Best Long-Term Investments in Canada 2025

Long-term investing is one of the most powerful ways to grow your wealth. As the name implies, long-term investing means that an investor buys an asset with the intent to hold it for some time. The time frame can be years or even decades.

Over time, long-term investing has the potential to produce excellent returns due to the magic of compound interest.

While this strategy might not appeal to everyone, especially those with a high risk tolerance, it has historically proven to be an effective way to build long-term wealth, ride out market volatility and save you money on fees and other costs.

In this article, you will find out more about long-term investing, including how to choose the right investments, and what the best long-term investments are for Canadians in 2025.

Long-Term Investing = the Best Investment For The Future

A long-term investment generally refers to any asset that an investor plans to hold for at least one year. Personally, I like to consider long-term investments to be a 5+ year window.

These assets can be a number of things, such as stocks, bonds, real estate, and more. We will be taking a closer look at each option and helping you choose which one might be best for you. If you want to make money long-term, then buying and holding assets is definitely the way to go.

Mathematically-speaking, trying to time markets and get in and out of positions is a terrible idea for most people. As MDJ readers are well aware, we always recommend using a well balanced dividend stocks portfolio to maximize returns in the long run. To do so, we use a subscription service called Dividend Stocks Rock (DSR) – which makes it easier to learn more about stocks and make the right picks.

Long-term investment strategies have a lot more to do with particular goals than short-term investments. Usually the goal of a day trader, the epitome of a short-term investor, is to make as much money in a day off of market volatility and near-term gains. There are also strategies for short-term investing that include things like GICs or bonds, and high interest savings accounts.

However, long-term investment is like getting married to your investment, in that you’ll plan to stay with it through thick and thin, market gains and losses, knowing that in the end it will all pay off.

Long-term investment strategies in Canada are used to help investors reach specific financial goals, such as saving for a child’s college education, optimizing tax-free savings, as well as saving for retirement. Over time, long-term investments can indeed help you reach all of those worthy financial goals, and now, let’s look at how.

What to Look For in a Good Long-Term Investing Opportunity

There are a few key factors to consider when looking for a good long-term investment, including, but not limited to:

- Understand how much money you are willing to invest (and not have daily access to) for the long-term. As your long-term strategy will only work if you let the money sit and make gains for some period of time, you want to make sure you can live without it for at least a year.

- Decide what your goal is. Your strategy, and therefore plan, will depend greatly on your goal. If it is for saving for your child’s college education, you want to look for something that has tax benefits, and that might potentially be a bit riskier as you have 18 years to ride out some of the lows to potentially make greater gains.

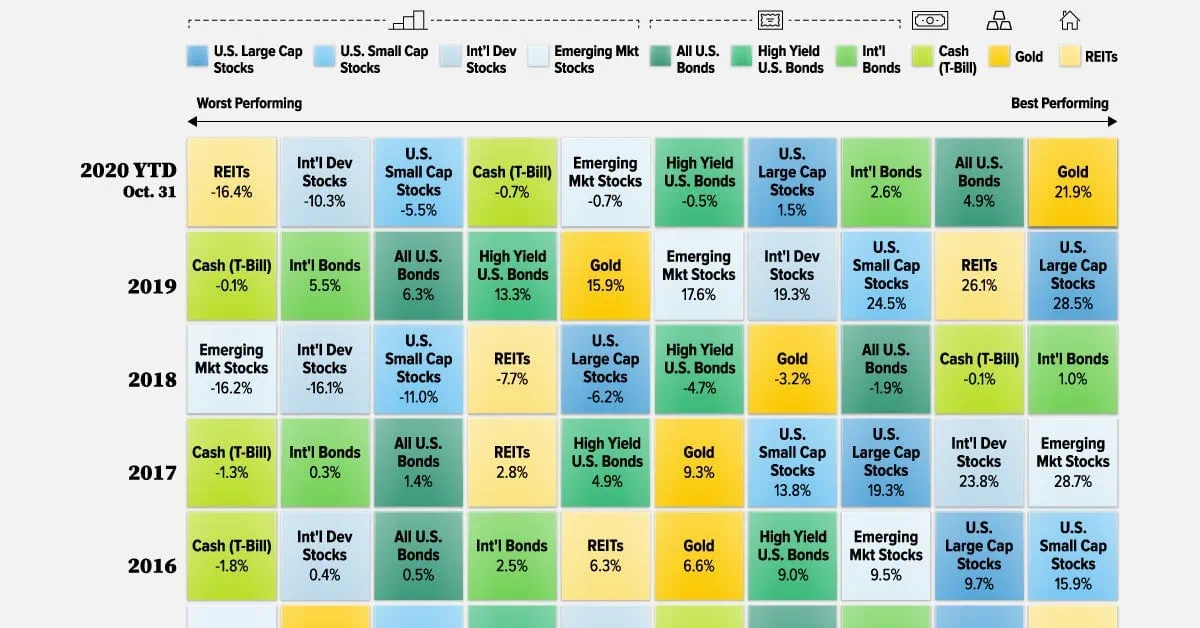

- Look for options that allow you to diversify your portfolio. As many of our readers know, diversification is key for any successful investment portfolio. When it comes to a stock portfolio for example, that means that you will look for a range of small-cap, mid-cap and large-cap companies. It also means looking to spread your investments across geographic areas as well, giving you a bit of protection during uncertain times.

- Keep costs low. If you are not using a low-cost brokerage, you’ll be taking away from gains you make over time. Pay attention to the expense ratios to help you make the most of your money.

- Get very clear on your risk tolerance. Some of your long-term investments will have greater risk-reward, which means sometimes they may appear to tank, for example, if you invest in stocks and the market takes a dive. When this happens, some investors panic and cash in, leaving potential future money on the table for when the market (almost inevitably) rebounds. To avoid these potential losses, make sure to take the time to determine your risk preference.

Taking the time to consider these factors will help you earn the highest return on your long-term investments.

Top 9 Long-Term Investment Ideas for Canadians

While we have already discussed the basics of planning your long-term investment strategy, we have yet to discuss specific methods for each of the goals you might have. In this section, we will break down some of the specific strategies you might want to use for each of your long-term investment goals.

Tax Advantaged Accounts in Canada: TFSA, RRSP, RESP

One of the benefits of certain long-term investment options available in Canada is that they are also particularly beneficial when it comes to taxes. When making any investment it is important to consider the taxes and fees, as the real ROI could end up taking a big hit once the taxes and fees have been paid.

Tax Advantaged accounts such as the TFSA and RRSP will both help you save more money in the long run. The TFSA allows for Canadains to contribute up to $6,000 per year, and you will have already paid income tax on those contributions, when you withdraw from the account later, you will not be taxed.

The RRSP on the other hand does not tax your earnings on contributions, which can be 18% of your total income (but limited at $27,230 total per year), while the money is in your account, but you will be taxed later when you withdraw funds from your account.

If you want to learn more, we also suggest reading this guide for safe withdrawal rates in Canada, or this one on withdrawing from your RRSP or TFSA for retirement.

For those planning for their child’s future, the RESP is not only a great way to make the most of your investment into their future tax-wise, as contributions are not taxed, but the Canadian government will match 20% of your contributions! While technically the money is taxed upon withdrawal, usually students’ income is so low that in the end, they will not experience any tax liability on these withdrawals.

If your main goal is to save money on taxes, these are the investment tools to use to help you reach your goal. To learn more about Canada’s tax advantaged accounts, check our TFSA vs RRSP article.

Canadian Equities for Long-Term Investment

Equities, which can be purchased as part of the tax advantaged accounts mentioned above, are a great way to build wealth over the long term. Luckily, it has become even easier for folks like us to invest in the stock market.

ETFs

Exchange Traded Funds, most commonly referred to as ETFs, are a great way to hold many slices of high performing stocks. Essentially the way ETFs work is that a given fund will hold a hundred or even a thousand different stocks, so when you purchase a share of one ETF, you can hold a hundred or even a thousand different stocks with a single purchase.

Because of their low cost and high diversification they have become quite popular for the DIY trader. As a long-term investment they are a great bet because an ETF usually holds the most high performing stocks in a given category. One of the best ETFs for long-term investing in Canada is the Canadian version of VOO, TSX:VFV, which is a US ETF that tracks the S&P 500.

Since 1957, the S&P 500 has had an annualized return of 10.67%. With the magic of compound interest, an initial investment of $1,000 would become $2,892.97 in 10 years time. That means you will have earned nearly $2,000 simply for your time and patience.

ETFs are great for those who have a bit of a moderate risk tolerance as the funds include only the highest performing companies within a given category, so you’ll feel less of a burn if even a few of the companies start to underperform.

There are a number of ETFs available in Canada that are perfect for meeting your long-term investment goals. Check out our full articles on the Best All-in-One ETFs in Canada and the 45 Best ETFs in Canada to learn more.

Our most recommended broker, Qtrade, offers free buying and selling of ETFs. Read our Qtrade review to find out more, or visit their site using the button below to enjoy our exclusive promotion.

Growth Stocks

To help you diversify your long-term investment strategy, you can consider adding high-growth stocks to your portfolio. Growth stocks are stocks that are expected to outpace the average market rate in terms of growth.

Because they are committed to growth instead of rewarding their investors with dividends, they reinvest the money into the company to fuel faster growth. Examples of growth stocks would include Shopify, Facebook/Meta, Netflix and Amazon.

If you had been lucky enough to invest $1,000 in Shopify when it first opened on the market in 2015, you would have about $54,500 worth of Shopify stock today. Now that is an impressive return.

As this is a riskier strategy, you have to be diligent in choosing a good company to invest in and be willing to weather the volatility.

Mutual Funds

Mutual Funds are usually actively managed funds, and because they are actively managed by professionals. Mutual funds usually hold about 100 different securities that are made up of a mix of stocks, bonds, and other assets. When you invest in a mutual fund, you join a group of investors who equally share in the profits and losses of the fund.

Because they are actively managed, they often charge higher fees because you are essentially paying someone to manage your portfolio. Some of the best long-term mutual funds in Canada include Ninepoint Energies Series F, TD Canadian Bond Fund – O and Mawer International Equity Series O.

We’re not big fans of mutual funds here at Million Dollar Journey due to the high costs involved. Canada has some of the highest mutual funds fees in the world, so if you’re trying to keep your money working for you, then you want to leave these investments alone. See our mutual funds guide to learn more.

Bonds

Bonds can be a safe long-term investment strategy. Bonds essentially represent loans made to businesses and governments, and those loans are paid back with interest, which is how a bond holder will earn money on their bond investment.

While they won’t necessarily give you the returns a stock might, they can give you a bit of protection against inflation. Bonds come in different shapes and sizes. There are short-term bonds, long-term bonds, and even bond ETFs, to name a few.

Short-term bonds are still a good choice for long-term investing because they mature in one to three years, which by definition makes them a long-term investment. In Canada, typically bonds yield around 2% interest annually, which doesn’t sound like much, but over time, it will add up. It’s more than you will get with most high-interest savings accounts.

Long-term bonds are, as the name implies, bonds that mature over a longer period of time than short-term bonds, maturing in 10-30 years. Because of the longer time period, your money has the potential to grow more. As an example, on average, government bonds produced an annual rate of return of 5-6%.

Finally, the option with the highest potential to earn in the greatest returns are long-term bond ETFs. Like the ETFs we have discussed before, bond ETFs are like a basket of different bonds, with each one having a particular strategy.

Using the Vanguard Long-Term Bond ETF at Market Price as an example, we can see that it has had a cumulative total return of 173.10% since its inception in 2007. That rate of return is indeed impressive, and although bonds are not always considered the most exciting way to invest long-term, the numbers speak from themselves.

Over the last couple of years, bonds have in general not been performing very well in the market, but if you look at historical data, you can see that over time, it will likely improve giving you decent returns.

Although bonds are considered a safer bet than others, they still do come with a certain amount of risk. The good news is that there is a bond type for all types of risk tolerance and adds great diversification to any portfolio.

Robo-Advisors

Robo-Advisors are a low-cost way you can build long-term wealth. Think of them as the e-version of your trusty financial advisor. Robo-advisors make it easy to automate trades as well as re-balance your portfolio.

The best Canadian Robo-advisor services are Wealthsimple, CI Direct Investing and Questwealth. Like any good financial advisor, your robo-advisor service will take the time to assess your current financial goals, your short-term and long-term goals, risk tolerance, as well as get to know if you have particular preferences you prefer, such as investing in commodities, clean energy, or tech.

After analyzing your information, your robo-advisor will offer advice and help you start your investment journey. An added benefit is that your robo-advisor will help you rebalance your portfolio as needed, ensuring that you have optimal asset class weightings, meaning that you don’t hold too much or too little of a certain asset type, protecting you if one of them happens to take a dive.

Robo-advisors are perfect for newer investors that want to invest, but do not want to make too many decisions, and who don’t feel comfortable with the whole rebalancing act, which should take place at least once a year to keep your portfolio in good health. Currently, our top pick is Wealthsimple – read the review linked above or visit their site by clicking the button below.

GICs

Several years ago, Guaranteed Investment Contracts (GICs) would not have not even appeared in this list of best long-term investments for Canadians. However, in this current economic climate, GIC rates have climbed considerably, making them a great option for the long-term.

GICs are similar to the US’s Certificates of Deposit (CD). Essentially you are making a deposit for a fixed rate of time in exchange for a higher interest rate than you would having it parked in a savings account.

The great news is that GICs are considered safe investments, and at the moment you can fetch an attractive 5.25% yield on a 1-year GIC from EQ Bank. GICs for longer periods of time can still net you more than 5% in yield – check our list of the best GICs in Canada for all the details on that.

High Interest Savings Accounts

Similar to GICs, because of rising interest rates, a high interest savings account (HISA) is now a viable option for a long-term investment.

High interest savings accounts work just like a regular savings account. The money in these savings accounts accrue interest each month. The differences between a GIC and HISA are that the interest yields for GICs are for the most part higher, but with the HISA you will be able to withdraw money from the account whenever you need and usually without a fee.

Currently EQ bank is offering a 2.50% interest yield on its Bank Savings Plus Account. For a comparison of all available options, visit our list of the best high interest savings accounts in Canada.

While both GICs and a HISA could be good options now, interest rates could change at any time. So, it’s important to take note of this and decide whether or not you could earn more in the long run by putting your money elsewhere. In our Editorial Team’s opinion, you can earn more over time with alternative investments.

Real Estate for Long-Term Investment in Canada

Real estate is one of those assets that some tout as the asset to have, and won’t even think about any other type of investment. We believe that it is certainly a valuable asset to add to your portfolio, but by no means should it be the only one.

The reason real estate is a great long term investment is because generally, it appreciates in value. For example, the average single-detached home price in Toronto has increased 14.6% year-over-year, with townhomes close behind at 10.6%.

Given that it’s relatively easy to use investing leverage when dealing with real estate, these gains can be magnified – but that leverage can also significantly add to risk, so make sure you understand what you’re getting into before jumping in!

Not only is the value of a home likely to increase, but there are a variety of ways to make money off of owning real estate, through renting, flipping, or simply buying a home and living in it for a number of years then selling it at a profit.

Of course, this type of long-term investment will require more money up front so you can make a down payment, but it will be worth it for the potential long-term gains it will provide. If done right, investing in real estate can offer you a great path towards long-term wealth. For a deeper dive, read our guide on mastering the Smith Manoeuvre or this comparison between investing in commercial and residential real estate.

REITs

If owning physical property isn’t for you due to location factors, lack of money for a down payment, or just the fact that you don’t want to deal with being a landlord, you can invest in Real Estate Investment Trusts (REITs).

A REIT can be purchased just like any other equity through your brokerage account and allows you to own shares of a trust that holds real estate assets, so you can benefit from the appreciation of those assets without having to deal with any of the hassles that might come with owning real estate.

Many REITs also pay dividends, so as the value of your REIT investment goes up, you’ll also be benefiting financially from the dividend payments you’ll get. There are a number of popular REITs in Canada, and you can learn all about them in our article Investing in Canadian REITs.

Real Estate Crowdfunding

Another option for those that just don’t want to own actual real estate is by getting into real estate crowdfunding. This is a relatively newer long-term investment strategy, but one that has gained popularity due to its accessibility and decent yields.

By investing in a real estate crowdfunding project, which you can do in Canada through platforms such as NexusCrowd, addy Invest and RealStarter, you will be enabling real estate developers and investors to complete big projects, and as a reward for your investment you will become a shareholder.

This is a great option for those who would like a low-cost way to invest in promising real estate projects, and willing to accept a lot more risk in case the project doesn’t pan out and you lose your money. With addy Invest, you can begin with as little as $1, and some real estate crowdfunding projects are quite successful, with reported annual returns ranging from 2-20%.

Pros and Cons of Long-Term Investing

It’s always wise to look at the pros and cons of any investment strategy before choosing what is right for you.

Pros of Long-Term Investing

- Potential for higher returns with the help of compound interest, especially when dividends are reinvested.

- Fewer transactions means lower fees, saving you hundreds or more over time.

- You’ll have a portfolio that is diversified, which is always something to aim for when it comes to investing.

- You have time to ride out market volatility.

- In many places, long-term capital gains will be taxed at a lower rate, saving you money.

Cons of Long-Term Investing

- There is a risk of capital loss due to market uncertainty and volatility.

- Losing out on other potential investment opportunities because your capital will be tied up.

- Market underperformance could mean you end up with less of a return on your long-term investment than planned.

While there are some definite cons to consider, when compared to short-term investments, long-term investments have historically won out the vast majority of the time.

Long Term Investing in Canada FAQ

Final Thoughts

When deciding whether or not a long-term investment strategy is right for you, it’s important to consider your risk tolerance, and whether or not you can stick to an investment strategy through tough market conditions.

The fact is that long-term investments tend to outperform short-term investments, even those made by so-called financial experts.

For those looking to use their investments for future retirement, long-term investing makes perfect sense. Long-term investments have excellent potential to provide you with a stream of income that will keep you financially secure for years to come.

Not only that, it will save you money on fees and taxes, as well as make it easier for you to ride out volatile market conditions when compared to short-term investing.

However, if you get a bit uncomfortable holding onto investments when the market is down, or prefer to have more liquidity so you can be open to opportunities that may come your way, long-term investing might not be the right fit.

To find out more about ETFs, which are excellent options for long-term investments, check out the Best ETFs in Canada. If the idea of owning a piece of real estate is more appealing to you, check out the Best Real Estate Stocks in Canada.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?