Desjardins Review (2025 Update – Free ETFs + Stock Trading)

Desjardins Brokerage Review

-

Online Fees and Pricing

-

Account Options

-

Customer Service

-

User Friendly Platform & App

-

Inactivity Fees and ETFs

Desjardins Review Summary:

Desjardins Online Brokerage, also known as Disnat, established in 1983, is recognized as the first online brokerage. It offers investors a user-friendly, secure, and cost-effective platform for online trading. In this Desjardins review, I’ll explore the advantages and drawbacks of the Disnat platform, and provide an overview of the Desjardins app.

Additionally, I’ve put together a detailed comparison between Disnat and our leading brokerage Qtrade.

One of the standout features of Desjardins is its access to all North American securities, offering strong benefits for its users. Keep reading to see how Desjardins measures up against Canada’s best online brokers.

Pros

- All major account types available

- Free stock and ETF trading

- Better fees for young investors

- No commission on ETFs, stocks, and most mutual funds

- Plenty of perks such as events and training sessions

Cons

- Quarterly inactivity fees

- $1,000 account minimum

- Outdated & basic platform

- No promotional offer/welcome bonus or referral program

What is Desjardins Online Broker?

When it comes to Canadian online brokers, Desjardins Online Brokerage isn’t typically one of the first names that comes to mind. That being said, in the spirit of providing a full selection of broker reviews, our MDJ editorial team looked under the hood of one of Canada’s original discount brokerages.

Desjardins is best-known among those living in Quebec and Ontario; however, it’s also active in western Canada as well. It often goes by the name “Disnat” and has been around since 1982. In 1983, Disnat was the very first Canadian company to offer discount brokerage for Canadian securities.

Desjardins Online Brokerage does have some die-hard users, especially those from Ontario and Quebec, where the bank’s first locations opened. Those who do their regular banking with Desjardins may choose it as their online brokerage in order to keep all their financial services under one roof.

We still feel that they’re sacrificing quality for convenience – but we’re also keeping an eye on Disnat as recent changes have led to an increase in customer satisfaction (more on this later).

As Disnat is a platform for self-directed investors, they do not offer robo-advising. For those looking for robo advisors, check out our picks for the Best Canadian Robo Advisors.

Is Desjardins Online Brokerage Safe and Trusted?

With a pedigree that spans over 40 years, Desjardins Online Brokerage is as trustworthy as any of the major Canadian banks. The Desjardins Group itself was founded in 1900!

Disnat uses 128-bit encryption, plus industry-standard firewalls, secure session management, and 2-factor authentication. Desjardins is also a member of the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF).

While any financial investment carries some risk, Desjardins Online Brokerage works hard to ensure that any risk you incur is purely due to your personal investment decisions.

Desjardins Online Brokerage Review: Fees and Pricing

Desjardins’ pricing structure has become more competitive overall, but it has disappointingly maintained its inactivity fee, which is currently $30 per quarter. While there are ways to avoid this fee, such as making sure to complete at least 6 trades a year, holding a registered account (RESP, RRSP, RRIF, LIRA, or LIF), or having at least $15,000 in your trading account, it’s still a factor to consider.

Sure, a few leading brokers also charge some kind of inactivity fee (see our Qtrade review or Questrade review for comparison) – but those can easily be waived by buying even a single ETF.

Not only that, but leading online brokers usually have some kind of a welcome bonus. These promotions do a lot to mitigate any unexpected costs you might incur while getting yourself familiar with a new platform and experimenting, trying to find the best long-term portfolio. Unfortunately, as of this moment, Disnat does not offer any promotions to new users.

Desjardins Online Brokerage: Commission-Free Trading (ETFs, Stocks, and Mutual Funds)

No-fee ETFs are quickly becoming the standard for discount online brokerages, and now Disnat is no exception. But Desjardins went a step further and eliminated trading fees on stocks as well, joining National Bank Direct Brokerage (NBDB) to offer almost entirely commission-free trading.

The Desjardins Online Brokerage offers no-commission trading on most mutual funds, although there are some exemptions. Personally, we’re not big fans of mutual funds even as a long-term safe investment, so this doesn’t really add a lot of value in our opinion.

Commission-free trading of stocks as well as ETFs is a possible game-changer, though. It led to a surge in Disnat customer satisfaction following the announcement. Desjardins is now ranked #2 in JD Power’s Customer Satisfaction Study for self-directed investors.

We’re keeping an eye on the situation to see if we need to reconsider our assessment.

Desjardins Online Brokerage Fees: Disnat Classic and Disnat Direct

Desjardins has two different self-directed investment platforms: Disnat Classic and Disnat Direct.

Disnat Classic is for all traders, both new and experienced, but takes a more simplified approach. It’s meant for those who do a couple of trades per month. Disnat Direct, on the other hand, is for those who are more aggressive, active traders.

The commissions for stocks and ETFs, options trading, mutual funds, and fixed income securities are the same for both Disnat Classic and Disnat Direct clients, as you can see in the chart below. The difference lies in the platforms and the access to market data – which we’ll look at next.

| Commissions on online security trades | Disnat Classic | Disnat Direct |

| Equities and ETFs | $0 | $0 |

| Options | $1.25 per contract (minimum $8.75) | $1.25 per contract (minimum $8.75) |

| Mutual Funds | $0 (on most) | $0 (on most) |

| Fixed Income securities | $50 minimum commission fee/trade | $50 minimum commission fee/trade |

Disnat Platform Fees

As mentioned above, Desjardins Online Brokerage has two different platforms. Disnat Classic and Disnat Direct.

Disnat Classic is free of charge. Clients have access to real time quotes and market data on a streamlined and easy to navigate platform. It’s meant for those who want simple but modern analysis tools that won’t overwhelm them with data.

Disnat Direct is a high performance platform for those looking for more customizable options. There are three pricing options of varying capacity for watch lists and market depth of quotes. Prices at each level depend on how many trades you make per month. See the chart below for the different price points.

| Streaming Quotes Level 1 | $35/month if less than 10 trades. $0 per month if 10+ trades and the value of the portfolio is $15,000 or higher |

| Streaming Quotes Level 2 | $105/month if less than 41 trades. $0/month if 41+ trades and the value of the portfolio is $15,000 or higher |

Admin and Account Fees

Disnat account holders should be aware that Desjardins Online Brokerage has inactivity fees of $30 per quarter. These will be waived on the following conditions:

- You have made 6 or more trades in the preceding 12 months

- Your portfolio value is $15,000 or more

- You hold a registered account (RRSP, RRIF, RESP, LIRA, or LIF)

Please note that these admin and account fees are the same for both Disnat Classic and Disnat Direct clients.

Desjardins Online Brokerage Fees and Pricing Summary: How Does Disnat Stack Up?

We always encourage our readers to compare before they trade, and what we know about Desjardins has given us a lot to think about. Now that they have zero commission ETF and stock trades, it does make them more competitive compared to other online brokers. But is it enough?

Let’s take a look at how Disnat compares to Questrade and Qtrade.

| ETFs | Mutual Funds | Options | Account Fees | |

| Disnat | $0/trade | Most commission-free | $1.25 per contract/$8.75 minimum | A number of fees including inactivity fee, and account registration fee |

| Questrade | $0 ETF buy, sell at $0.01/share (min. $4.95 to max. $9.95) | $9.95/trade | $0.75 per contract/$4.95 minimum | $0 monthly account fee |

| Qtrade | 100+ free ETFs to buy and sell | $0/trade | $8.75 + $1.25 per contract, or $6.95 + $1.25 per contract for investor plus | $25 per quarter for non-registered accounts (excluding FHSA, and fee for other accounts can be waived if certain conditions are met), and $15 per quarter for US dollar registered accounts |

As you can see, just focusing on fees alone, the switch to commission-free trading has made Desjardins fairly competitive. Paying the lowest possible amount in fees can make a huge difference to your bottom line, especially if you are actively day trading.

However, low fees aren’t the only thing that makes a great DIY broker. If you’re looking for a more balanced choice with very competitive trading fees, free ETFs and a world class platform to boot, then Qtrade is still the best online broker in our books, and definitely trumps Desjardins Online Brokerage any day.

Disnat Brokerage Platform and App

Desjardin’s most popular platform, Disnat Classic, offers clients a simple and easy to use platform to trade stocks, options, bonds, mutual funds and new issues. It’s accessible online via your desktop, laptop, or mobile device. It’s relatively straightforward and intuitive, but our principal complaint is that it lacks some of the extras that other online platforms have.

Built for active investors, Disnat Direct offers more advanced trading tools, customizable charts and watchlists, and streaming market data. It’s a web-based platform, making it easily accessible from either Mac or PC.

Both platforms offer free webinar training and access to a representative by phone during business hours. However, they do not offer the wealth of research options or tools that other brokers do.

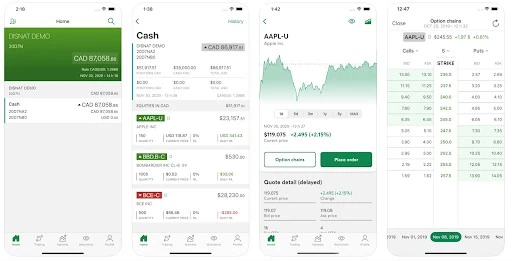

Disnat Mobile App Review

The Desjardins app seems to have been improved since our last update, currently sitting at a 4.7 star rating on the App store. Before there were multiple complaints about the app being buggy or slow, but now most reviews applaud its functionality and ease of use.

The Disnat app is also rated at 4.7 stars by Android users on the Google Play store.

When navigating the app you will be able to see an overview of all of your accounts and assets in one place, easily place orders on stocks and options, get quotes and trade immediately, access a range of market indexes and graphics, and view your watch list.

The fact that Desjardins was able to greatly improve its app shows they are committed to listening to customer feedback and doing something about it. This is always a good sign. Compared to our top investing apps though, I’d argue there is still room for substantial improvement.

Disnat Customer Service

Anyone can contact Disnat customer service via their phone line, Monday to Friday, from 8:00 am to 5:00 pm ET. The number is 1-866-873-7103.

Current customers of the online brokerage have the option to submit written queries via an online contact form.

Some users online report long waits during peak hours, but given their #2 spot in JD Power’s 2024 Canada Self-Directed Investor Satisfaction Study, they must be effectively resolving issues!

Disnat Brokerage Review: Young Investors

If you are a young investor between the ages of 18-30, you can take advantage of a special offer with Desjardins Online Brokerage. The Brokerage clients will receive:

- Transfer fees refunded up to $150

- No inactivity fees or administration fees

- No minimum balance for RRSP accounts

- No fee stock and ETF trading (CAD and USD)

This offer is for Disnat Classic, the simpler, and most popular trading platform of the 2 offerings by Disnat.

This definitely makes investing much more appealing and achievable for first time investors. We’ve got to hand it to Desjardins for giving beginners an easy and low cost way to start their investment journey.

Desjardins Online Brokerage Accounts

Desjardins Online Brokerages offers both regular and registered accounts. Most of the accounts are available for both Disnat Direct and Disnat Classic clients. Account options include the following:

- RRSP

- TFSA

- FHSA

- RESP (Disnat Classic only)

- LIRA

- RIF

- LIF

- Cash Accounts (Disnat Classic only)

- Margin Accounts

- Margin Options Accounts

- Short-selling Accounts

Beyond the above accounts, they also offer accounts for associations, cooperatives, corporations, foundations, sole proprietorships, trusts, and more.

The Desjardins Online Brokerage Prestige Program

The Desjardins Prestige Service Program is a nice little perks program for those who hold “substantial assets” with the Quebec-based bank. The basic idea is that there are two different “prestige tiers”.

- Silver: $500,000 – $999,999

- Gold: $1 Million+

As you climb the prestige ladder you can get access to elite perks such as IPO access, preferred lending rates, personalized customer service help, preferred fixed income rates, and no-fee online education events.

Overall, it’s quite similar to most “high net worth” packages that the various brokers offer. While it doesn’t have a ton of value in our view, you could see it being another checkmark in the, “I’ve always banked with Desjardins, and all things being equal, I’d prefer to keep my online broker with my other financial services” column.

Desjardins Review FAQ

Who is Desjardins Online Brokerage Best For?

My research into Desjardins Online Brokerage reveals that it provides a fairly solid DIY platform with reasonable fees. Offering access to all North American securities and an easy-to-use app makes it a good option for beginner investors, particularly those who already have a Desjardins banking account.

However, as you can tell from my review above, it’s not my top pick. The platform received only a modest C+ rating from the Globe and Mail. Desjardins doesn’t stand out among the growing number of Canadian online brokerages due to its quarterly inactivity fees, account balance minimum of $1,000, and relatively basic trading platform. They also have a limited number of perks or extras, and no promotional offer for signing up.

To learn more about my top recommended Canadian online brokerages, check out my full reviews of Qtrade and Questrade. For a deeper comparison of how these top-tier brokerages stack up, take a look at my comparison of Questrade vs Qtrade.

Desjardins is following in National Bank’s footsteps: it eliminated commissions on stocks and ETF’s.