Net Worth Update Dec 2011 (+0.97%) – Year End Summary

Welcome to the Million Dollar Journey December 2011 Net Worth Update – The Year End Summary. For those of you new to Million Dollar Journey, a monthly net worth update is typically posted near the end of the month (or beginning of the next) to track the progress of my journey to one million in net worth, hopefully by the time I’m 35 years old (end of 2014). If you would like to follow my journey, you can get my updates sent directly to your email or you can sign up for the Money Tips Newsletter.

This year was a wild ride! The buoyant market of 2010 carried over into the first half of 2011 then the bottom fell out with the bears taking over the remainder of the year. The financial news was dominated by the debt problems within the European Union and how it’s the end of the world as we know it. The fear of course is that the insolvency of a single country within the union could have repercussions throughout global markets. Insolvency or not, the fear in the market has lead to large swings in the market, and has resulted in a negative year for most market indices.

With a significant portion of our net worth invested in equities, the down market this year took a bite out of net worth growth. We had a long stretch of positive monthly updates, but then the markets humbled me bringing losses in August and September. Fortunately, we had gains in the other 10 months of 2011 bringing a total net worth gain of 15.70% finishing the year at $585,228.00. The goal of reaching $1 Million in net worth over the next three years is quite the task but I believe that it’s achievable providing that I stay aggressive.

Similar story to last year, cash savings (ways to save money) played a huge role in our net worth in 2011. Without strong cash flow and subsequent savings, I’m pretty certain that our net worth would be in the negative overall.

This year was also exceptionally busy! With my full time work picking up, having our second child, working on new web projects while running Million Dollar Journey and Canadian Money Forum, I was stretched pretty thin this year. Oftentimes writing articles during the week until after midnight (like this post). I’m hoping that 2012 brings some sanity back to my schedule.

On to the numbers:

Assets: $666,928.00 (+0.86%)

- Cash: $4,500 (+0.00%)

- Savings: $69,000 (+6.15%)

- Registered/Retirement Investment Accounts (RRSP): $118,600.00(+0.59%)

- Tax Free Savings Accounts (TFSA): $29,700.00 (+1.37%)

- Defined Benefit Pension: $37,200.00 (+1.09%)

- Non-Registered Investment Accounts: $28,680.00 (-3.43%)

- Smith Manoeuvre Investment Account: $87,500 (+1.39%)

- Principal Residence: $291,748 (+0.00%) (purchase price adjusted for inflation annually)

Liabilities: $81,700 (+0.06%)

- Principal Residence Mortgage (readvanceable): $0 (0.00%) (Paid off in 2010!)

- Investment LOC balance: $81,700 (+0.06%)

Total Net Worth: ~$585,228.00 (+0.97%)

- Started 2011 with Net Worth: $505,800

- Year to Date Gain/Loss: +15.70%

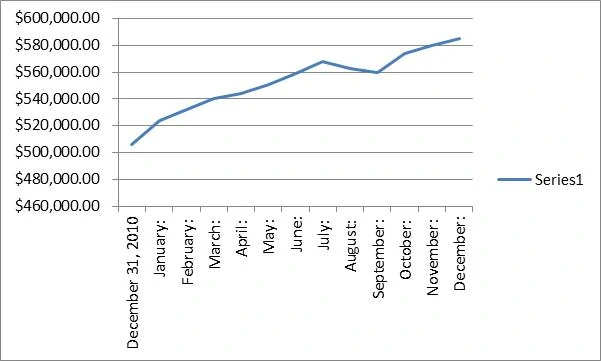

Here is a summary of our monthly net worth totals for 2011, note that we started 2011 with $505,800 :

- January: $524,048.00

- February: $532,198.00

- March: $540,448.00

- April: $544,040.00

- May: $550,480.00

- June: $558,713.00

- July: $568,148.00

- August: $562,948.00

- September: $559,348.00

- October: $574,248.00

- November: $579,598.00

- December: $585,228.00

Some quick notes and explanations to net worth questions I get often:

The Cash

The $4,500 cash are held in chequing accounts to meet the minimum balance so that we pay no fees (accounting for regular bill payments – ie. our credit card bill). Yes, we do hold no fee accounts also, but I find value in having an account with a full service bank as the relationship with a banker has proven useful.

Savings

Our savings accounts are held with PC Financial and ING Direct. We usually hold a fair bit of cash in case “something” comes up. The “something” can be anything that requires cash such as an investment opportunity that requires quick cash or maybe an emergency car/home repair. We also need cash to cover any future tax liabilities.

Real Estate

Our real estate holdings consist of a primary residence and REITs plus a rental property. The value of the principal residence remains valued at the purchase price (+inflation) despite significant appreciation in the local real estate market.

Pension

The pension amount listed above is the value of both of our defined benefit pension plans. I basically take the semi annual statement and add the contribution amounts (not including employer matching) on a monthly basis. The commuted value of the pensions are not included in the statements as they are difficult to estimate.

Stock Broker Accounts

Another common question is which discount broker do I use? We actually have accounts with multiple institutions. I’m hoping to reduce the number of accounts that we hold in the near future. Here is a review of some of the more popular online stock brokers.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

It would be interesting to see you investment performance for the year not including savings / contributions as it compares to the TSX. Do you have that info. I believe TSX was down about 11%

I have no doubt that you’ll reach your $1 million target FT!

I reviewed and I had a modest 11% gain from last year.

I love tracking net worth- it’s fun to push yourself and review monthly areas you can work on.

I hope you get some R&R in 2012 too ;)

Congrats FT!

Similar to Sampson, we narrowly missed our goal for this year (largely due to the volatility in the equity markets). Our increase for 2011 was 14% and this was done with the Mrs. (also the big earner in the house) at home on maternity leave for 9 months out of the year.

It was paying off debt that resulted in our gains. Our assets hardly changed over the course of the year, despite regular RESP, RRSP and TFSA contributions.

2011 was the first year I tracked our net worth and this website was the reason I started doing that.

@Miiockm, we went from $190k to almost $585k in 5 years (2007-2011) which includes periods where our income was much less than it is now. I can only hope that our income and assets will continue to grow at an accelerated pace.

You can see a history of our growth here: https://milliondollarjourney.com/net-worth-update-dec-2010-1-87-year-end-summary.htm

May I ask how you plan to make $410,000 in 3 years when this year you posted a gain of $80,000? Not that $80k a year isn’t mighty impressive already.

Thats a very good job. 16% in a year when most people either lived flat or had modest gains. Super.

Great job FT.

We narrowly missed our targets this year, and managed a healthy 11% increase in net worth despite the big earner staying home on mat leave. We are most certainly at the mercy of the equity markets, but were fortunate with some timely buys, and have been loading up on bonds the past 2 years which have helped also.

I honestly don’t know if will hit our $1M target, and honestly, it may be very challenging for your family as well. If markets remain range-bound, I suspect we’ll have modest gains these next few years, and then have some bigger years down the road and a big surge in NW.

Good luck with next year’s goals – and I’m curious whether you’ll take a plunge by investing into something else. Maybe it’s time to start a franchise or two ;)

Thanks frugal.

Mostly first due to savings, leverage and investing. But overall we did not have big investment gains.

Hi FrugalTrader, is your TFSA for two people or were you able to grow it so much over three years?

@rg – I have a few tricks left that I haven’t revealed! Seriously though, we plan to continue increasing our income while keeping our expenses under control thus socking away more and more cash.

@liquid, as the account gets bigger, even small percentages turn out to be big numbers!

@jungle, congrats on the big numbers! Was that mostly due to savings or investments?