Investing in Canadian Retail Stocks 2024

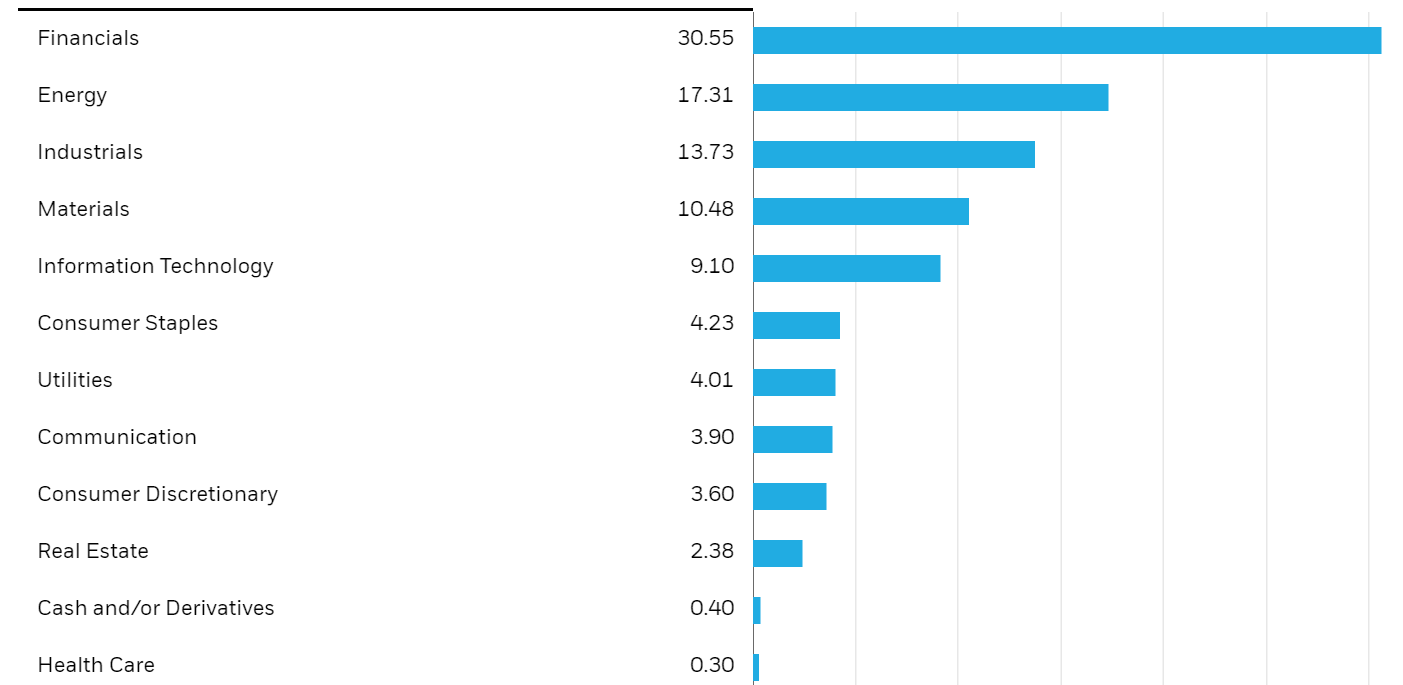

It is no secret that the Canadian stock market is not very well diversified by sector. Canada is largely financial, energy and materials, with all of that other stuff in between. By investing in Canadian retail stocks, investors can add some much-needed diversification.

Canadian retail stocks can also help investors profit during times of economic strength and certain types of retail stocks can offer a nice hedge against periods of slow growth or recessions.

A certain segment of Canadian retail stocks can also help the inflation fight – think Canadian grocers or convenience stores that have profited handsomely over the last two years.

Our favourite Canadian retail stock is Alimentation Couche-Tard (ATB). As always, Mike from Dividend Stocks Rock sums up our investor thesis:

While the concentrated Canadian stock market might be a disadvantage for those who own a stock market ETF or mutual fund, it might present an opportunity for investors who create their own stock portfolio. When we build our own stock portfolio we certainly do not need to follow the index weighting. We can build a more balanced portfolio.

Here’s the current sector breakdown for the Canadian market. The chart for the TSX Composite, ticker XIC, is courtesy of BlackRock Canada.

And when we build our portfolio we Canadians will largely shore up those sector holes by investing in US dividend growth stocks or perhaps a US dividend ETF or market ETF.

The Canadian retail stocks are mostly economically sensitive. Canadians need to be employed and with free cash flow to spend at these retail stores. They often depend on a healthy economy and economic growth.

Retail stocks will fall into two categories. First off there are consumer staples or defensives. As per the name they are staple items that we simply need in our daily lives. And then there are consumer discretionary companies. Those are items that are not necessities but are a choice of how to personally allocate money for personal needs and wants.

Early in 2023 many analysts and economists were preparing for an earnings recession. In a report BMO offered only Consumer Discretionary, Consumer Staples, Industrials, and Utilities saw net positive earnings projections for the first two quarters of 2023. It turned out to be a solid year for retail stocks. The index (XSP) was up 6.2% in 2023.

As I shared in the space, BMO’s top Canadian retail stock picks were Alimentation Couche-Tard, Dollarama Inc., and Metro. That basket greatly outperformed the market and the consumer staples index in 2023.

Dividend Investing for Canadian Retail Stock Pickers

As we know the Canadian Dividend Investor will often invest in Canadian banks and other financials as the bedrock of the portfolio. We might then turn our attention to Canadian energy stocks and investing in Canadian REITs is a wonderful source of income and portfolio diversification.

You’ll find more ideas in the best Canadian dividend stocks for 2024.

Some Wide Moat Retail Stocks in Canada

I am a big fan of investing in wide moat or moat stocks that suffer from very little competition. They might even be in an oligopoly situation such as the banks.

We also mentioned those moats when investing in Canadian railway stocks.

There’s nothing like a moat to help protect our earnings, free cash flow and dividend growth.

When it comes to investing in Canadian retail stocks we might build around the grocers. The space is dominated by a few players, so much so that it is oligopoly-like. Canadians mostly want to shop at a full service grocer. As an added benefit and layer of diversification, a few of the grocers also own the major pharmacy chains in Canada.

On that front we’ll start with Loblaws (L) that acquired Shoppers Drug Mart several years ago.

Metro (MRU) Metro is a leading food and pharmaceutical company that covers Quebec and Ontario. The brand names areMetro, Metro Plus, Super C, Food Basics, Adonis, and Premiere Moisson, as well as the pharmacies under the Jean Coutu, Brunet, Metro Pharmacy, and Food Basics Pharmacy names.

Empire (EMP.A) is a food conglomerate that operates Sobeys. Other brands and outlets include Safeway, IGA, Foodland, Farm Boy, FreshCo, Thrifty Foods and Lawtons Drug.

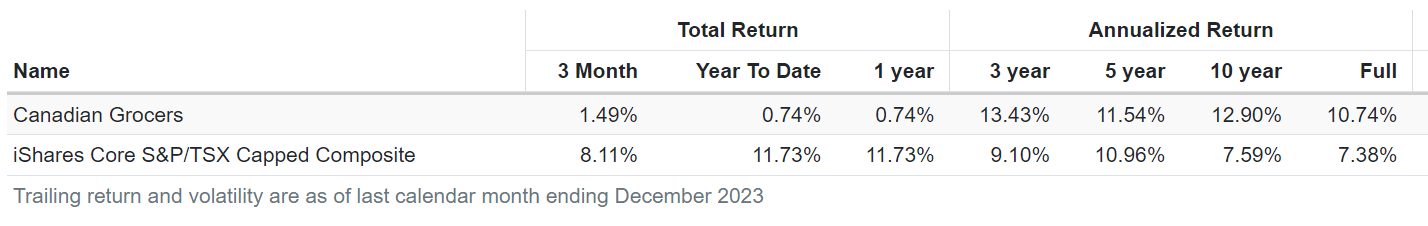

We see there is sizable and consistent outperformance.

The grocers have been wonderful Canadian retail stocks. They are less economically sensitive and are in fact pure consumer staples – we need to eat. It can be a good idea to overweight these stocks for defensive purposes, and again as part of the dedicated inflation protection. In fact they have been so profitable they faced accusations of price gouging. The accusations were shown to be unfounded. Grocery sales increased due to inflation and consumer choice. Greater earnings naturally went along for the ride. That said, margins were shown to have increased in the pharmacy operations.

Another interesting add on in this space is The Northwest Company (NWC). The North West Company caters to the needs of underserved and rural communities in Northern Canada, Western Canada, rural Alaska, the South Pacific islands, and the Caribbean. You will gain some international

diversification. It generates 75% of its revenue from food sales and the remainder from general merchandise and various offerings. This stock has been another wonderful performer. It has averaged 9.07% annual over the last ten years, beating the market by 1.4%. The stock delivered an impressive 11.23% annualized over the last 3 years. Over the last 5 years, Northwest has delivered 9.33% annual. Northwest has been a wonderful inflation stock.

Fuel up with Alimentation Couche-Tard

Alimentation Couche-Tard (ATD.B) is an incredible Canadian success story. It is one of the most international of the popular Canadian dividends stocks. From Couche-Tard:

Couche-Tard is a global leader in convenience and fuel retail, operating in 29 countries and territories, with more than 16,700 stores, of which approximately 10,800 offer road transportation fuel. With its well-known Couche-Tard and Circle K banners, it is the largest independent convenience store operator in terms of the number of company-operated stores in the United States and it is a leader in the convenience store industry and road transportation fuel retail in Canada.

Couche-Tard is a global leader in convenience and fuel retail, operating in 29 countries and territories, with more than 16,700 stores, of which approximately 10,800 offer road transportation fuel.

With its well-known Couche-Tard and Circle K banners, it is the largest independent convenience store operator in terms of the number of company-operated stores in the United States and it is a leader in the convenience store industry and road transportation fuel retail in Canada.

They also have significant presence in other regions around the globe. Couche-Tard are habitable acquirers that know how to bolt on acquisitions and feed that income and dividend stream. Here’s Mike at DSR with a quick video:

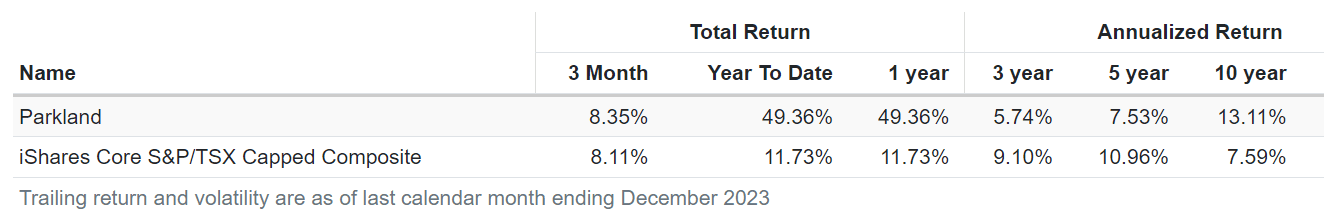

In the same space you might also look to Parkland Fuels (PKI) Parkland is a Canadian independent fuel retailing company based in Calgary, Alberta. Its subsidiaries include several gas station chains, including Pioneer, Fas Gas Plus and Ultramar.

Parkland has crushed the market over the last 10 years, though it has been an underperformer over the last 5 years.

Grab a Tims While You’re on the Road

Tim Hortons (QSR) is one of the most iconic brands and institutions in Canada. They cover every street corner across much of the country and they also have a significant presence in the U.S. northeast. They have global expansion plans in the works, including China. In fact, they are looking to open 1700 Popeyes in China over the next decade.

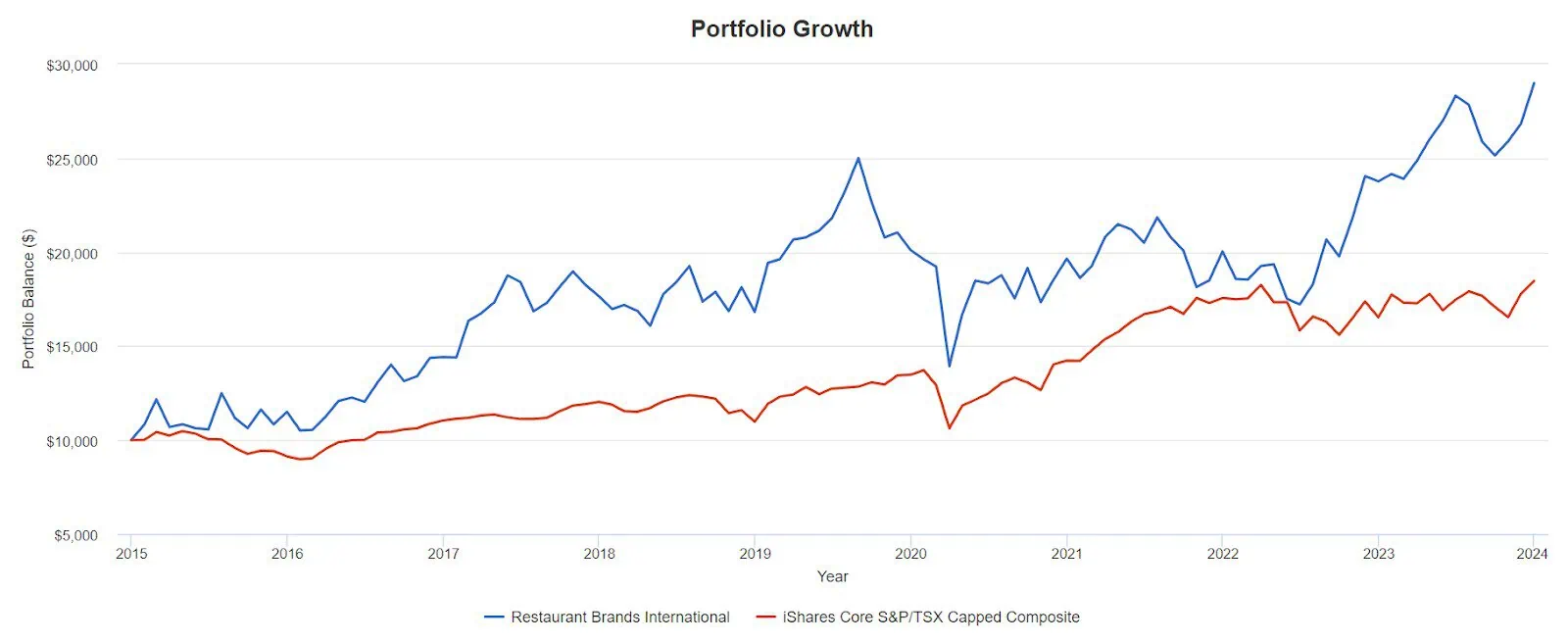

Tim Hortons is part of Restaurant Brands International. The stock offers an interesting opportunity as it is listed in Canada on the Toronto Stock Exchange, but it is more of a US focused company compared to Canadian. QSR (the ticker stands for Quick Serve Restaurant) also includes the very successful Popeyes and Burger King. They also recently acquired Firehouse Subs.

QSR has started to pour it on in recent years. Popeyes and Burger King have been serving up the growth. Firehouse Subs has been ringing up the sales as well. That was a good pick-up for QSR. Firehouse is soooooo good.

From inception in 2015 QSR has delivered 12.55% annual vs 7.06% for the TSX Composite.

Here are a few highlights from the November quarterly report.

- Revenue of $1.84B up 6.4% year over year

- Consolidated system-wide sales growth of 10.9% year over year, up $1.1 billion

- Adjusted EBITDA of $698 million increased 9.3% organically versus the prior year

Restaurant Brands International has been a wonderful performer. And the growth prospects look very encouraging.

More Iconic Canadian Brands

Most Canadians have a place in their heart for Canadian Tire (CTC.A). It is a wonderfully run business with a very strong brand. The company and stock has been surprisingly resilient over the years, they have been able to fend off competition from US and global players. It operates in the automotive, hardware, sports, leisure and housewares sectors. Its Canadian operations include: Canadian Tire, Mark’s, FGL Sports, PartSource, and the Canadian operations of Party City.

The company has delivered spectacular dividend growth over the years. CTI delivered total returns of 20.6% in 2020, 67.8% in 2021 and then fell 25.5% in 2022, and then added 3.67% in 2023. The stock was in outperformance mode but it has not recovered from the slip in 2022.

The price decline allowed a generous dividend in 2023, and now at 4.8% in early 2024. That said, sales have turned soft. In the November quarterly report Canadian tire sales were down 0.6%, Mark’s sales were down 0.2% and SporkCheck sales were down 7.4%. Earnings were down 11.4%. The Canadian consumer is reevaluating their spending plans. Discretionary stocks are coming under pressure.

You might also take a seat with Leons Furniture (LNF). The company has locations in every Province across Canada. This company has been a long-time (and surprising) Canadian success story. This company is off the radar for many Canadian dividend investors, but has been a market-beater over the longer term. It is currently at very good valuations, and it offers a solid dividend. And it is known to throw the occasional special dividend at you.

Sleep Tight with ZZZ

You might also consider the iconic Sleep Country (ZZZ), great ticker by the way. Sleep Country Canada Holdings Inc. is a Canadian mattress retailer, with over 260 stores operating in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Quebec, New Brunswick, Prince Edward Island and Nova Scotia.

The same story hit ZZZ. After a strong 2020 and 2021 the stock went to sleep in 2022. It bounced back in 2023 with a 15.7% return.

Those Loonies Can Add Up

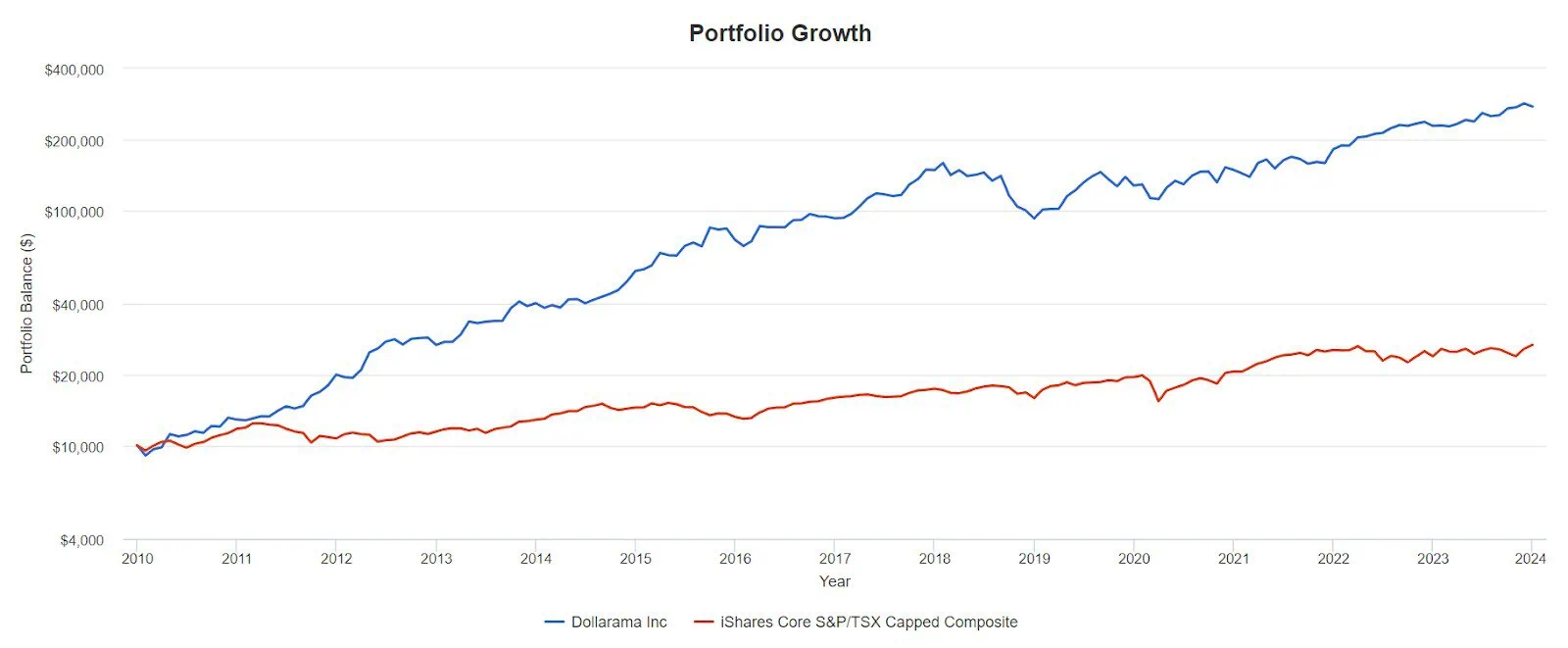

Canada has its own low budget dollar store by way of Dollarama (DOL). They’ll feed your portfolio one loonie at a time.

Dollarama is a Canadian dollar store retail chain headquartered in Montreal. Since 2009, it is now Canada’s largest retailer of items for four dollars or less. Dollarama has over 1000 stores and has a presence in every province of Canada.

While Dollarama has been on the expensive side (ironically), it has absolutely destroyed the TSX over the last decade and more.

Canadian Retail Stocks For Your Portfolio

You might also consider the success story known as Canada Goose (GOOS) and Lululemon (LULU) in the specialty clothing brand category.

This post might help you realize that while Canadian retail stocks don’t always get a lot of press, it is actually a very robust sector that has served investors well. They would pair nicely with our favourites such as bank stocks, telco stocks, utilities, energy and pipeline stocks.

Your portfolio could likely benefit by investing in Canadian retail stocks. It adds some wonderful layers and diversification. There’s embedded inflation protection in many of these companies. And you would have added some outperformance from the time we put these on the table at Million Dollar Journey.

You can also look to U.S. consumer staples, many of them being multinationals with global reach. In our accounts (for me and my wife) we hold Walmart (WMT), Pepsi (PEP) and Colgate Palmolive (CL). U.S. consumer discretionary stocks can add even more growth potential.

As always, look beyond Canada for greater diversification.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Great article

Can you suggest a few Canadian retail ETFs for those of us who don’t want to own a basket of stocks in this sector?

Sorry for the delay. Check out iShares XST.TO and BMO’s STPL.TO. One is Canadian, the other more international.

Much appreciate Dale