Best Money-Making Apps in Canada 2024

Maybe you’ve been scrolling social media at some point and seen that there are apps that will pay you for basically nothing and help you make money online.

It’s not quite as ridiculous as it sounds at first!

There actually are apps that will pay you for doing something that you would be doing anyway (like shopping) or help you grow your money. While it’s not quite “nothing” it’s still pretty much “found money”.

This post isn’t about apps that help you get a job or facilitate finding gigs. Uber, Skip, Lyft, and Upwork do not feature on this list.

You don’t have to do any kind of specific job to use these apps, you just have to, well, use them.

How Do These Apps Work?

This list covers three kinds of money-making apps:

Cashback Apps: Cashback apps give you rewards for shopping, either at a specific list of partners or through their app marketplace. They’ll allow you to redeem your earnings, either for cash like a cashback credit card or for merchandise, gift cards, appliances and so on.

Coupon Apps: While there are coupon apps that just let you see the deals, some of them offer you cash rewards for buying certain products and providing proof of purchase.

Investment Apps: stock trading apps keep the stock market in your pocket and make investing easy. These apps don’t specifically give you cash rewards, but they sure make growing your savings easier!

Are These Apps Safe And Legit?

Any time an app offers you money, it’s wise to approach with caution. Scams exist, and you don’t want to fall for one.

The apps on our list are from legitimate companies, often with millions of users. But, for general reference, here are some basic things to consider:

1. Reviews: If there are lots of negative reviews, pay attention. Also, if there are lots of extremely similar 5-star reviews that don’t go into detail, it can be a bad sign (“Great app! Works well!” over and over again in different variations should raise a bit of a red flag)

2. App descriptions: Read the app description and watch out for big promises without specific features (if they tell you that they’ll help you earn hundreds of dollars, they’d better include convincing information about how)

3. Permissions/terms of service: Check the permissions list and terms of service carefully, especially with apps that want access to your credit or debit card. Make sure you understand what you’re allowing them to access – and don’t do the thing we all do, where we just click “Accept” without reading. Big mistake.

4. Download numbers: If the app is relatively new and it has extremely high download numbers, be on alert. That rarely happens and can often mean a company has used bots to elevate their numbers.

Best Money-Making App in Canada – Moka

The best money-making app in Canada is Moka (formerly Mylo). Moka is an investment app with over 750,000 users.

We like Moka because you don’t have to shop anywhere special, you don’t have to do anything different – you just grow your investments in the background.

You connect Moka to your debit and/or credit card. It rounds up every purchase to the nearest dollar and invests the change, which means you grow your investments with every purchase without even noticing. Your money is invested in a diversified ETF portfolio that matches your preferred risk tolerance.

Moka is not a free app – they have two tiers, the basic $7.99/mo, or Moka 360, which gives users financial advice and cashback perks for $15.99/mo. You can find more details in our Moka Review.

Best Money-Making Cashback Apps

Cashback apps are designed to give you cash or redeemable rewards points in exchange for purchases you would be making anyway. Users usually shop through the app’s portal, and they update your rewards totals regularly.

As opposed to cashback credit cards, which usually reward users for every purchase in specific categories, cashback apps are often limited to a list of partner stores. Their earn rates are also generally far lower than even your average no-fee cashback credit card.

But if you’re just looking for an extra few dollars a month for doing basically nothing, they can be worth a try.

To maximize your cashback rewards, remember that these apps can be used at the same time unless they specifically say otherwise. Stacking your rewards means more cash for you.

Remember: Cashback apps are usually linked to your debit or credit card, so be sure to read the terms of service and make sure you’re comfortable with them.

Here are some cashback apps that are legit and could be worth a try:

Rakuten

Formerly Ebates, which has been available to Canadians since 2012, Rakuten has about 5 million members and over 750 partner stores.

Users visit their favourite online stores via the app or website portal and earn cashback on their purchases. Earnings are auto-credited to your account.

If you’re shopping online from your computer, Rakuten offers a browser extension that notifies you of any cashback deals. Note: not all offerings at partner stores qualify for earnings, and rewards tend to fluctuate. Never assume – double-check everything.

Payment is available quarterly via Paypal, cheque, or Amazon gift card, provided you’ve accumulated at least $5.01.

Drop

Over 3 million users in Canada and the US use Drop and have received more than 16 million in total rewards. Drop users shop offers from their favourite stores directly from the app to earn points. 1,000 Drop points can be redeemed for $1.

Drop’s earn rates vary but have been known to go as high as 8% with special offers. They also give you options to earn more points by playing games, answering in-app surveys, and taking advantage of special offers.

Earnings show up on your account weekly, but you can’t cash out until you’ve earned at least 25,000 points ($25 value), which can take a while.

Ampli

Ampli is a newer cashback app and has been on the market since 2019. Instead of offering points like Drop, Ampli users accumulate cash rewards.

Ampli members visit the app to see special cashback offers from their retail partners. They have a more limited selection than Rakuten or Drop, but it’s growing.

Ampli is a subsidiary of RBC and uses bank-level encryption to protect your data. You don’t need an RBC account to use Ampli, although users with linked RBC cards can be eligible for additional bonuses like 1% cashback on some offers.

When you accumulate $15 in cashback earnings, you can cash out via e-transfer.

These cashback apps are similar to the apps that KOHO and Stack use for their credit cards. Both of these cards offer excellent cashback earn rates with their partner stores and could be better options than the apps on this list. You can learn more about their offerings in our list of the Best Prepaid Credit Cards in Canada.

Best Canadian Coupon Apps

Unlike the cashback apps, which are associated with specific retailers, another family of apps partners with specific brands.

These apps don’t care whether you buy that box of Life Cereal from Loblaws or Walmart, so long as you buy it. This makes them good candidates for stacking with cashback apps and/or credit cards.

Much like a mail-in rebate, these apps require proof of purchase before paying out cash to your account.

Bonus: You can upload your receipt to more than one app at a time, which lets you maximize your earnings even more.

Caddle

Caddle gives users weekly offers on featured products via their app. In order to earn the reward, you purchase the product(s) at the store of your choice, then photograph and upload the receipt. You can also complete a questionnaire or watch an ad to maximize your earnings.

Once the receipts are processed, your cashback earnings are credited to your account. You can cash out at $20 and receive a cheque in the mail.

Checkout51

Checkout51 works the same way as Caddle. You browse the weekly offers, purchase items at the store of your choice, and then scan and upload your receipts. Earn rates vary but have been known to go as high as 35% cashback.

Once you’ve accumulated $20, you can request a payout and receive a cheque

Note: You may have heard of other coupon-clipping apps like Flipp and Reebee, but they don’t pay out cash, they help users scan multiple flyers and keep track of deals.

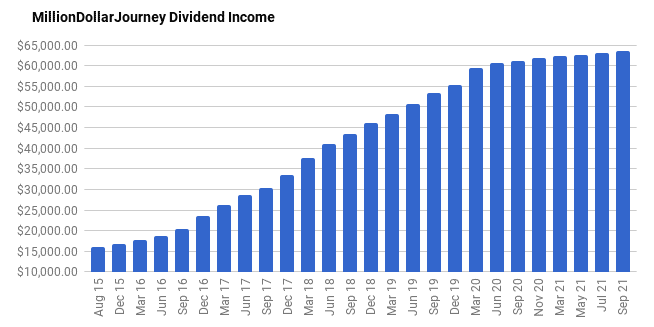

Best Investing Apps

Investing apps also help you make money by doing next to nothing. In this case, you’re not earning cashback or rebates for purchases, you’re investing cash in the stock market and watching it grow. We recommend these apps over any of the others on this list because there’s more oversight and your earnings don’t depend on an app developer.

Moka, our pick for the best money-making app on this list, is an investment app. It can give you cash back if you choose to pay the premium monthly fee, but even the investment-only tier could be worth it, depending on how many purchases you make monthly.

That being said, if you want to start investing, even with next to no budget, there are other apps worth considering. Wealthsimple is our top robo advisor pick and has lower fees for small accounts, no minimum balance, and a feature that also allows you to invest your spare change.

If you want a more hands-on investment app, consider one of Canada’s Robin Hood Alternatives like Qtrade or Questrade, which allow you to make trades yourself. Even with a small budget, you’ll see your investment grow. If you’re comfortable with risk (and higher possible rewards), you can look into day trading and see what you can do by playing the stock market.

Any of these options would be better than the apps on this list, with higher possible returns and potential for growth.

Canadian Money-Making Apps – FAQ

Best Canadian Money Making Apps: Summary

If you’re wondering “Are there really apps out there that will pay me for shopping?” the answer is yes. They won’t pay you much, but they WILL pay you if you do the legwork. Any of the apps on this list are legit, and some people have found them worth it.

Our favourite app on the list is Moka, which is an investment app more like Weathsimple Invest than any of the others here. But, while it’s our favourite app, it’s not our favourite investment tool – so if you decide that you want to invest in long-term growth instead of waiting for your $20 payout, consider the platforms in our best Canadian online broker list instead.

Make sure that you read all the fine print (you heard us) and that you feel comfortable with any access they ask for. And keep in mind that these apps won’t pay anywhere near enough to support you- these aren’t side-hustles, they’re just ways to get a bit more money back in your pocket.

for further reading, check out these other guides:

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?