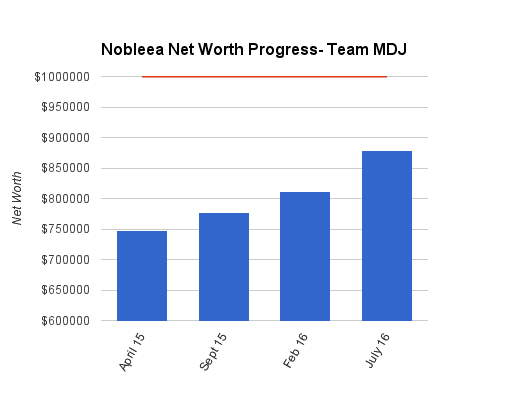

Net Worth Update July 2016 – Nobleea the Oil and Gas Engineer (+8.38%)

Welcome to the Million Dollar Journey February 2016 Net Worth Update – Team MDJ edition. A select group of readers were selected to be part of Team MDJ which was conceived after the million dollar net worth milestone was achieved in June 2014. Nobleea – the Oil and Gas Engineer, was selected as a team member and will post net worth updates on a quarterly basis. Here is more about Nobleea.

- Name: nobleea

- Age: 38

- Net Worth: $879,394

- Day Job: Engineering manager at oilfield services company, Teacher (wife)

- Family Income: $130,000 (main job), $10,000 (part time job), $80,000 (wife main job), $5,000 (wife part time job)

- Goals: Million dollar family net worth before 40, Retirement from primary job at 50 (for me)

- Notes: Owns primary house. Building new home across the street.

We live in Edmonton where incomes are decent and housing prices are fairly reasonable. Some may roll their eyes at the high family income and say that a million dollar journey is going to be pretty easy. I have a plan to retire at 50 and pursue other interests. My wife will likely continue working until it makes sense to retire with her DB pension as the penalties for early retirement are pretty severe. We are in the process of building our new family home on a tear down lot across the street from our current home with an expected occupancy date some time in Sept 2016.

Our goals for 2016 are varied, but our financial ones include: contributing 30K to our TFSA; moving in to our new house and selling our old one for $475K or more; tracking utility consumption on the current and new house; and, tracking and reducing

our monthly spend in a variety of categories. The end goal is to have a reasonable budget by the middle of the year. The TFSA is invested in a mix of 85% couch potato ETF’s and the remaining blue chip stocks. Looking at these goals, we have already completed the majority of them.

There have been significant changes and updates since our last update here. For one, we sold out current house in a private sale. There was good interest just from word of mouth. The price ended up being 485K and it closes at the end of July. The net worth below has been updated with the sale price minus legal/closing fees. Our new house is almost ready for possession, obviously before the end of July when we move out! We are fairly confident that we could not have gotten much more for the current going through a realtor once you factor in the realtor fees and keeping a house clean for showings with a toddler.

One of our goals for the year was tracking utility consumption in our old and new house. There was a fair amount of design and construction modifications made to make the new house more energy efficient. Our 5 year average consumption in our current/old house are Power 513kWh/month, Water 12m3/month, Natural Gas 6GJ/month. The average Edmonton household uses 600kWh/mo, 16m3/month water, and 10GJ/month so I was happy to see were were under those. Our new house is significantly larger, but much better insulated, sealed, constructed, and designed with passive solar concepts in mind. I am hoping to drop all our utility consumption.

I mentioned the last update that my company went to single furlough where our pay was reduced by 10% but we were given one unpaid day off every 2 weeks. Since then, we moved to double furlough (working 4 days a week) plus a suspension of the company match portion of our RRSP. The market has since improved and as a result, we are now back to single furlough and I expect by the end of the year, all furlough will be completed and the RRSP match will be reinstated.

We have continued with our TFSA contributions and expect them to be maxed out by the end of the year for both of us. We plan to save about $35K a year and once the TFSA’s are full, these savings will be going in to non registered accounts. The TFSA and non-registered savings will be used for early retirement.

Other big news is that our family will be growing by one later this year. My wife will be on maternity leave for 10 months starting around Halloween. We plan on spending a month somewhere warm during her maternity leave. This may involve me taking parental leave or just extended holiday time. Our daughter’s RESP is healthy and has a balance of about $10,500

though the value is not included below. It is invested in TD e-series. She turned 2 earlier this year.

It looks like we will pass the Million dollar mark in October next year (2017), which would be before my stated goal of age 40. In May 2009, when we started tracking net worth in earnest, the value was $136,377.

On to the net worth numbers (Quarter/Quarter):

Assets: $1,839,805 (+20.8%)

- Cash: $7,303

- Registered/Retirement Investment Accounts (RRSP):

$146,660 (-0.6%) - Tax Free Savings Accounts (TFSA): $35,878 (+403%)

- Defined Benefit Pension: $152,000 (+8.3%)

- Principal Residence: $483,250 (+5.5%)

- New Build Property: $964,664 (+51%)

- Vehicles/Other: $47,182 (-9.1%)

Liabilities: $960,411 (+35%)

- Construction Mortgage: $554,660

- Mortgage: $380,235

- Credit Cards: $25,506

Total Net Worth: $879,394 (+8.38%)

- Started 2016 with Net Worth: $717,634

- Gain/Loss to Date: +22.5%

Some quick notes and explanations to common questions:

The Cash

Cash includes bank account balances in two accounts, plus any gift card balances. When not building a house, we use cash flow modeling to predict the maximum amount we can put towards debt/investments today without having a negative balance in the future, taking all one time or non-regular bills in to account.

Loans and Credit Cards

The credit cards are paid off in full every month with no interest due. We put all our expenses on credit cards for cash back. As this can be a substantial amount some months, I believe it needs to have a line item in your monthly net worth as it is a liability at that snapshot in time.

Savings

TFSA’s have just started and we hope to have them maxed out within a year or two. This will be our early retirement fund, or emergency savings if it comes to that.

Real Estate

Our primary residence was purchased in 2008 for $355K. We put in $110K in DIY renovations since then in a complete overhaul. The house value shown here is based on those two numbers and is conservative relative to what similar homes in the area sell for. As part of our financing for the new house, our home was appraised by the bank at $480K which lines up well with the estimate above. With legal fees and small repairs that had to be done as part of the sale, the bank appraised value was very accurate.

Our new home will likely have a finished cost (lot+construction) of around $1,090,000. That is the value that will be assigned to it in the net worth statement once it has been completed.

Pension/Investments

My wife has a DB pension as a teacher. The balance shown is the termination benefit should she quit from her position tomorrow, net of any taxes. I have a matching RRSP plan through my work. Combined with CPP, we are not worried about retirement income, it’s just a matter of timing. We plan on contributing to my RRSP in order to get the full company match but no more, then max out TFSA for investments, and then non-registered investments.

We have pretty substantial unused RRSP contribution room (~100K) and will likely never use it. Perhaps in the event of a large capital gain, we may contribute some to offset the capital gain taxes.

Vehicles/Other

Just over half of this amount is vehicles. We have a two 2013 model year vehicles, one purchased new, one purchased used. I depreciate their value every month in net worth updates to keep it at just above wholesale value. The two vehicles combined cost us $250/mo in depreciation and repairs. I find that reasonable considering it would be hard to lease a single small vehicle for that price. The “Other” refers to fairly extensive photography equipment (part time business), sporting equipment and personal property.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

You’re an inspiration, Nobleea. Congrats on the new baby! I, as well, live in Edmonton near Terwillegar area. Where abouts are you located?

I’m also not sold that you should invest in non-reg before maxing out your RRSPs first. You’re not financially independent yet, and all the #s that I’ve crunched (and i’m a CMA) suggest that maxing registered accounts is the best way to go. The extra tax refund can then be used for more savings.

Having more money during retirement and paying more taxes is actually a good problem to have. I’m also in the same age bracket as you and I am *not* counting on OAS.

Hopefully we can connect in person in the near future!

Thanks, we’re located near Bonnie Doon. I’ve recently ran some numbers, and obviously TFSA is the first place to go, after that it gets a little murky based on my situation, though that may be different than the ‘average’ situation. First, I unfortunately have a fair amount of booked capital losses that are being carried forward. I would definitely keep funds in non-registered accounts until all those capital losses are used up. Second, if we are able to retire early enough that we still have school-age children (a real possibility), and IF the new child benefit payment program stays as it is, there is a bit of a benefit to having the net income as low as possible to max out the child benefit payment, at least until the kids are over 18. It’s a balancing act and probably some optimal solution but not something I need to figure out right away since RRSP contributions are a bit of a one way street, where as non-reg can be easily moved around. What I will for sure do is max out TFSA, then go to non reg and keep on going there until I have enough capital gains to use up my carry forward capital losses. At that point, I can continue with non-reg, or contribute all to RRSPs, or some combination of the two. I suspect that’s a decision that won’t have to be made for 4-5 years yet.

403% increase in TFSA is amazing. I am curious about the returns. What are you invested in?

The increase is almost all due to contributions and not growth. I switched the TFSA to a bit of a core and explore portfolio (85/15%) where the core is a couch potato based on the BMO ETF’s and the explore is a few Canadian stocks (NA, WCP, CJR.B, SLF). The XIRR as of the start of the year is 18.6%.

Frugal Trader, what is your opinion on this? Once TFSAs are maxed out, is the next logical step to invest in non-registered investments for optimal money management in early retirement (and leave unused RRSP contribution)? We don’t have any non-registered investments yet.

It really depends on your situation. For example, if you and your spouse expect to have fully loaded defined benefit pensions during retirement, then you may want to consider a non-registered portfolio after your TFSA. The RRSP would be taxed at a fairly high rate if you have strong base income during retirement. Otherwise, I typically follow the rule to keep everything tax sheltered until you run out of space. RRSP’s work really well if you are high income, and expect to be lower income during retirement.

Hope this helps!

Also, don’t forget debt. Even with low interest rates, I like the psychological boost of getting rid of debt.

Thanks for the comment. I haven’t run the numbers in great detail, but the thinking is that with just my DC RRSP contributions (and company match), along with a DB pension, we will have more than enough income in retirement especially when you factor in the required withdrawal amounts from an RRIF. Hitting the RRSP hard now in the form of contributions would result in higher income than we need and would lead to OAS clawback (assuming it’s still around when we’re in retirement). Since I believe we’ll have enough saved up for the retirement period (65+) in the form of RRSPs and DB pension, any additional funds are to be used for early retirement. If these are funds we want to access between 45 and 65, then an RRSP is probably not the best vehicle for it as most institutions don’t like regular RRSP withdrawals. We could convert some to an RRIF, but there’s probably only a handlful of people in the country that have converted to an RRIF before 50.

There are other considerations such as child tax benefits (our kids would still be under 18 when we retire). If we are just living off TFSAs and non-reg funds, then our family income would be quite low. I would hope they introduce means testing for such a case, but if not, we’ll just donate the child benefits. Withdrawals from an RRSP or RRIF would show up as income and the pension income doesn’t start until 55 or so (once all kids are over 18). I do think there’s a chance that my income from ventures or other activities during ‘early retirement’ will not be insignificant. I guess that’s not retirement if you’re working. Having savings in TFSA and non-reg makes it easier to access without a tax hit than in an RRSP.

That being said, maybe I will run the numbers in more detail. It’s hard to predict what tax rates, OAS eligibility, income, will be like in 10-30 years. Might have to run a few simulations.

Hi Nobleea,

Great progress! Our financial situation has some similarities to yours in that we are close to reaching the $1M net worth however most of it is tied up in my DC pension plan and our primary residence. We also have a substantial amount (around $100K) of unused RRSP contributions. I’m curious why you mentioned in your post that you plan on going to non-registered investments (after maxing TFSAs) instead of using your unused RRSP room? I always thought it was best to max out all tax efficient accounts prior to moving to non-registered investments. Our goal is also to be financially independent at about 50 yrs old (10 years from now).