Is BCE Stock a Good Buy Right Now?

If you’re considering investing in BCE stock in 2024, evaluating the company’s performance, dividend growth, and the latest developments in the telecommunications industry can help you make your decision. Being informed about BCE’s recent advancements is crucial in determining whether it is a wise investment choice, and comparing it with its fellow Canadian telecommunication competitors over at Telus and Rogers.

If you’re looking to diversify your portfolio with more dividend stocks, I recommend exploring our article on Top Canadian Dividend Stocks. This valuable resource offers insights into reputable Canadian companies renowned for their consistent dividend growth, including those in the telecommunications sector like BCE. In fact, Bell has been so consistent in paying dividends over the years, it is often referred to as a bond-like stock.

Want To Buy Bell Shares? Price, Performance & Analysis

- BCE.TO Stock Price: 50.73

- Dividend Yield: 7.88%

- Price-to-Earnings (P/E) Ratio: 21.03

- 5yr Earnings Per Share Growth: -5.96%

- 5yr Dividend Growth: 5.09%

- Payout Ratio: 126.95%

Our BCE Stock Analysis

- BCE appears to be an appropriately valued stock at its current share price of $59.

- It currently hovers below the pre-Covid price level, indicating a possible buy opportunity.

- Dividend yield sits high at around 7.88%.

- Largest telecom company in Canada, with over 6000 retail locations.

BCE appears to be an appropriately valued stock at its current share price of $50.73. Although it is still slightly below the pre-Covid price level, this presents a potential buying opportunity for investors. Our analysis suggests that BCE is an attractive long-term investment option.

The company’s strong market position, combined with its commitment to rewarding shareholders through dividends, makes it a compelling choice for investors looking for stability and income generation. Additionally, BCE’s recent announcement to adapt its news delivery methods in response to financial pressures and changing market dynamics demonstrates its ability to adapt to evolving industry trends.

Should I Buy BCE in 2024?

BCE has continued to demonstrate resilience and adaptability in 2024, navigating the evolving market conditions. While facing financial pressures, BCE has made strategic decisions to adapt its news delivery methods, including the closure of radio stations and foreign bureaus. Additionally, BCE’s media arm has requested the federal telecommunications regulator to waive local news requirements, citing outdated market realities.

These developments reflect BCE’s proactive approach in addressing challenges and optimizing its operations. While the company faces financial pressures, it is actively seeking relief through the potential compensation from online streaming giants under the Online Streaming Act. BCE recognizes the importance of exploring new avenues for revenue generation in a changing media landscape.

Despite these challenges, BCE remains a prominent player in the Canadian telecommunications industry. Its position in the industry’s oligopoly, along with the strong demand for telecommunications services, contributes to its favorable market environment and profitability.

For investors interested in telecom investment opportunities in Canada, we recommend exploring our comprehensive guide on the Best Telecommunications Stocks in Canada. This resource provides detailed information on companies driving renewable energy innovation and sustainability in Canada.

How Can I Buy BCE Shares?

To buy Bell shares, you can use any of the available Canadian online brokerage services. At MDJ, we prioritize guiding our readers in selecting discount brokerages that align with their needs. We continuously update our list of Top Online Brokerages in Canada, ensuring that our readers have access to the best recommendations and current promotional offer codes.

Once you have registered for an online brokerage account, purchasing Bell shares is a straightforward process. Simply use the search bar to find the ticker symbol “BCE” and determine the number of shares you want to buy.

For example, if you intend to invest $600 in Bell shares and the current stock price is $60, you would enter “10” and select the “market limit” option. The online brokerage platform will then present you with a prompt confirming your order: “Do you want to buy 10 shares of BCE at $60 each, totaling $600?”

Once you confirm the order, the online broker will take care of the rest. If you require further assistance with investing in the Canadian stock market, we invite you to explore our comprehensive guide on How to Buy Stocks in Canada.

BCE Stock Past Performance

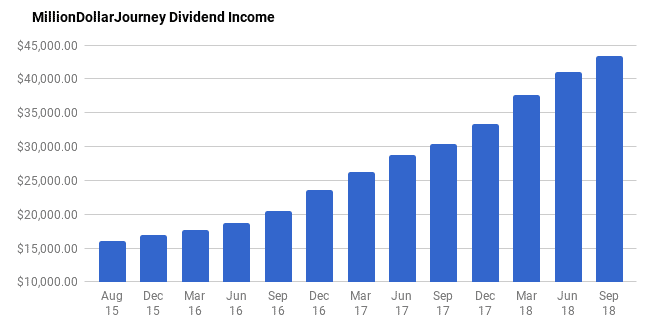

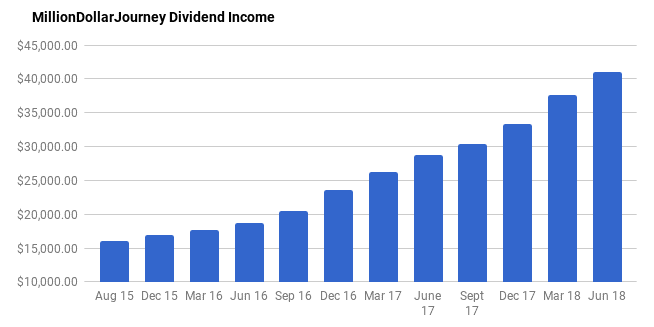

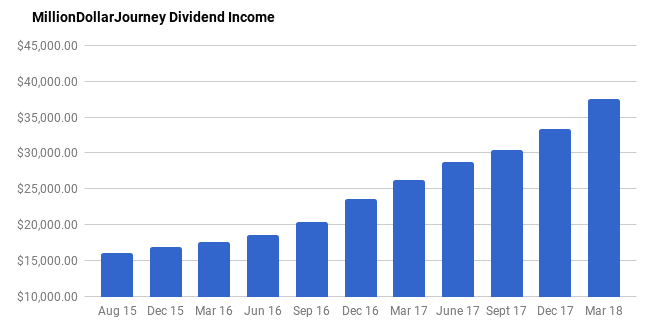

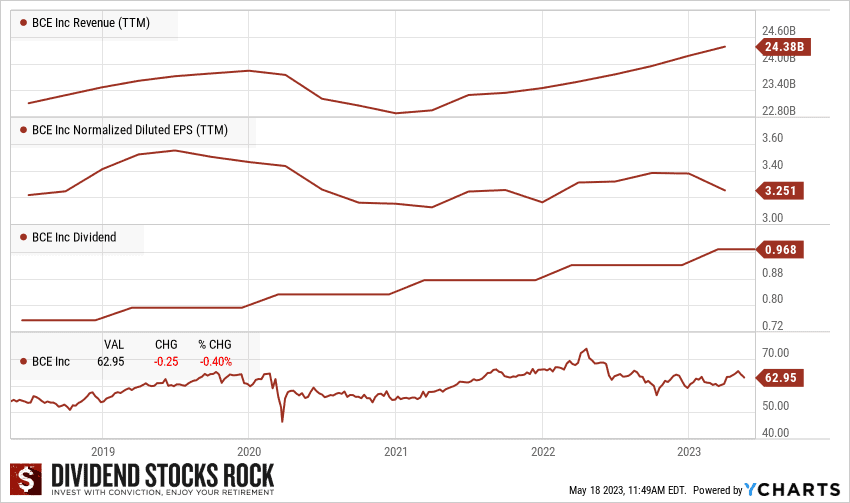

Over the past three years, Bell has shown consistent growth in its dividend payouts, even though at times its revenues and earnings did not match those payout levels. This to me says two things, one is that Bell is committed to rewarding its shareholders with dividends, the second is that it indicates a strong position in the telecommunications sector, as the company has a long record of paying out dividends.

Bell experienced a decrease in earnings in 2021; however, the company has shown signs of recovery, and future revenue growth is expected. This indicates that Bell is actively addressing any challenges and taking steps to improve its financial performance.

The recent recovery in earnings are the result of Bell’s recent strategies such as reducing its workforce by 3% and divesting 9 of its media stations. As an investor, this gives me confidence that BCE management has the investor in mind, and are adapting to new regulatory conditions. This ensures that BCE stock will pay dividends for quite a long time.

As a long-term investor, I prioritize investments that offer both growing dividends and steady capital gains. Bell has demonstrated a decent dividend growth rate of 4% over the past five years, placing it higher than its peers in the industry which has a median dividend growth rate of 1.66%.

For a comprehensive analysis and comparison of dividend stocks, including advanced statistics and a wider range of stock options, I highly recommend referring to the Dividend Stocks Rock (DSR) Guide. It provides valuable insights for investors looking to make informed decisions in dividend investing.

BCE Stock Forecast

BCE Inc., boasted a net income of $2,926 million reported in 2023. BCE stock remains an attractive choice for investors seeking opportunities in the telecommunications industry. One key factor contributing to BCE’s appeal is its position within the profitable oligopoly of the Canadian telecom sector. While the lower net income may have affected the stock price, long-term investors might see this as a potential buying opportunity.

The Canadian telecommunications industry is characterized by a limited number of major players, and BCE is one of them. This oligopoly structure provides companies like BCE with a stable market environment and strong profitability. With limited competition and a high demand for telecommunications services in Canada, BCE enjoys a competitive advantage in the industry.

With the recent merger of Shaw and Rogers finally being completed, Bell shareholders will continue to benefit from a sector with even fewer competitors. With fewer competitors, BCE can capitalize on its existing customer base and solidify its market presence.

As of now, the market is split almost equally between the three players, with Rogers having a slight edge at 31.6% market share. For Bell shareholders, this means a more stable pricing environment as fewer competitors means less aggressive price wars. This will potentially result in improved margins and profitability.

For investors interested in exploring other potential investment opportunities within the Canadian telecommunications sector, we recommend referring to our comprehensive guide on the Best Telecom Stocks in Canada. This resource offers valuable analysis on the Canadian telecommunications sector and highlights key players in the industry.

It’s important to note that BCE operates in the telecommunications industry, which is influenced by various market factors. As a leading telecommunications provider, BCE’s success is closely tied to the growth and advancements in the industry. However, it’s crucial to consider that BCE, like any company in this sector, is not immune to economic fluctuations and competitive pressures in the market.

If you prefer a passive investing approach and aim to reduce risk by investing in ETFs rather than individual stocks, we suggest referring to our comprehensive list of the Best ETFs in Canada. Exploring these ETF options can provide you with diversified exposure to various sectors and asset classes, allowing you to benefit from a broader market performance.

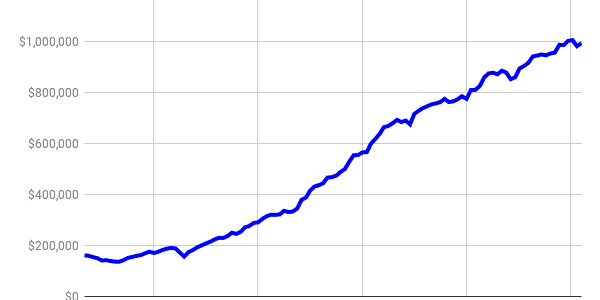

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?