Case Study: Young and Cash Rich

Kevin, from Canadian Money Forum, started a forum topic asking for advice on his financial situation. Check it out:

I’ve chosen to write this topic in order to have an idea about what you would do in my situation. I’ve read most of the MDJ blog, as well as several other websites, but the more I read about it, the less confidence I have to actually do something. With the current economic crisis, this could easily turn into one-of-a-lifetime opportunity, and staying on the sidelines isn’t a valid option.

Here is my background:

I recently turned 22 and am working in downtown Montreal at a job paying me $33k/year. I currently live in a 4 and a half appartment at $630/month and I’m renting a room in it. I’m single and don’t have any kids. Here are my assets: 36000$ in cash rotting in bank accounts, a car worth about 3000$ now. I don’t have any RRSP, no TSFA ( Yeah, I really need to get one! ). I just started out a non-registered account at work, a stock offering at 2% matched by the company, which I took. The company doesn’t pay dividends and the growth seems limited. In any case, that account has virtually nothing at the moment.

My liabilities are a student loan of 16000$ currently at 3.3% ( not locked ). My budget averages out on the course of the year at around 400$/month free. It may be higher as I don’t take into account tax returns, etc.

My goals in life : I don’t have any particular goal at the moment. I would like to retire early, although I don’t expect to have any expensive hobby during the course of my life ( although that may change, but knowing myself, it’s unlikely ). I currently don’t want kids until I’m maybe 27, and by then, I’ll see if I want any or not. I’ve looked to buy real estate in Montreal ( a condo where I could rent a room, a duplex or whatever ), but by the time I started looking them ( around the same time last year ), prices don’t seem to have went down at all. I’m not the handy type of person also.

I’ve looked into Reits, but with the real estate crash ( and from what I’ve read, the crash is likely not at the bottom yet ), I’m more or less afraid to see Reits with interesting yields ( 5+% ) go bottom-up. I’ve looked into dividend stocks, mainly banks. But, with the RE and credit crisis worsening, is it safe to invest in them? I’m not afraid of them going bankrupt, but more like seeing them reduce dividends greatly, bringing the stock prices way down.

I’ve looked quickly bonds, but they’re not really interesting due to very low yields. With the upcoming inflation that is likely coming, RRBs could be an option, but I would need to read more about them. I’ve also looked in starting my own business over the Internet ( I have tons of free time at work (2-3 hours a day), but I haven’t found anything that could work, most ideas I’ve had being already realized, and free to the general public.

That’s pretty much a good summary of my situation right now. Knowing this, what would you do if you were me?

After reviewing Kevins financial profile, it appears that he’s in great shape. Having $36,000 in cash from a single 22 year old making $33k/year is quite the feat. Here is what I would do:

1. Pay off the Debt

To begin, even though the student debt is at a fairly low rate right now, it is floating, so it could go higher in the next couple years. Even with the low rates, paying off the debt would provide a return much greater than idle cash in addition to freeing up more cash flow. Besides the financial benefits of paying off the debt, there is the psychological benefit of “freedom” when outstanding debt is eliminated.

2. Save for your goals

Kevin mentioned that he is interested in buying a house in the future. One thought would be to start his RRSP so that he can take advantage of the RRSP home buyers plan in the future. As Kevin is currently in the lowest tax bracket, I would suggest to claim the tax deduction in a future higher income year.

An alternative would be to use a TFSA for his savings or a combination of a TFSA and RRSP. At least that way, he would have access to some cash without having to worry about being taxed on the withdrawals.

3. Get Rid of Company Stock

I would get rid of the company stock. The reason is that too much of Kevin’s wealth would be tied into the one company as it’s his main source of income. One strategy could be to exercise the company stock options immediately upon receiving them (if they are in the money). Note though that this would generate tax payable in the form of capital gains.

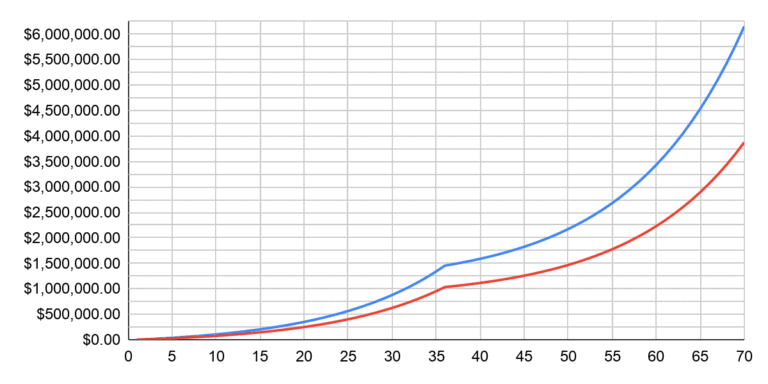

4. Build a Portfolio

Once he has money set aside for his immediate financial goals, then it’s time to start building a long term portfolio. What should he invest in? For most investors, the best bet would be to index. I know, I know, I don’t entirely practice what I preach (only a portion of my portfolio is indexed) but indexing really is a smart (and passive) way to invest for someone who doesn’t watch the market all day long.

Investors can index via mutual funds or ETFs. Mutual funds can be cheaper if investing small amounts per month, but ETFs have lower MERs overall. A popular, and cheap, set of index funds are the TD e-Series. For ETFs, you can check out my low cost diversified ETF portfolio.

5. Start a Business

For a young (and single) guy like Kevin with some free time on his hands, I would definitely recommend going into business. As he seems to be Internet savvy, I can suggest what I’m doing. That is providing free content and adding value to an audience about a subject that he is enthusiastic or even passionate about. Not only can this be fulfilling, it can pay for beer, diapers or even your mortgage. The sky is the limit.

6. Stay Frugal

If Kevin can remain fairly frugal, keep his expenses low, and banks his raises, he will achieve his financial independence in a relatively short period of time. In saying that, I would recommend that Kevin stay the course, invest for the long term but of course splurge a little every now and again to enjoy what money can buy.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Instead of letting it rot in bank accounts, shove it into one of the high interest online savings accounts while you decide what else to do with it.

For a 22 year old kid, I’d say hes got a firm grip on life, and looks like hes in alot better shape than alot of the 22 year old kids I know, and I should know this… because I myself am 22 years old… though I’ll be turning 23 this month… not really looking forward to that! lol

Right now… I am majoring in Finance in my Junior year, so it was fun to read this case study. If Kevin does everything right with the advice hes been given, he should be real well off financially at age 27 when he wants that child, hehe.

Till then,

Jean

@ Tom

I was looking at disability insurance for my hubby 48 years old in a trade and it would be over $400 per month for almost nothing. Not sure what it would have been if he were in his 20s as his is a dangerous trade but yeah, you don’t want to wait.

Aolis, afaik, interest on national student loans are given a tax credit, not a tax deduction. (https://milliondollarjourney.com/difference-between-a-non-refundable-tax-credit-and-a-tax-deduction.htm)

Saif, if you have no debt and cash on hand, I would open a TFSA and learn how to invest for the long term. You have an advantage with your long investment time line.

hi HELP PLZ

I am turning 18 this march and I have about $21,000 cash (what to do with it)

. not in debt

.I save 15-20% of every pay (part time job)

.going to college next year

.live in Montreal if that helps

I don not know what to do to with my money

I have nobody who is good with money

so I ask you pros for help

thank plz reply

.

Interest on government student loans is deductible.

Once it is paid off, he is unlikely to be able to borrow a similarly large amount to invest with so little credit history.

Given his young age, the low rate and the state of the market, he could easily invest the 16k instead and simply pay the interest. This is what I did.

Given his low salary, TFSA is clearly better than the RRSP. He can even withdraw money for a house from the TFSA and pay it back whenever (or not), unlike the RRSP. The salary will grow over time and then he can start contributing to a RRSP.

He might want to think about getting a condo so that he can live it up close to downtown for awhile.

I don’t know what everyone is talking about. This guy is not “Cash Rich”. At the rate that he is going for $400/month savings, that’s not that much money that he’ll be able to save. When I was 22, I had a $36K/year job for internship, then it went from $45 to $55 to $65, $75 to $85 to $100, to $240(self employed) at 29 years old and I’m still struggling to get to that financially independent dream. It’s the government that takes all my money, I spend very little, have two properties, and I don’t see myself retiring for years. People don’t realize how the government sucks the life and ambition out of you in taxes. Keep working hard.

All the Best

You’ve got to tell us how you got 36K in cash (55K gross) after working just one year. That’s huge and congrats!

Be happy with the cash you have. However, know that you’re only in your 20’s once, so if I had that cash, I’d just live it up, but not on debt. You have your life to make good money, and if you can make 36K cash 1 yr out of school, you will probably have $1mil in cash by age 30.

Best,

RB

PS – every human being – ALL OF US – have “biases” – it is part of being HUMAN. Again – I feel I owe YOU – the people on here – a certain degree of information. I am NOT trying to SELL you – but I AM trying to inform you. Most people are not aware of the issues I raise. Funny – the largest (BY FAR) purchasers of individual DI are Doctors – those most aware of the problems – PLUS those exposed to professional association policies. They can well afford to purchase “cheaper” policies and choose NOT TO – in massive numbers. You say “at $33,000 can he afford it?” I say it is up to me to find a way to design a program he CAN AFFORD – but at LEAST – it is my job to inform YOU of the options – and the implications of those options.

With all due respect – having seen what happened to my brother – you want details I will be glad to give them – and reading Stephen’s posting – I will DELIGHTEDLY declare my bias. Also – my “clients” are insurance ADVISORS – I do not sell to the public. Again – I will just remind you of a few facts – our income is our most important financial asset. EVERYTHING revolves around and assumes that one item. How many of us find $1.00 to $1.50 a DAY for “junk” purchases. This is what I am talking about – as far as amount is concerned – and protecting our most important asset is hardly a “junk” purchase. Also – given what is happening with jobs – and benefits – we cannot rely on “employee benefits” to be there. Forget the terminology issues – the bloody plan will NOT BE THERE. Having PRIVATE DI is a TOUCH more important than a Starbuck’s Coffee