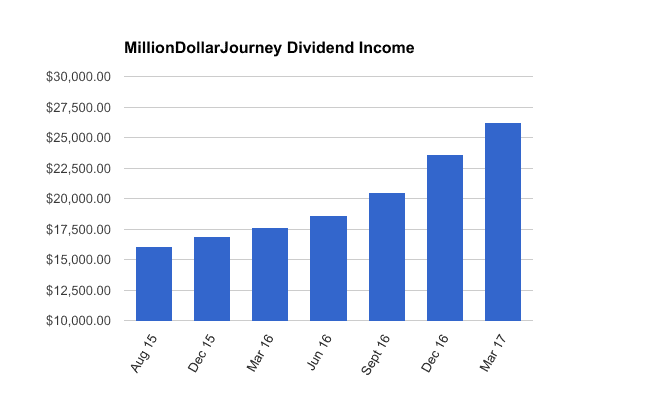

Financial Freedom Update (Q1) – March 2017 (+10.89%)

Welcome to the Million Dollar Journey March 2017 Financial Freedom Update – the first update for the year. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point where they are enough to cover our family expenses. All within the next 5 years. If you would like to follow my newest financial journey, you can get my updates sent directly to your email, via twitter (where I have been more active lately) and/or you can sign up for the monthly Million Dollar Journey Newsletter.

In my first few Financial Freedom updates, I talked about what life has been like since becoming a millionaire, why I like passive income, and our family financial goals going forward.

Here is a summary:

Financial Goals

Our current annual recurring expenses are in the $50-$52k range, but that’s without vacation costs. However, while travel is important to us, it is something that we consider discretionary (and frankly, a luxury). If money became tight, we could cut vacation for the year. In light of this, our ultimate goal for passive income to be have enough to cover recurring expenses, and for business (or other active) income to cover luxuries such as travel, savings for a new/used car, and simply extra cash flow.

Major Financial Goal: To generate $60,000/year in passive income by end of year 2020 (age 41).

Reaching this goal would mean that my family could live comfortably without relying on full time salaries. I would have the choice to leave full time work and allow me to focus my efforts on other interests, hobbies, and capitalistic pursuits.

Previous Update

To give you context for this update, here are the numbers in my previous financial freedom update.

December 2016 Dividend Income Update

Account Dividends/year Yield on Cost SM Portfolio $5,600 4.04% TFSA 1 $1,956 4.53% TFSA 2 $2,250 4.67% Non-Registered $210 1.37% Corporate Portfolio $8,300 3.54% RRSP 1 $4,800 3.55% RRSP 2 $520 2.68%

- Total Invested: $631,439

- Total Yield on Cost: 3.74%

- Total Dividends: $23,636/year (+15.5%)

Current Update

Since December, there has been little change to our financial situation. In fact, it has been more go-with-the-flow type mentality. In a previous update, I announced that my spouse took the leap and resigned from her professional healthcare career. Since she was on a leave of absence for the previous two years anyways, there was very little financial pain with the move.

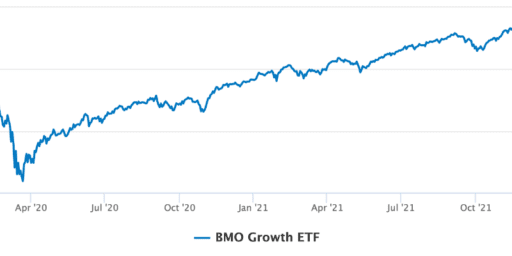

There has actually been some financial benefit to leaving her position, namely her pensions. One pension has already been transferred to a LIRA with Questrade, but there is a larger pension that I’m currently dealing with. We have the option to leave the pension in place until the age of 60, but we are in the process of taking the inflated commuted value (due to the low-interest rate environment) lump sum and investing it ourselves. I’m still contemplating the investment strategy for the new money, but it will likely be along the lines of indexing with ETFs. Boring but effective!

We still live off my government salary, and we still pay close attention to our spending (here is a breakdown of our expenses in 2015 ). Since we do not have any large debt servicing requirements (mortgage, rent, car payments etc), my salary allows us to live comfortably, but far from extravagantly.

Now, let’s talk a bit about my passive income strategy – generating dividend income. As dividends are the main focus of my passive income pursuit, there is a large dependence on the market. While there are merits to this investment strategy, there are also substantial risks – particularly dividend cuts. The goal of the strategy is to pick strong companies with a long track record of dividend increases.

On the topic of dividend increases, 2017 is off to a great start. It’s only the first quarter, and there have already been a large number of dividend increases in my portfolio. I received a raise from:

- TD Bank (TD); Scotiabank (BNS); Magna (MG); Royal Bank (RY); CIBC (CM); TransCanada (TRP); Great-West Life (GWO); Thomson Reuters (TRI); Manulife (MFC); BCE (BCE); Enbridge (ENB); Canadian Utilities (CU); Canadian National Railway (CNR); and, Metro (MRU).

In addition to the dividend raises, I’ve continued to deploy corporate cash into dividend stocks which has resulted in the biggest contributor to dividend income growth ($8,300 annually -> $9,700 annually). Since this is currently my largest investment account, it also adds the most weight to my overall holdings.

In my overall portfolio, here are my current top 10 largest holdings (besides cash):

- Bank of Nova Scotia (BNS);

- TransCanada Corp (TRP);

- Fortis (FTS);

- Bell Canada (BCE);

- Emera (EMA);

- Canadian Utilities (CU);

- Enbridge (ENB);

- Royal Bank of Canada (RY);

- iShares Core MSCI All Country World ex Canada Index ETF (XAW) (mostly from my wife’s RRSP); and,

- Manulife (MFC).

March 2017 Dividend Income Update

| Account | Dividends/year | Yield on Cost |

| SM Portfolio | $5,800 | 4.20% |

| TFSA 1 | $2,100 | 4.89% |

| TFSA 2 | $2,500 | 4.87% |

| Non-Registered | $210 | 1.37% |

| Corporate Portfolio | $9,700 | 3.66% |

| RRSP 1 | $5,300 | 3.68% |

| RRSP 2 | $600 | 2.66% |

- Total Invested: $679,450

- Total Yield on Cost: 3.86%

- Total Dividends: $26,210/year (+10.89%)

Through a combination of deploying cash and collecting those juicy dividend increases, the start of 2017 has been strong with a 10.9% bump in dividend income. With the financial goal of $35,000/year by the end of this year, I will need to stay aggressive in deploying savings capital into yielding positions.

We still have a long way to go, but for the most part we are moving in the right direction. There is cash available to deploy in most of our accounts. That’s in addition to the dividends that are constantly being churned out which gets deposited as cash and reinvested again (the power of compounding). You may notice that RRSP 2 is also fairly minimal in dividends, that’s because that is my wife’s RRSP, and it is 100% indexed.

If you are also interested in the dividend growth strategy, here is a recent post on how to build a dividend portfolio. With this list, you’ll get a general idea of the names that I’ve been adding to my portfolios.

Let me know if you have any questions by leaving a comment.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Hi FT,

Do you drip your stocks in the corp acct or or build up the cash received to make future purchases? What frequency do you buy stocks in this account and would you buy more than 1 at a time and do you go buy a minimum purchase price or use questrade for the corp acct where it may not matter the purchase size? Why not use a dividend etf in this account?

Hi Sue, I prefer to build cash and add to positions when valuations are more attractive. I considered using a dividend ETF, but I prefer to hold individual positions for dividend growth stocks. Are you a dividend growth investor as well? Do you use an ETF?

Hi FT, I see that you include both RRSP portfolios in the overall dividend income. If you actually did leave your full time employment, would you really be withdrawing from the RRSPs?

Oh and the Corporate Portfolio you mention, is that where you have most of your US stocks?

Hi Sergio, I would have no problem withdrawing the distributions from the RRSP account while our incomes are low (ie. early retirement). I hold my US stocks within my RRSP.

Hey FT, have you investigated writing covered call options to generate extra income? I usually write covered call options that will provide me with at least a 15% gain if my options were executed.

Hi Leo, I have played around with covered calls but didn’t like the idea of having my “hold forever” positions called away. I may look at this again in the future.

I love your strategy. But I don’t know if I would have the stomach to choose individual stock. I guess I will stick to ETF and add some stock on the side.

Just wanted to say that I have really enjoyed reading your journey. I am a similar age, though in Australia, with a similar level of net worth – however, I am relatively new to the FI blogging community. So it feels rally fascinating to read a ‘parallel’ journey (though I am not at FI – our targets are very comparable).

Not sure I would have the stomach for the individual share allocations you have built up, particularly in the finance sector, though the utility shares are obviously an excellent stabilising force. I can see the attraction of the simple direct holding though, versus paying an extra layer of fees.

A dividend income strategy can have a tax advantage but only if you stay in canada. When investing internationally or for higher income brackets, cap gain has the best tax benefits.

While dividends feel “fun” to be getting paid by the companies you own, it would be safer to be more diversified in a general index and internationally.

Good post, keep it up with your wealth growing plans!

Is yield on cost really a useful metric?

That’s a good question Nobleea! I use it to give me context to the power of dividend growth!

how do i find out my dividends / tear on my rrsp account? is there a specific formula to use or is this something my bank can provide me?

Hi Mike, your rrsp statements may give your dividend amounts. Otherwise, you’ll need to track it yourself. I use google spreadsheets, you can see more info here:

https://milliondollarjourney.com/how-to-create-a-stock-watchlist-with-google-spreadsheets.htm

Hey FT,

I’m going to begin tracking my dividends like this too. How are you grabbing your dividend info? Is this manual or can the google finance api do that?

I manually grab the info from sources like ca.dividendinvestor.com. Tawcan has a really good article on grabbing the dividend, but limited to the number of ‘query’s’ that you perform.

http://www.tawcan.com/using-google-spreadsheet-dividend-investment/

Good to know thanks!

“While there are merits to this investment strategy, there are also substantial risks – particularly dividend cuts.”

I think your biggest risk is Canadian bias, I don’t see anything outside of the TSX listed.

Do you think it would have been better if you:

1. Bought your house

2. Accumulated a stock portfolio

3. Paid off mortgage

Instead of:

1. Bought your house

2. Paid off mortgage

3. Accumulated a stock portfolio

I definitely have a lot of assets in the TSX. However, we also have substantial assets in US/foreign equities. My entire RRSP ~$150k is in US equities, and Mrs. FT’s RRSP is mostly in XAW (US/international). But yes, my corp portfolio is skewing the results towards Canada due to the large size.