BMO InvestorLine Review 2025

BMO InvestorLine Review

-

Trading Fees and Pricing

-

Account Options

-

Customer Service

-

Platform Options

-

Overall Banking Convenience

-

Promotional Offers

BMO InvestorLine Review Summary:

BMO InvestorLine is a very good online brokerage option. It’s reliable, straightforward, and offers all the account options a DIY investor needs. Additionally, I really appreciate the list of 100+ ETFs that they allow you trade for free (setting themselves apart from some of their big bank brokerage competitors).

While BMO’s direct trading platform isn’t my absolute top pick, I think it’s a great fit for BMO customers that just want to keep life simple. Convenience can be a real plus, and having everything from your mortgage to your safety deposit box under one financial roof can just make life easier. It also gives you some decent leverage to try to negotiate that lower mortgage rate or premium credit card offer.

If you’re hunting for the very best mix of features, pricing, and ease-of-use, I’d still check out our top-rated platform: Qtrade. But if you’re like many Canadians and just want the security of banking with a company that has been around for longer than the country has, then InvestorLine is going to do everything you need it to!

Pros

- Best Bank-owned Broker

- 100+ Free ETFs

- Strong App

- Trust and Reputation of 200+ Years

- Solid Consumer Education

Is BMO InvestorLine Safe and Trusted?

In a word, YES.

As one of Canada’s oldest and most trusted companies (founded in 1817) the Bank of Montreal is as safe, trusted, and legit as you can get.

InvestorLine has been around longer than the internet – BMO introduced self-directed trading way back in 1988 before moving online in 2000. That’s an impressive history!

BMO InvestorLine is CIRO regulated and CIPF insured. They use 128-bit encryption and multi-factor user authentication to keep your data safe. While any online financial transaction has some risk, BMO is as safe as it gets.

BMO InvestorLine Review – Mobile App & Software

BMO has a strong online platform that’s convenient and simple to use. Its mobile app ranked the highest of the big banks in our list of the Best Stock Trading Apps in Canada. However, the mobile apps for both Qtrade and Questrade come out ahead of BMO InvestorLine by a wide margin.

The online platform’s dashboard is streamlined and easy to navigate, but still gives you access to all the tools you need. It’s also extremely customizable, meaning you can hide any tools or features that you’re not interested in seeing regularly. This is a great feature for novice investors or people with simple portfolio needs.

The MDJ editorial team appreciates the ability to get a bird’s eye view of a portfolio on a single screen. This allows users to better understand their asset allocation and make important investment decisions that can help them meet their goals faster.

For the more research-inclined, the BMO platform also gives users access to plenty of industry-leading tools and market data.

The mobile app offers flexibility and convenience. Users report that it’s slightly less comprehensive than the online platform, but it gets the job done. Making trades and moving your money is easy, quick, and secure.

BMO InvestorLine Free ETF Trading – $0 Commissions

In June 2021, BMO became the first of the big bank brokerages to offer a list of ETFs that are completely free to trade (providing that you hold on to them for at least one day).

This has turned out to be a real game-changer as far as offering value to discount brokerage customers, with other banks such as Scotia iTrade and Desjardins joining in the fun. Qtrade and NBDB also offer completely free buying AND selling of ETFs, with Questrade offering free ETF purchases only.

Sometimes when a bank offers free trades on ETFs, they mean free trades on their own ETFs (looking at you, TD Easy Trade). But there’s no bait and switch when it comes to BMO’s commission-free ETFs, which has some excellent names on the list. My personal favourites include:

- VCN – Vanguard FTSE Canada All-Cap Index ETF

- VFV – Vanguard S&P 500 Index ETF US

- VIU – Vanguard FTSE Developed All -Cap ex-North America Index ETF

- VAB – CA Vanguard Canadian Aggregate Bond Index ETF

- All of the Vanguard and BMO all-in-one-ETFs are available

- Several ESG index ETFs are available

It is excellent to see that creating ultra-diversified, super-simple portfolios just keeps getting cheaper and cheaper for Canadians!

Day traders should remember that the trades are only free if you hold onto the ETF in question for at least 24 hours.

BMO Works Best for Large Portfolios

The BMO InvestorLine 5 Star Program is the bank’s lure for high net-worth individuals and/or active traders. Most of Canada’s discount brokerages have some version of this break for top-tier investors.

The 5 Star Program doesn’t cost anything – users are automatically enrolled if they meet the eligibility requirement: a $250,000 account balance or at least 15 trades in a 3-month span. Here’s a look at the perks that you’ll enjoy at all three levels:

Gold Star ($250,000+ OR 15-74 trades per quarter) | Platinum Star (2M+ OR 75-179 trades per quarter) | Diamond Star ($5M+ OR 180+ trades per quarter) | |

Trading Fees/Discounts | 5-15% | 10-20% | 20% |

Customer Support | Dedicated 5 Star support | Priority 5 Star support | First priority 5 Star support |

BMO Active Trader (real-time market quotes) | Yes | Yes | Yes |

BMO Active Trader Pro (real-time Level 2 quotes) | No | Yes | Yes |

Capital Markets TSX 60 Research | No | Yes | Yes |

Education events and BMO Capital Markets TSX60 research | No | Yes | Yes |

Exclusive IPO Allocation Options | No | No | Yes |

Access to Private Banking Options | No | Yes | Yes |

The basic idea of BMO’s 5 Star Program is that if you generate substantial trading fees or have a large amount of money invested with BMO, you’ll get a small break on the $9.95 fee, and you’ll get access to some elite trading information streams, plus portfolio analysis, custom watchlist updating and so on.

The Platinum and Diamond levels also offer discounts of 100% on RRSP homebuyer and lifelong learning withdrawals and on deregistration and additional RIF payments.

With over 12 Million customers and $422,701 Billion (2024 Annual Report to Shareholders) in asset managed, BMO certainly has the resources to compete with the features that any other Canadian brokerage account brings to the table.

BMO InvestorLine Review: Trading Fees and Prices in 2025

When we look at BMO InvestorLine’s Self-Directed trading and account fees, it’s important to keep in mind that major Canadian banks such as BMO and their competitors over at RBC, Scotia Bank, CIBC, and TD, aren’t trying to offer the cheapest products on the market. Instead, the general aim of their products is to be cost-competitive, but to prioritize the following:

- Ultra-safe products backed up by centuries of banking experience.

- A large customer service and technology team.

- Elite usability and design.

- Maximum user customization options.

BMO InvestorLine Self-Directed Account Fees

While there are no minimum deposits needed to open a BMO InvestorLine Self-Directed account and get started, you’ll be charged quarterly account fees of $25 if your non-registered account balance is under $15,000 or if your registered accounts are under $25,000. RESP accounts under $25,000 are charged an annual administration fee of $50.

Obviously, if you open an account and deposit more than these amounts you will not owe any account fees at all.

BMO InvestorLine Self-Directed Trading Fees

BMO InvestorLine’s trading fees are generally competitive with the rest of Canada’s big banks and are higher than Qtrade or Questrade. At a flat $9.95 per trade (it doesn’t matter how many shares you buy) it’s a simple – if slightly pricey – business model.

As noted above, there are quarterly or annual fees that depend on account balances. Pay attention to this minimum as it can add up in a hurry if you open a few accounts with BMO InvestorLine but carry a small balance in them for a few quarters.

Obviously, the higher fee model is somewhat standard for Canada’s big banks. In return, you get to access to a massive full service bank that allows you to keep all of your banking activities under one umbrella. You also get a great long-term track record of safety and stability.

Here’s a quick look at the rest of BMO InvestorLine’s fees:

Product | Fees |

Stocks & ETFs | $9.95 flat-fee per trade |

Options | $9.95 + $1.25 per contract |

Mutual Funds | $0 |

Gold & Silver | $35 + $1.00 per ounce for gold, $0.10 per ounce for silver |

RRSP, LIRA, RRIF, LRIF | $0 for accounts greater than $25,000 |

TFSA | $0 for accounts greater than $25,000 |

RESP | $0 for accounts greater than $25,000 |

Non-registered | $0 for accounts greater than $15,000 |

Transfer out | $150 |

Mobile App | Free |

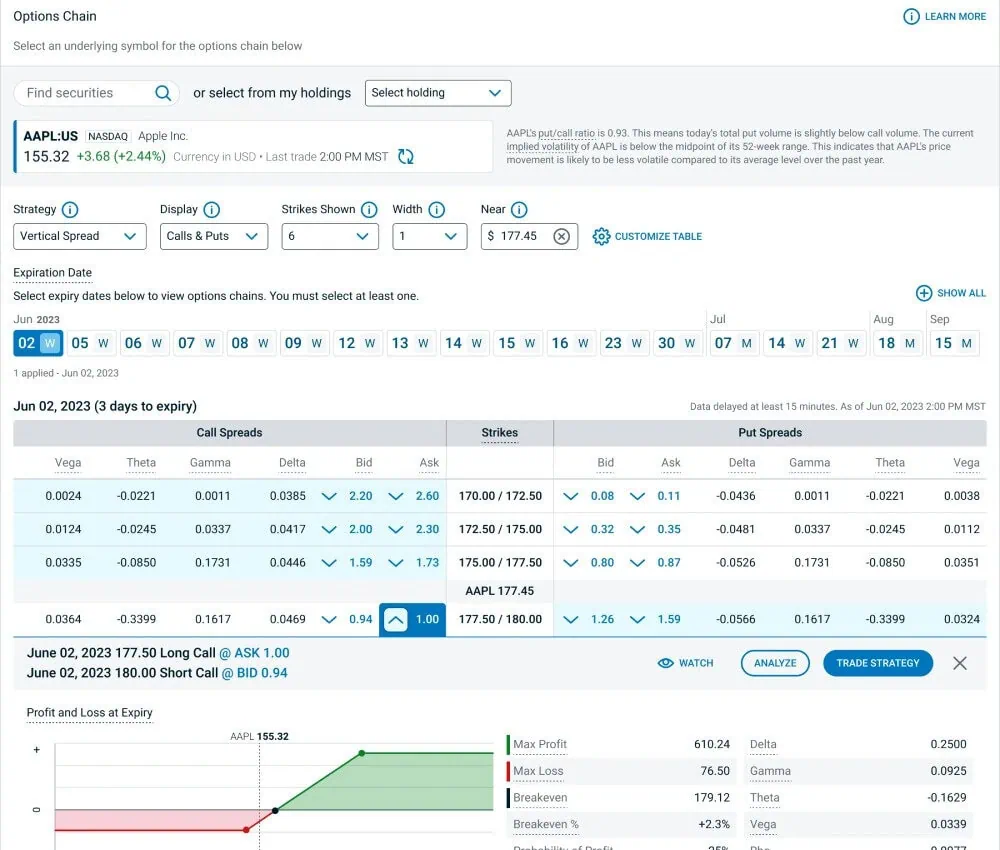

BMO InvestorLine Self-Directed Options Trading Fees

Personally, options trading isn’t a part of my investment portfolio, but if you’re into the adrenaline rush of shorts, hedging, etc., then InvestorLine is going to charge $9.95 per trade + $1.25 per contract. This is the standard rate across all of Canada’s large banks.

BMO InvestorLine Account Types

As one of Canada’s top online brokers, BMO InvestorLine gives you access to essentially every type of investable account in Canada, including:

- Non-registered accounts (both CAD and USD)

- Margin Accounts

- RRSP (both CAD and USD)

- Spousal RRSPs

- TFSA (both CAD and USD)

- RESP

- RRIF

- FHSA

- Spousal RRIFs

- LIF

- LIRA

- Corporate Accounts

- Non-Profit Organization Accounts

- Estates and Formal Trust Accounts

This is one advantage of a big bank platform: you might pay more in commissions to use BMO InvestorLine Self-Directed, but you’re going to absolutely have access to all of the accounts that you could ask for as a Canadian investor. And again, if you go with ETFs from their commission-free trading list, you’re not even paying more at all.

BMO InvestorLine Review: What Is adviceDirect?

We’ll take a deeper dive into the unique service known as AdviceDirect in a separate review, but we thought we’d mention it here briefly.

AdviceDirect is a nice little mid-point between a full-service investment advisor model, and a completely hands-off DIY product.

If you want the flexibility and responsibility of using a discount brokerage to manage your own investments, but also feel that you could use some help in selecting specific investments or staying on top of your portfolio, then you may want to look closely at the BMO adviceDirect account.

AdviceDirect’s services include:

- Automated portfolio monitoring

- Unique information flows

- Exclusive investor education options

- A dedicated team of licensed advisors

As active investing goes, a premium service like adviceDirect is a solid choice. It gives you access to industry experts – at a much lower price point than traditional mutual fund channels. The MER on mutual funds is usually about 2.5%, while adviceDirect is only 0.10%-0.50% per year (depending on your balance). Up to $1MM in assets pays the full 0.50%. You get a break down to 0.30% if you have assets of between $1MM and $5MM. Over $5MM gets you the low 0.10% rate.

In any case, much lower than the 2.5% traditional mutual fund fee!

BMO InvestorLine and BMO adviceDirect may complement one another, but they’re two separate products with different applications and services. So while you definitely do NOT need to subscribe to adviceDirect in order to use the BMO InvestorLine brokerage, it could possibly be a better option depending on your experience level and desire for expert support.

BMO InvestorLine Review FAQ

2025 BMO InvestorLine Ratings

Every year we make sure to check out the Surviscor and Globe and Mail broker ratings, as we find them the most comprehensive online (other than our own of course).

For the 2025 BMO InvestorLine report card we’ll start with the Globe and Mail. Their rankings are based on over 100 factors, further broken into 5 categories:

- Convenience and security

- Cost

- Investing experience

- Tools

- Services for retirees

“InvestorLine is an example of bank-owned brokers with old-school pricing, specifically trading commissions just below $10 for stocks and exchange-traded funds. If you pay top price, you have to ask where the value is. InvestorLine delivers for the most part, but without the sparkle needed to be in the front rank in this group. A big plus is the menu of 108 commission-free ETFs from the BMO, iShares and Vanguard families.”

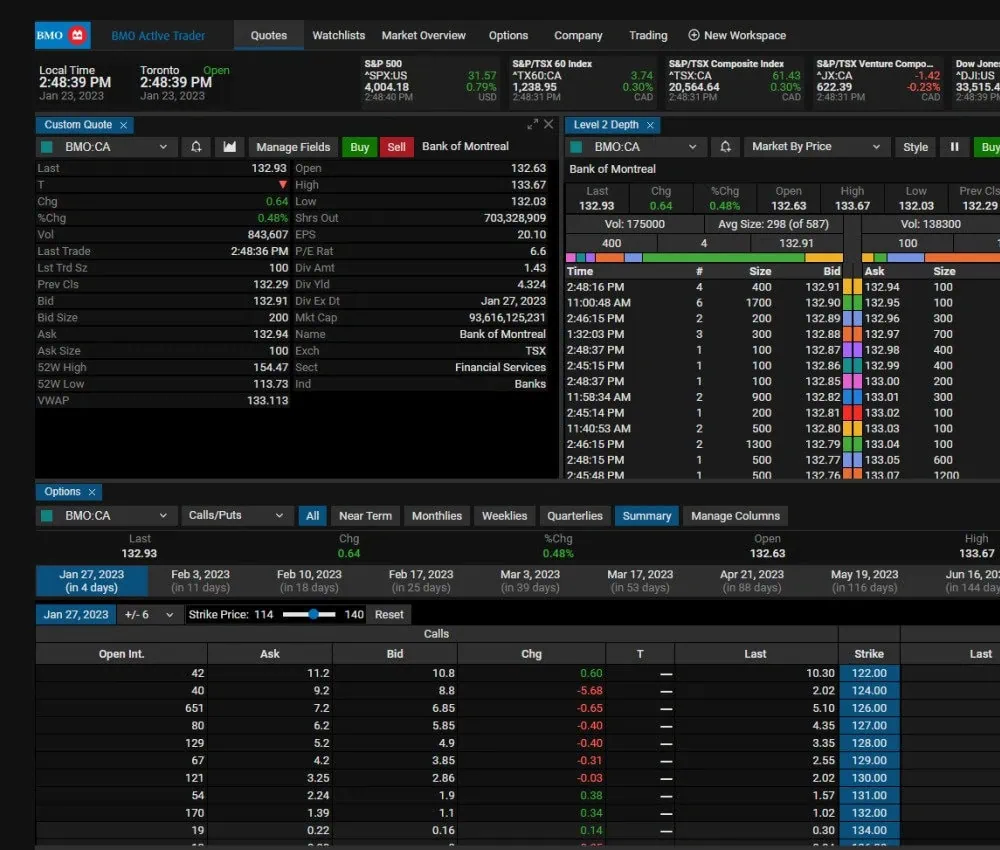

BMO Active Trader

BMO has stepped up its game for frequent investors with the launch of BMO Active Trader. If you’ve ever been frustrated by clunky broker dashboards or felt like you were missing out on advanced tools without paying extra fees, this platform is worth a closer look.

BMO Active Trader is a browser-based trading platform designed for investors who make a lot of trades and want more speed, data, and flexibility than what you’d normally find on a bank brokerage site. Think of it as a “pro mode” for InvestorLine clients. As of now, there is no mobile app available for the Active Trader platform.

It’s part of BMO’s 5-Star Program, which means you don’t pay extra to use it as long as you meet the trading or asset requirements. The interface is faster, more customizable, and loaded with features that make it easier to trade stocks, ETFs, and options.

The platform itself is free if you qualify, but you do need to hit certain thresholds. To unlock Active Trader, you’ll need either:

- 15 or more trades per quarter, or

- A $250,000 account balance.

Once you’re in, the commissions are competitive for active investors. Standard InvestorLine pricing is $9.95 per trade, but if you place 150 or more trades over a rolling three-month window, the rate drops to just $3.95 per trade. Options contracts cost $3.95 plus $1.25 per contract.

Active Trader isn’t for everyone. If you’re the type of investor who buys a few ETFs a year and holds them for decades, you’ll likely never use this platform. But if you’re more of the day trader type, like to trade options (especially multi-leg strategies), want real-time streaming data, or rely on advanced charting and technical indicators, then BMO Active Trader might be a good fit!

Who Is the BMO InvestorLine Discount Broker Best for?

If you’re already a BMO customer, there’s nothing wrong with paying a little extra for the convenience of having your banking and investing in one place. The bottom line is that BMO InvestorLine is a well-equipped brokerage that is going to do everything you need it to. It is very safe, and has all the stability you’d expect of a massive big bank brokerage account.

You will, however, be paying a small premium for a platform that doesn’t pack quite as many features as the very best Canadian online brokers.

Because Million Dollar Journey readers continue to request the latest development in Canada’s brokerage market, we prioritize keeping our information up to day. So make sure to check back for the latest improvements to my BMO InvestorLine review throughout 2025.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Despite what’s stated in this article, BMO Investorline does not offer a FHSA. If you’re a BMO customer, BMO directs you to their in-branch financial services advisors who sell you mutual funds which can only be managed through in-branch meetings. BMO may be the only bank that does not offer a FHSA in their related discount brokerage. This is not ideal for managing your entire portfolio online in one place.

Thank you Mark for pointing this out, we are in the process of reaching out to them to clarify it, since their website clearly states you can. Will revise the article accordingly once it’s cleared out.

I initiated the sale of my Tesla stocks through my BMO Direct Investment account. However, the transaction status seemingly indicates a purchase occurred two days later, coinciding with a drop in stock prices. This has raised concerns that the broker may have manipulated the status from a sale to a purchase.

This situation suggests a possible execution error, as brokers are expected to faithfully carry out orders according to the account holder’s instructions. I promptly contacted BMO to address this discrepancy. Unfortunately, their initial response claimed that the mistake was on my part. However, it’s important to note that when I initiated the sale, the system indicated there was no quantity available, and the total amount remained in my account. It was only after two days, when stock prices had fallen, that the status appeared to change. I will continue to pursue this matter with BMO to clarify and rectify the situation.

I have been an Investorline customer for years, but will now be changing to another platform and provider. The new website is a complicated disaster which would take hours to learn (to no profit) especially compared to the old site which was simple, clean and intuitive. The current design may be a web designer’s idea of improvement, but is not in the least user friendly. Customer service is awful. I recently had occasion to call them to confirm that a trade had been cancelled (since the website did not show it) and was misled by the first representative I talked to. The second representative promised to send me a message promising to clean up the mess, and did not. The third representative also promised to send messages promising to resolve the matter, and did not. In addition, he hung up on me.

Stay away

Back.a few years, BMO Investor line was tops but now it’s 3rd rate. A week does not seem to pass without a major change to its platform. Seems change for the sake of change. Once it was possible for customers to communicate via My Link .While BMO can still communicate by My Link; it’s closed to clients who previously had a written record. I am deaf and consequently the availability of My Link was vital. I expressed my disappointment with BMO’s CEO but never did I receive a satisfactory explanation of why My Link is not two way communication link.

Being a BMO investorline client I am generally pleased. Their platforms are pretty good but could some additional data such as what is your Div rate on shares you have held for years.

Biggest issue is they don’t offer a drip on all Cad shares which is a pain. Also they do not drip any US equity. (Synthetic DRIP at BMO)

I have tried quite a number of different vendors over the years, ameritrade, e-trade, price waterhouse, option express, questrade to name a few, finally settle down with InvestorLine. Here are my 2 cents.

Individual brokers tends to have lower commissions than the bank owned ones, however, they charge ecn fees. No big deal if you only buying 100 shares. But if you are like me, buying in the lot of 2000-5000 shares or more, the advertised $4.95 commission (questrade) will quickly turn into $20+, substantially higher than any bank.

The second reason I switched to InvestorLine was that I have grown my portfolio to 500,000 since, I can now access the market Pro feature which basically live data. You will need to be a frequent trader or pay a substantial fee with companies like questrade.

That being said, you definitely should stay with the individual brokers if you have a small portfolio, to avoid account fees.

As far as customer service, there are always bad apples regardless companies. I’m not happy with InvestorLine, so is questrade, and I don’t think there is much difference between all these brokers. The key is to set up everything properly so you can minimize the chance of calling for support. After all, these online brokers are all for diy.

Stay away from Investorline. Make sure you read the contract very carefully. They change terms without notifying you and their customer service is non-existent. You can literally be on hold for hours before speaking to someone and in this day and age they can’t even give you an indication of how the long the wait will be? Honestly, check out TD. Talk to people – they will tell you the same thing. BMO is not customer focused and does not value your business- look elsewhere

I use both BMO Investorline and RBC Direct. While they both have their strengths and weaknesses, and while BMO does have some good research tools, BMO is simply terrible with customer service and with outside resources such as morningstar giving just as good analysis as what’s offered in the platform, I would say this should be a defining red flag issue.

My husband and I both use Questrade. And while I find it a huge pain to set up my various accounts, now that they are set and we are trading, we’re very happy with it. I think the major perk is the low cost! Interesting to hear about one of the Top 5’s brokerage units.

Just to clarify, there is likely no fee for the TFSA account as you were questioning. Every brokerage I’ve seen charges an annual fee only for RRSP accounts, usually if the balance is under $25,000.