Ultimate Smith Manoeuvre Guide For Canadians

When I first started writing about the Smith Manoeuvre nearly two decades ago, I had no idea it would strike such a chord with Canadian DIY investors. What began as a niche topic on how to turn your mortgage into a tax-deductible investment loan has since become one of the most popular articles on this site – with hundreds of comments and follow-up questions from folks across the country.

I kicked off my own Smith Manoeuvre journey in 2007 – which, looking back, was just about the worst timing you could pick in the last 50 years. But despite launching right before a major financial crisis, it has worked out surprisingly well.

As we move into the summer of 2025, mortgage rates might continue to ease slightly, but the era of dirt-cheap borrowing is clearly behind us. That means yes – you’ll likely be paying more on your HELOC than in the past. But remember: your marginal tax rate helps reduce the sting of that interest, since the loan is being used to generate investment income. In fact, higher rates actually widen the Smith Manoeuvre’s edge when compared to simply accelerating mortgage payments. That tax deductibility really starts to shine when interest costs rise – and obviously that’s even more true if you’re in the higher income tax brackets!

Over the years, I’ve posted regular updates on my Smith Manoeuvre portfolio and the Canadian dividend stocks I’ve used to fund the strategy. Since that first article, I’ve personally collected hundreds of thousands of dollars in dividend payments, watched the value of my holdings grow steadily, and saved tens of thousands in taxes along the way.

I’ve now pulled together everything I’ve learned from nearly 18 years of experience into one place. This Ultimate Guide to the Smith Manoeuvre includes all the tips, tools, and traps to avoid – based on real-world results (not just theory).

Introduction to the Smith Manoeuvre

For those who don’t know what the Smith Manoeuvre is, it’s a Canadian wealth strategy that is designed to structure your mortgage so that it’s tax deductible. Our U.S. neighbours already get the luxury of claiming their mortgage interest on their yearly tax return, and now there is a way for us Canadians to do the same. (Kind of.)

There’s a tax rule in Canada, where if you borrow money to invest in an income-producing investment (like a dividend-paying stock or an investment property), you can deduct the annual interest paid on the investment loan from your income tax.

In layman’s terms, if you get a loan with x amount of interest per year, you can claim that x interest during income tax season if you use the loan toward stocks or rental properties. If you’re still confused, please read on below where I will eventually explain everything step-by-step.

If you’re wondering if the juice is worth the squeeze – just understand that while properly implementing the Smith Manoeuvre does require a little bit of reading, it can save you thousands of dollars per year in taxes, as well as supercharge your long-term investment returns.

Mr. Fraser Smith came up with the idea of the Smith Manoeuvre (hence the name) and revealed it as a way for Canadians to turn their plain old mortgage debt, into shiny new investment debt – which was tax deductible and ready to grow.

To summarize the Smith Manoeuvre in a nutshell, the main idea is that you borrow money against the equity in your home, invest it in income-producing entities, and use the tax return to further pay down the mortgage.

Rinse-and-repeat until your mortgage is completely paid off, leaving you with a large portfolio and an investment loan. Voila! Your mortgage is now an investment loan which is tax-deductible. Plus, you have a much larger portfolio that is ready to take advantage of the long-term rate of return that stocks have traditionally generated over the last 200+ years.

While I have a tendency to optimize, here is a slightly modified version of the Smith Manoeuvre which you can use if you have already started a non-registered investment account like I did. If you have not yet opened a non-registered account, then just skip to Step 2.

1. Sell all existing stock from non-registered investment accounts and use it toward a down payment for step 2.

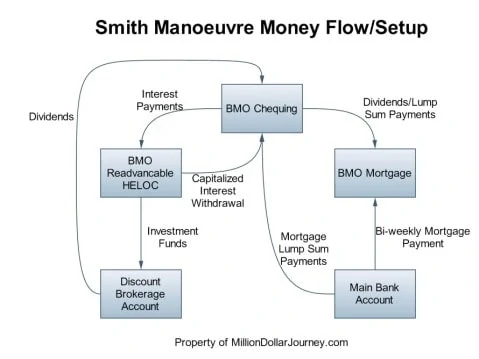

2. Obtain a readvanceable mortgage. This is a mortgage that has 2 entities, the Home Equity Line of Credit (HELOC) and the regular mortgage.

Nothing unique about this setup EXCEPT that as you pay down the mortgage, the credit limit on the HELOC increases. This is a key feature that is needed when implementing the Smith Manoeuvre. Note that you usually require at least 20% equity/down payment before you can obtain a readvanceable mortgage.

All of Canada’s major banks offer this type of HELOC + Mortgage setup; however, I wouldn’t bank on walking into a branch and talking to anyone who has any idea what the Smith Manoeuvre is!

3. Use the HELOC portion of your mortgage to invest in income producing entities like dividend paying stocks or rental property. With every mortgage payment, your HELOC limit will increase. So with every regular mortgage payment, you will invest the new money in your HELOC. Note that you SHOULD NOT use the HELOC money to invest in your RRSP or TFSA as you will lose the tax deduction on the invested money. If you don’t already have an investment account, here is a review of the more popular discount brokerages in Canada.

4. When tax season hits, deduct the annual amount of interest that you paid on your HELOC against your income. So, if you paid $6,000 in interest payments for the year and you have a marginal tax rate of 40%, you will get back ~$2,400 of it.

5. Apply the tax return and investment income (dividends, etc.) against your non-deductible mortgage and invest the new money that’s now in your HELOC.

6. Repeat steps 3-5 until your non-deductible mortgage is paid off.

As you can see, this process will pay down your regular mortgage in a hurry.

Additionally, it’s important to understand that in its pure form, the Smith Manoeuvre advocates for never paying down the original HELOC. Simply pay the interest each year, deduct it on your taxes, and leave the investments to do their thing. This can, of course, be modified depending on your risk tolerance. This is also why multi-millionaires often have large investment loans, and why the tax code is set up to take advantage of that fact.

How Much of My Home Equity Can I Use for The Smith Manoeuvre?

Nationally-regulated banks can only allow homeowners to borrow up to 65% of their equity towards their “revolving” or home equity line of credit portion. However, homeowners can still borrow up to 80% of their equity in total. This means that the remaining 15% (80% – 65%) has to be in the form of an installment mortgage with a regular repayment schedule.

This is a relatively recent rules change and the important thing to remember is that at no point can you ever be borrowing more than 80% of the total value of your house, and at no time can you have a HELOC greater than 65% of the value of your house.

Should I Do the Smith Manoeuvre?

One particular (and critical) fact to keep in mind is that even though the Smith Manoeuvre includes making your Canadian mortgage tax deductible, it also includes a leveraged investment strategy.

What the heck is a leveraged investment strategy, you might ask?

Leveraged investing refers to the act of borrowing money in order to invest. The term comes from the idea that when you borrow money to invest, you can “move” great sums of money – sort of like how using a bar and a fulcrum allows someone to apply physical leverage in order to move a heavy object.

When using the Smith Manoeuvre and implementing a leveraged investing strategy it is critical that you understand that if markets go down, you still have to pay interest on your investment loan.

Consequently, borrowing money in order to invest can be quite risky in the short term, and if you need the money in the next 5-10 years, I would definitely not set up a Smith Manoeuvre! Leverage works against you, so when markets go down, you will really feel that sting if you are looking at your investment accounts every day.

It’s crucial that you know yourself, know how you respond to risk, understand how investing markets work, and be confident in your long-term strategy no matter what markets do in the short term. I cannot emphasize enough how important it is to know if you will be able to sleep at night after watching 40% of the value of your Smith Manoeuvre account seemingly evaporate.

It’s bad enough when this happens inside an RRSP or TFSA, but there is an added layer of psychological warfare that occurs when that investment has been purchased with “borrowed money”. It’s possible (if unlikely) that you could end up with an investment loan that is worth more than your now-cratered investment portfolio.

Now, if you understand how equity markets work, and are confident that profitable businesses will keep making money in the long-term – then this isn’t a big worry. You can ride it out, keep making your mortgage payments, keep deducting the interest, and live life.

If you can’t wrap your head around how this all works, and instead just keep coming back to, “It feels like I’m gambling my house on the stock market,” then the Smith Manoeuvre simply isn’t for you.

The Advantages:

- You get to build a large investment portfolio without waiting to pay off your mortgage first (the power of compounding). This is an absolutely massive advantage in wealth-building power relative to the average Canadian!

- You get to pay down your non-deductible mortgage in a hurry.

- Your new investment loan is tax deductible. This obviously becomes even more valuable if you are in the higher tax brackets.

The Downside:

- You need to be comfortable with LEVERAGE and investing in general.

- You need a plan ‘B’ in the case that you need to move and home values have gone down. If you invested properly, your portfolio should at LEAST cover your loan.

- Some record-keeping has to be done for tax purposes.

What are the Benefits and Investment Returns of the Smith Manoeuvre?

Here are my personal numbers and plan from back when I started the Smith Manoeuvre – which I’ll use to calculate the benefit. You’ll notice that back in 2008, houses were much cheaper, and interest rates were much higher. These numbers were my original plan, and for the most part, they held up pretty well:

- Old Residential Home Value: $140,000

- Old Outstanding Mortgage: $80,000

- Equity: $50,000 after Realtor fees.

- Cash Savings used: $20,000

- Non-Registered Portfolio: $40,000 (liquidate)

- Total Down Payment: $110,000

- New House: $275,000

- New Mortgage: $275k-110k= $165,000 (non tax deductible)

- New HELOC (@ 6%): [ ($275k x 75%) – $165k] = $41,250 (tax deductible)

- Total Debt: $206,250

- New Mortgage Payment (accelerated bi-weekly) @ 5.25%: $584.12 (not including property tax, insurance etc).

- Original Amortization: 16 years

The Criteria:

- All tax returns will be applied to the non-deductible mortgage balance, which then again, increases the HELOC balance.

- All dividends will be used to pay down the non-deductible mortgage.

- HELOC interest payments will be capitalized. That is, the HELOC required payments will be paid by the HELOC itself. This will avoid using any of my own cash flow to support the investment loan. The spreadsheet will account for this.

- Assume that the LOC will be invested in dividend paying stocks that provide an income stream of $1400/year (assume 3.5% average dividend yield). This equates to a $54 / bi-weekly period applied to the mortgage. This should be increasing annually but for simplicity sake, I will be keeping this constant.

- Assume that since I’m going to continue to max out my RRSP, I won’t have any extra cash to pay down the mortgage.

The Assumptions:

- Marginal Tax Rate: 40%

- Average Investment Growth Rate: 8%

- Diverted Periodic Investments: $54

- HELOC Interest rate: 6%

- Mortgage Interest Rate: 5.25%

The Results:

- Non-deductible mortgage paid off in 11.78 years instead of 16

- Investment Portfolio Value after mortgage is retired: $244,833

- Portfolio Value NET of HELOC: $38,583

- Investment Portfolio Value after 25 years: $908,640

- Portfolio Value NET of HELOC: $702,390

Summary:

- This analysis shows the benefits of using the Smith Manoeuvre, not the down side. You need to be comfortable with leverage, especially the downside, before you even consider using this strategy.

- The Smith Manoeuvre enabled me to pay off my mortgage in 12 years instead of the stated 16 years with no extra cash flow out of my pocket.

- At the end of the mortgage term, assuming that I average 8% returns over that period of time, my portfolio value minus the loan amount will be approximately $38,000.

- If I continue to hold the tax-deductible loan after paying off my original mortgage loan, and allow my investments to continue to compound – the overall result will be roughly $700,000 more in my pocket.

A common argument against the Smith Manoeuvre is that there is simply too much risk in “gambling” your home in the stock market.

If you have this question, it’s honestly a good indicator that the Smith Manoeuvre isn’t for you – and that’s ok!

You know what’s not for me?

Anything involving motors, wrenches, etc!

It’s important to “know thy self” when it comes to leveraged investing. Investing in the stock market might come with an inherent level of risk – however it’s NOT gambling at all. Using fairly stagnant home equity that would just sit there otherwise, not compounding much on your behalf, is NOT “gambling your house”.

Think about it this way…

Isn’t it a “gamble” in some sense of the word when you buy a house and take out a mortgage 5-10x as big as your down payment?

If you look at that house as an investment, you just leveraged a ton of money in order to buy an asset that is about as non-diversified as you can get. That huge amount of money that you just borrowed is now tied up in a single property – which can’t be moved – and that will rely on the whims of the local real estate market, which you have no control over.

PLUS, it’s pretty illiquid and will cost you thousands of dollars to sell. How is that less risky than setting up a portfolio of stable dividend stocks, which are diversified across massive industries, and that earn money from all over the world?!

Not just that, but they have 20+ year histories of paying their shareholders ever-increasing dividends, year after year (Read: Our list of Canadian dividends kings). I know which asset sounds less risky to me!

The diversification of your assets that is a necessary part of the Smith Manoeuvre actually makes your overall financial picture less risky – but if that’s hard to envision, then you’ll find it very difficult to not panic when markets hit a downturn, and using leveraged investing just isn’t for you.

How to Set up The Smith Manoeuvre

Before I start with the details, we need to make sure that your investment loan is, in fact, an investment loan that is tax deductible. If you get a loan to invest in a tax-sheltered account, like an RRSP, TFSA, and/or an RESP, then the interest is not tax deductible.

Also, tax deductibility of an investment loan depends on if you use the proceeds to generate business/investment income. You cannot use a HELOC secured against your rental property on personal expenses and still claim the interest as a tax deduction.

Calculate Your Interest Deductible:

To determine the tax return of the interest paid on your investment loan, multiply the total interest paid during the year by your marginal tax rate.

For example: if you paid $1,000 in interest for the year and you are in the 40% marginal tax bracket, you will receive $400 back from the government.

CRA Rules for the Smith Manoeuvre

Canada Revenue Agency (CRA) expects that if you use borrowed money to invest that you will receive some sort of income from your investments. The “income” includes interest, dividends, rent, or royalties. Even if a stock that you purchase does NOT currently pay dividends, as long as they have a reasonable “expectation” of future dividend payments, then it “should” remain deductible.

Although CRA only expects income from your investment portfolio, in 2003, the finance department declared that in order for investment loans to remain deductible, the interest/dividends must produce a profit. That is, the dividends must EXCEED the interest that you are paying on the loan.

I know, the finance department and the CRA are on different pages on this one.

According to Globe and Mail writer Tim Cestnick, the CRA will generally ignore the finance department rules and accept the tax deduction as long as it produces any income, but check with your financial advisor for the latest rules.

I know this much, the companies on our dividend stocks list (which we update quarterly) definitely meet the CRA’s and the finance department’s criteria.

Keep Your HELOC Interest Tax Deductible!

Once you use a loan/line of credit to invest, do NOT withdraw from it unless it is from dividends/interest that the investment produces.

For example, if you use a $10,000 line of credit to invest, achieve a $5,000 capital gain, and subsequently withdraw $5,000 to spend on a vacation, how much of your loan balance is still deductible? $10,000? Nope!

According to Tim Cestnick, since you withdrew 1/3 from your investment loan, only 2/3 of your remaining loan is tax deductible.

This includes Return Of Capital funds/income trusts also!

Technically, as you receive ROC distributions, it will decrease the tax deductibility of the investment loan. This can be avoided by using the ROC to pay down the investment loan, then re-investing if desired. Technically, this “should” be the same as simply leaving the ROC distributions in the investment account (confirm with your accountant). If you invest in dividend stocks, there won’t be any return of capital to worry about, but if you’re invested in REITs (Real Estate Investment Trusts) or various types of ETFs or mutual funds, there is likely to be some return of capital mixed into your returns.

If you gain $300 (or any amount) in dividends though, you can withdraw $300 and spend it as you please. If you’re using an investment loan to perform the Smith Manoeuvre, I would suggest using the dividends to pay down the non-deductible mortgage, so as to further accelerate the conversion to deductible/good debt.

As a side note, many people have written comments about using the investment loan to buy mutual funds with HIGH distributions. Typically, high distributions include return of capital – which is fine, providing that you NEVER withdraw them.

If ROC distributions are withdrawn from the investment account, the tax deductible portion of the loan will be reduced. Only dividends/interest can be withdrawn without any consequence to the investment loan. This makes sense when you consider the principle of “income producing securities” being the key focus, because return of capital is not “income” per se.

Smith Manoeuvre Example:

- Make sure your investment loan produces income of some sort.

- ROC distributions are undesirable for leveraged investment accounts as they decrease the tax deductibility of the investment loan. There are ways around this, but it can turn out to be an accounting/paper trail nightmare.

Best Investments for the Smith Manoeuvre

Look – if I knew which investments were going to perform best (whether in your Smith Manoeuvre portfolio or otherwise) I wouldn’t be sharing them for free on the internet. The truth is that I have no idea which specific stocks are going to skyrocket and which will plummet. All I know is how to apply Canada’s tax rules to your Smith Manoeuvre investments (which have to be in a non-registered investment account) and historically, how large groups of stocks have fared over the long term.

However, with that said, when it comes to the Smith Manoeuvre, I have a preference toward purchasing steadily-growing dividend paying stocks. While I still do my own research, I now use Dividend Stocks Rock in order to organize my “watch list” for excellent Canadian dividend opportunities.

Why Dividend Stocks You Ask?

I believe that investing in mostly Canadian dividend-paying stocks is the most efficient way to implement the Smith Manoeuvre. The reason being, is that Canadian dividends of strong companies (like the big banks) have a history of increasing dividends that can be used to pay down the non-deductible mortgage.

If you agree that dividend investing should be your primary focus, the absolute best place to start your journey is over at Dividend Stocks Rock (DSR). Managed by fellow blogger Mike from the Dividend Guy Blog since 2013, DSR isn’t just a weekly newsletter with stock picks. It’s a platform that will help you manage portfolio and dramatically improve your results.

It’s also a great big picture strategy to use for the Canadian stock market specifically due to the fact that Canadians love their big companies. People might think that hockey and maple syrup are the most Canadian of things, but I think it might actually be a love for strong oligopolies!

When you think about our banks, pipelines, utilities, insurance companies, railways, and telecommunications companies, they are all dominated by a handful of large companies. Sure, these massive companies are unlikely to see the surging growth of a stock like Shopify, but then again, they aren’t going to have the same massive drop off that Shopify had in 2022 either!

As we look forward to 2025 and 2026 and we read yet more reports of market-shaking volatility on the horizon due to the Trump tariff threat, one has to keep in mind just how negative things sounded at various times in the past as well. Back in 2018 we were due for another 2008 as it had been ten years since the big recession.

After a record year in 2019 we were sure that NOW it was time for the world to end. Then 2020 Covid stopped the world economy and we were “obviously” in for another great depression. After a great run in 2021, the markets were “obviously” overvalued, and now in 2022 and 2023 runaway inflation and rising interest rates were going to cripple the stock market. Finally, 2024 was going to be the year when a softening job market and negative market sentiment finally brought the market down…

Except none of that had any lasting impact on Canadian dividend stocks, and they just continued to pump out dividends while watching their stock price trend higher over the medium- and long-term.

Sure, if you had loaded up on tech stocks then you might have had higher overall returns over the last couple of years. But if we’re borrowing money “against our house” here, then to me, it makes it all much easier to stomach if our Smith Manoeuvre portfolio consists of stable, solid, blue chip stocks.

That’s why I chose Canadian companies with a long track record of having consistent profit margins and even-increasing dividend payments. No matter how bad the news headlines get, I have always been able to count on incoming dividends to brighten my investing mood, and keep me focused on my long-term goals.

Buy Dividend Stocks Using the Best Fee-Free Discount Brokers

At MDJ, we constantly review and compare discount brokers with a particular focus on FREE ETF and STOCK purchases, so you can rebalance your portfolio without paying an extra. As it stands, the best place to invest in Canadian ETFs is Qtrade. Not only is it the best Canadian broker, but also the only one which allows for both selling and buying ETFs for free.

Why not just buy interest bearing bonds or GICs?

Publicly-traded companies that pay dividends in Canada (think “big companies listed on the Toronto Stock Exchange”) are eligible for the enhanced dividend tax credit, which results in a substantial tax break for dividends compared to interest-bearing income like GICs.

Plus, the excellent record for these dividend growth stocks simply offers a vastly superior long-term rate of return. Companies like Telus, Enbridge, or RBC are just in such dominant positions within the Canadian market, that their prospects for paying ever-increasing dividends are absolutely excellent.

To summarize, the strong dividend company (if history is any guide), will increase their dividend on a regular basis AND you will receive a tax credit for any dividend income that you receive. Putting the dividend income and the annual tax refund towards the non-deductible mortgage will make the conversion from bad (non-deductible) debt to good (tax-deductible) that much quicker.

Since dividend investing is a subject all on its own, we’ve also written a separate in-depth guide on the best dividend stocks.

Can I Use ETFs or Robo Advisors to Do the Smith Manoeuvre?

One of the most common questions that I get asked is, “Can I use ETFs when doing the Smith Manoeuvre?” Over the last couple of years, that question has evolved to also include the services of Wealthsimple – that will manage a portfolio of ETFs on your behalf.

The short answer is: yes.

The longer answer is… you might not want to go that route.

Legally speaking, the vast majority of ETFs (and certainly all of the most common ones) meet the CRA’s definition of an income-producing investment.

A person could certainly be successful if they used basic ETFs to create diversified portfolios, using the money from their HELOC. Here’s the two main issues that people run into and why I prefer to use Canadian dividend stocks.

1) Almost any ETF is going to complicate your tax situation. This is due to the fact that the distribution dividends that ETFs reward investors with each year, commonly contain non-ideal forms of income such as foreign bond interest, foreign dividends, and distributed return of capital (which is especially common for ETFs that include REITs).

2) In addition to the tax complication – which can mean several hours of paperwork each year as you track your adjusted cost base and where your income is coming from – ETFs that include these different types of income just aren’t nearly as tax efficient as Canadian dividends in a non-registered account.

If you do decide to go the ETF route, a basic Canadian equities ETF that does not include REITs is probably your best bet.

Personally, many of you know that I’m a huge fan of Canada’s all-in-one ETFs, as well as old school favourites like XAW or VXC. I love the instant diversification that they bring to the table, and how easy they are to recommend to folks. I don’t use them in my Smith Manoeuvre, however.

Instead, I use them in my RRSP and TFSA, as well as in a separate non-registered account (to make the accounting paperwork easier). They are an easy way to diversify away from the large exposure to Canadian dividend-payers that my Smith Manoeuvre account offers.

Using Robo Advisors Like Wealthsimple for a Smith Manoeuvre

Obviously if ETFs legally work for using the Smith Manoeuvre, then so too would a portfolio of ETFs managed by a robo advisor such as Wealthsimple.

That said, I actually email-interviewed their portfolio management team in order to confirm that there was nothing that I had overlooked. They responded that not only was it fully within the CRA rules to run a tax-deductible loan through a robo advisor account, but that the annual fee that you would pay to Wealthsimple would be tax deductible as well.

Additionally, they mentioned that investing through a Wealthsimple non-registered account would allow the client to take advantage of tax-loss harvesting, and that they would track the book costs – greatly aiding in the overall paperwork battle that can be the main drawback to using ETFs.

Naturally the same drawbacks would apply with Wealthsimple’s ETF portfolios, as with the ETFs we covered above, as far as tax treatment for foreign dividends or bond interest. You would also have to factor in the tax-deductible fees that Wealthsimple would charge for their services.

Overall, I like the idea of getting help on the paperwork side of things AND using the Smith Manoeuvre would allow you to get all of the benefits of Wealthsimple’s VIP levels – which you can read about here in our full Wealthsimple Review. This could lower the fees that you already pay if you use Wealthsimple for your RRSP, TFSA, and/or RESP.

That said, I’m still partial to the simplicity of going with my Canadian dividend strategy.

Investing in Your RRSP and TFSA vs The Smith Manoeuvre

One of the common arguments that I see online, is that maxing out your RRSP plus TFSA – and investing for the long term – will outperform the Smith Manoeuvre.

I will agree with the basic math behind the statement that due to the fact that your RRSP and TFSA can grow tax free where the Smith Manoeuvre, even with tax deductible interest, is taxed on the dividends and capital gains.

However, I don’t believe the Smith Manoeuvre is a replacement for your RRSP and TFSA, but a replacement for your non-registered portfolio.

The optimal strategy would be to maximize your RRSP and TFSA, then if you have any money left over, pay down the mortgage, which in turn would increase your HELOC balance. Take the money from the increased HELOC balance and put it into stable dividend-paying blue chips.

In fact, the RRSP is the perfect place to put your international equity exposure, and your TFSA is the best place to put your fixed income. If you use your accounts this way, you can use your Smith Manoeuvre investments (which are likely to be Canadian dividend-paying stocks as discussed above) as part of a broader balanced portfolio.

The tax treatment for international (especially American) ETFs is better in your RRSP, and the interest income generated by bonds or bond ETFs is fully taxed at 100% of your marginal tax rate unless it’s sheltered in a registered account.

Always remember that there is an increased risk involved with leveraging your investments, so before you attempt any of this on your own, you better be pretty darn comfortable with investing. Either that, or find a good financial planner to put you in tax efficient, low-cost ETFs.

Be aware that apart from the leverage/risk/sleeping-well-at-night element, success depends on the equation (market returns)-(investment costs)-(interest)-(taxes on inv earnings)+(interest tax deduction).

The fact that the interest tax deduction is at your marginal income tax rate, while taxes on the actual investment earnings are likely lower (cap gains and dividends), juices returns a bit through tax arbitrage.

Over a full economic cycle (market returns)-(interest) is positive, but there is no guarantee of a large difference between what your investments will earn and the interest that you’ll owe. This reality means that having the nerves of steel to not tinker – as well as low investment costs to not fritter away the positive spread – are crucial.

The other key factor when looking at the Smith Manoeuvre vs TFSA + RRSP debate is that most people who look into this strategy won’t be doing so from a “dead stand still” as they look ahead at the next 50+ years. Most folks will be somewhere midway along their financial journey’s path, and will likely own a home.

Allowing folks to move their equity from the relatively low traditional returns on real estate (despite what some in the GTA might have you believe) to relatively high traditional returns in equities, can make a massive difference. Take a look at the math behind my personal $700,000 example that I originally used for more evidence. Consequently, it’s not a “vs” argument, but more of a “yes, and” agreement.

Arguments Against the Smith Manoeuvre

A common argument that I sometimes see is that paying off your mortgage, and then investing in a non-registered portfolio will outperform the Smith Manoeuvre.

The math involved with that argument just doesn’t make sense. When implementing the Smith Manoeuvre you are paying down your mortgage at an accelerated rate AND investing in a non-registered portfolio at the same time. Time and compounded returns should make the difference.

Not only is there more time in the market for your investments to compound, you pay NOTHING out of pocket to maintain your HELOC. You simply withdraw the interest owed monthly from your HELOC and re-deposit it. (Aka “capitalizing the interest”)

The only issue is that in order to make the Smith Manoeuvre work, you’ll have to reach an investment return that is greater than the interest that you are charged. For example, if a HELOC charges 6% and you’re in a 40% tax bracket, then your effective interest is 3.6% after your tax deduction.

North American stock markets have averaged 10%+ over the last 100+ years, but I used 8% in my personal calculations. In any case, it should be much higher (long-term) than 3.6%.

If you have a non-registered portfolio before you start the Smith Manoeuvre, all the better! Sell your investments, and pay down your mortgage, then re-borrow and re-purchase the stocks again! Now you have a head start in paying off your non-deductible mortgage AND you can use the HELOC funds to repurchase your investments. This is actually the perfect example of why the math is on your side when using the Smith Manoeuvre.

Another common argument against the Smith Manoeuvre is that there is simply too much risk in “gambling” your home in the stock market.

Dealing With Cashflow Problems on the Smith Manoeuvre

Another common question we get is: What about making the HELOC payments?

Doesn’t that put a crimp in your cash flow?

To get around this cash flow problem you can “capitalize the interest”.

Essentially, this is where you use a loan to make the loan interest-only payments. In this case, you can use the existing HELOC to make the HELOC payments.

Confusing? It’s not as bad as it sounds.

For those of you new to this strategy, capitalizing on the interest is one of the bonuses of this strategy. It’s where you use the investment loan to pay for the interest owed, and everything remains tax deductible.

As funny as that sounds, the rule is that if you take out a loan (we’ll call it Loan B) to pay for interest on your initial Smith Maneuver loan (Loan A), then Loan B interest is also tax deductible. So technically, if I use the HELOC balance to pay for the HELOC interest, then the entire HELOC balance should remain tax deductible. I utilize this strategy as it allows me to have an investment loan without actually using any of my own cash flow to service the loan interest.

The easiest way is to have your HELOC interest automatically deducted from your chequing account each month – then do a transfer for the same amount from your HELOC to repay your chequing account.

I would also recommend having a dedicated chequing account for this strategy in case CRA comes knocking on the door for your records. At least that’s the way that I have it setup.

And yes, I would recommend against maxing out the HELOC as you’ll need the space to pay for the interest incurred.

If you are capitalizing the interest though, isn’t there a point where you run out of HELOC space (credit available)? The answer is yes! This brings us to our next point below.

Running Out of HELOC Space With the Smith Manoeuvre

If your instalment mortgage is paid off, and you are using the HELOC to pay for itself, your HELOC balance will continually increase. The question is, are you comfortable with a maxed out HELOC? Note that a large HELOC may impact your credit score as you may be borrowing a large amount of your overall credit available.

Personally, I have seen the impact with my Equifax scores but not so much Transunion. You can likely check your credit score for free with your bank. If your bank doesn’t offer the service, here are some other free ways to check your credit score and report. You can also get your credit score (Equifax) for free with Borrowell.

Let’s take a look at an example. Say an initial loan of $100k from a HELOC with an interest rate of 4% and a credit limit of $250k. Providing that there are no more transfers from the HELOC to the portfolio, how many years will it take for the HELOC to be maxed out? 24 years! Check out the table below.

| Year | Balance |

|---|---|

| 1 | $100,000.00 |

| 2 | $104,000.00 |

| 3 | $108,160.00 |

| 4 | $112,486.40 |

| 5 | $116,985.86 |

| 6 | $121,665.29 |

| 7 | $126,531.90 |

| 8 | $131,593.18 |

| 9 | $136,856.91 |

| 10 | $142,331.18 |

| 11 | $148,024.43 |

| 12 | $153,945.41 |

| 13 | $160,103.22 |

| 14 | $166,507.35 |

| 15 | $173,167.64 |

| 16 | $180,094.35 |

| 17 | $187,298.12 |

| 18 | $194,790.05 |

| 19 | $202,581.65 |

| 20 | $210,684.92 |

| 21 | $219,112.31 |

| 22 | $227,876.81 |

| 23 | $236,991.88 |

| 24 | $246,471.55 |

| 25 | $256,330.42 |

Let’s take a look at a personal example that I wrote about my own HELOC a few years ago. At that point, the balance was about $140k with 4% interest and a credit limit of about $215k. If we were to have capitalized the interest right up until my credit limit, I could have done that for about 12 years.

| Year | Balance |

|---|---|

| 1 | $140,000.00 |

| 2 | $145,600.00 |

| 3 | $151,424.00 |

| 4 | $157,480.96 |

| 5 | $163,780.20 |

| 6 | $170,331.41 |

| 7 | $177,144.66 |

| 8 | $184,230.45 |

| 9 | $191,599.67 |

| 10 | $199,263.65 |

| 11 | $207,234.20 |

| 12 | $215,523.57 |

To mitigate against the HELOC balance from getting too large, you could simply make the payments out of your own cash flow and/or you use the dividends generated from your investments to pay down the loan.

At that point in time, my Smith Manoeuvre portfolio generates about $7,800/year in dividends. If I were to have withdrawn those dividends right onto the investment loan (and to keep things simple, let’s assume that interest rates stayed the same AND that there was no dividend growth – which obviously was NOT as good as the situation I’ve enjoyed over the last few years).

| Year | Balance | Deposit |

|---|---|---|

| 1 | $140,000.00 | $0.00 |

| 2 | $145,600.00 | $7,800.00 |

| 3 | $143,312.00 | $7,800.00 |

| 4 | $140,932.48 | $7,800.00 |

| 5 | $138,457.78 | $7,800.00 |

| 6 | $135,884.09 | $7,800.00 |

| 7 | $133,207.45 | $7,800.00 |

| 8 | $130,423.75 | $7,800.00 |

| 9 | $127,528.70 | $7,800.00 |

| 10 | $124,517.85 | $7,800.00 |

| 11 | $121,386.56 | $7,800.00 |

| 12 | $118,130.03 | $7,800.00 |

| 13 | $114,743.23 | $7,800.00 |

| 14 | $111,220.96 | $7,800.00 |

| 15 | $107,557.80 | $7,800.00 |

| 16 | $103,748.11 | $7,800.00 |

| 17 | $99,786.03 | $7,800.00 |

| 18 | $95,665.47 | $7,800.00 |

| 19 | $91,380.09 | $7,800.00 |

| 20 | $86,923.30 | $7,800.00 |

| 21 | $82,288.23 | $7,800.00 |

| 22 | $77,467.76 | $7,800.00 |

| 23 | $72,454.47 | $7,800.00 |

| 24 | $67,240.65 | $7,800.00 |

| 25 | $61,818.27 | $7,800.00 |

| 26 | $56,179.00 | $7,800.00 |

| 27 | $50,314.16 | $7,800.00 |

| 28 | $44,214.73 | $7,800.00 |

| 29 | $37,871.32 | $7,800.00 |

| 30 | $31,274.17 | $7,800.00 |

| 31 | $24,413.14 | $7,800.00 |

| 32 | $17,277.66 | $7,800.00 |

| 33 | $9,856.77 | $7,800.00 |

| 34 | $2,139.04 | $7,800.00 |

| 35 | -$5,887.40 | $7,800.00 |

As you can see from the table above, using the dividends from the portfolio would result in paying off the HELOC entirely by about 35 years (at least in this scenario – it’s faster if you count the tax deduction).

The main takeaway here is that you should plan on capitalizing on the interest on your investment loan, take note that you will eventually run out of HELOC space unless you plan on: refinancing; paying it off using dividends; and/or using your own cash flow.

For further reading, check out my article about running out of HELOC space with the Smith Manoeuvre.

Capitalizing the Interest on the Smith Manoeuvre With the Rempel Maximum

Ed Rempel, a certified financial planner (CFP) and accountant, has been a regular comment contributor to the Smith Manoeuvre articles on this blog. He has come up with a twist to the Smith Manoeuvre strategy that maximizes the tax and investment return on your leveraged portfolio.

He calls this strategy “The Rempel Maximum“.

Please check out the two interviews on the Smith Manoeuvre – which my staff writer Kyle Prevost recorded over the last couple of years at the Canadian Financial Summit with Ed.

How Exactly Does “The Rempel Maximum” Work?

The “Rempel Maximum” is a variation of the Smith Manoeuvre that maximizes both your tax and potential portfolio return while using $0 of your own cash flow. When you use the Smith Manoeuvre, you will get a small increase in your HELOC balance as you pay down your mortgage which is then used to invest.

With the Rempel Maximum, instead of using the small increase to invest, you use the increase to fund your investment loan/HELOC. This may result in obtaining an additional investment loan depending on the size of your principle payment. More on this below.

This way, you get the tax deduction from the HELOC along with the tax deduction from the investment loan. Canadian tax rules state that you can deduct the interest from a loan that supports an investment loan.

On top of that, you’ll have a large balance to work with initially to take advantage of compounding returns and time.

How Do I Implement the Rempel Maximum?

You’re probably wondering how large of an investment loan can you obtain? According to Ed Rempel:

For example, if your mortgage payment pays $500/month of principle ($6,000/year), you divide the $6,000 by the interest rate (say 6%), which gives you $100,000. You increase the credit line limit on your readvanceable mortgage to 80% of your home value, which is often done for free at the major banks. Then you borrow and invest up to the credit line limit. If there is less than $100,000 available, then you finance the rest from an investment loan.

Based on the above example, the banks will give you [principle payment/interest] as your maximum investment loan including your HELOC. Depending on how much equity you have in your home, you could end up with a fairly large investment loan.

What Are the Risks Involved With the Rempel Maximum?

This strategy uses the maximum leverage available to you based on your principle payments, or how much your credit line is readvanced with every payment. Needless to say, the investor must be aggressive, comfortable with risk, and experienced with investing.

As you already know, leverage amplifies your returns, good or bad.

Below is an example from Ed Rempel:

You have a home worth $400,000 and a mortgage of $200,000 at 5% interest (Editor’s Note: Can you tell we worked through this example a few years ago!) and are paying $1,169/month (25-year amortization). You can re-borrow at a rate of 6%, the investments average a 10% long-term return, and you are in a 40% tax bracket.

Each mortgage payment pays down $336 of principle x 12 months/ 6% = $67,200.

Since you have more than the $67,200 in available credit on your Smith Manoeuvre credit line, you can borrow this $67,200 to invest.

The interest payment is $336/month – which can be paid entirely from the Smith Manoeuvre credit line each month.

The additional benefit of the Rempel Maximum over the “plain vanilla Smith Manoeuvre”?

After 25 years of regular Smith Manoeuvre: $410,000

After 25 years of the Rempel Maximum Smith Manoeuvre: $718,000

That’s over $300,000 in difference over 25 years! The craziest part is that if you use the Smith Manoeuvre and the rules around borrowing to invest in Canada to your advantage, this $300,000 difference would compound over the next 25 years (assuming you never paid the loans back, and just kept making interest payments).

Who Should Use the Rempel Maximum Smith Manoeuvre?

There are 3 criteria that a person should consider before implementing this strategy:

- The investor must be experienced and comfortable with risk.

- The Rempel Maximum works best if your initial HELOC balance is small. ie. Someone who is just starting the Smith Manoeuvre with a little over 25% in equity.

- The investor must be in this for the long-term (think 25+ years).

Summary:

The Rempel Maximum is a way to maximize the potential returns from implementing the Smith Manoeuvre through the additional tax deduction and increased leverage. This can be an extremely powerful and lucrative strategy if used properly over the long term.

If you are considering using this strategy twist to the Smith Manoeuvre, make sure that you are comfortable with the maximum leverage applied to your portfolio.

I’ve Paid Off My Mortgage – Should I Stop the Smith Manoeuvre?

Another common set of questions that I get revolved around, “What if I’ve paid off my non-deductible mortgage while implementing the Smith Manoeuvre? Now what?”

What do I do with the large remaining investment loan?

How do I arrive at this situation?

There will come a point where the non-deductible mortgage gets paid off completely and the investor is left with a large line of credit (of tax-deductible “good debt”) which is invested in the market.

Besides jumping up and down in celebration, there are a few options once the non-deductible mortgage is paid off:

- Keep the investment loan forever. This is the main strategy if you follow the Smith Manoeuvre to a tee. The rationale is to keep collecting the tax deductions for the remainder of your life.

- Pay off the investment loan completely over time.The opposite of the above is to start paying off the investment loan once the non-deductible mortgage is wiped out. Basically, the investor here would apply the old mortgage payments toward the HELOC. The tax deduction would still apply, however at a reduced amount every year as the HELOC balance reduces. I’m more in favour of this option, or the one below, as I’m not sure I would be comfortable having a large looming debt during retirement. Even if it’s good debt.

- Pay off a portion of the investment loan. This is a hybrid of the above strategy where the investor would pay down the investment loan to a point where they are comfortable with the monthly payments. The investor can decide how much per month they can afford to pay indefinitely and pay down the balance accordingly. Of course, the investor would have to account for higher inflation years as it would affect his or her monthly line of credit servicing costs.

The three answers above are all correct, it’s up to the investor to decide how much risk they can allow in their portfolio and still sleep well at night..

Record Keeping for Your Dividend Stocks as You Do the Smith Manoeuvre

The process of saving and investing can be a rewarding experience. However, when it comes to taxes and reporting your investment returns to the CRA, the experience can be frustrating.

If you have used the Smith Manoeuvre to exchange your non-deductible mortgage interest for tax-deductible investment loan interest, you may be wondering how to report that interest expense on your tax return.

Filing Your Smith Manoeuvre Tax Return

When it comes to personal finance, proper record keeping ensures that you can track progress towards your goals. When it comes to income tax, proper record keeping can help avoid the denial of a deduction and incur interest and penalties.

When you file your tax returns, you are not required to submit any documentation to the CRA to prove your claim for interest expenses. However, you must keep adequate records to support your claim in case the CRA asks to see them.

You must be able to show that the funds withdrawn from your line of credit were used to purchase investments. You can show this link by attaching a cancelled cheque from your line of credit to your brokerage statement or attach your bank statement showing the funds transfer from your line of credit to your brokerage account.

You also need to support your interest expense calculations. Attach copies of your line of credit statements along with a cover sheet showing your calculations to your income tax return.

This is why I personally recommend keeping your HELOC account as 100% Smith Manoeuvre funds. If you begin using that HELOC account to fund other purchases, the record-keeping can get easily muddled.

Maintaining proper records will ensure that you can quickly access your records and prove your claim at any time.

Personal Use of Funds

When you borrow to invest in income producing properties, the interest you pay is tax deductible. However, interest used for personal purposes is not tax deductible.

It is important to ensure that when you use your line of credit to invest, that you avoid using it for personal purchases. Using your line of credit for personal purchases could result in your deduction being denied unless you can conclusively link the proportion of the line of credit to your investments.

It can be difficult to determine the proper proportion if there are a number of personal purchases on your line of credit. There is also a greater possibility for error. It is advisable that you use a second line of credit for personal purchases…or better yet, use cash!

Reporting Your Tax Return

So, you have assembled your bank statements and calculated your interest expense and now you are ready to claim the deductions on your tax return.

The deduction for interest paid on your investment loan is reported as “Interest Expenses” on Schedule 4 Part IV Line 221. The description should be “Investment Loan.” The total amount reported on Line 221 of Schedule 4 is then recorded on Line 221 of the T1 Income tax and Benefit Return.

And that is it!

If you are unsure of what you can claim or what you can deduct, it is advisable that you speak with a tax professional.

Smith Manoeuvre Checklist

While the benefits of the Smith Manoeuvre are definitely attractive, it is not something that you want to “try out” to see if it’s right for you. Instead, it’s a long-term commitment to use a proven leveraged-investment strategy, through both good markets and bad.

To help you with the decision, here is a checklist of things to consider before diving in:

- Do you already have the 20% down/equity in your home, to avoid the CMHC insurance?

- Can you handle,and are you willing to deal with the challenges of using leveraged investing?

- Is your RRSP and TFSA maxed out? This technique shines the most when done using your non-registered (taxable) accounts.

- Are you willing to accurately track your transactions in case you get audited by CRA? The benefits to the Smith Manoeuvre are clear, but are you willing to do that extra bit of tracking to ensure that it is done properly?

- Do you have a plan ‘B’ in the case that you need to move and home values have gone down? If you invested properly, your portfolio should at LEAST cover your loan.

Smith Manoeuvre Frequently Asked Questions

How Is a Person Supposed to Pay for Both the Mortgage AND the HELOC at the Same Time?

This is probably amongst the biggest concerns people have had, as the borrower will be responsible for BOTH payments while implementing the Smith Manoeuvre. This includes your primary mortgage (principle + interest) along with your HELOC (interest only). Seems a bit steep, hey? Say you get a $100k HELOC @ 4.45%, that’s an extra $371/month on top of your existing mortgage payment.

After talking to both Fraser Smith and Ed Rempel about this issue, I’m convinced that capitalizing the interest on the HELOC is the best option!

Scratching your head yet?

If you re-read our section on capitalizing the interest you’ll see that it basically means withdrawing the monthly interest due from the HELOC account, and redepositing the amount as the interest payment.

If you capitalize the interest, you will never make the extra interest payments out of your own pocket while your primary mortgage exists.

You will only start paying the HELOC interest out of pocket/cashflow when the primary non-deductible mortgage is paid off. So as you can see, using the Smith Manoeuvre, you will always have a payment. It never goes away. However, the payments are now tax deductible.

Why Would You Need 20% Down on Your House to Start the Smith Manoeuvre?

The reason is that most of the readvanceable mortgages out there REQUIRE 20% down. The mortgages that do NOT require 20% down will charge an extra CMHC fee.

Which Spouse Should Claim the Investment Loan?

When you are a couple, what is the best strategy for getting the best tax return from the interest paid on the HELOC used to buy investments?

The answer is that it really depends on the financial situation of the couple, and all the variables that your particular scenario entails – but, let’s look at the different components of this question:

Does it matter whose name the investments are purchased under or should they be under both names?

Typically, whoever funds the investment account is responsible for the taxation on the account. However, investment loans are different. You can have both spouses on the “title” of the investment loan (ie. HELOC), but it’s the name (the one who submits their SIN) on the investment account who gets taxed (and obtains the right to claim the tax deduction).

With that said, providing that you purchase tax efficient investments, it would be optimal to keep the investments in the name of the higher-income spouse.

It makes sense to claim the investment income under both spouses if both spouses are in the same tax bracket. This would help in future years when income splitting is a concern.

According to Ed Rempel, although you can have both names under one investment account, you can choose who to charge the investment income. As long as you keep the deduction consistent through the years, this shouldn’t pose a problem.

Does it matter who owns the HELOC or if it is jointly owned?

As mentioned above, if the HELOC is jointly owned, you can put the money into an investment account of either spouse, or a joint account.

If the HELOC is under both names, does the tax deduction for the interest paid get split between the two people?

Again, it doesn’t matter if the HELOC is under both names, what matters is the name on the account that is investing the money. The owner of the account investing the money, is the owner of the tax deduction and tax liability.

Conclusion:

Be sure to claim the investment loan under the spouse with the highest income. If both spouses have similar rates, then invest under both names.

Please remember that I am not a tax professional, so consult an accountant before following any taxation advice you find here.

What is The Maximum The Canadian Government Will Allow Me To Borrow in a HELOC or Readvanceable Line of Credit To Do The Smith Manoeuvre?

The maximum size of your HELOC in 2022 is 65% of the value of your home. With home values falling quickly in some areas, make sure to keep an eye on this figure. When you consider that the government only wants your maximum house debt to be no more than 80% of the value of your home when combined with your mortgage – then your mortgage balance plus your HELOC can never top 80%. This is to prevent a complete housing meltdown like we saw in the States in 2008.

Is a Leveraged RRSP Better than a Smith Manoeuvre?

We received a reader question about the strategy of borrowing to invest in an RRSP instead of a non-registered portfolio (like the Smith Manoeuvre):

“I have a readvanceable mortgage, but why shouldn’t I just use my RRSP instead of investing in a non-registered account? Wouldn’t it make sense to use that space first? Simply take my equity out as I pay my mortgage (like I’m about to do the Smith Manoeuvre) but instead invest inside my RRSP. Then get my tax refund back, put that on the mortgage, withdraw the equity on the other side again, and continue that process?”

Now I realize that in the scenario I just layed out, I would not receive the interest deduction that you would receive for a non-registered investment, but instead would receive the normal return that an RRSP would receive. As far as I can figure, the effect would be receiving a large tax refund in the present (by using RRSP) and smaller in the future, versus a normal Smith Manoeuvre where you receive a very small refund at first, and larger in the future (on a continual basis I realize until the loan is paid).

To begin, let’s go over the tax rules, as well as the benefits & disadvantages of each strategy.

Leveraged RRSP:

- Tax refund on the contribution – thus a larger tax return to put on mortgage.

- Investment loan is NOT tax deductible.

- All withdrawals from the RRSP are taxed at the marginal tax rate when you eventually retire.

Leveraged Non-Registered Portfolio:

- Tax refund based on the interest to service the investment loan. Depending on the current interest rates, this can fluctuate. This tax deduction is small initially but will grow over time as the investment loan grows.

- Withdrawals are very tax efficient from a non-registered portfolio. Only 50% of capital gains are added to income, and dividends can be extremely tax efficient depending on the amount of other income during the year.

Having explained the tax rules, our Smith Manoeuvre Calculator can be used to compare both strategies. This is the scenario and conclusions that we arrived at:

Instead of borrowing home equity as it accumulates to invest in a non-registered portfolio, borrow to invest in an RRSP, and apply the full refund to the mortgage. This uses a readvanceable mortgage so there is a lot of flexibility to do this as each payment is applied.

So, the tweaked Smith Manoeuvre Calculator found that:

Inputs:

- $300,000 House Value

- $240,000 Mortgage @ 5%

- $1,395.85 monthly payments amortized over 25 years

- 8% investment growth rate

- 5.75% HELOC rate

- Marginal Tax Rate of 46.41%

It should be noted that higher Marginal Tax Rates at the time of contributing to the RRSP make the case for investing in an RRSP more favourable when compared to the ‘traditional’ Smith Manoeuvre.

Here are the outputs:

With Smith Manoeuvre:

- Mtg is retired in 21 years

- $240k HELOC that is TAX DEDUCTIBLE

- Investment portfolio of $304,142 that is NON-REGISTERED

- Adjusted cost base (not including commissions) of $138,516

With RRSP:

- Mtg is retired in 18.25 years. Therefore, run the scenario until 21 years still making ‘mortgage payments’ but the money now goes to paying the HELOC interest and anything left goes into RRSP.

- $240k HELOC that is NOT TAX DEDUCTIBLE

- Investment portfolio of $395,143 that is in an RRSP

Assuming the same MTR as used above, the net of it is whether a $240k LOC that costs $13,800 after tax to service annually and a fully taxable portfolio of $395k (that would be worth $212k if cashed out all at once) is better than having a $240k LOC that costs $7,650 after tax to service annually and a $304k portfolio (that would be worth about $265k if cashed out all at once).

If, however, your MTR is lower when you cash out (e.g. < 30%), then the advantage swings to the RRSP investment – especially if you can get rid of the HELOC quickly.

The basic conclusion is that the higher your marginal tax rate AND the larger the difference between the cost of the mortgage/HELOC and your investment growth rate, the better it looks for the RRSP.

All in all, I don’t see sufficient evidence to suggest that the Smith Manoeuvre/RRSP hybrid can reasonably be expected to outperform a traditional Smith Manoeuvre as long as tax efficient investing is used for the traditional Smith Manoeuvre. That is based on these facts:

- At the end of the 21-year period, the traditional Smith Manoeuvre has a HELOC with tax deductible interest payments where the SM-RRSP hybrid has no tax benefit. This will become more important the longer an investor hangs on to the tax-deductible investment loan.

- The RRSP will have significant tax consequences as one withdraws funds from it. The SM’s non-registered portfolio, although smaller, will have substantially less tax liability on withdrawals.

- A >4% difference between the long term mortgage rate and investment performance over 25 years is uncommon in Canada.

- Many folks just won’t have the room in their RRSP in order to keep their entire Smith Manoeuvre investment portfolio running through it – so that adds another layer of complexity as you’d now have a non-registered SM portfolio, and an RRSP SM portfolio.

Should I Buy USA Stocks for the Smith Manoeuvre?

One other question that we’ve gotten a couple of times in the comment section is, “Can I use USA stocks for the Smith Manoeuvre”.

The answer is: I wouldn’t recommend it.

You’re going to get slammed on the withholding taxes side of things when it comes to high-yield US dividend stocks. Alternatively, what you could do is invest in Canadian companies that do a lot of business in the USA or around the world.

For example TD bank generates more than a third of its revenue from the US market. Energy/Utilities giants like Fortis also do a lot of business south of the border.

Using these companies to broaden your geographical risk profile – while maintaining your dividends in tax-friendly Canadian Dollars – makes a lot of sense.

Is 2025 the Right Time to Start the Smith Manoeuvre?

Yes – 2025 still looks like a pretty solid time to start the Smith Manoeuvre.

I’ll be the first to admit I didn’t exactly pick the perfect moment to begin mine. I kicked it off in 2007 – which, in hindsight, was probably the worst time in recent memory to load up on equities.

And yet… it worked.

Despite the brutal timing, I’m still very happy with how things turned out. That’s the beauty of taking a long-term view.

Right now, Canadian stocks aren’t dirt cheap, but they’re not outrageously priced either. After a couple of sluggish years for dividend payers (2022 and 2023 were rough), there isn’t a lot of “froth” in the market. Remember, the worse the news headlines, and the more negative everyone is about investing, the less risk that the bottom can really follow out.

The current market noise and economic headlines around tariffs might feel stressful, but most of the uncertainty we’re dealing with is short-term in nature. If you’re thinking long-term – like a Smith Manoeuvre investor should be – this could actually be a very good entry point.

No one has any idea what tariffs will look like in the short term, but I venture to say that where Canadian companies are concerned, they will be reduced substantially going forward, as the cost to the US consumer will just be too high. Even if they stick around for a while, remember that Canada is more a service economy these days than anything else. Rogers doesn’t really care tariffs – and Enbridge tells us that the pipelines will remain full no matter what the tariff rates are.

What gives me even more confidence? Higher interest rates than five years ago. I know that sounds counterintuitive, but hear me out: with a Smith Manoeuvre, the interest you pay on your investment loan is tax deductible. That means the higher your rate, the bigger the write-off. It’s one of the few times in life where rising costs can work in your favour.

So yes – folks renewing their mortgage might feel a bit of a sting that higher interest cost accelerates your SM loan and boosts your annual tax deduction. For those that had the misfortune of their mortgage coming up for renewal a couple of years ago, it might really be worth it to look into the prepayment penalty for breaking your mortgage – as rates have already come down substantially. For long-term investors willing to weather a bit of short-term uncertainty, 2025 looks like a fine time to get started.

The Smith Manoeuvre During a Market Crash

Below is an archived article from Million Dollar Journey which was written during the 2008 financial crisis. I thought I’d re-publish it and update in our main Smith Manoeuvre article considering how many similarities there are with what we saw in 2022, and what many are predicting in terms of a recession in 2025.

It’s a good reality check of what happens in the markets, and how heavy the losses can be, especially with a leveraged portfolio. Think of it as a way to test yourself to see if you have the right temperament for the Smith Manoeuvre.

There has been much concern over the viability of the Smith Manoeuvre or a leveraged investment strategy during this recent bear market. The main concerns are due to a couple of reasons:

1) Sinking equity prices

2) The rapid increase of interest rates

The truth of the matter is that leveraged investing is risky in the short term. My investment account is facing the relatively risky equity market along with building interest on the capital that supports it. The opportunity for the account to grow at an accelerated rate is great, but so is the opportunity for values to drop.

With current market conditions, it’s a gut check to see who can really take the leveraged investing heat. With HELOC (home equity line of credit) rates, hanging between 7% and 8%, that interest bill that your portfolio is having to pay is going home substantially!

What am I doing with my leveraged portfolio during this correction? Even with the extreme fear in the streets, I have my eye on the big picture and my long investment timeline. Therefore, I’m sticking to the plan, watching the best dividend paying stocks and deploying some cash when they appear cheap.

I’ve said this before, and I’ll say it again, these market corrections are temporary and should be viewed as an opportunity to buy cheap equities for the long term. It may take a while (even years) for the markets to bounce back, but if you buy cheap, you’ll take full advantage of the upcoming recovery.

As you can see, there is wisdom to be found from past experiences!

Throughout the early months of the pandemic that we went through in 2020 (and the accompanying market panic) I was able to position my self to capitalize on a market that needlessly penalized high-quality dividend paying companies.

I personally was able to add many shares of Enbridge at price points that proved to be ridiculous. I did a ton of research and just could not understand why people were so worried about the pandemic overly affecting this midstream utility.

These days I find people unreasonably bearish on Canadian utility stocks and Canadian bank stocks. I’m eagerly snapping up shares of those stocks while people have a bad taste in their mouths from the rapid rise in interest rates.

The Enbridge pick proved to be one of the best returning short-term investments that I’ve ever had the stomach to make. Once the market panic subsided, and people began looking at balance sheets instead of news headlines again, Enbridge subsequently bounced back and I reduced my exposure.

I enjoyed snagging the stock at price levels that netted me a 7.5% dividend yield, and also enjoyed a 20% capital gain in the process. (Yes I know, I didn’t get in on the very bottom – but I’ll take it!)

If you’re going to be able to stomach the ups and downs of the Smith Manoeuvre you have to be able to think past the short-term noise of the stock market. For me, focusing on dividend growth really helps overcome irrational buy/sell behaviour.

No matter how smart you think you are, we can fall prey to the behavioural biases hidden deep in our lizard brains. If you’re curious about how psychology can affect your investing, I recommend checking out the work of Daniel Kahneman, Amos Tversky, Dan Ariely, and Richard Thaler.

As we look ahead to 2025 and 2026, our crystal ball is certainly cloudy. While we looked to be on a one-way track down from the 2022/2023 inflation spike, the Trump administration could change all of that with an ill-advised set of policy rollouts.

I personally think that interest rates aren’t going down much from here. Higher government debts all over the world are going to lead to bond-buyers having much more leverage to demand higher payouts in the years ahead. That’s going to necessitate higher interest rates.

One way to help mitigate those higher-for-longer interest rates is to turn your mortgage (non-tax deductible debt) into tax-deductible debt. For folks in higher tax brackets, this is going to take your real interest payment down quite a bit in terms of after-tax bite.For example, if your marginal tax rate is 50%, then your 6% HELOC loan is really a 3% real interest rate, because you’re going to get half of that interest payment back on your tax returns at the end of the year. That tax deductibility feature was the driving force behind Fraser Smith’s original Smith Manoeuvre thesis several decades ago.

No Better Time to Turn Your Mortgage Into a Tax Deductible Investment Loan

In both 2023 and 2024, stock markets massively surprised to the upside. While the Toronto Stock Exchange 60 didn’t get the same massive bump as the Magnificent 7 tech giants south of the border, they were still very solid overall returns.

In 2025 I see Canadian dividend stocks closing the performance gap from the past couple of years. Canadian bank stocks, Canadian telecommunications stocks, and Canadian utility stocks for example have really suffered from high interest rates.

These are companies that have taken on some debt over the years to build out their competitive advantage. So their bottom lines are hurt in the short-term, due to increasing interest payment costs. But, the more important long-term consideration is that these Canadian dividend-payers have used that borrowed money to build oligopolistic companies. It is virtually impossible for a new Canadian telecom company or bank to start from scratch and grab market share. That gives me a ton of long-term confidence.

It could very easily be the case that 2025 is the year either (both?) the Canadian and American economies fall into recessions. But remember, the economy is not the stock market. A recession that badly hurts medium-sized Canadian companies isn’t likely to lead to a massive loss for a pipeline or a utility.

Given the results of the Canadian stock market over the last 18 years, the Smith Manoeuvre has generated several hundred thousand dollars for me. Simply put: I started this thing at the absolute worst time, and my net worth is still much higher than it would have been had I not done it. That should help assuage any fears around the idea of, “I can’t start this now – we’re at the top of the stock market and the only place to go is down.” It’s certainly possible we could see a downward price movement at some point this year, but it’s also possible the growing earnings will keep things in positive territory throughout the next couple of years.

Because so many people continue to first find this site through searching for Smith Manoeuvre information, I intend to personally update throughout 2025 (and beyond) – so if you have any questions, send them our way.

FT

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

So I’ve read both your advice and Ed Rempel’s advice quite thoroughly. First I notice that you lean towards recommending dividends, while Ed leans towards capital growth. I think your article could be expanded with a paragraph to point out the two strategies while maintaining your POV. Or ask Ed if he’d be willing to co-write this page with you?

Second is that I think a lot of us have learned a lot from you about the stocks vs ETFs and ROC concerns. Your page basically sums it up better than anywhere else and helps us DIYers understand it. That being said, I’d like to know if we could go down the rabbit hole of “So you insist on doing this with ETFs without a robo adviser anyway…” article or section. I’d love to have some ETF pseudo recommendations (since you don’t recommend ETFS for this in the first place… but if you did…). I’ve read elsewhere that some people use ETFs and then conservatively just only withdraw 70% of their distributions to account for ROC. They use the 70% to pay the mortgage and reinvest, and they just leave the 30% in their account and reinvest it. This doesn’t give them the full return for their buck but simplifies their lives come tax/paperwork season. I’d love to see your take on this, and/or an ETF strategy for the smith maneuver for someone who doesn’t want to do maximize it but wants to keep it simple with reasonable safety measures against the CRA.

I don’t quite understand the need for a readvanceable mortgage?

We’ve owned our home for a few years now. If I applied for a HELOC now I would have access to enough funds for at least a few years of Smith Manoeuvring I would think. Is the readvanceable mortgage only necessary when you have just purchased a home and have not had any time to build equity to borrow against? Or am I missing something key?

Hey Kevin, using the existing equity in your home is a great way to get started (HELOC) but it is limited and capped. This strategy is actually called “Prime The Pump” and is an accelerator. However, the Smith Manoeuvre in it’s truest and simplest form is actually recycling or rather “upcycling” the equity that is unlocked and released in every mortgage payment that you make – giving almost unlimited access to capital and investing opportunities. I think everyone can agree that compounding interest in your favour is the 8th wonder of the world (Albert Einstein said it)… and that is the significance of a readvance mortgage = Time of cash in the investment vehicle = exponential greater wealth than you ever could have traded your time to work for it. Oh and…. it creates tax credits on your tax returns against your active working income so you can pay the government less money (that you would owe anyways) year -after-year and you can use the refunds to pre-pay your mortgage, unlocking more equity to rinse and repeat. This is how regular Canadian folks can pay off a 30 year mtg in 10 years or less. Add a rental property (or a few) to the mix and you can be fully mortgage optimized with total tax efficiency really fast. Don’t miss the magic – its in a readvanceable mortgage.

Ok, but doesn’t everything past your second sentence apply to a non-readvanceable mortgage as well if there is space on my HELOC? Obviously the big difference is eventually I will run out of space, but everything else is still applicable right? If not, you have to dumb things down for me because I don’t know what I’m missing. I’m “upcycling” the equity I already have, I’m getting the benefits of compounding interest, I’m getting tax credits, I can use the refunds to pay down my mortgage. The ONLY difference is that once I run out of room in my HELOC I have to stop the strategy until I can apply for either more space or switch to a readvanceable mortgage at that time.

Again, what am I missing?

You are correct, but the key factor is that you hit a ceiling in plateau cause you run out of room to invest.You’re always only limited to your available resources so this is a way that you can have continual resources recycling for you.

But also … you are leaving tax efficiency on the table to pay less income tax against your working income

I am Smith Manoeuvre certified and this strategy is complex because it’s not a one-size-fits-all. There is many moving parts and much to learn which cannot be taught in a blog dialogue etc. But the core fundamental issue is that you’re not being efficient if you just have a HELOC and a regular mortgage cause you’re not recycling or, or I should, your equity as you make it, which say up-cycling money and time in the market/ using it for owning an income generating asset (like rental property) that is making money for you. Time in the market/asset matters and make a monetary difference. And …

Who likes paying more income tax and I need to!

Hi,

I’ve started the Smith Maneuver last year /w capitalizing interest and withdrawing distributions to prepay mortgage and feed the cycle, but instead invested in a dividend paying fund historically with no distributions.

However, I took a look at it’s distribution characteristics and it suddenly shows a mix of cad dividend (85%), “other income”, capital gains, foreign income, negative foreign tax paid, and the dreaded but tiny return of capital (0.079%).

As the RoC had been polluting my Smith maneuver money flow, can this be fixed or is it better to liquidate, zero everything out, and restart from scratch?

I haven’t done my taxes for last year yet so I still have a bit of time to plan my action.

Thanks in advance

Hi sorry I am a bit confused on the capitalizing interest part.

When making my principal payments and extra payments from dividends I get more room in the heloc. If i am following correctly I then keep borrowing the extra room from the heloc to keep it maxed out.

How do you pay heloc interest from the same heloc if it is maxed out? Or do you not max out the heloc and save a bit of room each month to withdraw into the separate bank account to pay the interest? Or better to just use dividends to pay for the interest?

Thanks and much appreciated

There must be a limitation here somewhere. Are you saying I could deduct 100% of my taxable income if I paid enough interest?

E.g. I make 100k per year and pay 100k in interest on investment loan, I can deduct the full amount and pay zero income tax?

Typically there is a limitation to a certain percentage of taxable income that can be written off