HSBC InvestDirect Review 2025

HSBC InvestDirect Review

-

Fees and Pricing

-

Account Options

-

Customer Service

-

User Friendly Platform and App

HSBC InvestDirect Review Summary:

Our HSBC InvestDirect Review comes with a twist. Back in 2022, the Royal Bank of Canada announced plans to acquire HSBC Canada and we promised to keep you up-to-date with any further developments. Well, folks, it happened, RBC purchased HSBC and HSBC InvestDirect. The deal closed on March 28, 2024, and clients of HSBC were transferred over to RBC.

For a look back at what the product was like we’ve kept our review from before the migration.

However, now that HSBC InvestDirect is no longer an option you may be looking for a different self-directed brokerage. With our rating of 2.6/5 HSBC InvestDirect never stood up against the offerings of the best online brokers in Canada.

Our favourites are Questrade, which will give you global exposure with a great user experience, and Qtrade, which is our top-rated Canadian brokerage with free buying and selling options, excellent customer service, a great app, and an attractive promo offer.

Pros

- One of the biggest banks in the world

- Most markets and currencies to trade in

- Discounts for active traders

- Flat-rate trading fees are lower than many big banks

Cons

- $25 inactivity fee

- No commission-free ETFs

- Additional fees for trading in international markets

- Outdated platform

- Recent drop in customer service quality

What Is HSBC InvestDirect?

Here you’ll find our historical review for HSBC InvestDirect. As of April 2024, HSBC and HSBC InvestDirect no longer exist as it was bought by RBC.

HSBC (The Hongkong and Shanghai Banking Corporation) was founded in 1865. Today, it’s a multinational conglomerate and one of the largest banks in the world. HSBC is best known in Europe, the Asia Pacific region, and of course, here in North America.

HSBC InvestDirect Canada is the self-directed investment branch of HSBC allowing DIY investors to trade across 30 international and domestic markets. It stands out from other Canadian discount brokerages because it lets you trade on 30 different domestic and international markets in 10 different currencies.

In addition to the usual North American stock exchanges, HSBC InvestDirect gives traders access to markets in:

- Europe

- Asia (China, Japan, and Hong Kong)

- Australia

This makes it one of the only truly international DIY trading platforms available to Canadian investors.

Is RBC Buying HSBC Canada?

In November 2022 the Royal Bank of Canada announced plans to acquire HSBC Canada for a whopping $13.5 billion. Customers didn’t react very favorably, and with the amount of exposure HSBC has to the housing market in cities like BC and Ontario, perhaps they are right to be a bit weary.

It seems the regulatory bodies aren’t too thrilled with the idea either. In May 2023 the Competition Bureau called for input into its review of the takeover.

As of now, HSBC Canada is still HSBC. We’ll keep you updated on any developments as they arise.

2024 Update: In September 2023 the Competition Bureau of Canada approved the deal. Then in December 2023, Hon. Chrystia Freeland, Deputy Prime Minister and Minister of Finance, approved the sale of HSBC to RBC. The deal closed on March 28, 2024 and the migration of HSBC clients’ accounts took place.

Is HSBC InvestDirect Safe and Legit?

As you can imagine with a 150+ year history and a global reach, HSBC is as well-known as any of the big banks.

HSBC InvestDirect uses 128-bit encryption, firewalls, and digital certificates to help protect clients’ privacy. They also have a 100% reimbursement guarantee for victims of “fraudulent events” (subject to terms and conditions, as you can imagine).

HSBC InvestDirect’s Canadian parent company, HSBC Securities (Canada) Inc., is a member of the Canadian Investor Protection Fund as well as the Investment Industry Regulatory Organization of Canada (IIROC).

Basically, HSBC InvestDirect keeps your money as safe and protected as you would expect from a big bank.

HSBC InvestDirect Fees

While the overall fees are certainly not the best in Canada, and reviews of customer service and the platform indicate that there is much to be desired, HSBC InvestDirect is worth considering for those who have an interest in global trading.

We’ll break it all down for you as our HSBC InvestDirect review continues further down the page, but first, here’s a quick look at how their fees compare to other leading online brokers.

| ETFs | Mutual Funds | Options | Account Fees | |

| HSBC InvestDirect | $6.88 per contract/$4.88 for active traders (plus additional fees for international trading) | Over 4,000 commission-free mutual funds | $6.88 per contract/$4.88 for active traders + $1.25 per contract | A number of fees including inactivity fee, and annual RESP account fees |

| Qtrade | $6.95-$8.75 | $0 | $8.75 per contract/$6.75 for active traders + $1.25 per contract | $0 (as long as certain requirements are met) |

| Questrade | $0 ETF buy, sell at $0.01/share (min. $4.95 to max. $9.95) | $9.95/trade | $9.95 + $1 per contract | $0 monthly account fee |

| Interactive Brokers | Tiered and fixed commission pricing | Over 19,000 commission-free mutual funds | Tiered and fixed pricing, starting at $1.25 per contract | $0 monthly account fee |

If you are into options trading, cutting costs is key, and while HSBC’s fees are lower than Qtrade’s, they’re clearly not the winner here. If you haven’t gotten into the game yet, but are interested, check out our guide about options trading in Canada.

Along the same lines, if you’re a day trader, you’ll want to keep costs as low as possible, as you’ll be trading in volume. And again, HSBC isn’t your best choice.

HSBC InvestDirect ETFs and Mutual Funds

A major strike against HSBC InvestDirect is their lack of commission-free ETFs. This is an increasingly serious issue as free ETF trading is quickly becoming a standard offering in the industry.

While not enough to turn everyone away, it’s a definite turn-off for some would-be investors. Many current and would-be investors have made it clear that they’re willing to switch platforms if it means avoiding being overcharged.

In fact, Disnat (Desjardins’s online brokerage) recently eliminated trading fees on both stocks and ETFs – and they rocketed up 69 points to land the #3 spot on JD Power’s Customer Satisfaction study as a result. Our preferred online brokers at Qtrade, Questrade and BMO Investorline offer commission-free ETFs, and we consider ETF trading fees to be a serious downside for any discount brokerage.

On the other hand, while there are no commission-free ETFs, HSBC InvestDirect does offer more than 4,000 commission free mutual funds.

HSBC InvestDirect Trading Fees

HSBC InvestDirect commissions start at $6.88 for HSBC Premier and HSBC Advance clients for online and ETF North American trades, and a flat fee of HK$288 for most trades on the Hong Kong market.

Individuals who complete 150 or more trades per quarter are considered to be Active Traders, which makes them eligible for a reduced rate of $4.88 per trade on North American markets and 20% off international equity trades.

Options for both the flat rate pricing and the Active Trader pricing are an additional $1.25 per contract.

Keep in mind that additional commission fees apply for trades made on international markets. For example, trades under €25,000 made on European exchanges will incur an additional 0.50% fee. You’ll get the best rates by sticking to the North American exchanges.

Options for both the flat rate pricing and the Active Trader pricing cost an additional $1.25 per contract. Currently, more than 4,000 mutual funds are commission-free.

HSBC InvestDirect Admin and Account Fees

Administration fees can be a real deal breaker for us when we’re reviewing a discount brokerage, and in the case of HSBC InvestDirect there are quite a few to take note of. Here are just a few of the many fees HSBC InvestDirect clients encounter:

- Accounts are charged a $25 inactivity fee if fewer than three trades are made during the preceding 3 months. However, this fee will be waived if you maintain a balance of $25,000 or more in the account.

- RESP accounts have an annual $50 administration fee

- Each registered account is permitted one free withdrawal, with each additional withdrawal costing $50.

Additionally, there are fees for wire transfers, handling, document administration etc. You can find the full list of admin-related fees here.

HSBC InvestDirect Account Options

HSBC InvestDirect allows clients to hold direct-trading, registered, foreign currency, personal, and corporate accounts. Registered account options include:

- TFSA

- RRSP

- RRIF

- RESP

- LIRA/LRSP

- LIF/LRIF

It is important to note that you cannot hold US dollars in these registered accounts.

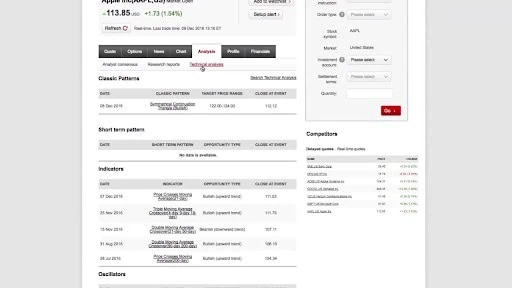

HSBC InvestDirect Trading Platform and Tools

HSBC’s online platform is pretty run of the mill, offering the basic trading tools you need to execute transactions with relative ease.

To be fair, they do have some decent research and planning resources. Their market analysis tools allow you to:

- Monitor real-time stock prices

- Analyze stock trends

- Research global economic news and trends

- Access reports

- Create your own charts and alerts

- Create and monitor your ideal portfolio with the help of HSBC’s Asset Allocation tool.

However, while they’re useful, they’re not enough to set HSBC InvestDirect apart from their competitors.

Does HSBC InvestDirect Have a Mobile App?

Finally, HSBC has joined the modern self-directed investment world by adding investment capability to its app.

Unfortunately, only iOS users will benefit from this move as it’s only available on the App Store at the moment.

That being said, it is pretty convenient for current HSBC customers, who can invest directly through the HSBC Canada app. The app itself has a solid 4.7 star rating on the App Store.

HSBC InvestDirect Review: Customer Service

HSBC InvestDirect’s customer service seems to have dropped off in the past 5+ years. Back in 2015, they scored the top rating for customer service in a report by Dalbar Canada Review.

Today, however, reviews claim that HSBC’s customer service leaves much to be desired with reports of clients waiting for as long as 73 hours to hear back from customer support. That being said, they do offer customer service in multiple languages including French, English, Mandarin, and Cantonese which may be beneficial to some clients – as long as they don’t mind waiting for it.

HSBC InvestDirect Against Cryptocurrency in 2021

HSBC made waves in April 2021 by stating that customers of InvestDirect could no longer trade the MicroStrategy (MSTR.O) stock due to its status as a “virtual currency product”.

The company’s press release stated, “HSBC has no appetite for direct exposure to virtual currencies and limited appetite to facilitate products or securities that derive their value from VCs (virtual currencies).”

This bold move ran contrary to several banks’ recent embrace of cryptocurrency and offering various Bitcoin-related product lines to customers.

By the end of 2021, HSBC spoke out in favour of CBDCs (central bank digital currencies) with several HSBC economists and officials touting them as more transparent and stable, and therefore less risky, than typical cryptocurrency such as Bitcoin. You can read the full report from HSBC Group Chief Executive for more context.

We’ll be keeping an eye on HSBC’s efforts in the field of digital currency – in the meantime, you can read our post on the best cryptocurrency apps and platforms in Canada for more information about crypto trading.

HSBC InvestDirect FAQ

Who is HSBC InvestDirect Best For?

As of April 2024, HSBC InvestDirect no longer exists so it is not an option for anyone. Even before it was sold, it was near the bottom of our list of best online brokerages in Canada because of its reportedly poor customer service and lack of free ETF trading.

For the majority of Canadian investors, Qtrade is the best option. While it may not provide the most exposure for international markets, it has a great deal of international ETFs available, and therefore can most likely offer what you need in order to diversify wisely. Check out our full Qtrade review to see why it’s our top-rated Canadian brokerage.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

HSBC has hidden charge like a scam. I buy 28.00 they purchase 28.40. And they took the profits out of it. HSBC stock platform is just a scam. Never use it.

I share the previous commentator’s views in whole!! Have called several times only to be on the phone for over 3 hours and get hang up on, or over 4 hours, then the phone goes silent. What is going on? I have also suggested call-back option. They promised that there is some changes being made for the end of March 2021. Meanwhile, I go without my much needed funds during this pandemic…which is a challenge on its own. Regrettable!! Poor, poor, poor, poor!!!

Invest Direct has a very very very very pool customer service. Try to contact within their work hours twice, waited for 1 1/2 hours, with no one answer the phone and have to give up. If you do not have the manpower, just do not let the clients waiting and have a call back option.

Just make me wonder if you are just cheating your clients.