Volatility Index – Trade The VIX And VXX

On this article we’ll be looking at how and when to invest in VIX and VXX, aka: the Volatility Index. We’ll tackle how to buy and sell VIX and VXX, whether it deserves a spot in your portfolio, and what exactly the VIX and VXX even are!

While investing in the VIX or VAX is more technical than the typical questions we try to answer, we’ll break into chunks and describe exactly what a Volatility Index is, what the VIX and VXX indicate, what are the differences between the two, and how do you buy or sell the VIX and VXX?

We’ll make it simple for you: The VXX is basically a bet – a bet that there will be a substantial amount of stock market volatility (typically when the market crashes or sees significant corrections).

If you can accurately predict when these events can happen, you will make money – lots of it. But if you cannot accurately predict these events, and the market continues a nice steady upward gain month over month, year after year, you will lose money.

Lots of it.

So, before you read on, we just want to say this:

Please note, Volatility Indexes (VIX) and VXX are highly technical financial instruments that are leveraged by professional hedge funds and financial institutions. Before utilizing or buying VXX or VIX we implore you to fully understand the risks of leveraged investments. These investing tools are instruments that if used incorrectly can significantly damage your nest egg.

Volatility Index (VIX) Explained

So let’s start with the first question we typically get: What is the Volatility Index (typically called the VIX) and what does it track?

When people refer to “The VIX” they are referring to the CBOE Volatility Index (VIX); CBOE being the Chicago Board Options Exchange. As you might have guessed from the name, CBOE is an options exchange run CBOE Global Market and is one of the largest options exchanges for option contracts on equities (stocks), indexes, and interest rates in the world.

In 1993, the CBOE created the Volatility Index (VIX) as a gauge of volatility in the U.S stock market. Since then, it has become the de facto measure of U.S market risk and investors’ sentiments. Basically, the more scared or ecstatic investors are, the higher the VIX gets.

What is VIX Based On?

As we’ve already hinted, the VIX is an index, meaning that it tracks a group of stocks or markets. In this case, it is an index that “measures” or values the implied volatility of S&P 500 index options. But let’s break this down to understand this better.

But let’s break this down to understand this better.

- S&P 500 Index Options

Like equities and stocks, options can be bought for indexes like the S&P 500, Nasdaq, and the TSX. These are called Index Options (What is an option? See our quick primer on what an option is).

- Index options of the S&P 500 can be volatile or can be stable

When the stock markets are experiencing volatile conditions, then index option prices of the S&P 500 tend to be volatile (i.e. the price of options premiums of options can be volatile) due to the fact future values will be very difficult to predict and “bets” on the direction of the S&P 500 would carry more perceived risk.

When the stock markets are stable, then index option prices of the S&P 500 tend to be stable too.

- What are volatility and volatile conditions?

Volatility measures the magnitude of price movements that a financial instrument experiences over a certain period. The more dramatic the price swings are in that instrument, the higher the level of volatility, and vice versa.

Thus, when the price of a financial instrument experiences a lot of price swings, this would be considered volatile conditions.

Putting these points together, we can see that the VIX measures or values implied volatility of S&P 500 index options. In other words, VIX looks at the volatility of the index options of the S&P 500. If market conditions are volatile, and thus S&P 500 option volatility increases (i.e. the magnitude of price swings increase), then the value of VIX will go up. Conversely, if market conditions are stable, then the value of VIX will go down.

Great! Now we know-how what VIX is, you’re ready to make money off of its movements right?

Not so fast.

Like the S&P 500 Index, you can’t simply go and buy an index. There are no such things as an S&P 500 or TSX 60 stock.

There are, of course, exchange-traded funds (ETF), which try to track and match the S&P 500 by owning the same stocks on the S&P 500. There are a lot of examples out there that are worth buying, from Vanguard’s S&P 500 ETF, BlackRock IShares Core S&P 500 Index ETF, and BMO S&P 500 Index ETF (just to name a few).

In the case of VIX, there are no ETFs, but there are exchange-traded notes.

What’s an exchange-traded note (ETN) you ask?

Well, like an exchange-traded fund, an ETN tries to match the index as much as possible. But whereas an S&P 500 ETF would buy up the stocks listed in the S&P 500, an ETN on the other hand is fixed-income security created to track the performance of something – in our case, the VIX.

There are many examples of ETN (otherwise known as Exchange Traded Products, or ETP), such as Velocity Shares Daily Long VIX Short-Term ETN (VIIX), but the most famous and the granddaddy of them all is the iPath Series B S&P 500 VIX Short Term Futures ETN, aka VXX (or more technically correct, the VXXB, as this is the second iteration of VXX, with the original VXX no longer being able to be purchased). VXX and VIIX are ETNs that can be bought and sold like stocks on listed exchanges.

What is The VXX Based On?

Ok, there was a lot in the last section, but let’s recap:

- The VIX is an index that “measures” or values the implied volatility of the S&P 500

- You can’t buy the VIX, but you can buy Exchange-Trade Notes (ETN) or Exchange-Traded Products (ETP), notably the iPath S&P 500 VIX Short-Term Futures ETN (VXXB)

- An ETN (in this case – the VXXB), is a fixed income security created to track the performance of the VIX

So the question you might have now is, what is the VXX based on and how does it work? (Note: For the purposes of this article, we will use VXXB and VXX interchangeably since they are the same thing.)

Well, this is where things get a bit complicated and can get a bit technical, but we will simplify it as much as possible.

As noted above, VIX is an index that “measures” or values the implied volatility of the S&P 500.

The measure looks at a constant 30-day weighting and uses multiple S&P 500 option expiration cycles. The VXX on the other hand attempts to track the performance of the S&P 500 VIX by using short-term index futures (see aside for a quick primer on what a future is).

To be more specific, VXX attempts to track the performance of S&P 500 VIX using the first two months’ futures to calculate an average. In other words, if today was Sept 22, the VXX would be using the futures of both Sept and Oct on each trading day, and attempt to replicate the price moments. When Sept futures settle (i.e. its October 1 and futures contracts of Sept are closed), then the next two months are used as averages (i.e. Oct and Nov).

While this seems complicated, the main point you have to keep in mind is, VXX is based on future contracts, specifically, contracts that settle over the next two months. If the values of these future contracts go down, then the VXX value goes down. Conversely, if the values of the future contacts go up, then the VXX value goes up.

VXX vs VIX – What is the difference between VXX and VIX

To summarize the main things you should take away from this article:

- VIX is an index that measures the implied volatility of S&P 500

- Like all indices, you can’t buy the VIX directly

- But unlike major indices, you don’t buy an exchange-traded product that owns the underlying investments (like stocks in the S&P 500)

- Instead, you must buy VXX (or, to be more precise, VXXB). VXX (VXXB) is a fixed-income security created to track the performance of VIX but using short-term index futures.

- If the values of these future contracts go down, then the VXX value goes down.

- Conversely, if the values of the future contacts go up, then the VXX value goes up.

With that said, you’re now probably thinking, “How do I buy VXX?”

How to Buy VXX

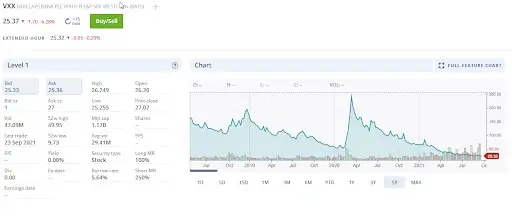

Well, this is probably the simplest, most straightforward part about VXX; you can buy it pretty much at any major self-direct online or discount brokerage! For example, if you type up VXX at any major online brokerage, chances are you’ll see something like this:

VXX will typically be called something along the lines of “Barclays iPath Series B S&P 500 VIX Short-Term Futures ETN” or something close.

Don’t have an online or self-directed broker? Then you’re in luck! We’re written about them before, but here are a select few brokerages we know of that you can purchase VXX from:

- BMO Investorline – a self-direct bank brokerage from one of Canada’s top 5 banks

- Questrade or Qtrade – online discount brokerages that we’ve written about before and both highly recommend.

If you want to see more options for brokerages, have a look at our comparison of Canadian discount brokers.

What is a VXX or VIX ETF

The VXX ETF is actually a bit of an oxymoron. If you followed our explanation above, you know that VXX is an Exchange-Trade Notes (ETN), or sometimes also called an Exchange-Traded Products (ETP). As an ETN/ETP, VXX is a fixed income security created to track the performance of VIX. In other words, it tries to track the performance of VIX, but through the use of Index Futures (discussed above).

An exchange-traded fund (ETF), on the other hand, is a financial product or security that tries to track an index (like the S&P 500) or a sector (like the Dow Jones Industrial – an index of 30 prominent companies listed on US stock exchanges). That said, ETF tracks an index by purchasing and owning a bunch of stocks/securities that make up the said index. For example, Vanguard’s S&P 500 Index ETF (VFV) seeks to track (as best as possible, not accounting for fees and expenses) the performance of the S&P 500 by buying the stocks listed in the S&P 500 and tries to match up the weighted volume as possible as well (unless you are purchasing an equal-weighted ETF).

As you can see, ETFs and ETP/ETN (which VXX is) are pretty fundamentally different. So when you hear someone talking about VXX as an ETF – feel confident and free to correct them!