Best Canadian Online Brokers – January 2026

As the temperatures start to dip downward, it’s clear that Canada’s best online brokerages are in a battle that just keeps heating up. The big news for Canadian DIY traders this past week was that Qtrade (our #1 rated online broker) just made stock and ETF trades 100% free. They’ve eliminated all charges on trades on the Toronto Stock Exchange, AND they got rid of their quarterly account fees too.

When you pair the incredible run the Canadian, American, and international stock markets have been on, with this cost-free investing movement, you get a golden age for Canadian investors (despite all the tariff bluster).

After nearly twenty years of tracking this space, I’ve seen every “limited-time offer” and pricing gimmick under the sun. I also keep active accounts at every major brokerage, which gives me a firsthand look at what’s actually improving and what’s still driving investors crazy. Combine that personal experience with hundreds of reader emails and comments each year, and you can see why I have a good handle on the 2026 best online brokerage rankings.

My updated rankings dig into the top Canadian brokerages including: Qtrade, TD Direct Investing, RBC Direct Investing, Scotia iTRADE, CIBC Investor’s Edge, Questrade, Wealthsimple, and National Bank Direct Brokerage. We’ll look at how these top online brokers stack up when it comes to free trading, platform user experience, account options, cash-back promo offers, and customer service.

Top Online Brokers in Canada Comparison

FREE to buy and sell

100% FREE

Free to buy and sell

$0 - only ECN fees

$9.99 per ETF trade

$9.99 ($7 for Active Traders)

FREE buying and selling of 80+ ETFs

$9.95 ($7.95 elite accounts)

No Available Promotion

$9.95 per ETF trade

$9.95 ($6.95 elite accounts)

No Available Promotion

$9.95 per ETF trade

$9.95

No Available Promotion

Free to buy and sell

$0 Trades

What Are The Best Canadian Trading Platforms?

The cheapest DIY investing solution in Canada is the online discount brokerage. (It certainly isn’t the big bank mutual funds!) Online brokers run the websites and apps you use to log in and trade your own investments.

Whether it’s stocks, ETFs, bonds, or even more advanced options trades – these platforms are your gateway to buying your own investments. Most Canadians stick to the basics like index ETFs or blue-chip stocks, but online brokerages give you access to just about every type of investable asset out there.

Fast forward to today and most trades are under $10 – or even free – and you can buy or sell directly from your phone or desktop in seconds. As you see in the online brokerage comparison above, Canadians have more choices than ever, and the fees have never been lower.

Just a quick note: Throughout this article, I use the terms “online broker,” “online brokerage,” “stock trading app,” and “discount brokerage” pretty much interchangeably. They’re all talking about the same thing – the platforms Canadians use to invest on their own and keep more of their returns by cutting out unnecessary fees.

Best 2026 Broker Promo

Up To $2,000 Cash Back + Unlimited Free Trades

Open an account with Qtrade and get the best broker promo in Canada: 5% cash back when you fund a new account!

The offer is time limited - get it by clicking below.

Must deposit/transfer at least $1,000 in assets within 60 days. Applies to new clients who open a new Qtrade account by January 5, 2026. Qtrade promo 2025: CLICK FOR MORE DETAILS.

Our 2026 Stock Broker Choices

Picking the best online brokerage account for your individual needs and tastes isn’t an exact process. There are just too many variables involved to definitely say. “This is the Best Canadian Broker for every single person.” Hence, we go into great depth with our Canadian trading platform reviews, and designate each broker for the type of customer that could benefit most from using it.

With that being said, we have 4 ranking pillars that we use to determine the quality of each of Canada’s discount brokerages:

- Stock and ETF trading Fees

- Brokerage Accounts Fees

- Quality of Customer Service

- Promotions and Bonuses

Qtrade Direct Investing – MDJ’s Top Canadian Broker

When you add the new free trading and complete slash-and-burn of account fees (aka “inactivity fees”, to Qtrade’s outstanding platform and customer service, there is no doubt who the best online broker in Canada is for 2026. That said, as always, we’ll be paying attention to our comment boards and inboxes in order to implement any real-time feedback we get from the Million Dollar Journey community.

But don’t just take our word for it… longtime Canadian personal finance veteran, Rob Carrick of the Globe and Mail says that:

No other broker is good in so many different areas and no other broker makes such consistent year-by-year improvements.

Qtrade’s commitment to innovating additional value to their platform – while keeping the site incredibly user-friendly for both new investors and veterans – means that Qtrade has actually expanded its lead over the last few years. That they’ve been able to consistently deliver such an elite product (while now also cutting fees to $0) has allowed the broker to continue to set that value bar higher and higher.

Not only is Qtrade my top overall brokerage pick, but right now Qtrade is running one of the best promos I’ve seen in years. Until November 26, 2025, you can get 5% cash back on deposits up to $15,000 (max $750), plus 1% cash back on larger deposits, up to a total bonus of $2,000.

If you move an account from an existing brokerage over to Qtrade – that counts – AND you can get up to $2,000 cash back if you have more money to invest or are moving a larger account over. If you’re already a Qtrade customer, you can open a new account to take advantage of this free cash back.

The only real competitor to Qtrade when it comes to offering well-rounded broker features for rock-bottom prices is Questrade. Read on to find out why we have Questrade at #2, and what types of investors might benefit more from the other trading platforms we review.

| Million Dollar Journey’s Overall Rating: | 4.9 / 5 |

| User Experience | Excellent |

| Customer Service | World Class |

| Free ETF Trading | Yes – Buy & Sell For Free |

| Trading Fees | $0 (Free Trading) |

| Minimum Balance | $1 |

| Current Promotion | 5% Cashback + Unlimited Free Trades |

| Full Review | Qtrade Review |

Qtrade Direct Investing Pros:

- Great Promo Offer – 5% Cashback + Unlimited Free Trades

- Consistently rated #1 over the past decade

- Free ETF and stock trading

- No account fees or inactivity fees

- Excellent Customer Service

- One of the best apps on the market

- Elite investor tools

- 5% Cashback + Unlimited Free Trades

Qtrade Direct Investing Cons:

- Not the absolute cheapest for options trading

Best 2026 Broker Promo

Up To $2,000 Cash Back + Unlimited Free Trades

Open an account with Qtrade and get the best broker promo in Canada: 5% cash back when you fund a new account!

The offer is time limited - get it by clicking below.

Must deposit/transfer at least $1,000 in assets within 60 days. Applies to new clients who open a new Qtrade account by January 5, 2026. Qtrade promo 2025: CLICK FOR MORE DETAILS.

Runner Up Canadian Trading Platform – Questrade

Questrade is a solid option and as of March 2025, they’ve officially joined the zero-commission trading club. That means $0 trading fees on stocks and ETFs.

With trading fees now down to $0 + ECN Fees (as well as the usual currency exchange fees when you buy stocks or ETFs on the USA stock exchanges), Questrade remains one of the lowest-cost options in Canada, making it an attractive platform for both beginners and experienced investors.

In recent years, Questrade has made significant improvements to both its desktop platform and mobile app. The upgrades have greatly enhanced usability, allowing for smoother trade execution, better portfolio tracking, and more customization for active traders. While it’s still not as sleek as some of the best brokerage platforms out there, it gets the job done efficiently, and long-time users will appreciate the refinements.

If there’s one area where Questrade has struggled, it’s customer service. During the pandemic, wait times exploded, with some customers reporting hold times of four hours or more for both chat and phone support. Email responses often took a week or longer. While they have worked to improve response times, this remains Questrade’s Achilles’ heel.

That said, if you’re not the type to rely heavily on customer support and are comfortable managing your investments independently, then Questrade’s zero-commission trading, strong platform, and solid reputation make it one of the best brokerage choices in Canada. Check out our Qtrade vs Questrade article to see how our two top choices stack up!

| Million Dollar Journey’s Overall Rating: | 4.4 / 5 |

| User Experience | Excellent |

| Customer Service | Lacking in the last 2 years |

| Free ETF Trading | Free to buy and sell |

| Trading Fees | $0 (plus ECN fees) |

| Minimum Balance | $1,000 |

| Current Promotion | $50 in Free Trades |

| Full Review | Questrade Review |

Questrade Pros:

- No Fees To Build an ETF Portfolio!

- Very Low Trade Costs (ideal for building a dividend-heavy portfolio)

- $0 Annual Account Fees

- 24-Hour Paperless Account Opening

- Globe and Mail “A” Rating + Best DIY Brokerage Website

- Good Promo Offer

- Solid USD Trading Options

- $50 in free trades for new accounts

Questrade Cons:

- Better options online for those interested in doing in-depth analysis research on stocks prior to purchase

- Customer service rating took a real hit the last couple of years – the main reason we now rank Qtrade ahead of Questrade.

- Only 2.9/5 app rating on Google Play – reviews mentioned delay in pricing on app vs desktop

TD Direct Investing – Great Platform & Best Big Bank Brokerage

TD Direct Investing is the best of the big bank brokerage options in Canada. It was the first one to open up in 1984, and it has been near the top ever since. Basically, you’re trading paying a little more in fees for arguably the best trading platform in Canada – at least for desktop users. While their mobile app isn’t the best, it is also a very good product and overall user reviews are very positive.

If you already bank with TD, or if you know you are going to make a lot of use of their excellent trading platform, then signing up with TD Direct Investing is probably a good idea. Rob Carrick from the Globe and Mail loves TD Direct Investing as he thinks their platform is the most user friendly, and likes the various types of tools that investors get access to.

It’s important to note that the mobile app TD Easy Trade is NOT the same thing as TD Direct Investing, although you can access your accounts from either one. TD Easy Trade’s direct ancestor was the TD GoalAssist platform. That mobile investing app often gets significantly lower scores than the desktop platform.

If TD were to really embrace free ETF trades, they could start challenging for the top spot. If you want the safety and security (as well as the obvious convenience) of keeping all of your assets under the umbrella of one of Canada’s big banks, TD Direct Investing is a great choice.

| Million Dollar Journey’s Overall Rating: | 4.2 / 5 |

| User Experience | Excellent |

| Customer Service | Very Good |

| Free ETF Trading | $9.99 per ETF trade |

| Trading Fees | $9.99 ($7 for Active Traders) |

| Minimum Balance | None – But fees apply to accounts holding less than 15K |

| Current Promotion | None |

| Full Review | TD Direct Investing Review |

TD Direct Investing Pros:

- One of Canada’s most trusted financial companies

- Easy and convenient if you already bank with TD

- Modern, easy to use platform

- Good amount of account options to choose from

TD Direct Investing Cons:

- Higher trading fees, ETFs in particular

- Very high account fees unless you maintain a $15K balance

BMO InvestorLine – Solid If Unspectacular

Much like their fellow big bank cousins, BMO InvestorLine is a perfectly serviceable brokerage option – it’s just not your best bet. The $9.95 per trade fees, as well as various account fees just make it too pricey to take the top spot.

That said, if convenience is your main goal and you want to keep all of your banking and investing services under one roof, then BMO’s broker can do everything that you need it to. If you have a large portfolio to invest, BMO will also lessen the account fees that you’ll have to pay.

One place BMO InvestorLine stands out amongst the big banks is that they do have 80 ETFs that they allow to be bought and sold for free. They are unique in this regard. Qtrade allows 100+ ETFs to be traded for free, and Questade allows all ETFs to be purchased for free (but not sold for free) – but BMO is the only big bank brokerage with this feature.

If you’re looking for a brokerage that excels at customer service and user experience though, you probably want to look in another direction. BMO ranked #13 on the latest Surviscor Canadian brokerage rankings.

| Million Dollar Journey’s Overall Rating: | 3.8 / 5 |

| User Experience | Solid – could use a refresh |

| Customer Service | Better than average |

| Free ETF Trading | $9.95 per ETF trade (aside from 80 free ETFs) |

| Trading Fees | $9.95 ($7.95 for elite accounts) |

| Minimum Balance | $0 |

| Current Promotion | None |

| Full Review | BMO InvestorLine Review |

BMO InvestorLine Pros:

- Best bank-owned broker

- Convenient option for many Canadians who bank with BMO

- Includes all major account options

- 80 ETFs that can be traded for free

- Well known and trusted company

BMO InvestorLine Cons:

- Fees are much higher than other brokers

- 3.6/5 for their mobile app

- Missing the latest information and user experiences advantages that the leading Canadian brokerages have made over the last three years.

Quebec’s Favourite Canadian Broker – National Bank Direct Brokerage

National Bank Direct Brokerage shook up the world in August of 2021 when they announced that they would be the first of Canada’s “Big Banks” to roll out commission-free purchases of not only ETFs, but also shares of Canadian stocks as well. This was a crafty move by NBDB, as the online broker has struggled to make any headway in the past, and this has garnered the a unique value proposition.

If per-trade fees are the be-all and end-all when it comes to what you need from your broker account, then National Bank Direct Brokerage is definitely worth a look. That said, there are several reasons why the broker perennially receives one of the lowest grades in Canada from many of the personal finance authorities.

NBDB does not have a mobile app of any kind yet, and its online platform leaves much to be desired when compared to the well-oiled machines that our top choices bring to the table. Finally, there are no real portfolio analysis tools or investor information sources available at NBDB, so it really is the “no frills” option when it comes to the Big Bank brokerages.

If you’re wondering how NBDB is going to make money if they don’t charge any fees, it’s important to point out that they will charge you a $100 account fee if you’re account is under $20,000, and that they will make money off currency exchange when you buy stock in US Dollars, and/or when you “buy on the margin” (borrow money from National Bank in order to make investments). So don’t worry about poor old National Bank – they’ll still do just fine!

| Million Dollar Journey’s Overall Rating: | 2.8 / 5 |

| User Experience | Lacking – Bad platform and no mobile app |

| Customer Service | Mediocre at best |

| Free ETF Trading | Free buying and selling of ETFs |

| Trading Fees | $0 for Canadian or US stock trades |

| Minimum Balance | $0 |

| Current Promotion | None |

| Full Review | National Bank Direct Brokerage Review |

NBDB Pros:

- No Fee Trades

- Good bricks-and-mortar presence if you live in Quebec

NBDB Cons:

- No Mobile App

- No Portfolio Analysis Tools

- $100 Account Fee

- No Sign Up Promotions

- Poor Overall Platform Rating

- Onboarding Process is Labour Intensive

Other Canadian Online Brokers

Even though Qtrade and Questrade are practically neck and neck for the title of the best online broker, and BMO represents the best compromise option when it comes to using a discount broker that Canadians are familiar with, that doesn’t mean they are the only viable choices. Luckily, we Canucks have plenty of good options available if you want to see if there is a better fit.

Read on to find out a little more about “the best of the rest”, including what we like and dislike about each of the other trading platform options in Canada. We also have detailed reviews for all of those companies which will be linked from the relevant part of text – so if you want to learn more about a specific one you can simply click the review link and get all the added info you need.

RBC Direct Investing – 2nd Best Mobile App (After Qtrade)

As mentioned above, all of the big banks trading platforms are quite comparable and could all be classified as ‘elite products’. The biggest upside is of course the fact that if you already bank with them, opening a brokerage account with a specific bank becomes easier and much more convenient. In that regard, RBC is no different.

RBC Direct Investing offers you the same trade-off as other big banks do – you pay higher fees and in return enjoy an excellent platform and a lot of account options to choose from. In RBC’s case, their biggest advantage is their mobile app, which has the best ratings out of all the options listed on this page.

| Million Dollar Journey’s Overall Rating: | 3.9 / 5 |

| User Experience | Excellent |

| Customer Service | Good |

| Free ETF Trading | $9.95 per ETF trade |

| Trading Fees | $9.95 ($6.95 elite accounts) |

| Minimum Balance | $0 |

| Current Promotion | None |

| Full Review | RBC Direct Investing Review |

RBC Direst Investing Pros:

- User friendly, advanced platform

- Fantastic mobile app

- Easy to set up if you bank with RBC

- Safe and trustworthy company

RBC Direct Investing Cons:

- Much higher fees compared to other online brokers

CI Direct Investing – Competitive Fees + Best Brokerage for Canadian Expats

Formerly known as Virtual Brokers, CI Direct Investing is an excellent brokerage option for Canadian expats who are now residing overseas. The vast majority of Canada’s online brokers will not accept expat clients, so CI’s broker really distinguishes itself in this regard.

It’s also worth noting that CI is one of the biggest financial companies in Canada and the brokerage has been in the business since 2009 – so it’s not a small newcomer to the scene.

While CI has continued Virtual Broker’s tradition of having low fees, it has yet to really catch up to our market leaders when it comes to the trading platform’s user experience, as well as overall customer service.

The mobile app in particular has been much criticized. The lack of an attractive promotional offer makes it even more difficult to recommend this Canadian broker to anyone other than expats.

| Million Dollar Journey’s Overall Rating: | 3.7 / 5 |

| User Experience | Bad |

| Customer Service | Good |

| Free ETF Trading | $1.99 To Buy and $7.99 to Sell |

| Trading Fees | $1.99 – $7.99 |

| Minimum Balance | $25,000 – Only applies to non-residents |

| Current Promotion | None |

| Full Review | CI Direct Trading Review |

CI Direct Pros:

- Very competitive fees, similar to industry leaders

- Best solution for Canadian expats

- Trustworthy and safe with a long positive track record

- Great fees and platform for very active traders

CI Direct Cons:

- Not the best product for passive investors

- Platform is overall not very user friendly or nice

- Pretty basic mobile app

- No promo offers for new signups

Scotia iTrade – Excellent for Traders Who Like Scotiabank

Like most of the big banks, Scotia’s trading product is an elite one. The platform is modern and integrates very easily with all other Scotia products so you get a very good ‘all in one’ solution for your financial needs.

Scotia iTrade is particularly attractive for those who want to deposit large amounts of money and be very active with their accounts. If you do that, then it somewhat mitigates the higher fees and the overall convenience and ease of use really shines through.

Scotia’s trading fees are higher than the top brokers on this list, but are on par with all the other big banks. The only real major downside is their mobile stock trading app – it got abysmal reviews and hasn’t been updated in a long while.

| Million Dollar Journey’s Overall Rating: | 3.7 / 5 |

| User Experience | Good, except for the mobile app |

| Customer Service | Good |

| Free ETF Trading | $9.95 per ETF trade |

| Trading Fees | $9.95 |

| Minimum Balance | None |

| Current Promotion | None |

| Full Review | Scotia iTrade Review |

Scotia iTrade Pros:

- Great all-in-one solution

- Ideal for day traders

- Excellent desktop platform

- Well known and trusted company

Scotia iTrade Cons:

- Fees are much higher than other brokers

- Bad reviews for their mobile app

Editor’s Note: Still looking for more brokers? Read our reviews of HSBC, Interactive Brokers or Desjardins. All 3 are perfectly fine choices, but we failed to identify any field where they shine above the rest, and our user’s reviews weren’t stellar to say the least.

CIBC Investor’s Edge – Not Canada’s Best Online Broker

Look, not every online broker can be “one of the best in Canada.” By definition, someone has to be on the outside looking in.

At the moment, that “someone” is CIBC’s brokerage account. You can read our CIBC Investor’s Edge Review for all the details on the platform, but suffice it to say that the mediocre user experience doesn’t really justify the high account fees.

If you have the rest of your accounts at CIBC, it’s not the end of the world to also have a CIBC Investor’s Edge account. You might even be able to use that account to negotiate a slightly better mortgage rate, or get some savings account fees removed.

That said, there is just no denying that while IE’s per-trade fees are competitive, those annual account maintenance fees can really chew up your returns when you’re getting started with investing. The lack of any sort of free ETF trading is also a big negative in my opinion.

Finally, there is just no denying the substantial amount of negative feedback that we’ve received in the comment section of our review over the years. It’s certainly possible that a company with the resources that CIBC has (I mean… the company made $5 billion last year) could take a great leap forward at any time – but for now, Investor’s Edge ranks near the back of the discount brokerage pack.

| Million Dollar Journey’s Overall Rating: | 3.5 / 5 |

| User Experience | Average |

| Customer Service | Below Average |

| Free ETF Trading | $6.95 per ETF trade |

| Trading Fees | $6.95 |

| Minimum Balance | None |

| Current Promotion | None |

| Full Review | CIBC Investor’s Edge Review |

CIBC Investor’s Edge Pros:

- Lower fees than other big banks

- Possible to purchase fractional shares

CIBC Investor’s Edge Cons:

- High fees on ETF trading

- $100 per year account maintenance fee

- Most negatively mentioned customer service of all MDJ brokerage reviews

Wealthsimple Trade (Self Directed Invested) – You Get What You Pay For

Wealthsimple Trade (now often referred to as Wealthsimple Self-Directed Investing) is part of the ever-expanding Wealthsimple universe of products. Originally, Wealthsimple made its name as being the easiest way to access passive index-investing philosophies through their robo advisor (then called Wealthsimple Invest, and now called Wealthsimple Managed Investing).

Those days are now gone as Wealthsimple seems to turn a profit, and increase the margin on their products using strategies like payment for order flow where your trading activity where they get paid to route your orders through specific market makers. This is how they’re able to offer their “free” trades.

Furthermore, Wealthsimple really began focusing on trading cryptocurrencies through their online brokerage platform, as opposed to developing the overall user experience.

Ultimately, I feel like the company is using “free trades” to get them in the door – and then re-routing customers to more profitable ventures. I’d love to see them get back to their roots again as a consumer-educating company that operated flawless platforms.

| Million Dollar Journey’s Overall Rating: | 3.3 / 5 |

| User Experience | Lacking – Buggy Mobile App, solid website |

| Customer Service | Poor |

| Free ETF Trading | Free buying and selling of ETFs |

| Trading Fees | $0 |

| Minimum Balance | $0 |

| Current Promotion | $50 Off |

| Full Review | Wealthsimple Trade Review |

Wealthsimple Trade Pros:

- Free Trading – no fees or commissions

- Easy to open an account

- $50 is better than nothing as a sign up bonus

Wealthsimple Trade Cons:

- Customer service is lacking

- Payment for order flow is unethical

- 1.5% conversion rate on US trades

- Nudges toward high-profit areas like cryptocurrency that are bad for most people.

- No research or portfolio analysis tools

Are These Canadian Stock Brokers Safe?

The first question that most risk-averse Canadians have in regards to opening a discount brokerage account is: Are Canadian online brokers safe?

In short: YES!

Look, in a day and age when the USA’s top secret files can get hacked, it would be dishonest to say anything is 100% safe from prying eyes. That said, Canada’s online brokers have as good a safety record as any financial institution on the planet when it comes to preventing data breaches, malware, and other types of fraud.

All that to say – your money and investments are exactly as safe with an online brokerage account as they would be with any other type of investing or banking in Canada.

You can rest easy knowing that if these brokerages ever had an internet security issue, they would most assuredly be out of business quite quickly. They have incredibly strong incentives to make sure that they have the best talent in the world working hard to keep your information safe.

Common online broker security measures include the following:

- SSL encryption

- Ultra-secure servers

- Two-step authentication process when logging in

- Automatic logout

- Regular system monitoring

Of course, it’s not just up to the online broker. You need to be cautious as well. If you are investing online (or sharing any personal information online, really), you should take the following steps to better protect yourself online.

Recommended Steps

- Install anti-virus and anti-spyware programs on your computer

- Use strong passwords that are hard to guess

- Take advantage of two-factor authentication when offered

- Always be mindful of who is around when you are entering your account information. As much as possible, this should be done when you are alone at home. If you need to step away from the computer, make sure to log out first.

At the end of the day, yes, investing online does have risks, it’s not typically seen as a risky activity. As mentioned above, there are plenty of security measures in place and procedures you should be following as well. It’s really just about being smart and cautious with your personal information.

Are Qtrade and Questrade as safe as BMO, RBC, TD, CIBC, and Scotia?

Most Canadians feel pretty confident parking their money with the Big Banks. That’s fair enough, as RBC, TD, Scotiabank, BMO, and CIBC have been around for over 150 years and dominate the country’s financial landscape. Their sheer size and track record make them feel rock solid.

And yet I recommend Qtrade and Questrade at the top of my list. Are they quite as trustworthy as the heavy hitters?

It’s a fair question, especially if you’re new to online brokerages or just making your first move away from a traditional bank branch. The good news is: yes, Qtrade and Questrade offer exactly the same level of account protection as the big guys.

Both DIY investing platforms are members of the Canadian Investor Protection Fund (CIPF). That means your assets are protected up to $1 million per account type, so that’s $1 million for your RRSP, another $1 million for your TFSA, another $1 million for your non-registered account, and so on. This isn’t some extra you need to pay for, it’s built right into the Canadian financial system.

If the firm holding your investments goes under (which, to be clear, is incredibly rare), the CIPF steps in to ensure your assets are transferred or recovered. It doesn’t cover investment losses (your investments’ performance obviously can’t be insured by the brokerage), but it does protect you from a brokerage failure.

And if you’re wondering about the companies themselves…

Qtrade is owned by Aviso Wealth, a major player with over $145 billion in assets under administration and ties to Desjardins and Canada’s credit union system.

Questrade is on the verge of becoming a Schedule I bank, joining a group that includes 35 domestic banks like EQ Bank and Tangerine. The government recently issued letters patent to incorporate Questbank, which puts Questrade into the final phase of regulatory approval to offer full banking services.

So, while Qtrade and Questrade might not have the same brand familiarity as TD or BMO, the underlying safety nets are just as strong.

Now, just to be clear – none of this protects you from actual investing risk.

Your broker can guard your account from hacks, your platform can help prevent fraud, and CIPF can have your back if a firm collapses, but no one can guarantee your ETF or stock won’t drop in value.

The Canadian online broker can keep your information safe from being hacked, there are steps that can be taken to minimize vulnerability to fraud, and the CIPF will protect your assets from a company that is in trouble – but there are no guarantees when you invest in stocks, bonds, ETFs, or commodities. Again, this might be obvious to you, but you wouldn’t believe the questions that end up in our inbox sometimes!

Why did we decide to rank Qtrade above its primary rival, Questrade?

- Over the years, the inbox and comment boards at MDJ have consistently had significantly more complaints about Questrade’s customer service standards vs Qtrade’s customer service.

- While Questrade has improved its phone and line chat wait times over the last couple of years, my personal experience (as well as several 3rd-party reviewers such as Surviscor) confirms that Qtrade is still significantly ahead when it comes to both user experience and customer service.

- The current promotional offer from Qtrade is just leaps and bounds ahead of anything else out there. It’s like they took the best free trades bonus, the best cash back bonus, and the best instant money in your account bonus – and stacked them on top of each other!

- Finally, I just think that Qtrade’s overall investor education package, combined with the app and desktop platforms are a significant advantage. Both brokerages are good options, and I actually have accounts with both (I kept my old Questrade one for research purposes), but Qtrade has simply managed to out-innovate their primary rival at Questrade for several years now.

| ||

|---|---|---|

| Canadian ETFs | Yes! Free buying and selling of ETFs. | Free buying and selling of ETFs |

| User Experience | Consistently ranking #1, high availability and friendly to customers. | Has made big gains over the last three years, rated just behind Qtrade by most publications. |

| Trading Fees | 100% FREE |

|

| Research Tools and Education Materials | Has been at the top of Canadian brokerage rankings in this category for over a decade. | Made excellent gains in the last few years. |

| RESP Accounts | Available | Available |

| ECN Fees | None. | Up to $5 per trade. |

| Transfer Fees | Free Electronic Funds Transfer. Additional fee for transferring out. | Free Electronic Fund Transfers up to $50,000 CAD and $25,000 USD. Additional fees for wire transfers and transferring out. |

| promotion | 5% Cash Back + Unlimited Free Trades | $50 in Free Trades |

| Sign Up | Visit Qtrade | Visit Questrade |

Qtrade isn’t the unchallenged leader in every single category – but they have no glaring weaknesses, and absolutely shine when it comes to free ETFs, elite customer service, and unparalleled access to information and education tools. See our in-depth Qtrade Review for more information, or this Questrade vs Qtrade comparison.

The newest edition of the Globe and Mail (with the help of Dalbar Canada) 2024 discount brokerage rankings just came out and once again ranked Qtrade ahead of Qtrade, earning an A grade.

Globe and Mail authors stated that, “Qtrade has lived at the top levels of this ranking for ages because it’s always making big and small improvements.”

“Any broker can fill an order to buy stocks, exchange-traded funds, mutual funds, bonds and more. Qtrade helps you build a well-constructed portfolio and then monitor it to ensure it continues to work for you.” and, “They may be the king of steady year-by-year improvement.”

I should take a second to note that between 2009 and 2016 I was a very happy Questrade user. I still think they are a solid step above the big bank online brokers. It’s just the case that Qtrade currently offers more advantages (plus a significantly better promo offer) than Questrade. Unless you’re a big options trader, or making 50+ trades every month (without selling any ETFs), then Qtrade should be the choice.

I will say that there is one other area I have to rank Questrade #1: Funny Commercials. “You’re not still using your dad’s money guy are you?!” still gets me more often than not. Kudos to Questrade for actually injecting some real math into a 30-second spot in order to show Canadians just how much money MER fees are going to cost them when they invest in mutual funds instead of low-fee investing options.

Comparing Canadian Stock Broker Trading Fees for ETFs and Stocks

Everyone is looking for low investing fees in Canada, and there’s no doubt that online discount brokers offer the best rates relative to mutual funds and even robo advisors. But, just how much better off are you with a discount broker? Let’s take a look:

| Broker | ETF Trading Fees | ECN Fees |

| Qtrade | Free to buy or sell | $0 |

| Questrade | Free to buy and sell | Yes, Questrade charges ECN fees |

| BMO InvestorLine | $9.95 to buy and sell | $0 |

| TD Direct Investing | $9.95 to buy and sell | $0 |

| RBC Direct Investing | $9.95 to buy and sell | $0 |

| National Bank Direct Brokerage | Free to buy and sell | $0 |

When it comes to ETFs we need to remember that even though a few of the online brokers mentioned in this article offer free ETFs to buy, you often need to pay a fee to sell. This is one area that allows Qtrade, BMO, and NBDB to really shine.

Another fee that you will want to keep in mind are ECN fees. So, what exactly is an ECN fee? ECN stands for Electronic Communication Network and these fees are essentially service charges that you will pay on your trades, although they can sometimes be avoided.

You can see from the chart above what the average price of an ECN fee is for each broker. If you’re buying and selling relatively small amounts of shares, the fee won’t add up to much. However, if you’re making large Market Orders (as opposed to limit orders) and “removing liquidity from the market” – then you might end up paying something like $2-$5 per trade on a 500 share purchase or sale.

I think it’s also worth mentioning that Canada has some of the highest investment fees in the world. A Morningstar 2017 global study compared the investment fees and expenses in 25 different countries around the world. So, where did Canada fall on the scale?

At the bottom.

We paid the highest investment fees out of all the other developed countries on this list. When you read or hear stats like that, it’s really no wonder that more and more Canadians are becoming interested in taking the proverbial bull by the horns and getting into DIY investing themselves rather than paying others to do it for them. After all, the end goal is to make money – not flush it away on unnecessary expenses such as buying yachts for mega-wealthy yacht owners..

Bottom Line: If you’re a passive investor or prefer to diversify through ETFs, you really can’t beat Qtrade’s free ETF policy. If you’re more into margin trading, or want to specialize in trading options, then Questrade is worth a strong consideration as well.

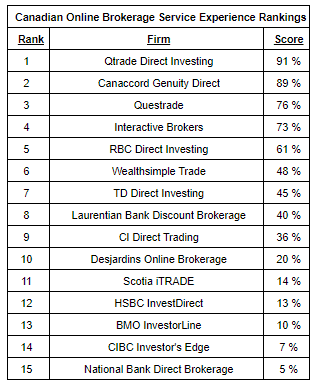

2024 Surviscor Canadian Online Broker Rankings

The new 2024 Surviscor rankings coming out for Canadian online brokers were recently released, and as expected, my preferred brokerage continue to take the top spot.

Surviscor raved about the best broker in Canada saying: “Qtrade Direct Investing provides the best customer service experience amongst Canadian Online Brokerage firms as measured by the 2024 Surviscor Online Brokerage Service Level Experience review.”

Glenn LaCoste, the Preside of Surviscor Group stated, “Congratulations to Qtrade Direct Investing for its continued service response excellence and its breadth of service interaction choices for all types of digital investors.”

Christine Zalzal, the Head of Online Brokerage and Digital Wealth over at Qtrade was happy to accept the award stating:

“What makes a great online brokerage firm for investors is not only a great online trading experience but also being supported by a great service team. At Qtrade, we’re always listening to our customers. A strong customer-focused culture is embedded into our DNA. As more Canadians explore the world of self-directed investing, we’re continuing to invest in our people and our platform to help build their confidence to build their wealth.”

Given the expertise that Surviscor has 18 years of experience in reviewing Canada’s online brokers, they have substantial credibility with the space. The data is the culmination of approximately 2,200 individual service interactions throughout the previous year.

Qtrade continued with its Surviscor Canadian online broker ranking dominance by taking the #1 spot in the 2024 DIY investing desktop comparison.

These rankings were released right at the end of 2024, and Surviscor confirmed my personal opinion that Qtrade’s online desktop platform is simply the best when it comes to user experience and investor education. My preferred brokerage continues to impress with new innovation each year.

2024 Globe and Mail Carrick Canadian Online Broker Ratings

Each year The Globe and Mail’s Rob Carrick releases the 2nd best (*wink*) discussion of Canada’s online brokerages. While Rob doesn’t update his brokerage ratings throughout the year like we do, he has been writing about personal finance since almost the dawn of the discount brokerage platform in Canada, so his expertise is well known.

Here’s what he had to say about Qtrade in 2024:

Grade: A

For commissions at a flat $8.75, this consistently top-ranked broker gives you one of the better websites and apps for looking after your investments.

More than many others, Qtrade has created a mini-me app that reflects the high level of utility in the website, including a quickie chart that shows portfolio results over the past year. Online, there’s a Portfolio Score tool that slices and dices your holdings to provide insights on returns, fees, downside risk, income and environmental, social and governance (ESG) factors. Unlike some brokers, Qtrade never coasts.

While many of Canada’s top online brokers go through ups and downs, Qtrade’s consistency is what sets them apart. To prove my point, here’s what Carrick had to say last year:

“As has often been the case in this ranking over the years, Qtrade Direct Investing is the broker that does it best. Other brokers beat Qtrade in specific areas like commission costs, but Qtrade’s overall goodness becomes apparent as soon as you log in and find a neat little dashboard to get you up to speed on your investments.

Qtrade’s consistently strong showing in this ranking speaks to another of its virtues, constant improvement. Other brokers get better in fits and starts, while Qtrade moves ever forward.”

The Best Brokers Mobile App in Canada

Because I have a viewer-friendly dual monitor setup – and I spend too much time at my keyboard – I don’t use my online brokerage mobile app all that often. That said, I keep up to date with the latest app updates from Canada’s brokers because it’s obviously important to a lot of readers.

A note of caution when it comes to investing apps: these apps in general are set up to make you trade more. These trades are the only way that free trading apps make money (because they are selling your “order flow” as data to other companies). Consequently, they are incentivized to get you to trade as much as possible. That’s obviously not ideal from a long-term wealth management perspective.

Qtrade doesn’t sell your order information to others, and the reason I continue to rank it #1 as the best Canadian brokerage app (as well as the one I personally use the most) is that it is by far the most user friendly. Your screen isn’t crowded with “tips” and “features” that are basically useless (as you are when using other investing apps). Qtrade’s app continues to have the best app store ratings due to their simple elegance and consistent stability.

Read our full stock broker app comparison.

2026 Best Canadian Brokerage Promo Offers

Qtrade currently has the best cash-back brokerage promotional offer on the market.

In brief – they want to pay you up to $2,000 for opening an account with them. Not just “free trades” – just cold hard cash in your brokerage account.

Details:

In order to get your cash back, the minimum you have to invest is $1,000. The good news though is that your amount of “new net assets” can be spread out amongst multiple accounts. In other words, you can put $5,000 in an FHSA, $7,000 in a TFSA, and $13,000 in an RRSP in order to hit the $25,000 threshold and max out your cash back. Alternatively, you could put all $25,000 into a TFSA if you prefer.

It’s also worth noting that if you’re transferring your money from a competing brokerage, Qtrade will rebate your transfer fees (up to $150).

Who Should Use an Online Trading Platform?

In its most simple form, there are two categories that DIY investors need to seperate all new information into.

Category 1: Things you can control.

Category 2: Things you cannot control.

Here’s the surprising part: most investors – especially beginners – spend far too much time obsessing over Category 2 and not enough time focusing on Category 1.

Category 2 includes all the noise that dominates headlines and social media – stuff like:

- How the stock market performs day-to-day.

- Whether a recession is “right around the corner.”

- How inflation fears might affect commodity prices.

While these topics may be interesting to read about, there’s just no mathematical argument that they’re useful to DIY investors. Professional money managers, with massive research teams and mountains of data, get these predictions wrong all the time. So why waste your energy worrying about things that are, frankly, out of your hands?

What you can control on the other hand is cutting down on the fees you pay in order to put your money to work for you. There is a reason why the people involved with investing money are rich – it’s because they’re taking your investment dollars home with them!

The best discount brokerages in Canada allow you to cut out all of the middle men. Gone are the days of paying $30 per trade, plus 2%+ of your entire account in order to get access to the stock market. Our top Canadian discount brokerages won’t charge you any annual fees, allow you trade ETFs for free, and have very minimal per trade commissions of $5-$8. Cutting fees isn’t just smart – it’s one of the only guaranteed ways to improve your investment performance over time.

So, what sort of tradeoffs do you have to make in time and energy in return for cutting all those fees (which add up to hundreds of thousands of dollars for many Canadians over their investing lifetime)?

Honestly, this stuff isn’t that hard. I like to say if you can pass grade nine math, you can handle your own investment portfolio.

If you’re willing to invest just an hour or two of your time to complete some initial paperwork and read the above guide on how to navigate these online brokerage platforms… then you can unlock massive savings over your investing lifetime – savings that could add up to hundreds of thousands of dollars when compounded over decades.

For me, that tradeoff is a no-brainer. Using an online brokerage account isn’t just a way to save a few bucks, it’s the most effective way to take personal control of your financial future!

Best Online Brokers for Trading and User Experience (Ranking)

To rank Canada’s best online brokerages for trading and overall user experience, I combined my own hands-on testing with feedback from the Million Dollar Journey team. I currently keep seven brokerage accounts open – one as my main investing hub, one to run my Smith Manoeuvre account out of (it was just easier to keep it all in one spot for recordkeeping purposes) and five others purely for research and comparison.

Between myself and other MDJ contributors, we’ve got active accounts at every major Canadian online broker – so we’re talking from real recent experience here, not just scraping and regurgitating Reddit comments from 4 years ago.

Adding to that personalized experience, I factor in hundreds of reader comments left on our articles each year, plus the many emails we receive detailing real-world experiences. In that sense, my process ends up a lot like what Surviscor does with their industry ratings.

After weighing costs, ease of trading, platform design, and the quality of customer service, here’s our updated ranking of the best online brokerage user experience 2025. I think it’s worth noting the big jump for TD Direct Investing, as it is now the solid #2. Rob Carrick agreed with me in his most recent brokerage rankings as well, as even had TD in the top spot. (Click the links for full, detailed reviews of each.)

- Qtrade

- TD Direct Investing

- Questrade

- BMO InvestorLine

- RBC Direct Investing

- Scotia iTrade

- National Bank Direct Brokerage

- DI Direct Investing

- CIBC Investor’s Edge

- Wealthsimple Trade

Alternative to Online Brokers in Canada: Robo Advisors

I should take a second to point out that if you really want the ultimate in low-maintenance hands-off investing (like many of my friends do) then the Wealthsimple robo advisor platform has really distinguished itself from the rest of the pack when it comes to instant portfolio solutions, and is rated our best robo advisor in Canada.

You’ll pay more in fees than you would with a discount brokers account, but it is still less than 25% of what you’d be paying with a typical Canadian mutual fund. They’ll even give you $50 cash when you open an account!

Canadian Online Broker Frequently Asked Questions

What is The Best Online Broker in Canada?

Qtrade is our overall pick for the best online broker in Canada. Their combination of low prices, elite customer service, and constant innovation is simply the best in class.

That said, the best online brokerage account for YOU is the one that you are most likely to use. So if low costs are your priority, then Questrade or Wealthsimple Trade might be a better bet.

If keeping things simple and convenient by using a big bank is your preferred banking strategy, then we recommend BMO InvestorLine, with RBC and TD coming in 2nd and 3rd respectively. See our above comparison for more detailed information.

Are Online Brokers and Buying Stocks Online Safe in Canada?

Yes. If you read the section above on all of the ways online brokers keep your investments safe, then you are likely reassured that you will not be at risk of losing money to a broker’s fraud or the brokerage going bankrupt. There are very strict Canadian regulations on all of this stuff, and being a member of the IIROC, all the Canadian discount brokerages adhere to high safety standards.

Of course, we’re discussing safety from non-investment risk factors here. Please keep in mind that there nothing any investment platform can do to protect you from inherent investment risk. Your investments can obviously go down in value, and this has nothing to do with which brokerage you choose.

What is The Best Free Online Broker in Canada?

There is no real free online broker in Canada. You are either paying account fees, trading fees, or the brokerage is selling your information to other companies in exchange for a $0 upfront fee. The closest ones to being free are NBDB and Wealthsimple Trade. You can read my guide on the free stock trading in Canada for more information.

How Do I Open a Broker Account in Canada?

While it used to involve emailing signed documents back and forth to open a brokerage account in Canada, the last few years have seen more and more brokerages adopt online signatures in order to speed the account opening process.

It’s now easier than ever to sign up with a Canadian online broker and begin buying and selling stocks online.

You simply need to input your basic personal information (including your SIN), choose your account (RRSP, TFSA, Non-registered, margin, etc.) and then use the digital sign up for the platform. Processing times can vary depending on the brokerage and the time of year.

How Much Does an Online Brokerage Cost?

How much an online broker costs is going to depend on what type of investing you want to do and what level of information you want to pay for. Online brokerages generally depend on annual account fees and trading commissions as their main fees to users.

Some brokers also have inactivity fees. You’ll see in our 2026 Canadian brokerage comparison that we reveal what each broker costs when it comes to account fees, trading commissions, and ETF commissions.

What Canadian Online Broker Has The Best Customer Service?

Qtrade consistently ranks as the best broker for customer service, followed by the big bank brokers at BMO, TD, RBC and Scotia.

Of course, it’s not easy to quantify exactly what “great customer service” looks like, but we feel confident in stating Qtrade is at the top of the Canadian brokerage rankings due to the large number of emails and comments we get at MDJ, plus our constant reviews of both Moneysense magazine’s, and the Globe and Mail’s new broker comparisons each year.

Never has customer service been more important to consumers as in 2021 as we have seen many online brokerages really struggle with 4 hours+ delays in responding to online and phone inquiries. This is one of the key reasons we decided to rank Qtade above Questrade as our overall #1 Canadian discount brokerage this year. Read our detailed Qtrade vs Questrade article for a full comparison of the two.

Which Bank is The Best For Stock Trading in Canada?

While Qtrade is our best stock trading brokerage in Canada for 2026, if you feel the need to keep your financial life simple, and stick to one of the big banks, then we recommend the BMO InvestorLine brokerages over its competitors offerings at TD, BMO, RBC, and especially CIBC.

What Portfolio Should I Build With an Online Broker?

If you want to prioritize simplicity, we recommend an all-in-one ETF, whereas if you want to prioritize cashflow we are big fans of dividend investing. Check out our article on the best dividend stocks in Canada for 2026 for more information.

Can You Buy Stocks on a Mobile App?

Yes, buying stocks on mobile apps has never been easier or more convenient. While I personally still prefer to use my desktop, the brokerages have been steadily improving their apps over the last decade.

Our #1 ranked mobile app for Canadian discount brokerages is Qtrade, but the major banks (TD in particular) have also poured significant resources into improving their usability over the last few years.

For more information on mobile trading, read our comparison of the best stock trading apps in Canada or this list of the best Robinhood alternatives in Canada.

What is a Discount Broker Margin Account?

A margin account is simply a regular non-registered trading account with one special feature: It lets you borrow money to invest.

While some people are able to use a margin account to make large gains (with the broker’s money) in a shorter period of time, we generally don’t advise people to try this type of investing.

Statistically, you’re far more likely to lose money than gain money if you’re “trading on the margin” due to fees and basic human inability to pick stocks in the short term.

What is The Best Canadian Trading Platform for Beginners?

Qtrade. When you’re just starting out as a Canadian DIY investor you want a simple intuitive platform, low fees, access to investor education resources, and great customer support in case you make a logistical error. Qtrade simply excels in exactly those areas.

What is The Best Canadian Broker For Options Trading?

Questrade or IBKR are probably the best choices for options trading in Canada, but to be honest, options aren’t really our thing.

How Do Online Brokers Make Money?

In Canada, online brokers still make most of their money through per-trade commissions. These have been coming down in recent years (and there are even a few brokerages that have almost eliminated them entirely).

In addition to these easy-to-understand fees though, brokerages also make money by charging account fees, documentation fees, and most of all, through the forex fees that they charge if you buy stocks outside of Canada in another currency. Finally, if you keep cash balances in your account, brokerages can lend that money out like a bank does.

Day Trading Platforms in Canada

We’re not big fans of day trading at MDJ. The raw data against thinking you can outsmart the market enough to cover the increased trading costs just doesn’t exist.

That said, if you want to try your hand at quickly moving in and out of investment positions, then understanding what to look for in a Canadian day trading platform could make a pretty big difference to your bottom line.

You want to look for an online broker platform that emphasizes:

- Low per-trade fees (making use of “elite tier” pricing for people who make 50+ trades per month).

- The easy ability to use leverage – along with a relatively low interest rate on said leverage.

- The ability to trade non-conventional investment products like forex, CDRs, and cryptocurrencies.

There aren’t actually that many Canadian day trading platforms that meet these criteria. Interactive Brokers is probably the one most geared toward hardcore traders who what to use CDRs to place daily (hourly?) leveraged bets on market outcomes. You can also read this comparison between Questrade and Interactive Brokers.

We still think the Qtrade vs Questrade decision is the way to go if you’re a dividend investor or index investor who wants to dabble with a “core and explore portfolio”. Qtrade’s customer service can help smooth out any unexpected mistakes, while Questrade’s slightly lower non-ETF price-per-trade has to be more heavily weighted when you’re making several trades each day.

Again, worth reiterating here that we’re more about using online broker platforms to invest for the long term and cut fees to the bone, not to use them as day trading platforms meant to squeeze out small trading gains several times per day.

Final Words of Wisdom About Canada’s Online Brokers in 2026

As we look ahead to the second half of 2026, it’s clear that the industry is undergoing significant transformations. Questrade’s pursuit of a Schedule I banking license, signals a bold move towards expanding its financial services and enhancing its offerings to Canadian investors. Meanwhile, Qtrade continues to solidify its position as the top brokerage option.

If you’re still stuck in high-fee mutual funds (or relying on outdated “advice” from someone trying to meet their sales quota), it might be time for an upgrade. The DIY investing world has come a long way in the last decade – and today’s top online brokerages make it easier than ever to take control.

Sure, markets are going to keep reacting to headlines, interest rates, and political noise. But if there’s one rule that holds steady it’s this: Consistent, long-term investing still beats sitting on the sidelines. The world’s biggest companies have a knack for bouncing back – and rewarding patient investors along the way.

When it comes to picking a platform, the big banks still dominate your chequing account – but they’ve lagged behind on the investing side. Try asking a bank branch rep about their DIY investing platform and you’ll usually get a shrug… or a pitch for some barely-competitive in-house product.

Ultimately, the choice between these brokerages should align with your individual investment goals, preferences, and comfort with digital platforms. It’s about using a platform that works with you, not against you.

When your online brokerage feels clunky, people log in less often, hesitate to contribute, and make more emotional decisions. But when the experience is seamless and intuitive? You stick with your plan, and your investments quietly compound in the background (while you enjoy the more exciting aspects of life).

If you’ve recently transitioned to a new platform or have insights about your current brokerage experience, feel free to share your thoughts. I take a fresh look at our 2026 Canadian online brokerage rankings every month, and your first-hand feedback helps me keep things as accurate as possible.

Best 2026 Broker Promo

Up To $2,000 Cash Back + Unlimited Free Trades

Open an account with Qtrade and get the best broker promo in Canada: 5% cash back when you fund a new account!

The offer is time limited - get it by clicking below.

Must deposit/transfer at least $1,000 in assets within 60 days. Applies to new clients who open a new Qtrade account by January 5, 2026. Qtrade promo 2025: CLICK FOR MORE DETAILS.

After they cut the fees to ZERO, there is only one brokerage, QUESTRADE… the rest doesn’t count.

Questrade has no commission trades and ETFs for both buy & sell as of Feb 2025.

Their customer support is still not so great if you need it. You’ll be waiting in the queue for hours and it will sometimes reset and move you back to the end of the queue. :(

Description of NBDB isn’t up to date. Platform just has been revamped and there is a mobile app too.

Scotia has 104 ETFs that can be bought and sold with no commission.

With a Questrade account, you can also get a Passiv Elite membership account for FREE.

Passiv has been very helpful for me to keep track of investment allocations and goals as well as for re-balancing purchases for the portfolio when I put new cash in.

I agree with Cheryl (below). The BMO Investorline platform used to be simple, easy to use and intuitive. Now it’s horrible, ridiculously complex, and not at all user friendly. I have had bad experiences with their phone support as well. After at least 5 years at Investorline, I’m changing.

Thanks so much for this! I’m looking for a platform that lets me buy shares inside a joint account with my spouse. Do any of these have that possibility?

Hi Elle. Pretty much all of these brokers would give you that ability.

BMO Investorline recently changed its platform and it just awful. Some minor improvements but overall clunky and hard to navigate. After 10 years I am now considering changing to another broker. Very disappoint in BMO now.

I opened three accounts with Questrade yesterday. One was a LIRA on which I messed up the application. I called their customer service line and was speaking with a rep in less than a minute. He solved the problem I had and offered to stay on the line as I filled out the account.

As always, YMMV but maybe this is a good sign?

Thank you very much for this article, it has a lot of useful information