Book Review – Balance: How to Invest and Spend for Happiness, Health, and Wealth

Huh… this guy really gets it – I remember thinking to myself when I picked up Andrew Hallam’s first book Millionaire Teacher back around 2011.

I mean, it was never going to be a hard sell.

There’s preaching to the choir…

…and then there’s one money-nerd personal finance teacher preaching to another money-nerd personal finance teacher.

Truthfully, I owe a lot to Mr. Hallam. When I first started gobbling up investing books back in 2010 I was gradually starting to come to my own conclusions about how the vast majority of Canadians should invest their money. The problem was that very few people at the time believed the same principles that I did.

When Andrew wrote the Millionaire Teacher it was the perfect confirmation of everything that I had been slowly putting together (and writing about) – with extensive research to back it all up. It was the perfect resource to recommend and to use in my personal finance course.

Then, years later, during an interview at the Canadian Financial Summit, Andrew explained to me some of the major benefits that come with international teaching. The expat adventure that my wife and I are currently on is a direct result of that conversation. I drew upon his book Millionaire Expat several times as I wrote Build Your Canadian Expat Pension – Taxes and Investing Away From Home.

So it was with great interest that I picked up Mr. Hallam’s latest offering! Click Here to Order Andrew Hallam’s New Book: Balance.

Four Quadrants to a Successful Life

Andrew and his wife Pele have travelled all over the globe as teachers, visitors, and philanthropists. But even more than their travels, it is their commitment to engaging in authentic discussions with folks from all places and backgrounds that gives Andrew the credibility to produce an overarching “philosophy of a successful life”.

Andrew has boiled down his decades of accumulated wisdom into “Four Quadrants”.

- Having enough money

- Maintaining strong relationships

- Maximizing your physical and mental health

- Living with a sense of purpose

He writes:

“Think of success as a four-legged table, with each leg representing a quadrant. Each quadrant depends on the other. If they don’t all play their part equally, the table collapses. If one leg is spindly or cracked, it’s tough to maximize your life satisfaction, no matter how solid you might be in the other quadrants.”

This simple representation of what leads to long-term happiness really hit home for me. I often laugh and/or shake my head at the two dominant schools of thought when it comes to the average author commenting about money:

1) I’m an investment guru and here’s how to get wealthy. The more you have, the happier you’ll be – just look at me.

2) Money doesn’t make you happy, forget about it, all rich people are secretly miserable, it’s all about [fill in some sort of ancient/re-packaged wisdom here] – just look at me.

Andrew succinctly boils down the real truth (and then proceeds to back it up with excellent research): Being rich doesn’t make you happy, but having enough money is really key to living a fulfilling life. How you define enough is unique to you.

I really appreciate that phrasing of enough money.

I’ve helped hundreds of people sort out their financial lives, and Andrew has been at this a lot longer than me. Everything that I’ve learned supports Andrew’s conclusions when he writes about how weaving financial planning and optimization into your other three “table legs” in order to live your best life.

My Overall Thoughts on Balance

I’ll give a brief overview of the major subjects that Andrew covers in just a second, but before we get to the nuts and bolts, I wanted to comment on the general “flavour” of the book.

As with any piece of Hallam writing, you definitely get reassuring in-depth research to back up the main points, but that’s only one of the key ingredients mixed into Hallam’s cooking. His special sauce is the personal anecdotes and quirky metaphors that he tosses in along the way.

You’ll read about drunk Russians putting people in headlocks, former Olympic-level swimmers now happily living out of their cars, and the time he almost slept in Warren Buffett’s garage.

In order to illustrate a somewhat-esoteric idea such as, “Should you spend on material goods vs experiences in order to bring yourself the most happiness?” Andrew will instead pose an insightful (did I mention quirky) twist resulting in your feelings on the Grim Reaper visiting you and saying, “You have one more month to live. I’m going to erase one of your memories. It’s going to be the memory of your favorite material purchase or the memory of your favorite experiential purchase”

Another example of a unique Hallam spending-for-happiness strategy is to look at your former credit card statements and ask yourself if those purchases still make you happy or if they would make their way into a campfire story.

If I had read “Balance” when I was in my early twenties I likely would have skipped past a lot of the more philosophical conclusions and went right to the investing stuff. As I’ve gotten older and asked myself some hard questions about what really makes me happy over the long-term, Hallam’s insights ring more and more true every day.

As a result, I loved the book. It is a great blending of traditional Hallam touchstones on index investing and the problems with traditional money management structures, along with all that he has learned about the intersection of wealth and life over the years.

My favourite book blurb comes from another of my favourite money personalities:

“Imagine there was a multi-verse where the most content, satisfied, happiest future version of yourself traveled back in time to give you the blueprint to lead a fulfilling life. That’s this book.”

-Preet Banerjee

“What Preet said.”

-Kyle Prevost

What You’ll Find In Balance: How to Spend for Happiness, Health and Wealth

In no particular order, here were some of my personal highlights.

- How often do you really need to upgrade all your expensive material goods? Will the new car or RV really allow you to enjoy experiences more?

- Spending more doesn’t actually make you more attractive! (Andrew has some interesting research here, but anecdotally, I feel compelled to point out that while spending more might not make you more dateable, exercising like Andrew might.)

- Saying no to high-paying jobs that could weaken the non-financial legs of your stool might be a great idea.

- Does commuting destroy your body and soul?

- Giving money to people might bring more joy than you first think. I’m thinking that for Christmas next year we’ll get together as a family and look at donating to the Kiva charity that Andrew recommends. Very cool idea.

- Some interesting reflections on gratitude. I’ve read about putting gratitude front and center from other wise authors over the last couple of years and started to implement it more. Still work to do… so thank you Andrew, I am grateful for the reminder!

- How much should parents pay for their child’s post-secondary schooling? How should parents discuss money with their children? Included is a really cool personal story about Andrew and his mom sitting down to discuss his father’s mechanic wage when he was young.

- If it’s a Hallam book, you have to replay the passive investing greatest hits. I have blatantly stolen his Upton Sinclair quote, “It is difficult to get a man to understand something when his salary depends upon his not understanding it,” several times.

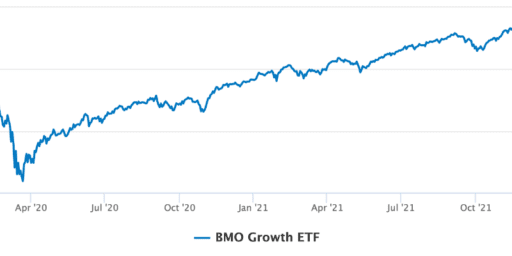

- One update to the Millionaire Teacher-style of building an index portfolio is the new comparison between a DIY ETF Portfolio, an all-in-one ETF, and using a robo advisor. It’s similar to the continuum that we explain in our article on Canada’s best all in one ETFs.

- An interesting discussion of socially responsible funds and what sustainability means in 2022.

- Notes on alternative ways to live an international life that include ideas like geoarbitrage and/or house sitting.

Interestingly there is very little insight on how to get rich quick using crypto currencies or NFTs.

I suppose Mr. Hallam must be leaving those for his next book… Unbalanced: Speculative FOMO.

Where To Find The Book Balance

The book is available for pre-order right now on Amazon for both Kindle and Paperback.

Alternatively, head to AndrewHallam.com to find out more about the book and view the first chapter for free.

Finally, you can check out my recent interview with Andrew below.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?