing out there.

The most popular option out there is probably the VanEck Rare Earth and Strategic Metals ETF (REMX) which has a somewhat high expense ratio of 0.83% – but just consistently delivers poor returns:

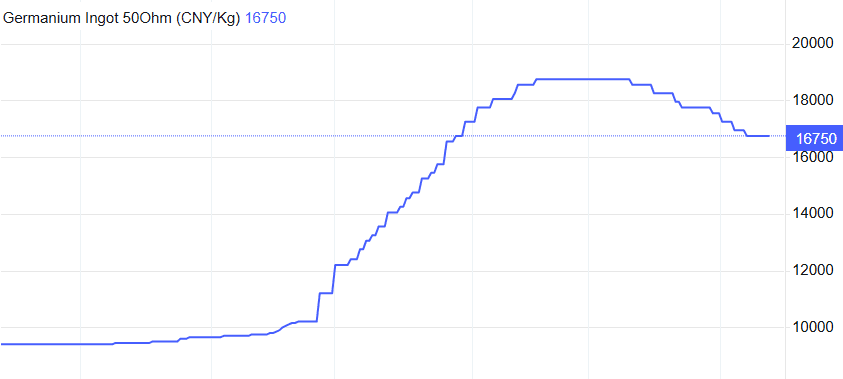

Over the same period, this is how the sport price for Germanium moved:

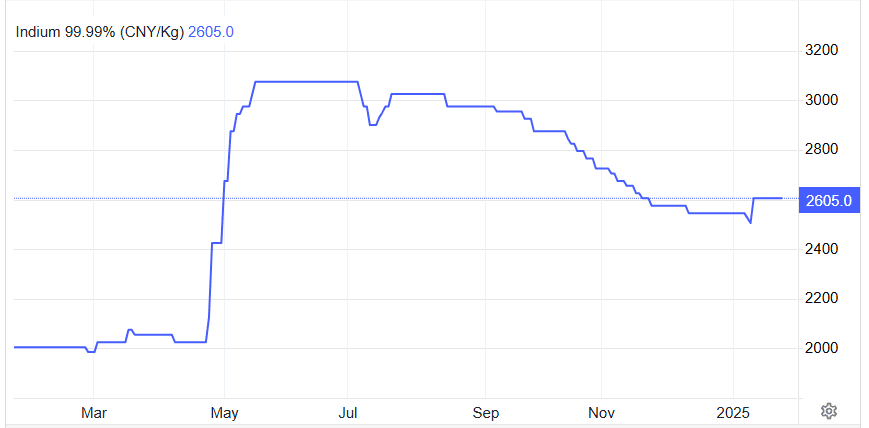

This is Indium:

By investing into the physical asset you get

- To decide which metals you want to invest into.

- To actually track the exact performance of the market price.

- To physically own these metals. Stock market meltdown, financial systems collapse etc., wouldn’t make the slightest difference to your investment.

- Truly diversify from having all your assets locked in your brokerage account.

- Become a frontrunner in investing, delving into a form of investment that very few have access to (but requires a min investment of $50,000).

How it Works

As odd (or different) as the process of buying rare earth and strategic metals seem, it’s actually pretty straightforward and safe.

After booking a sales call, you get a callback from a Sales Representative of Earth Rarest, a metal broker. Then and there you will get a complete lowdown of the process, the associated costs, what kind of assurance you will get, how to visit the physical storage facility etc.

The Sales Rep will explain more about Tradium, which is the company that facilitates those investments. Tradium is a family-owned company with more than 25 years of experience in metal trading geared at industry b2b import and export. Private investors make up a small part of their thriving business. They buy and sell in the hundreds of millions of dollars each year, store more than 300 tons of strategic metals in storage, and supply some of the world’s biggest names.

If you decide to invest, you will get a sales invoice to pay facilitated directly by Tradium, as well as a separate storage agreement. After paying you will get a confirmation about your purchase, storage, insurance policies, and how to schedule a visit. You will also get reassurance that Tradium is able to liquidate your position without a hassle on an almost immediate notice. That feeling of immediate liquidity goes a long way to allaying any fears investors have about investing in such a non traditional manner.

Again, it’s worth reiterating here that the average person looking to invest a few thousand bucks each year in their RRSP and TFSA isn’t the target market for this sort of investment. This is for folks who are really more into the wealth management stage of life, or looking to diversify from traditional investments big time like investing in collectibles, and believe they can identify an imbalance in the market.

Personally, I think there is a much better supply-and-demand rationale for buying rare earth metals than for joining the herd and buying a gold ETF. As far as commodity investments go, I think the investment thesis for select strategic metals is much better than for almost any commodity out there.