Best GIC Rates in Canada – May 2025

With the Bank of Canada hinting at possible rate cuts in 2025 – and with Trump’s tariffs lurking on the horizon – it’s looking more and more like the best GIC rates in Canada may have peaked for the time being. If you’re hoping to lock in a guaranteed return north of 3.5%, now might be the time to make your move.

A Guaranteed Investment Certificate (GIC) is basically Canada’s answer to the American Certificate of Deposit (CD) – a safe, boring, and effective way to grow your money without a lot of drama.

GICs are a great fit if you’re saving for short-term goals. Below, you’ll find our updated list of the best GIC rates in Canada, covering 1-, 3-, and 5-year terms (plus a few other options if you want to get fancy). Between Canada’s rock-solid banking system and the automatic protection from the Canadian Deposit Insurance Corporation (CDIC), GICs are about as safe as it gets.

One quick note before we dive in: We’ve been recommending EQ Bank for years – and it’s not just about their top-tier GIC rates. Their no-fee accounts, best-in-Canada high-interest savings account, EQ Bank Card, and smooth online platform have made them a standout across the board. You can check out our full EQ Bank Review for all the details.

Best 2025 Canadian Bank Offer:

4.00% Everyday Interest Rate

Open an account with EQ Bank & get the best interest rates in Canada - 1.25% + 2.75% interest rate if you direct deposit your pay.

The best daily interest rates in Canada* and great rates for GICs - up to 3.65% guaranteed in your registered account. Get it by clicking the button below:

* Rates are subject to change ** Applies to both New and Existing clients who open a new account. ***EQ Bank Review: more details

Best Canadian GIC Rates Compared

May 2025’s top Canadian GIC rates are listed below for 1-year, 3-year, and 5-year terms. These are the institutions MDJ’s staff personally tried and deem safe and offer an overall high quality product.

I also provided a more detailed comparison of all the major GIC options further down the page since there are some smaller banks and credit unions that offer slightly better rates. As always, we recommend checking the full terms and conditions before signing up with anyone, most importantly what amounts are CIDC insured.

Best 1-Year GIC Rates in Canada

EQ Bank – 3.50%

Motive Financial – 3.00%

Tangerine Bank – 3.45%

Best 3-Year GIC Rates Compared

EQ Bank – 3.55%

Motive Financial – 3.30%

Tangerine Bank – 3.50%

Best 5-Year GIC Rates

EQ Bank – 3.65%

Motive Financial – 3.55%

Tangerine Bank – 3.45%

What is a GIC?

The term GIC is short for Guaranteed Investment Certificate.

As an investment, it belongs in the same fixed-income family as bonds.

GICs are very safe investments as they are basically short-term loans to banks, and are insured in Canada by the Canadian Deposit Insurance Corporation (CDIC) if you use a major Canadian Bank such as EQ Bank. Even if one of Canada’s banks went bankrupt (incredibly unlikely) the CDIC would step in and pay you your principal back (up to $100,000 per account).

When looking at fixed income investments, the idea is that you are loaning an entity money, and in return, that entity is going to give you that money (called “the principle”) back, plus interest payments periodically.

So if you buy a government bond, you’re essentially loaning money to the government. When you buy a corporate bond (more risky) you’re loaning money to that company.

And when you buy a GIC, you are making an agreement with a bank to pay you your money back a number of years from now, plus give you a specific interest.

If you were to invest in a 5-year GIC with $100 of your hard-earned cash, you’d get paid about $3.40 each year for the next five years, and then at the end of the 5-year period you’d get your original $100 back as well.

Outlook for 2025 Canadian GIC Rates

Trying to figure out where GIC interest rates are going in 2025 is about as easy as predicting the weather six months out. In the second half of 2024, inflation in the USA stayed hotter than a lot of experts had predicted. That stubborn inflation has kept their interest rates higher for longer – and the ripple effects are definitely being felt north of the border.

Heading into 2025, the real wild card for GIC rates is President Donald Trump. Like it or not, his decisions are going to directly impact what happens to interest rates in both the USA and Canada.

If Trump continues to go full throttle with tariffs against Canadian companies, there’s a good chance the Bank of Canada could be forced to cut rates quickly in an attempt to cushion the economic blow. On the other hand, if Trump tones down his anti-Canada rhetoric – but ramps up tariffs on other countries while simultaneously kicking millions of undocumented workers out of the American labour market – then inflation could absolutely roar back in the USA.

If US inflation comes back the U.S. Federal Reserve would likely have no choice but to jack up interest rates again. And if they do, the Bank of Canada will come under serious pressure to follow suit. The last thing they want is to see the Canadian Dollar collapse – or to trigger an even bigger trade imbalance that would almost certainly paint a target on Canada’s back (again). The current Fed Chair – Jay Powell – appears to be quite reluctant to cut rates despite some cooler-than-expected recent inflation readings.

I personally think the risks are balanced in either direction. No one really knows what Trump will do. If I had to place a bet, I’d wager that inflation is going to come back to the USA pretty quickly given expectations and supply chain problems. That’s even IF free trade agreements get signed sooner rather than later – and right now that looks as if it will definitely be a “later” situation.

Best 2025 Canadian Bank Offer:

4.00% Everyday Interest Rate

Open an account with EQ Bank & get the best interest rates in Canada - 1.25% + 2.75% interest rate if you direct deposit your pay.

The best daily interest rates in Canada* and great rates for GICs - up to 3.65% guaranteed in your registered account. Get it by clicking the button below:

* Rates are subject to change ** Applies to both New and Existing clients who open a new account. ***EQ Bank Review: more details

Types of GICs in Canada

You can put GICs in pretty much any bank account or investment account in Canada (including RRSPs, TFSAs, RESPs, or basic bank accounts). The main types of GICs in Canada include:

The Classic Non-Redeemable GIC: The vast majority of GICs that Canadians invest in are non-redeemable GICs. All that phrase means is you can’t cash the FIC out early and redeem your cash. You are locked in to getting your specific interest rate payment annually, and then your money back at the end of that period.

This type of GIC is also commonly referred to as a “fixed GIC”.

A Cashable Redeemable GIC: The much less common cashable GIC is kind of the exact opposite of the non-redeemable GIC. It allows folks the ability to withdraw the initial money they put in (the principle) before the term is up. In order to get this neat little feature though, you are going to get paid a much lower interest rate than you would with the Classic GIC option.

Honestly, rather than go through the trouble of a cashable GIC, I’d just toss my money in one of our best high-interest savings accounts.

Laddered GIC: The phrase “laddered GIC” is just something that bankers like to say to impress people. All it really means is that a person can set up a series of non-redeemable GICs so that they will receive money each year.

For example, If I have $100,000, I might put $20,000 each in a 1-year GIC, 2-year GIC, 3-year, GIC, 4-year GIC, and 5-year GIC. In this way, I know that I will have $20,000 (plus interest) coming to me each year.

Market Linked GIC: This type of GIC is a niche produce that is linked to the performance of an underlying asset. It’s kind of like using the GIC structure to make a bet on something else (usually the stock market). Most people can safely ignore these types of GICs.

Variable Rate GICs: Again, another niche type of GIC that most people can probably avoid. This GIC’s return will go up and down with interest. It’s like the reverse of a variable rate mortgage.

Best GIC Rates For Registered RRSP and TFSAs vs. Non Registered GICs

The GIC is a very flexible investment product. You can invest in a GIC outside of any type of special registered account, and you can also place it within an RRSP, TFSA, RESP or other registered accounts.

Our preferred GIC provider, EQ Bank, even goes so far as to incentivize you to use their GIC inside your RRSP and TFSA by offering special GIC rates on those products:

Term | Registered (TFSA & RRSP) GIC Rate | Non-Registered GIC Rate |

3 Months | 2.75% | 2.75% |

6 Months | 3.00% | 3.00% |

9 Months | 3.05% | 3.05% |

1 Year | 3.50% | 3.50% |

15 Months | 3.50% | 3.50% |

2 Years | 3.55% | 3.55% |

27 Months | 3.55% | 3.55% |

3 Years | 3.55% | 3.55% |

4 Years | 3.55% | 3.55% |

5 Years | 3.65% | 3.65% |

6 Years | 2.60% | 2.60% |

7 Years | 2.60% | 2.60% |

10 Years | 2.60% | 2.60% |

Obviously the big bonus to putting GICs into a registered account (versus a GIC in a non-registered account) is that the interest gained on the investment in a TFSA or RRSP will not be taxed.

This is especially important for GIC income because the interest income that they produce is taxed at 100% of your normal tax rate (it’s as if you earned the money a job) whereas dividends and capital gains are taxed at much lower rates.

Are GICs Insured and Safe Investments?

GICs are safe investments in two different ways.

1) GICs are relatively safe in terms of investment risk.

As a fixed income investment, GICs are considered substantially safer than stocks. If a company were to go bankrupt (again, we’re talking super safe Canadian banks here) GIC holders would be some of the first ones paid out.

People who owned shares of a bank on the other hand, would be the last ones to get paid anything. (This is why equities like shares generally have higher long-term returns than fixed income investments.)

2) GICs are safe due to CDIC insurance.

The Canadian Deposit Insurance Corporation (CDIC) is an entity that the Canadian government set up to protect investors and to give people confidence when it comes to investing money in Canada. Canadian banks (notably not credit unions such as Oaken or Hubert) have their GICs fully insured by this Canadian government company – up to $100,000 per account.

So if you have $100,000 in GICs in your RRSP, $100,000 in GICs in your TFSA, and $100,000 in GICs in basic non-registered bank account – then you are fully insured on $300,000. If you do the same thing again at a second bank, you have $600,000 covered.

If your partner uses the same strategy – you now have over a million in fully insured GICs – and frankly you probably have too much money in fixed income investments!

So even if a bank were to go completely bankrupt and not be able to pay you your money, this branch of the Canadian government would step in to cover your losses – up to $100,000 per account.

Canadian Credit Unions have a similar government-ran insurance, but they are governed by provinces – not the federal government. That means that GICs from credit unions are considered almost as safe as those from Canadian Banks (such as EQ Bank and Tangerine) – but since the provincial deposit guarantee corporations aren’t as big as the CDIC (which is ran by a whole country instead of a province).

How to Open a GIC Account and Buy a GIC

There are a wide variety of ways to open a GIC account in Canada. You can buy a GIC within any registered or non-registered account, so basically anywhere that allows you to do that will allow you to buy a GIC.

As you can tell from our Canadian GIC Comparison chart at the top of this article, we’re fans of online banks and credit unions. They always have the best GIC rates in Canada because they have no bricks-and-mortar costs to subsidize with fees on their products.

That said, you can buy a GIC using any of Canada’s chartered banks – from the biggest company in Canada (RBC) to relatively small banks and trust companies. As mentioned above, you can use credit unions or caisses populaires to buy GICs – but remember they are covered by provincial governance, not by the CDIC.

Canada’s online discount brokerages will also allow you to purchase GICs, but the variety you’ll have to choose from depends on which online broker you use.

For the most part it’s quite easy to open an account and buy a GIC at any of these institutions since it’s such a well known product.

GICs vs Bonds and Other Fixed Income

Of course GICs aren’t alone when it comes to investment types that fit under the category of “fixed income”. You can check out our in-depth article on bond ETFs vs GICs vs high interest savings accounts for a close comparison of fixed income products.

Generally speaking bonds, GICs, and high interest savings accounts have different levels of liquidity, but they all fit under the same overall big picture. They are very safe investments with correspondingly low levels of anticipated returns compared to equities.

For 2025 I think the mid-term GICs specifically have raced out the best value when compared to the current rates offered on federal and provincial bonds, as well as high interest savings accounts. You can also read our article comparing the best short term investments in Canada for more information.

What is the Difference Between a GIC and a Term Deposit?

Due to the fact that many countries use the phrase “term deposit” to mean lending your money to a bank for a specific period of time, many newcomers to Canada often ask what the difference is between a term deposit and a GIC (Guaranteed Investment Certificate).

The truth is that in practical terms there is no difference between a GIC and a term deposit. Both terms refer to a person depositing money at a financial institution (usually a bank) for a specific period of time, and gaining a specified amount of interest on their money during that period of time.

Functionally, the important thing to understand is that both GICs and term deposits are short-term investments that would be covered by CDIC insurance at most banks (and provincial equivalents to the CDIC at credit unions).

Several years ago, Canadians used the phrase “term deposit” to talk about a shorter-term product that saw you lend your money to a bank for 3-9 months. GICs were generally for one year or more. Over time, banks started to offer 3-, 6-, and 9-month GICs, so that now, the two terms refer to nearly identical products.

I periodically will see offers for 1-month or 2-month term deposits in Canada, whereas I never see 1-month GICs featured. That said, it’s almost an irrelevant difference given the proliferation of high interest savings accounts and cash ETFs.

At the end of the day the difference between GICs and term deposits within a Canadian context is basically one of semantics. They refer to the same low-risk investment that sees an investor lend their money to a bank for a specific period of time. The investments are fixed-income (as opposed to equities) and generally track what the Canadian federal government does with interest rates, and are fairly similar to bonds as well.

Canadian GICs FAQ

Compare Other Top Canadian GIC Rates

Less established financial institutions can be a good choice especially for lower amounts of money, where the risk is lower and you really want to maximize returns. If that’s how you feel, here’s a quick comparison of the best GICs based on the data below (as of January 2025):

Bank Name | 1-Year GIC | 2-Year GIC | 3-Year GIC | 4-Year GIC | 5-Year GIC | Get Rates |

3.50% | 3.55% | 3.55% | 3.55% | 3.65% | ||

3.45% | 3.50% | 3.50% | 3.50% | 3.55% | ||

3.00% | 3.20% | 3.30% | 3.45% | 3.55% | ||

3.20% | 3.10% | 3.10% | 3.50% | 3.50% | ||

People’s Trust | 3.45% | 3.55% | 3.55% | 3.55% | 3.60% | |

3.50% | 3.60% | 3.60% | 3.60% | 3.65% | ||

2.75% | 2.85% | 2.60% | 2.55% | 2.50% | ||

Hubert Financial | 3.45% | 3.45% | 3.45% | 3.45% | 3.45% | |

Meridian Credit Union | 3.25% | 3.45% | 3.35% | 3.55% | 3.60% | |

ICICI Bank | 1.75% | 2.00% | 2.25% | 2.50% | 2.75% | |

Achieva Financial | 3.50% | 3.50% | 3.35% | 3.35% | 3.50% | |

MCAN Wealth | 3.60% | 3.65% | 3.65% | 3.65% | 3.70% | |

2.90% | 3.05% | 2.95% | 2.95% | 3.10% | ||

Canadian Tire Bank | 2.50% | 2.50% | 2.50% | 2.50% | 3.61% | |

Canadian Western Bank | 2.75% | 2.75% | 2.85% | 2.90% | 3.15% | |

3.05% | 3.30% | 3.30% | 3.40% | 3.40% | ||

Manulife Bank | 2.90% | 3.00% | 3.05% | 3.00% | 3.30% | |

BMO | 2.75% | 2.75% | 2.80% | 2.80% | 3.00% | |

CIBC | 3.00% | 2.75% | 2.75% | 2.75% | 2.90% | |

RBC | Up to 2.80% | Up to 2.85% | 2.65% | 2.70% | Up to 3.00% | |

2.70% | Up to 3.05% | Up to 3.14% | 2.75% | Up to 3.25% | ||

TD Bank | 2.80% | 2.85% | 2.65% | 2.70% | 3.00% | |

National Bank of Canada | 2.80% | 2.85% | 2.80% | 2.80% | 3.30% |

As you can see, while Canadian GIC rates have gone up substantially at every bank in Canada this year, the largest institutions generally have some of the lowest GIC rates available. Out of the Big 6 Banks it appears that BMO, TD, ScotiaBank National Bank, RBC, and CIBC all have much lower GICs available.

Are Canadian GICs Worth It?

If you’re serious about getting the most from your savings, locking in one of the best GIC rates in Canada is probably a solid bet right now. GICs are one of the best tools for short- and medium-term goals – whether you’re stashing cash for a house downpayment in an FHSA, or using your TFSA to save up for a new set of wheels, or that overdue kitchen reno.

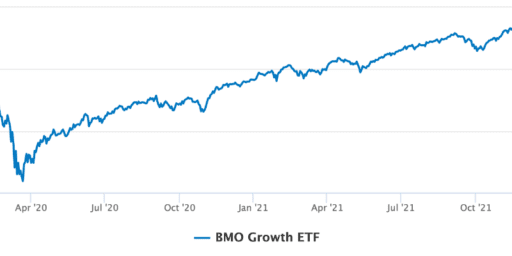

Even though GIC rates have started sliding a bit from their highs in 2024, they’re still miles better than the pathetic returns we got stuck with back in the 2010s and the Covid-crash years. The Bank of Canada might push rates lower in 2025, especially with Trump’s trade moves stirring up more uncertainty – so if you’ve been on the fence, it’s probably time to hop off.

The great thing about GICs is they don’t demand a lot of your brainpower. You’re not trying to pick the next tech stock rocket ship. You’re just locking in a guaranteed return and moving on with your life. No guessing, no gambling, no waking up to news that half your portfolio just vaporized.

They’re not going to make you rich overnight – but they’ll quietly help you reach your financial goals (without the drama). If you want to make sure your savings are actually working for you – and not just gathering dust in a 0.5% account – now’s the time to grab one the top GIC rates in Canada while they’re still hanging around.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

At EQ Bank, their savings account pays 4% if you set up $500/month or more in qualifying payroll direct deposits. It hardly seems worthwhile to lock in for a tiny bit more.

Another great option is a 1.5 yr which seem to have great rates too.