Best Canadian Healthcare Stocks For 2024

Admittedly healthcare stocks are not what we do best as Canadians. You won’t find any of them on our Best Dividend Stocks in Canada List or in our Dogs of the TSX recommendations.

Obviously, since the bulk of healthcare assets in Canada are owned by the government, there isn’t as much opportunity for private dollars to realize an investment return. It’s not like the USA where you have several very profitable large-cap healthcare stocks to choose from. That said, there are still a few interesting Canadian healthcare stocks listed on the TSX worth looking into.

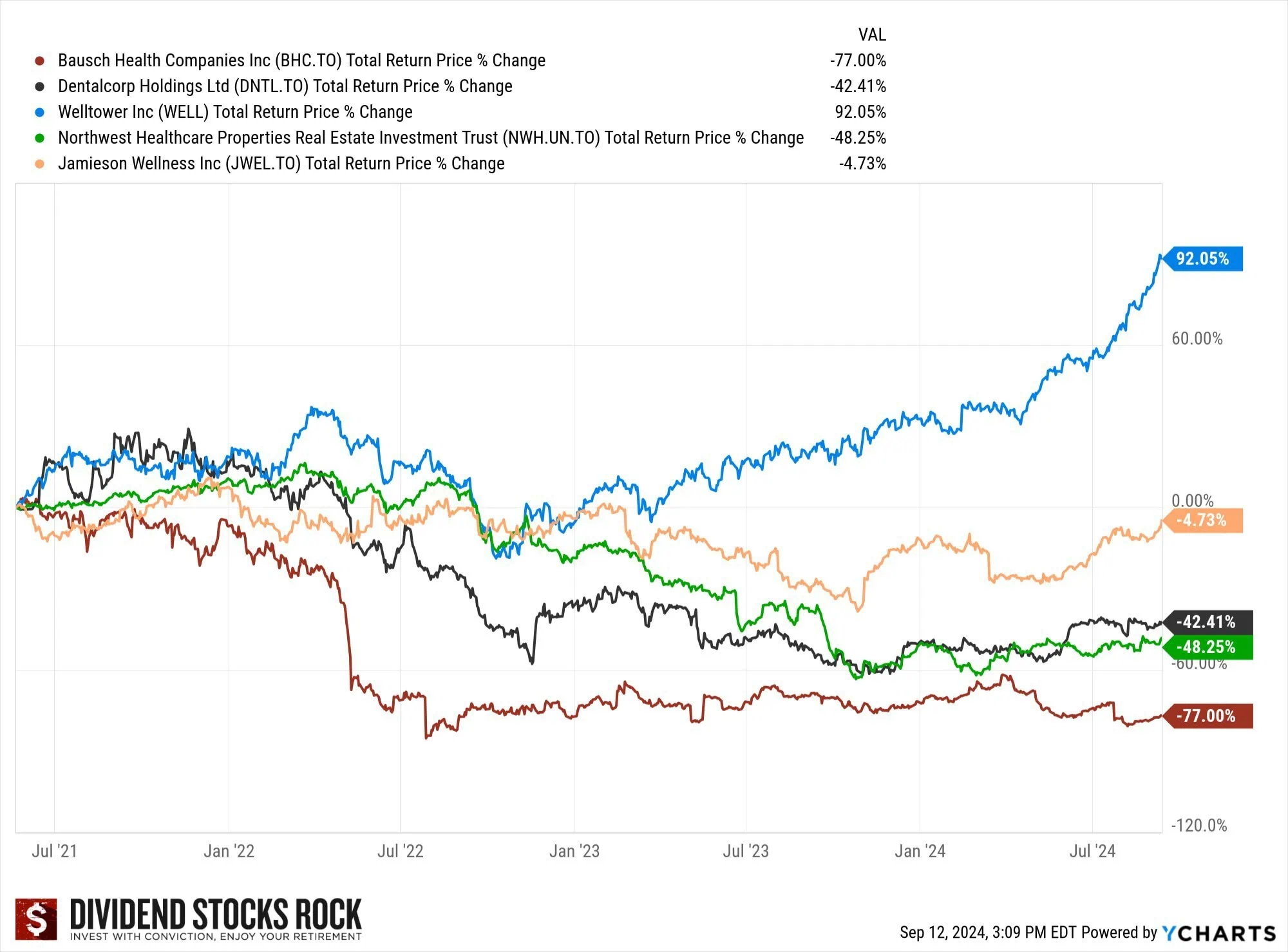

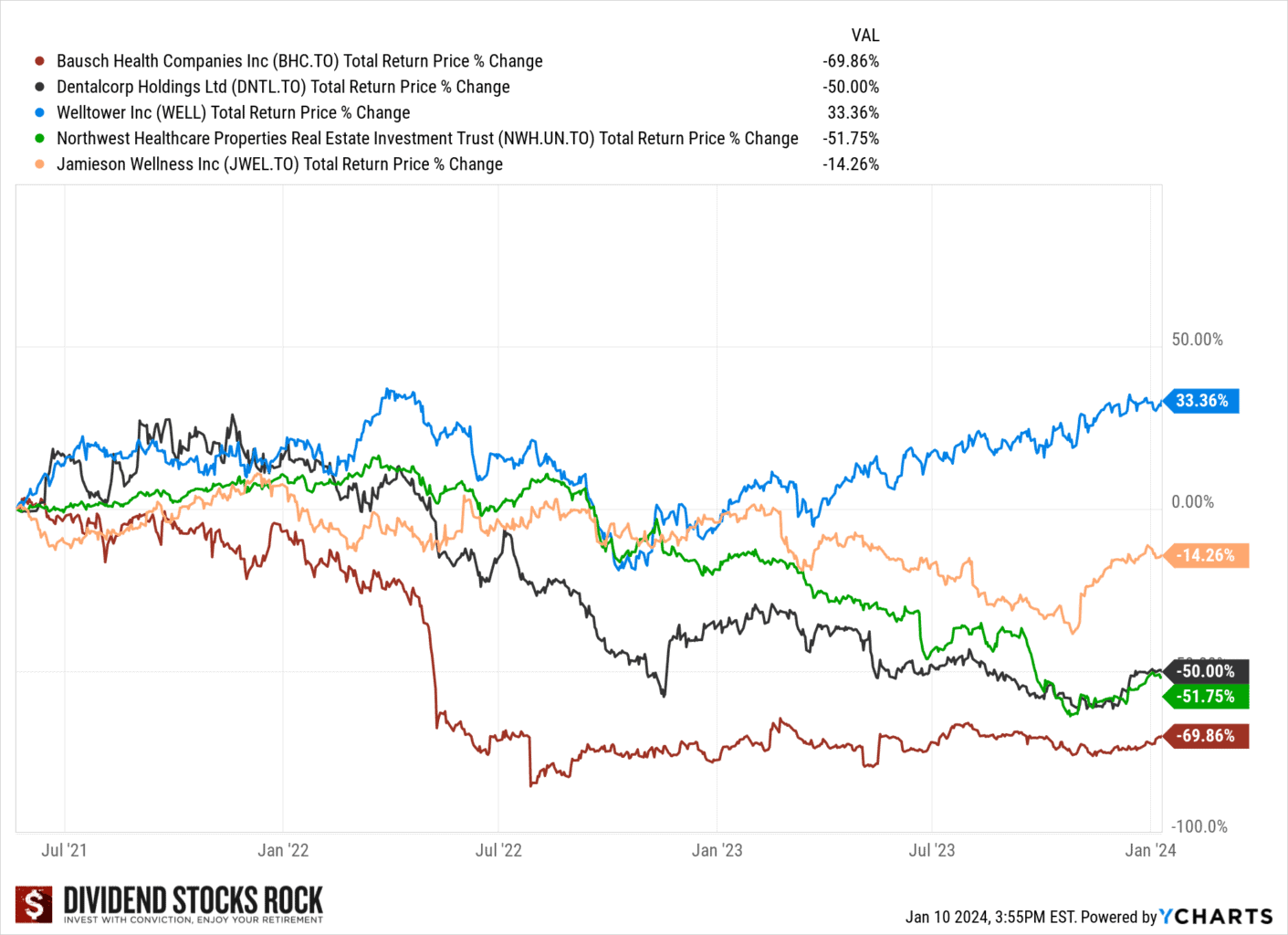

Canadian Healthcare Stocks Performance

Top 5 Canadian Healthcare Stocks

Below you’ll find my five contenders for the title of best healthcare stock in Canada title:

Name | Ticker | Price | Market Cap | P/E | Dividend Yield |

Jamieson Wellness | JWEL.TO | 35.26 | 1.427B | 26.51 | 1.70% |

WELL Health Technologies Corp.

| WELL.TO | 3.12 | 693.311M | N/A | N/A |

NorthWest Healthcare Properties REIT | NWH-UN.TO | 12.37 | 2.956B | 6.83 | 6.47% |

Dental Corp Holdings | DNTL.TO | 12.00 | 2.154B | N/A | N/A |

Bausch Health Companies

| BHC.TO | 11.32 | 4.092B | N/A | N/A |

?????? (Hidden, click for access) | (Hidden, click for access) | ?.??% | ?.??% | ?.??% | ?.??% |

1) (JWEL) Jamieson Wellness

Jamieson Wellness is a market leader in a growing field. It has recognized strong growth in China and has a dominant position within Canada.

Jamieson makes, markets, and distributes natural health products such as vitamins and supplements. It also offers sports nutrition products through its Iron vegan, Precision, and Progressive brands. The company’s main manufacturing sites are in Ontario.

As a well-run company that cuts out a lot of former middle-men in its supply chain, there is a lot to like when it comes to JEWL. Making and marketing vitamins isn’t flashy and you won’t see Jamieson’s name in the news like a Moderna for example. You will see their name pop up consistently on “buy” lists over the last few years.

The reason we’re going to give the #1 spot on our best Canadian healthcare stocks list to this relatively small (market cap of $1.5 Billion) upstart that only had its IPO a few years ago, is that they have simply exhibited excellent internal organic growth, and executed an efficient growth by acquisition plan.

Year-over-year revenue growth has been nearly 6%, and EBITDA was up 13%. With solid growth and a 1.7% dividend yield, it represents the best overall value amongst publicly-traded Canadian healthcare companies.

2) (WELL) WELL Health Technologies Corp.

Based out of Vancouver, WELL Health Technologies Corporation is a multi-national healthcare company that is heavily focused on digital health. As you might imagine, the stock skyrocketed during the pandemic when everyone rushed toward digital health solutions.

Since then, WELL has sank back to the reality of its earnings. That said, it is one of Canada’s only healthcare stocks from the technology field, and its market cap of $725 million makes it small – but not “micro”.

With services ranging from primary care, to dietary and mental health counselling, Well has a diversified health platform that delivers care in a multitude of ways. Some of the other small segments of the company include a medical records platform called OSCAR Pro, VirtuelMed, VirtualClinic+, a digital health app marketplace called Apps.health, and even a recordkeeping company for doctors.

Perhaps most noteworthy amongst these small segments is the recent revenue progress made by WELL’s cybersecurity business (which goes by the trade names Cycura and Source 44). The division’s recent quarterly report noted a 240% year-over-year increase. With Amir Javidan, Chief Operating Officer of WELL stating:

“We at WELL believe cybersecurity and patient data protection is one of our top priorities. WELL and its subsidiaries have made significant investments in this area, and we look forward to providing more Canadian healthcare practitioners with the country’s most comprehensive security solution for outpatient medical clinics.”

I’m not usually one to dabble in stocks this small, but WELL has a really interesting growth profile. You don’t usually see companies in this space with this kind of potential trading at 12x next year’s predicted earnings.

As someone who has lived in more rural parts of our country, there is definitely an opportunity here for telehealth – it will simply be a matter of who manages to scale first. In that line of thought, WELL would actually make an interesting takeover target for a company like Telus, who has shown interest in the digital health space.

3) (NWH-UN.TO) NorthWest Healthcare Properties REIT

Ok, so maybe the NorthWest Healthcare Properties REIT doesn’t technically belong on this list of the best Canadian healthcare stocks as most stock filters wouldn’t classify REITs that way – so sue me.

NWH-UN REIT is a cool niche within the medical real estate sector.

You know – the land on which the Baby Boomers will be spending a fair amount of time over the next twenty years!

It’s a relatively small REIT with a market cap of around $3 Billion. It has nine offices across five countries, controls 192 properties and within Canada, its medical facilities are concentrated in Calgary, Edmonton, Toronto, Montreal, Quebec City and Halifax.

With over 16 million square feet of leasable space through Canada, Brazil, Australia, New Zealand, and parts of Europe it is fairly well diversified. NorthWest Healthcare REIT has been aggressive in making acquisitions, and invested more than $1 Billion in 2021 alone.

I generally like the idea of being a healthcare landlord. My favourite source of information for dividend stocks is Mike Heroux from Dividend Stocks Rock, and he recently pointed out that this REIT has a 97% occupancy, and 80% is contractually indexed to inflation due to government contracts. I love those numbers.

The one number I don’t like is the number of dividend raises the REIT has pumped out over the last 10 years: 0.

Relative to some of the high-growth opportunities in US-based healthcare stocks, this REIT’s total return isn’t going to turn many heads. When compared to Canadian healthcare stocks however, it’s tough to discount the solid 6%+ yield, and sub-7.0 P/E ratio. Going forward, if the company exhibits the ability to raise rents substantially, and makes use of its niche expertise, dividend growth could return.

4) (DNTL) Dental Corp Holdings

One of the few areas of our economy that hasn’t been taken over by a massive conglomerate that can use economies of scale to their advantage is private medical practices in Canada – such as dental clinics.

Dental corp is doing its best to change that. I can’t say that I love this development from a consumer choice standpoint (I’m certainly not rushing to their clinics), but the concept of acquiring individual dental clinics and then using expertise to maximize revenues has worked in other industries.

As of the end of 2021, Dental Corp owned and operated 458 dental practices, which included 1,700 hygienists and 1,400 dentists.

Truthfully, I have no idea if this business model will work – but it’s an opportunity that a person could take a real bite out of (*cue groans*). Right now DNTL’s balance sheet looks rough due to all of the low-interest rate debt they loaded up on to make their acquisitions; however, I can’t think of many more recession-proof businesses than tooth cleaning/repair.

5) (BHC) Bausch Health Companies

Bausch Health Companies Inc. and its subsidiaries operate in five different segments:

- Bausch + Lomb

- Salix

- Ortho Dermatologics

- International Rx

- Diversified Products

The company’s headquarters is in Laval, Canada, and while the Bausch name is relatively new, you might remember the company’s former moniker of Valeant Pharmaceutical Inc. Valeant was Canada’s largest company by market cap at one point in 2015 before crashing back down to Earth.

Bausch has been focused on paying down a heavy debt load over the last few years, and there were even whispers of bankruptcy at times. That said, the company recently saw a significant bump to its share price as it let go of its long-time CEO and gave billionaire hedge fund manager John Paulson more power within Bausch.

Truthfully, I don’t love Bausch as a long-term investment. The only real reason that they’re on this list is the real lack of Canadian healthcare stocks available for public investment. They had a negative earnings per share last year and don’t pay a dividend.

That said, they are Canada’s largest company in the space, and maintain a market cap near four billion dollars. Also, they have made admirable progress to restoring their balance sheet and staying out of bankruptcy court the last few years.

If the company continues to reinvent themselves in a growing market (more than 80% of their sales occur outside of Canada) they could potentially become a great turnaround story.

Canadian Healthcare Stocks ETF

As you might have guessed from our Canadian healthcare stocks rankings, there really isn’t enough “meat to chew on” in terms of creating a Canadian healthcare stocks ETF.

There are some ETFs on the Toronto Stock Exchange (TSX) that will give you sector exposure.

The iShares Global Healthcare Index ETF (CAD-Hedged) is a great way to get world-wide exposure to the medical/healthcare niche for a reasonable MER of .65%. With names like Johnson & Johnson, Pfizer, and Merck at the top of the holdings list, it’s about as diversified and safe a healthcare stock play as you’ll find on the TSX.

If you’re looking for a fund that gives you specific access to the mid-size and smaller medical stocks in the USA, the FT AlphaDEX U.S. Health Care Sector Index ETF (FHH.TO) might be just the ticket.

In theory, these smaller firms should outperform their larger brethren (as a group) over the long term. As an actively-managed ETF, I’m not a huge fan – but again, there are limited options when looking for healthcare stocks on the TSX. You can check these ETFs, and see how they compare to our list of the best Canadian ETFs, to see why we don’t really recommend investing in these.

Final Words on Canadian Healthcare Stocks

I know that on the surface, healthcare investments sound like a great idea – especially in the midst of a recession. People will always need medicine and medical expertise right?

The problem is that a lot of the major publicly-listed medical companies in the world just aren’t listed on Canadian stock exchanges. You’ll need to go to the USA for that or use one of our Canadian Healthcare ETFs.

By and large, while there might be some diamonds in the rough, Canadian healthcare stocks are very small/risky, still in the embryonic stages, or have fallen considerably from their previous market glory. Instead, we recommend picking safer investments, namely bank stocks or energy stocks.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?