Best Real Estate Stocks in Canada 2024

I like the idea of owning real estate – but I don’t want the headaches of being a landlord.

If that sounds like you, then you basically have two options:

Invest in Canadian Real Estate Investment Trusts (REITs)

Or

Invest in Canadian real estate stocks.

Personally, I’m a massive fan of investing in Canadian bank stocks, and that gives me enough exposure to Canadian real estate – which is why I have three of the banks amongst my picks for best Canadian dividend stocks.

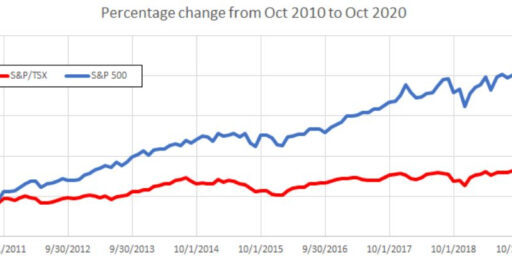

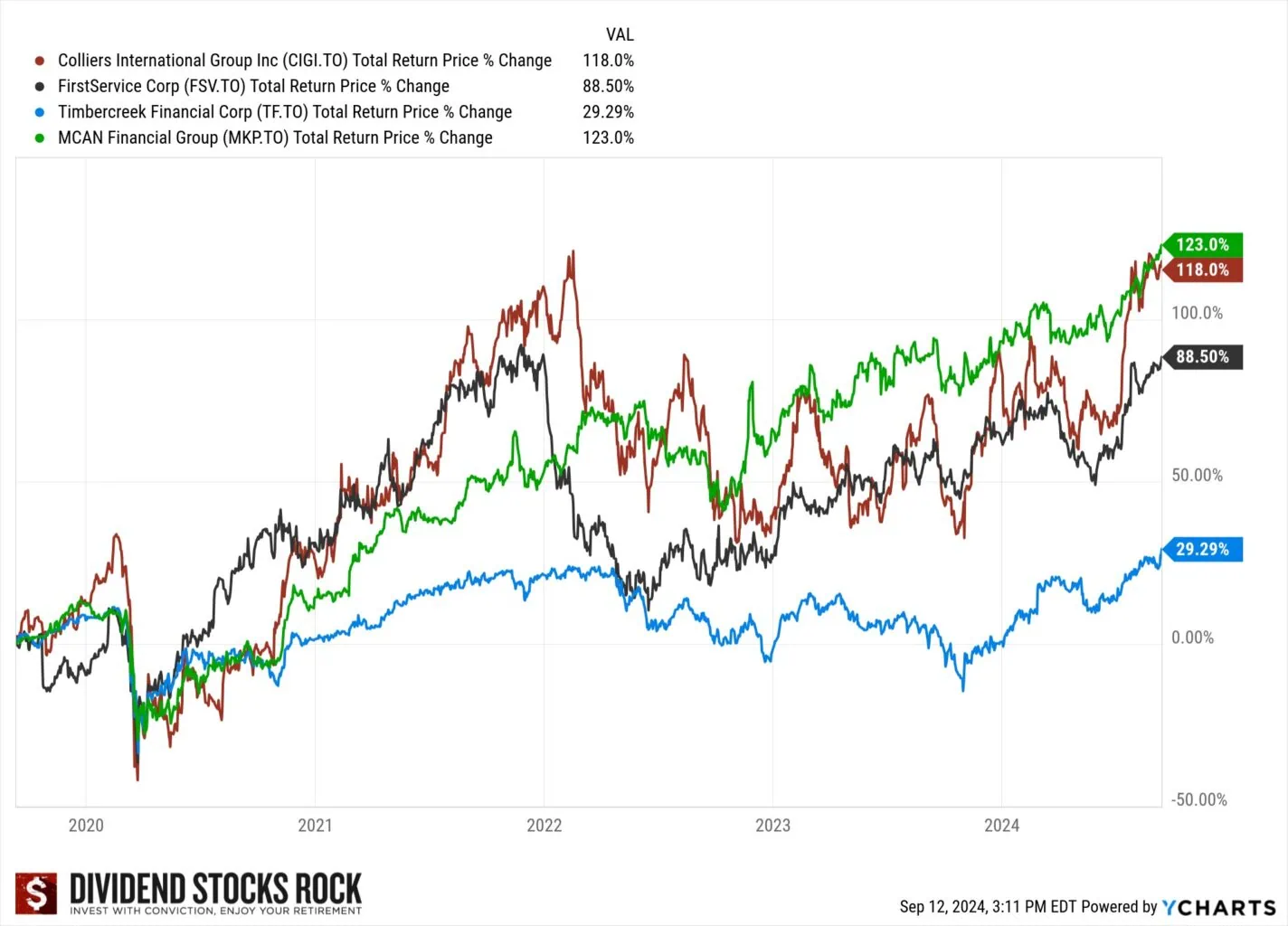

Canadian Real Estate Stocks Performance

This chart was created by Mike Heroux at Dividend Stocks Rock (DSR) – our go-to source for Canadian investing information.

Top 4 Canadian Real Estate Stocks

Below you’ll find my top contenders for the Best Real Estate Stock in Canada title. It bears repeating that these are non-REIT options. Real Estate Investment Trusts have a very specific way of generating their high dividend ratios, and some investors are looking for a different type of exposure to the real estate industry.

Name | Ticker | Price | Market Cap | P/E | Dividend Yield |

Colliers International Group | CIGI.TO | 153.28 | 6.657B | 59.62 | 0.26% |

First Service Corp | FSV.TO | 168.78 | 7.459B | 45.74 | 0.66% |

MCAN Mortgage | MKP.TO | 16.26 | 515.78M | 9.80 | 9.00% |

Timbercreek Financial | TF.TO | 8.23 | 680.44M | 16.80 | 8.38% |

?????? (Hidden, click for access) | (Hidden, click for access) | ?.??% | ?.??% | ?.??% | ?.??% |

1) Colliers International Group (CIGI)

Headquartered in Toronto, Colliers is likely a familiar name to many Canadians as their brand pops up on many real-estate related websites. The reason I have the stock sitting atop the best real estate stocks in Canada for 2024 is simply that it is more diversified than the rest of this list.

With operations in 68 countries, and services provided to real estate owners and developers from all around the world – as long as people want to buy and sell properties, Colliers will make money.

Having gone their separate ways in 2014, Colliers and First Service Corp used to be a merged company. Today, Colliers has focused on providing brokerage services to various real estate operators.

While the company has seen explosive growth over the last five years (as illustrated in the best real estate stocks in Canada chart above), it is still down nearly 20% YTD. Earnings have steadily increased by double digits over the last five years, and with the current valuation beat up due to a growth stock sell off, some experts think this might be an excellent entry spot.

Personally, as I said above, I sleep better holding bank stocks or Canadian pipeline stocks. That said, with 20% compounded growth over the last two-and-a-half decades, it’s tough to argue with the long-term track record.

2) First Service Corp (FSV)

Mostly a US-based company, (90% of revenues come from the States) FSV is a former tag-team partner of Colliers. The company’s earnings are evenly split between their twin verticals of Residential and Brands.

Much like Colliers, First Service operates on the periphery of the real estate market. They don’t own real estate directly like a REIT would. The Residential segment of the company allows operators to outsource their staff, engineering, security, and concierge operations. Brands on the other hand is more about marketing specific residential and commercial properties.

At the end of the day First Service has steady dividend growth (if unspectacular yield). Their earnings mostly trend in the right direction, but they just don’t have much of a competitive advantage moat in the highly competitive US market. While a long-term growth by acquisition strategy might work to build some efficiencies of scale, it will have to be executed perfectly.

First Service’s share price had boomed right along with everything else property-related during the pandemic, but has crashed by 34% so far YTD. Given the stability of their contracted revenue for the foreseeable future, the company will become a good value play at some point. Just don’t ask me when that will be!

3) MCAN Mortgage (MKP)

Third on our Canadian real estate stocks is MCAN Mortgage. Given my well established love for Canadian Dividend Kings you might have expected MCAN to sit atop my rankings, but alas, I’m just not sure that tasty 9%+ yield here to stay.

As a private mortgage company, MCAN takes investors money and loans it out to buyers of residential and commercial properties. This is basically a pure leveraged play on the Canadian housing market – far more so than the diversified Canadian banks.

Since MCAN passes along almost 100% of its earnings to shareholders, this is a pure yield play with very little overall share growth in the foreseeable future.

At a market cap of only $500M, it’s just too risky for my portfolio.

4) Timbercreek Financial (TF)

Timbercreek Financial is somewhat similar to MCAN Mortgage in that they are both publicly-traded niche lenders that are significantly under the $1 Billion market cap line. TF is somewhat unique in that its core focus is multi-residential properties, retail, and unimproved lands. It’s another purely Canadian play.

While that 8.5% dividend yield may have caught your eye, keep in mind that their payout ratio of over 140% doesn’t exactly scream “buy”. They are a small multi-unit correction away from having to cut that dividend substantially – and given the low growth profile, that would be drastic for shareholders of the small lender.

With both revenues and earnings trending in the wrong direction, you might be forgiven for wondering why Timbercreek is on my Canadian real estate stocks radar. The simple truth is that when you take away the large Canadian financial companies, the REITs, and the private real estate companies – there are only so many ways to split the Canadian real estate pie (as large as it is).

Best Canadian Real Estate Stock ETFs

If you’re looking to wrap up all of the best Canadian real estate stocks into the convenient packaging of an ETF, you might be a little disappointed that it doesn’t exist yet.

There are however, REIT ETFs – which might accomplish your goal of making money from the real estate market – along with instant diversification.

Check out our Canadian REIT ETFs article for more detailed information on the following Canadian REIT ETFs:

- BMO Equal Weight REIT ETF (ZRE)

- Vanguard FTSE Canadian Capped REIT ETF (VRE)

- CI First Asset Canadian REIT ETF (RIT)

- Purpose Real Estate Income ETF (PHR)

- iShares S&P TSX Capped REIT Index ETF (XRE)

Final Word on Canadian Real Estate Stocks

I’m not sure that now is the best time to be getting into Canadian real estate stocks – or REITs for that matter.

I mean, don’t get me wrong, it’s definitely a better time than it was a year ago… now that valuations have come back to non-nosebleed levels.

But that said, who knows what rising interest rates are going to do to the real estate market. While the best Canadian real estate stocks are internationally diversified, I don’t think there is going to be any geographical hiding spot from the pull back in the real estate sector.

As I said at the top, Canada’s banks give plenty of exposure to the real estate market – along with much better diversification and much wider competitive advantage moats. So that’s where you’ll find my portfolio hanging out, as opposed to in Canadian real estate stocks such as alternative mortgage lenders.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?