Best Canadian Railway Dividend Stocks in 2024

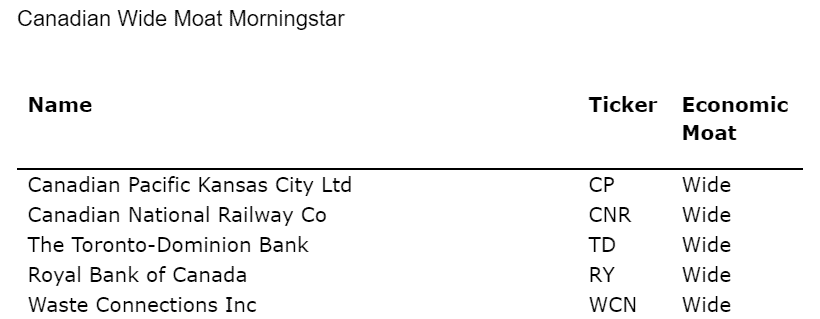

The two best Canadian railway stocks are part of an exclusive club in Canada. According to Morningstar Canada, in 2023 there were only five Canadian wide moat stocks. The list is short: RBC, TD, Enbridge, and then our two Canadian railway dividend all-stars: Canadian Pacific Railway (CP) and Canadian National Railway (CNR). The Morningstar wide moat list heading into 2024 includes RBC, TD Bank, Waste Connections and Canadian National Railway.

I would certainly suggest that when you look at the Canadian wide moat stocks, you include those railways and grocers. The oligopoly grocers were recently outlined when we looked at investing in Canadian retail stocks in 2024.

While those sectors offer a lower yield, you are likely to gain better total returns with less volatility, compared to concentration in higher-yield sectors such as Canadian pipeline stocks and Canadian telco dividend stocks.

What is an Economic Moat?

When a company is described as having a “moat,” that means it has a protective barrier, just as a moat around a castle would provide protection from invaders. A moat means a company has limited or virtually no competition. You don’t need to be Warren Buffett to figure out that no competition is good for long-term business!

Once again, in the latest Canadian Moat update from Morningstar, the two rails are in the select group of 5 names.

It’s no surprise to see the big Canadian banks which we covered last month with a look at 2024. You can read that article on the best Canadian bank stocks and compare their performance, so that you can determine which one is a better investment. I am partial to the two biggies in RBC and TD Bank. And I’d have to admit that Mike has been right about National Bank, for a long time.

When you invest in the Canadian railways you gain access to companies that have a lock on the transportation of goods across the country. They also move goods to and from the US. That’s a valuable and dependable business to be in.

While having a lock on a sector is an obvious benefit and it removes the risk of competition, it is no guarantee of investment success. There can be periods of weakness. The railways are economically sensitive companies. When the economy slows, less goods are moved around the country. In a recession, rail traffic can be greatly impaired.

For example, in the not-too-distant past, the rails were moving a lot of oil, but those volumes dropped due to the pandemic. Much of that oil supply has moved back to the pipelines. Plus, we’ve had additional pipeline capacity added, and the Trans Mountain pipeline construction process is making progress.

That said, the Canadian rail stocks are perpetual stock market beaters. Here are the rails vs the TSX 60 (XIU) from January of 2000.

So, if you also hold some of the major pipelines in Canada you’ll be picking up any lost rail business by way of those holdings. The pipelines work as a hedge for your railways. For a three-pack you might consider Enbridge, TC Energy and Pembina (one of Mike’s favourites the space). And in the chart, you’ve likely noticed the name change for CP Rail. We see the words Kansas City connected to Canadian Pacific. All aboard say many investors. From that KC announcement:

“CPKC is the combination of two historic railways – Canadian Pacific (CP) and Kansas City Southern (KCS). Today, we are CPKC and have created the first and only transnational rail network in North America. Drawing on our strong foundations and heritage, CPKC moves essential goods across our 20,000-mile network to support economic growth throughout Canada, the U.S. and Mexico.”

That’s fantastic news for Canadian investors in my opinion. We gain additional tracks and greater U.S. diversification. You can learn more about the history of Kansas City Southern in that post.

And not to be outdone, CP made its own U.S. acquisition, hooking up with Iowa Northern Railway. That adds 275 track miles that connect with CP.

Performance in the Pandemic

In addition to being some of the best long-term large cap performers in the Canadian market, the sub sector was a wonderful portfolio diversifier to hold in the pandemic period and during the 2020 stock market correction. In the following chart I have combined the two railways in equal weight fashion. It’s important to look at the entire sub sector.

What’s also interesting is that the railways have not come up short in any year over the last 5. Every year rang up positive returns.

Of course, I’m delighted to have put this subsector on the table for readers in 2018 and through 2019 and beyond. I hope you went along for the ride.

Canada’s two big railways reported quarterly and full-year earnings in January. Obviously 2023 was a challenging year, but the guidance for 2024 is quite encouraging. For CNR, revenue was down 2%, earnings down 5%, and free cash flow down 9% in 2023.

Canadian National raised its dividend by 7% in the last earnings report. A $4 billion buyback program is also in the works. Buybacks and dividends are all part of the total shareholder yield. It is the amounts that can increase your ownership of the profits (assuming you reinvest the dividends).

CNR projects 10% earnings growth in 2024. Remember, earnings and stock prices do not arrive in a straight line. We stay the course with good companies. Average analysts’ projections see modest upside.

A TD Securities action note offered that harsh weather impacted earnings (negatively) early in the year, plus …

“CN guided to ~10% EPS growth in 2024, which seems relatively full to us, and is at the high end of what we believe the Street was expecting (i.e., guidance of high-single-digit and/or up to 10% EPS growth), although it implies a marginal decline in consensus to ~$8.00 from $8.04. CN conceded that the economy remains uncertain, but is encouraged that Q4/23 volumes increased 10% sequentially, consistent with its view of a July bottom.”

They see earnings increasing from $7.28 per share in 2023 to $8.00 in 2024 and $9.17 in 2025.

CP earnings reports a revenue boost

On January 30th, CP Railway reported revenue that increased by 53.7% to $3.7 billion (Canadian). Core adjusted earnings per share increased to $1.18 from $1.14 in the same period last year. CP sees double digit earnings growth in 2024.

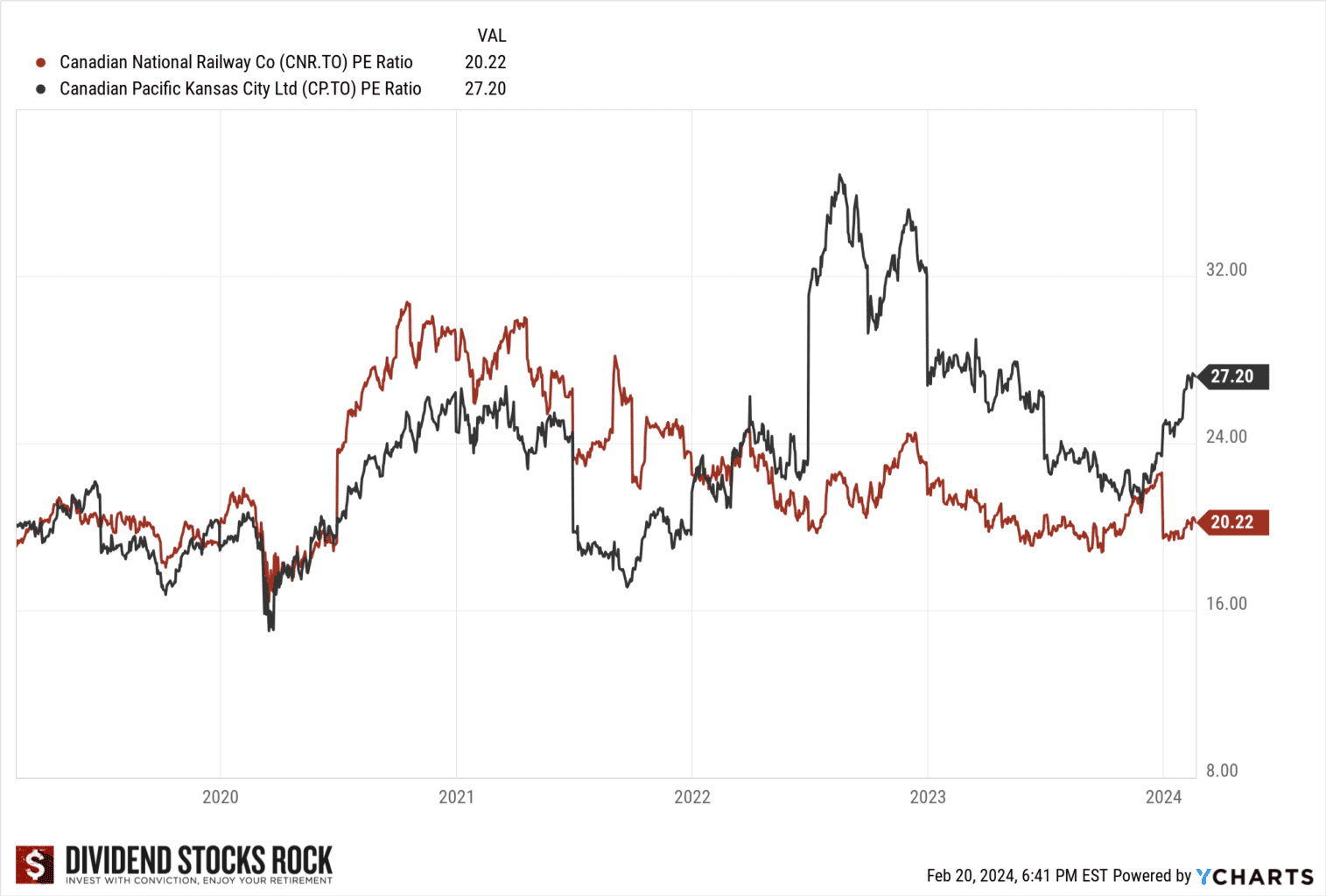

CP shares recently traded at 22.9-times estimated profits, also well above the five-year average of 16.3. Previously, the P/E ratio hadn’t cracked 19. Here is a look at the historical P/E ratio to February 4, 2024 for the rails courtesy of Dividend Stocks Rock.

There’s Growth Coming Down the Track

The Canadian railways are pricey, but that might be expected given the wide moat oligopoly status. But the good news is, there’s still growth potential.

Though railways aren’t laying down many new tracks, they are expanding with new infrastructure and customer relationships that are adding new revenue streams.

CP has a deal with container shipping company AP Moller-Maersk to move cargo from the ports of Vancouver and Montreal. CP also bought full control of the Detroit River Tunnel, which connects Windsor with Detroit. The pandemic moved the railways to get leaner and meaner. Railways have been getting significantly better at controlling their expenses by shedding tracks and through leaner labour forces. Operating ratios have fallen below 60% (low is good) from about 90% in the mid-1990s.

From TD Direct, analysts have a $113.72 average price target. That’s just modestly above the price in late January of 2024.

A TD Securities action note suggests that hooking up was a very good idea.

“We believe that the CPKC merger supports the most obvious multi-year earnings growth trajectory among the rails, which is a very unique/compelling proposition for investors, and imposes a floor under the stock to some degree. That said, CPKC is trading at an ~4x multiple-point premium vs. the group based on 2024E EPS (consensus), which we believe will be hard to sustain over time.”

They see earnings per share rising from $3.84 in 2023 to $4.31 in 2024 and $5.23 in 2025.

Canadian Railway Dividend Stocks: Get on Board, Add on Weakness

I’ve never been a fan of waiting for a stock to drop in price. That drop may not come and you eventually lose interest in a stock, thinking you missed your chance.

Or in this case, missed your train.

If you like the idea that when it comes to the two best Canadian railway stocks, you might start a position, and then add on any weakness. Or you may decide to start that position and add to it on a regular schedule. Take the market timing and guesswork out of the picture.

This has been my recommendation on the rails since the original railway post in 2019. From 2019, if you would have invested in Canadian railways stocks you would have been treated to some very generous market-beating returns.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

I also have the big ‘two’ holdings…CN and CP and they have treated me very well. I recently added Algoma with a short position; in my opinion, it is holding its own and giving a decent dividend. On the U.S. side of things, I added Union Pacific and it has not disappointed me. I rank railroads right up there with banks and telcos and will stay the course with them in my portfolio.