Is BNS Stock a Good Buy in 2024?

If you’re thinking about investing in Bank of Nova Scotia stock in 2024, you must consider the bank’s individual performance, its recent developments, and the future outlook for not just the Canadian banking sector, but the global financial services industry .

For additional perspectives on alternative investment choices, you can explore our article highlighting the Top Canadian Bank Stocks.

Want To Buy Bank on Nova Scotia Shares? Price, Performance & Analysis

- BNS.TO Stock Price: 62.42

- Dividend Yield: 6.75%

- Price-to-Earnings (P/E) Ratio: 9.36

- 5yr Earnings Per Share Growth: 4.16%

- 5yr Dividend Growth: 5.89%

- Payout Ratio: 50.31%

Our Bank of Nova Scotia Stock Analysis

- Priced at $65 per share, BNS presents a decent investment opportunity, I might call it a “hold”.

- Experiencing a year-to-date decline of 2.6%, down from its peak in 2022.

- Stands out as the most internationally oriented among Canadian banks.

- Boasts a substantial dividend yield of 6.6% and recently revealed plans for a dividend increase.

- Anticipates low-to-modest growth prospects.

Our Scotiabank stock analysis suggests that BNS is valued correctly, which presents somewhat of an appealing prospect for long-term investment. While it has a strong position within the Canadian banking sector, BNS is not expected to hit record growth rates anytime soon. At the current trajectory of the industry, growth is expected to be stagnant or low at best. However, its high dividend yield presents a good opportunity for consistent income.

It’s important to emphasize BNS’s thriving online bank, Tangerine, which has emerged as a driving force for innovation within the financial services realm. This diversification shows to me Scotiabank’s adeptness to evolving market dynamics, thereby reinforcing its ability to broaden revenue streams beyond traditional banking services.

To gain in-depth insights into long-term investing, I suggest consulting our guide outlining the top choices for Best Long-Term Investments in Canada.

Bank Sector Outlook

Over the past year, the stock prices of most banks have experienced a decline. This initial retreat occurred as the Bank of Canada and the U.S. Federal Reserve embarked on an aggressive path of raising interest rates in an attempt to rein in high inflation.

While higher interest rates can positively impact banks by potentially increasing their net interest margins, the rapid and substantial rate hikes within a short time frame are creating challenges for borrowers with limited financial flexibility.

Both businesses and homeowners with variable-rate loans immediately feel the strain upon a rate hike announcement. Borrowers relying on fixed-rate mortgages face difficulties during loan renewals. Prolonged elevated rates could elevate the risk of defaults.

Central banks are working to moderate economic growth and rebalance job markets. Economists predict a span of 12-18 months before the full consequences of these rate hikes are felt in the economy. Investor apprehension stems from the potential for central banks to push the economy too far, potentially triggering a significant recession. Such an outcome could lead to a higher-than-expected surge in loan defaults, putting banks in a challenging position.

The recent collapses of certain regional banks in the United States are further contributing to cautious sentiment among bank investors. Many are awaiting developments to ascertain if more challenges lie ahead. An impending catalyst might arise from loans linked to office buildings experiencing high vacancy rates.

If you’re worried about investing in one particular sector, I suggest considering investing in an ETF. Exploring our comprehensive list of the Best ETFs in Canada for 2024, provides you with diversified exposure across various sectors and asset classes, enabling you to capitalize on broader market trends and performance.

Should You Buy BNS Stock Right Now?

Bank of Nova Scotia (BNS) usually stands as a relatively underappreciated contender within Canada’s banking sector. It presents an alluring yield of 6.75%, offering significant income potential to investors. However, this appealing income opportunity is counterbalanced by a distinct drawback – limited growth prospects.

A closer examination of BNS’s growth trajectory reveals one of the less favorable records among major Canadian banks. Over the past five years, the bank’s revenue has displayed a modest annualized increase of just 2.3%, while its earnings per share (EPS) have actually experienced a slight decline within the same period.

Such growth metrics distinctly set BNS apart from its counterparts like Royal Bank or Bank of Montreal. You can read my recent RBC stock analysis to see the differences.

This divergence underscores the trade-off between income and growth that BNS presents to potential investors. While its generous yield can be appealing for those seeking immediate income, the bank’s historical growth performance raises questions about its potential for substantial capital appreciation. As with any investment decision, considering this balance between income and growth is essential in determining BNS’s suitability within a diversified portfolio.

For those seeking alternative investment opportunities, I recommend exploring our guide on the Top 10 Undervalued Stocks in Canada. This resource provides valuable insights into potential investment choices that may be currently undervalued in the market, offering a chance for astute investors to capitalize on potential future gains. By delving into this guide, you can access a range of carefully selected options that have the potential to deliver substantial value and returns over the long term.

How Can I Buy BNS shares?

To acquire shares of BNS, you can utilize any one of the many Canadian online brokerage services. At MDJ, we prioritize providing guidance to our readers in selecting discount brokerages that meet their needs, Our list of Best Online Brokerages in Canada is regularly updated, providing readers not only with top-notch recommendations but also access to advantageous promotional offer codes in the market.

After successfully registering for a brokerage account, the process of purchasing BNS shares, as well as other stocks, becomes quite straightforward. Begin by searching for the ticker symbol “BNS” and determining the desired number of shares you want to buy.

Let’s say you’re considering an investment of $650 in BNS shares, and the current stock price is $65. Input the quantity as “10” and opt for “market limit.” Your online broker will then prompt you, asking, “Do you want to buy 10 shares of BNS at $65 each, totaling $650?”

Once you confirm the order, your online broker will manage the remaining steps. Congratulations, you are now a shareholder of the Bank of Nova Scotia, one of Canada’s leading banks!

BNS Stock Past Performance

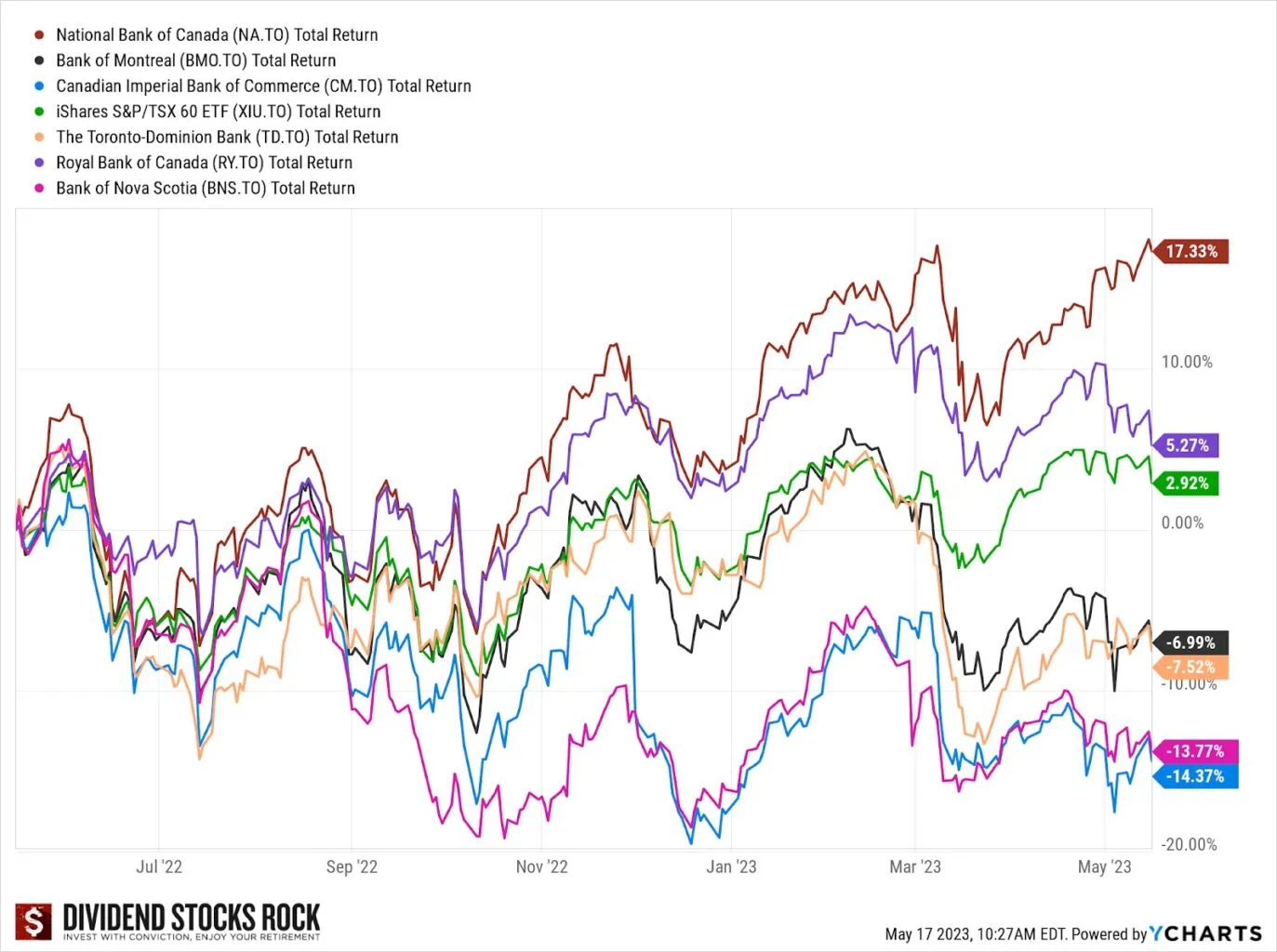

As illustrated above, the broader banking sector has experienced a downturn over the past year, spanning from June 2022 to May 2023. Notably, National Bank and RBC have emerged as outliers, outperforming the TSX Composite during this period.

While the current trend appears downward, I maintain confidence that BNS, in conjunction with its peers within the Canadian banking industry, will deliver consistent and reliable returns to its investors once the economy stabilizes and interest rates come down.

Despite Scotiabank’s relative strength in the Canadian market, the promise of its overseas ventures has not necessarily translated into substantial profits. Most of its international branches are situated in South America, which may not offer the same growth potential as other regions. It can be tough to achieve comparable profit margins when venturing outside of the oligopoly-protected Canadian market.

For those interested in delving further into dividend investing, I recommend exploring our updated compilation of Best Canadian Dividend Stocks. This resource offers insights into the realm of dividend-oriented investments and can provide valuable guidance.

As a committed long-term investor, my focus lies on ventures that offer both escalating dividends and consistent capital appreciation. While BNS has showcased a commendable dividend growth rate of 5.89% over the past five years, its revenue growth rate does not match this. As such when investing in BNS, I make sure that it is a smaller part of my portfolio, and much rather prefer other Canadian banks with higher capital gains.

If you’re seeking a comprehensive analysis and comparison of dividend stocks, complete with advanced statistics and a diverse array of stock choices, you need not look beyond the Dividend Stocks Rock (DSR) Guide. This comprehensive guide is a valuable resource, offering insights and information to empower investors in making informed decisions in the realm of dividend-centric investing.

Bank of Nova Scotia Stock Forecast

On May 24, the Bank of Nova Scotia released its financial results for the second quarter of 2023, reporting a net income of $2.13 billion. However, these results revealed a decline in net income and a failure to meet profit estimates, indicating a challenging quarter for the bank.

The bank’s net income decrease during the initial quarter of 2023 highlights the hurdles it faced, underscoring a concerning development for investors who had hoped for stronger financial performance. Notably, the bank’s performance fell short of profit expectations, indicating potential difficulties in navigating the current economic landscape.

The domestic market context further compounds these challenges, as the Canadian real estate market slowdown impacts the overall growth potential of Canadian banks. Mortgages constitute a substantial portion of Canadian banks’ portfolios, and the significant slowdown in the housing market is having a profound impact on the overall expansion of these financial institutions.

The Bank of Nova Scotia, similar to its industry peers, experienced a decline in earnings from its Canadian banking operations. This decline is particularly significant as these operations constitute a significant portion of the bank’s income.

For a deeper exploration of other potential investment avenues within the Toronto Stock Exchange, we invite you to delve into our comprehensive guide on Dogs of the TSX.

While the Bank of Nova Scotia offers a solid yield and is not considered an unfavorable company, there are much more compelling options available within the sector. For a more comprehensive evaluation of potential investment choices, we encourage you to explore our detailed article on the Best Canadian Bank Stocks.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?