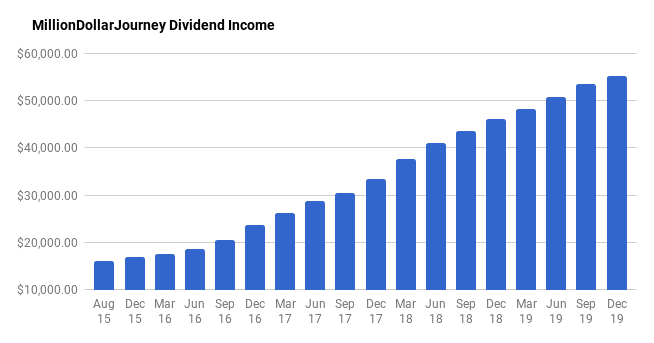

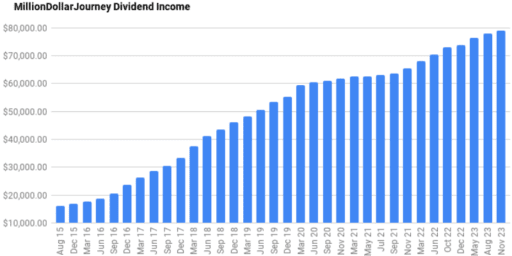

Financial Freedom Update (Q4) – 2019 Year End Update ($55,200 in Dividend Income)!

Welcome to the Million Dollar Journey 2019 (Q4) Year-End Financial Freedom Update. If you would like to follow my latest financial journey, you can get my updates sent directly to your email, via Twitter or Facebook, and/or you can sign up for the monthly Million Dollar Journey Newsletter.

For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point where they are enough to cover our family expenses. That is, our goal is to reach $60,000 in passive income by the end of 2020 (only one year remaining!).

Here is a little more detail on how we came about the $60k per year in passive income:

Financial Goals

Our current annual recurring expenses are in the $52-$54k range, but that’s without vacation costs. However, while travel is important to us, it is something that we consider discretionary (and frankly, a luxury). If money ever becomes tight, we could cut vacation for the year. In light of this, our ultimate goal for passive income to be have enough to cover recurring expenses, and for business (or other active) income to cover luxuries such as travel, savings for a new/used car, and simply extra cash flow.

Major Financial Goal: To generate $60,000/year in passive income by end of year 2020 (age 41).

Reaching this goal would mean that my family (2 adults and 2 children) could live comfortably without relying on full time salaries (we are currently an one income family). At that point, I would have the choice to leave full time work and allow me to focus my efforts on other interests, hobbies, and entrepreneurial pursuits.

The Previous Update

In the previous Q3 2019 update, we hit a major milestone in reaching our cross-over point. This is the point at which your passive income grows enough to meet (or exceed) your recurring monthly/annual expenses. In essence, it’s the point where you reach financial independence or FIRE (financial independence/retire early).

A number of years ago (in 2014) after hitting the million dollar net worth milestone, I made the switch to focus on passive income growth over net worth growth. The strategy was to leverage our wealth in pursuit of financial freedom.

While it was a slow start, the train has been building momentum over the last few years, and today, finally achieving a big milestone by generating enough passive income to meet our recurring expenses. While nailing the cross over point is satisfying, my passive-income goal of $60k will provide a bit of a buffer, and hopefully will be achieved sometime in the next 12 months.

While I plan to work in some capacity for the foreseeable future, achieving financial independence is like the ultimate financial insurance as we are a single income family.

Here is a summary of the last update:

September (Q3) 2019 Dividend Income Update

| Account | Dividends/year | Yield |

| SM Portfolio | $7,750 | 4.00% |

| TFSA 1 | $3,720 | 4.59% |

| TFSA 2 | $3,900 | 4.86% |

| Non-Registered | $3,450 | 4.26% |

| Corporate Portfolio | $24,500 | 3.87% |

| RRSP 1 | $7,300 | 2.65% |

| RRSP 2 | $2,810 | 2.31% |

- Total Portfolio Value: $1,465,526

- Total Yield: 3.65%

- Total Dividends: $53,430/year (+5.47%)

Current Update

Onto the investments – even with all the talk about a looming recession, 2019 has been kind to the markets with the TSX continuing to reach all-time highs.

While a bull market is great for net worth numbers, it also means it’s more expensive to buy quality dividend stocks. However, no matter what the market, there are always pockets of opportunities.

Personally, I like to buy quality dividend companies (and indexes) when their valuations are attractive. In other words, when they are being sold off (ie. dip). In this past quarter, I deployed capital into the following positions:

- iShares MSCI All Country World ex-Canada (XAW)

- MMM (MMM)

- Capital Power (CPX)

- Canadian National Railway (CNR)

- CAE (CAE)

- Waste Connections Inc (WCN)

As dividends are the main focus of my passive income pursuit, there is a large dependence on the market. While there are merits to this investment strategy, there are also substantial risks – particularly dividend cuts.

In 2019, there were significant cuts in two of my positions, SNC Lavalin (SNC) and Dorel Industries (DII.B). Fortunately, these were smaller positions within my overall portfolio.

The goal of the dividend growth strategy is to pick strong companies with a long track record of dividend increases. In terms of dividend increases, this year has proven to be lucrative for dividend growth investors.

In 2019, the Canadian portion of my portfolio received raises from:

- CU.TO (7.5% increase)

- RCI.B (4% increase)

- MRU.TO (11% increase)

- CNR.TO (18% increase)

- XTC.TO (6% increase)

- BIP.UN (7% increase)

- BCE.TO (5% increase)

- SU.TO (17% increase)

- GWO.TO (6% increase)

- TRP.TO (8.7% increase)

- RY.TO (4.1% increase)

- MG (11% increase)

- BNS.TO (2.4% increase)

- CAR.UN (3.8% increase)

- TD.TO (10% increase)

- CM.TO (2.9% increase)

- ATD.B (25% increase)

- PWF.TO (5% increase)

- L.TO (6.8% increase)

- CP.TO (27.5% increase)

- WN.TO (1.9% increase)

- T.TO (3.2% increase)

- H.TO (5.0% increase)

- SLF.TO (5% increase)

- NTR.TO (12.5% increase)

- BMO.TO (3% increase)

- EMP.TO (9% increase)

- CAE.TO (10% increase)

- RY.TO (2.9% increase)

- CM.TO (2.9% increase)

- BNS.TO (3.4% increase)

- FTS.TO (6.1% increase)

- EMA.TO (4.2% increase)

- SLF.TO (5.0% increase)

- T.TO (3.6% increase)

- BMO.TO (3.0% increase)

While growth in dividend income from deploying capital into new and existing positions was ongoing in 2019, dividend raises really made a difference resulting in over $1,700 in additional dividend income.

The best part is getting these raises without having to do anything! To put this in context, an extra $1,700 in dividend income is like buying $42,500 worth of dividend stocks that pay a 4% dividend. That’s an extra $42,500 that I don’t need to generate from savings!

In our overall portfolio, here are the current top 10 largest holdings (besides cash):

- iShares Core MSCI All Country World ex Canada Index ETF (XAW);

- Emera (EMA);

- Enbridge (ENB);

- TransCanada Corp (TRP);

- Fortis (FTS);

- Canadian Utilities (CU);

- Bell Canada (BCE);

- Bank of Nova Scotia (BNS);

- Telus (T); and,

- Royal Bank (RY).

As you can see in detail below, over the last quarter we have increased our dividend income from $53.4k to $55.2k which represents a 3.3% increase quarter over quarter and a 15.4% increase year over year.

With the goal of $60,000 in annual passive income, we are within 92% of our goal with 12 months to go. Assuming that things go according to plan, we should be able to surpass the $60k goal sometime in late 2020.

Here are the numbers.

December(Q4) 2019 Dividend Income Update

| Account | Dividends/year | Yield |

| SM Portfolio | $7,800 | 3.96% |

| TFSA 1 | $4,000 | 4.72% |

| TFSA 2 | $3,800 | 4.75% |

| Non-Registered | $3,500 | 4.22% |

| Corporate Portfolio | $25,200 | 3.77% |

| RRSP 1 | $7,800 | 2.59% |

| RRSP 2 | $3,100 | 2.44% |

- Total Portfolio Value: $1,541,602

- Total Yield: 3.58%

- Total Dividends: $55,200/year (+3.3%)

Through a combination of deploying cash and collecting those juicy dividend increases, this quarter has been fairly productive with a 3.3% bump in dividend income.

I welcome corrections/volatility as it gives investors in the accumulation phase a chance to buy quality companies (or index ETFs) at better prices, potentially increasing long-term returns. From what I am reading, economists are anticipating a recession within the next couple of years. But who knows, they’ve been calling for some sort of major correction since the bull market started in 2009.

If you are also interested in the dividend growth strategy, here is a post on how to build a dividend portfolio. With this list, you’ll get a general idea of the names that I’ve been adding to my portfolios.

If you want a simpler investing strategy that outperforms most mutual funds out there, check out my top ways to index a portfolio. As you can tell, I’m also a fan of indexing as the iShares XAW is my top individual holding.

Overall, 2019 has been a successful year that resulted in a 15% increase in dividend income. The $60,000 passive income goal is within throwing distance and I’m optimistic that it will be achieved before the end of the year.

All the best to you in your financial journey, and here’s to Health, Wealth and Happiness in 2020!

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

@Candba, I think anytime is a good time to start investing. However, it’s even better to start during a bear market. I will be posting an update soon (spoiler alert – I have been buying).

Thanks FT for your continuous motivation to rest of us!

Will wait for your new article!

Please share (if possible), what all you have been buying to enlighten us all here!!

Would you mind sharing more details, your totals in each account? I’ve got 975K and am receiving about 4,500.00 per quarter. I’m invested in ETF’s and dividend stocks

Hey D, if you divide the dividend total by the yield, you’ll get the account total:

December(Q4) 2019 Dividend Income Update

Account Dividends/year Yield

SM Portfolio $7,800 3.96%

TFSA 1 $4,000 4.72%

TFSA 2 $3,800 4.75%

Non-Registered $3,500 4.22%

Corporate Portfolio $25,200 3.77%

RRSP 1 $7,800 2.59%

RRSP 2 $3,100 2.44%

Total Portfolio Value: $1,541,602

Total Yield: 3.58%

Total Dividends: $55,200/year (+3.3%)

Hi FT,

Considering the recent meltdown in stock prices, do you think it could be a good time if someone wants to move into dividend investing approach?

Thanks for sharing your journey throughout!

FT,

You’re doing a great job personally. I have started following your approach and have been investing in few recommendations that i see in your investments.

Do you have a page on Do’s and Dont’s (more like rules/guidelines) while doing dividend investment/Choosing dividend stocks?

TIA

Thanks retireby45!

There is a post on how to build a dividend growth portfolio:

https://milliondollarjourney.com/how-to-build-a-dividend-growth-portfolio.htm

Otherwise, my advice would be to either index, or buy quality companies that have a history of growing their dividend. Focus on building your portfolio over the long term. For me, I rarely sell a strong dividend position (unless they cut).

Dear FT:

I noticed you have a corporate portfolio for your passive income. I was told that the tax rate for corporate is higher than individual personal rate, if the purpose of the funds in the corporate is only for the purpose of earning income/dividend/capital gains. Any comments/information/legal documents?

Thanks,

Joe

More than $10,000 in dividends is coming from the two RRSPs. Do you plan to withdraw those dividends for living expenses before age 71?

Would be interesting to see your annual expenses again. I took a gander at the previous link. Why so much insurance? Disability? Don’t you consider yourself self-insured, through this journey? I also live an approx $50k lifestyle with wife and 2 kids (Ontario). Currently yielding approx $23k in annual dividends. Goal is $25k for end of year, and $30k for FIRE (with wife continuing to work). Mostly only buying TDB8150 at 1.60% lately. Considering moving some to EQ or Wealthsimple at 2.4%. Not buying any individual securities until the big dip (assuming it ever comes).

Wow you’re so close to your goal of $60k a year. I think you totally can hit it.

We managed to receive over $23k in 2019, very happy with our progress. :)

Hello,

I have a couple of questions about SM Portfolio part of your approach.

1. In an October post, you stated you have about $145K borrowed and $7800 in income. Is that not more than 3.96% yield you listed?

2. You have the SM Portfolio listed as part of the income, shouldn’t you subtract the interest costs of the loan? Or are you accounting for that interest in the $60K yearly expenses that you need to cover? Basically, at about 4% interest rate you would have about $5K to $6K in interest. I understand you are capitalizing the interest back on the HELOC but eventually that runs out and the interest payment has to come from somewhere…

I am asking the 2nd question as I am in a similar position and want to see how you are accounting for this. Currently, my SM portfolio generates about $3K dividend over interest cost, and I use that in my total passive income number.

Hey Jawwak,

1. The yield listed is based on the market value of the portfolio, not based on the invested capital.

2. That’s a very good point. Lately, i’ve been using the dividend to pay for the interest charged by the HELOC. I do plan on paying down the HELOC to a more reasonable level (maybe around $100k) prior to pulling the trigger on retirement.

Congratulations, great update and it must be nice to head into work knowing you don’t need it! ?

Hey GYM! It certainly is nice knowing that I go to work knowing that I don’t “need” to be there to pay the bills. It also helps open up career options that pay a little less, but interesting to pursue.