Legal Wills Review: Canada’s Best Online Will Kit

Canadian Legal Wills Review Ratings

-

Value Per Dollar

-

Per Item Pricing

-

Online Help + Clear Instructions:

-

Availability Across Canada

-

30-Day Money Back Guarantee

-

1,000+ Google & Facebook Reviews

Legal Wills Review Summary:

An overall excellent value! Creating my will was quick and easy. It took me precisely 22 minutes – so 2 minutes more than the company’s “20 minute” prediction. The instructions were quite clear, and the step-by-step process made it easy to create a will that was as basic or as complicated as one wants.

I appreciated the per-item pricing which allows customers to decide if they want more of a “package deal” or just a simple basic will. (Unlike other online will kits which lock customers into a highly-priced package.)

Pros

- Fast and easy to use

- Very competitive pricing

- Overwhelmingly positive reviews everywhere

- WAY cheaper than a lawyer!

- 20% discount with MDJ

Cons

- Not a full replacement for a lawyer in complicated multi-million dollar estate planning situations

When I was asked if I wanted to write a Canadian Legal Wills review in exchange for a free trial of Canada’s best online will kit, I have to admit that I was embarrassed.

You see… Until yesterday I didn’t even have a will.

I know, statistics show that roughly half of Canadian adults don’t have a will, and only a third or so have one that is up-to-date.

[Editor’s Note: I originally wrote this Legal Wills review back in 2020, and I have been a very satisfied user ever since. The features below are fully updated for 2024. I’ve also had several extended family members use the product, so I benefit from their firsthand accounts as well.]

But I’m a personal finance writer! I’ve told other people, “The two most overlooked areas in personal finance are long-term disability insurance and having an updated will.” So you can see why I hesitated when Canadian Legal Wills reached out and asked if I wanted to try their platform.

Despite the embarrassment, I had to admit to myself that there were simply no more reasons left to procrastinate these final steps on the path to becoming a real adult. So I forced myself to sit down yesterday and confront my own mortality… 22 minutes later the awkward process was completely finished.

- What is an Online Will Kit? Actually… What Exactly Is a Will?

- Do I Need a Lawyer to Complete My Online Will?

- Is It Safe and Secure to Use Canadian Legal Wills?

- Canadian Legal Wills Review: My Experience

- Canadian Legal Wills vs Willful vs Formal Will

- What Are a “Power of Attorney” and “Living Will” – Do I Need Them?

- Our Canadian Online Will Kit Promo Offer Code

- Canadian Legal Wills Review: Final Verdict

What is an Online Will Kit? Actually… What Exactly Is a Will?

Ok, so if you’ve ever watched a legal drama or business TV series like Succession you know that a will is basically some sort of legal thing that lets the world know what you want done with your “stuff” when you go to that great tax haven in the sky.

In reality, a will can be any document that includes the following:

1) Your signature – in ink – witnessed by two people who are not family OR are not mentioned in the will. (Technically you don’t even need the witnesses, but this opens many cans of legal worms.)

2) As little or as much writing as you want, that details where your assets should go when you pass away – assuming you are “an adult of sound mind”. (Legally, this means that you are the age of majority in your area and have not been declared legally/medically unable to make decisions on your own behalf.)

That’s it. Your Stuff. Your Signature. Good to go right?

Almost…

An online will kit is basically a similar service to doing your taxes online.

Instead of guiding you through complex legal jargon, the website will ask you straight forward questions such as, “Do you have children?” or “Would you like to donate to charity when you pass away?”.

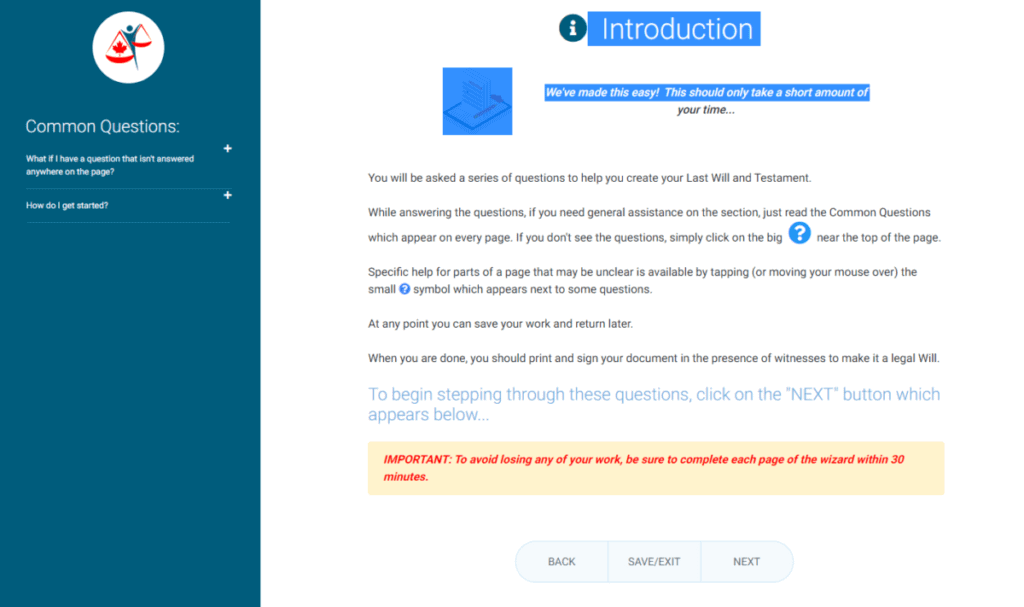

You simply answer these questions (don’t worry, there are a lot of helpful instructions to guide you, as well as personalized help available) and then the program will take your answers and use them to create an official will document that states your wishes in more formal wording. Just like a tax preparation program takes your answers to questions and then spits out a wall of specialized tax forms.

If you’re sick of thinking about a certain question, or want to chat with someone before entering an answer, it’s very easy to just hit “save” and come back to finish the process later.

LegalWills.ca Pricing and Popular Packages

The Best Deals – With Our Exclusive MDJ20 Promo Code Included

| Package Name | Price |

Standard Last Will and Testament | $32.97 |

| Most Popular: Premium Last Will and Testament | $44.77 |

| Best Value: Complete Estate Plan | $63.99 |

| Click here to automatically have our 20% promo code applied | |

Ala-Carte “Build Your Own Package” Legal Will Prices

| Service | Price | Description |

| Last Will and Testament | $32.97 | Create a fully legal will tailored to the laws of your province, specifying how your estate should be distributed. |

| Power of Attorney | $23.96 | Designate someone to legally make decisions on your behalf if you become unable to do so. |

| Living Will (Healthcare Directive) | $15.96 | Outline your wishes for medical treatment and care in situations where you cannot communicate them yourself. |

| Expatriate Will | $31.96 | For Canadian citizens living abroad, create a will that complies with Canadian law and pertains to your global assets. |

| Mirror Will | $55.92 (for couples) | A pair of wills for spouses or partners that mirror each other, typically naming the other as the primary beneficiary. |

| Life Locker | $23.96 | A secure repository for all your important information, accessible to your executor when needed. |

| Legal Will Storage | $9.56/year | Secure online storage for your legal documents, ensuring they are accessible but protected. |

| MyFuneral | $9.56 | Plan your funeral wishes in advance, relieving your loved ones of the burden during a difficult time. |

| MyLifeLocker Executor Handbook | $11.96 | A comprehensive guide for your executor, detailing everything they need to know about your estate. |

| MyMemories | Free with Will purchase | An add-on service allowing you to leave personal messages and memories for your loved ones. |

Do I Need a Will and Is It Worth It?

Yes.

This is one of those “do as I say – not as I do” scenarios.

As I admitted before, I should have had a will years ago. At a cost of $32, there is really no excuse to not get this done – other than the fact that it kind of sucks to think about your own mortality.

A common misperception is that wills are only for rich people who say things like, “I will be dividing my estate between various trusts, charities, and offshore accounts.”

The will that I created was very straight forward, with the main appointments and distributions of my possessions covered in just a couple pages. It simply states that if I were to pass before my wife, she would get all of my assets. If she were to predecease me, or pass away within 30 days of my own death, then I designated my brother to receive all of my assets. Then there were a few additional pages explaining concepts such as exactly what the Executor of my will can and cannot do.

That’s literally it. “All of my assets” is pretty basic stuff at the moment: house, vehicles, cash, investment accounts. I guess my brother could decide just how valuable my treasured book collection is relative to the space it would take up in his house!

Obviously my will is simplified a lot by having no children and only one sibling, but it bears repeating that this will stuff doesn’t have to be hard!

Creating this simple document could save a ton of headaches – right when people want to avoid any additional headaches. Sure, you might not really care a ton about your stuff after you pass away, but at the very least, consider the volume of decisions that you’re leaving to loved ones during a time where they don’t need any more decision-making fatigue.

One of my best friends had the misfortune of not knowing his dad all that well due to the fact that his parents were divorced when he was a child. Dad was only “in and out of the picture” for the next 15 years. When his father suffered a sudden heart attack and passed away, this obviously opened up many layers of emotions for him.

In addition to this considerable emotional turmoil and grief, he also had to deal with family conflict over how his father’s assets would be disbursed. With no will, semi-estranged children that lived in different countries from himself, a surviving mother, sister, and nephew that he was relatively close to, and several other complicating factors, you can imagine how difficult this man’s final wishes were to discern.

There’s no easy way to say this, but it’s worth noting that the prospect of instant money and possessions being inherited does irrational, sad things to many people. So on top of dealing with his father’s death, having to sort through a lack of closure in their relationship, and just the mental weight of dealing with funerals, etc., he was now part of what turned into a fairly intense family squabble.

The end result was that lawyer fees and probate ate up much of the modest estate, and the family has yet to recover from the emotional wreckage that came about due to the inheritance conflict.

Probate fees alone are like paying a voluntary final tax of 1.5-2% of your entire net worth!

Clearly, if you have children, just for their custody alone you really need a will.

Beyond that however, it’s worth noting that if you pass away your assets do not automatically go to your spouse. If you pass without a will – this is legally referred to as “intestate” – the administration of what you left behind will be complicated and expensive to figure out.

In fact, if you are married with children, and pass away without a will, you might think that your entire “estate” would simply be transferred over to your spouse. You would only be right if you lived in two Canadian provinces – anywhere else, and different provincial rules will divide up your estate in a different (re: more complicated) manner.

Depending on what laws your local jurisdiction has set up, it’s possible that your entire estate could be left to local government. If you need more motivation to get this thing done, just imagine all your cash being spent by whichever politician it is that you can’t stand!

If you have a complicated situation which involves complex tax structures – such as corporate assets – that you want to cover in a separate will, then you should speak to an estate planning attorney. But online will services are more capable than one might think. They can now deal with things like blended families, overseas assets, and pet trusts. What you won’t get however, is legal advice, or “estate planning” strategies to structure your estate to minimize taxes.

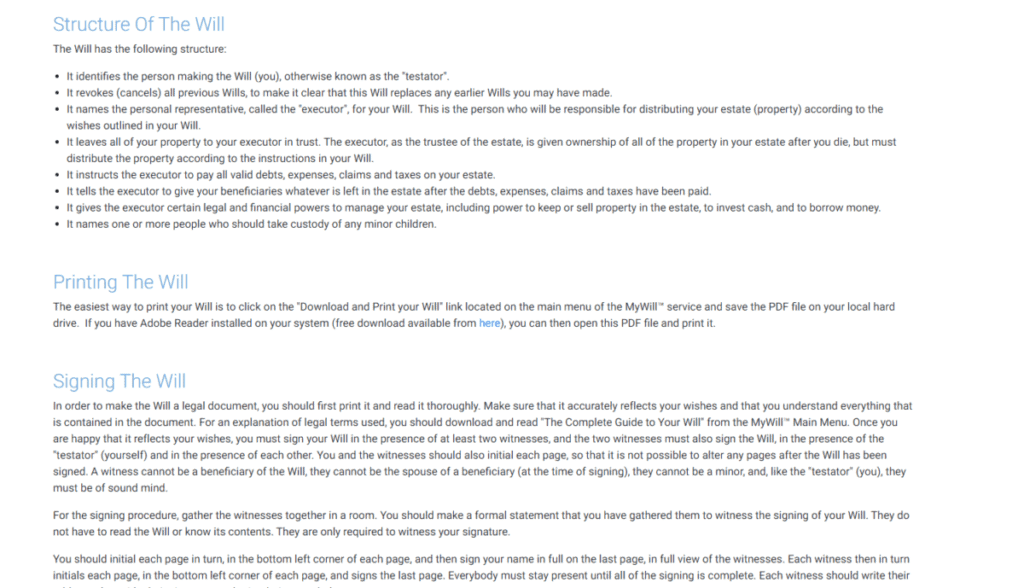

It’s important to understand that if your situation changes (you become married, enter into a common law relationship, have additional children, one of your beneficiaries or executor passes away, etc) then you have to re-do your will. This is a simple process with Canadian Legal Wills, as you can simply input your new changes, print, sign and date the new will. You’ll notice the wording at the beginning of the document states that past versions of your will are now invalid.

If you read all that and decided that you didn’t need a will or that the peace of mind isn’t worth $32 to you – then we’re playing in really different ballparks.

How Much Do Online Will Kits Cost?

I remember my parents talking to me about getting a will years ago. They had just gotten back from a meeting in a fancy lawyer’s office, and had gotten a “complete family will done for $1,200”.

With our MDJ20 promo code you can get your will done today for only $32!

No, that number isn’t a typo. Using an online will kit would have saved my parents 97% (or over $1,100).

We’ll discuss some of Canada’s other online will kit options below, but for now, just know that they price in at $39-$300. Several online will kit providers are more expensive than Canadian Legal Wills, but not nearly as pricey as that lawyer’s office.

It turns out that the vast majority of that complicated legalese writing that exists in most wills is pretty much a template. You simply need the software to plug in your custom options and names – and voila – a legal document ready for your perusal.

Remember – a lawyer doesn’t sprinkle any magic legal dust on a document that turns it into a “more legal” will.

Are Online Will Kits Legal In Canada?

The Canadian Legal Wills documents that you will download, print, and sign, are 100% legal wills in the eyes of any Canadian court.

Canadian Legal Wills has been around for 20 years and is based in Ottawa, Ontario. They have several lawyers on their advisory team. They know this stuff inside and out. If there were legal loopholes or oversights, they were noted and fixed long ago.

The truth is that the legal definition of a will in Canada is pretty basic – so it isn’t all that hard to meet the standard of a legal will. In theory you could write out a few sentences on the back of a napkin, have a couple of witnesses sign it, and that could be your will. I wouldn’t recommend that – but you could do it!

When I compared the document produced by my online will kit, to my parent’s will, they were very similar. My parents have a few more assets to worry about, and wanted to do a couple more complicated things, but the essential legal phrases and structure were identical.

Do I Need a Lawyer to Complete My Online Will?

Short Answer: No.

You do NOT need a lawyer to complete your online will – or a will of any kind.

That said, Canadian Legal Wills was careful to point out that:

We do not provide you with legal advice. We are giving you direct access to the same software that lawyers use to prepare their documents, but you are doing it yourself. In our opinion, lawyers significantly overcharge for most estate planning documents as they are inputting your information into software that generates documents like a Will for them.

We do the exact same thing. However, if you need custom clauses written to cover an unusual situation, we cannot do that, and we recommend that you seek legal advice. For example, if you have a child with special needs, they would need a trust written for their inheritance. We don’t do that.

In most cases, a document written using our service will be word-for-word identical to one prepared by a lawyer.”

That said, Canadian Legal Wills does offer a “Legal Document Review” option for an additional $69 – where their team of lawyers will review your completed will for “consistency and completeness”.

Personally, after several hours of reading about the ins and outs of using an online will kit vs the traditional lawyer option, I think it becomes a question of balance. The more of the following complicating areas that your will includes, the more likely I’d be to choose the “Legal Document Review” option or perhaps pay the much larger bill to get something custom done at a lawyer’s office.

- You’re in a difficult-to-define situation with a spouse or former spouse. (Ex: We’re “separated” but not divorced.)

- You have assets outside of Canada, the UK, or the USA.

- You own a corporation that is fairly complex.

- You have several million dollars in assets and would like to set up specific trusts and other legal tax avoidance strategies.

- You have a mental health history that would allow someone to challenge your status of “sound mind”.

Is It Safe and Secure to Use Canadian Legal Wills?

Obviously your will is likely to include the most personal of details, and you don’t need anyone rooting around in those right?

Canadian Legal Wills has been around for over two decades, and has an stellar A+ rating with the Better Business Bureau. They’re Google rating is 4.9/5 with almost 1,300 people having rated them. If you find me a restaurant that is a 4.9 with 1,300 customers I’ll show you one heck of a meal!

Canadian Legal Wills uses its 21+ years of experience and track record to ensure that your information is kept absolutely safe and secure. They state that:

All data passing from your computer to this web site is authenticated and encrypted using 256-bit “SSL encryption”. This is the most advanced level of encryption available today, and it means that any information sent from your computer is scrambled in a way which makes it completely unintelligible if intercepted.

When you are on a secure section within the web site (i.e. after you have logged in as a member), a padlock will appear on your web browser. This is your assurance that the encryption is in place and that you are communicating across a secure link.

Furthermore, this web site uses an industry standard high security streaming-encryption algorithm known as “RSA” to encrypt all of your information before it is stored online. RSA is a public-key cryptosystem developed by MIT professors Ronald Rivest, Adi Shamir and Leonard Adleman.

To give you a feeling for the level of security provided by this encryption, it has been estimated that with the most efficient algorithms known to date, it would take a computer operating at 1 million instructions per second over 300 quintillion years (that’s 3 with 20 zeros behind it!) to break the encryption. That’s several trillion times longer than the age of the Earth.

Furthermore, Canadian Legal Wills uses daily backups on each of their servers, and utilize a wide variety of physical protection for their primary systems. When using your credit card, all purchases are made through a Secure Sockets Layer (SSL) encryption, with Private Communication Technology (PCT) security standards. Your credit card is as secure as using it in any store or restaurant.

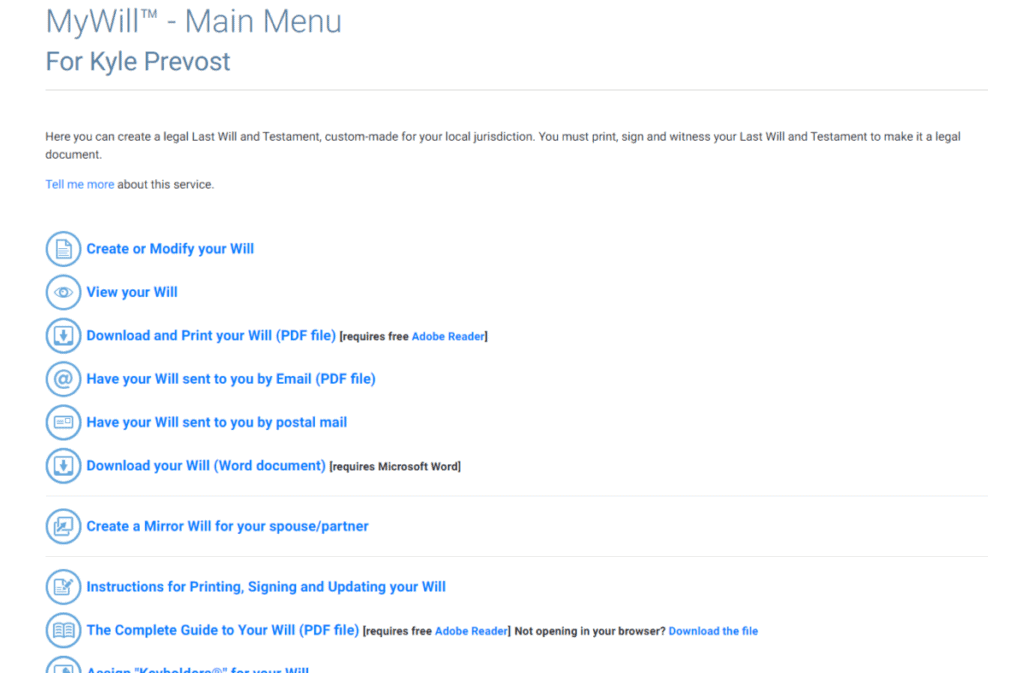

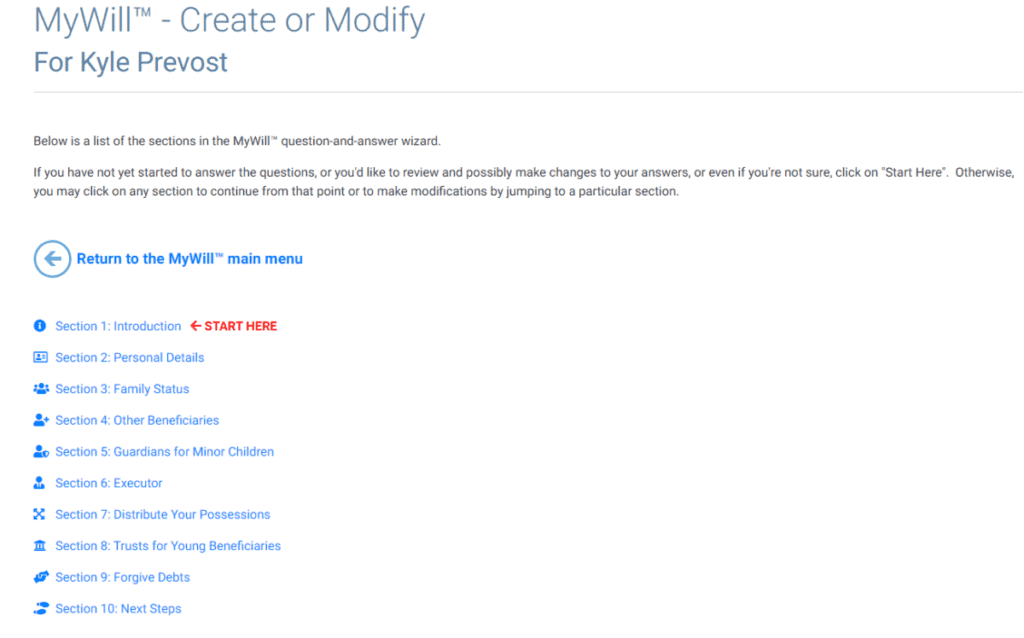

Canadian Legal Wills Review: My Experience

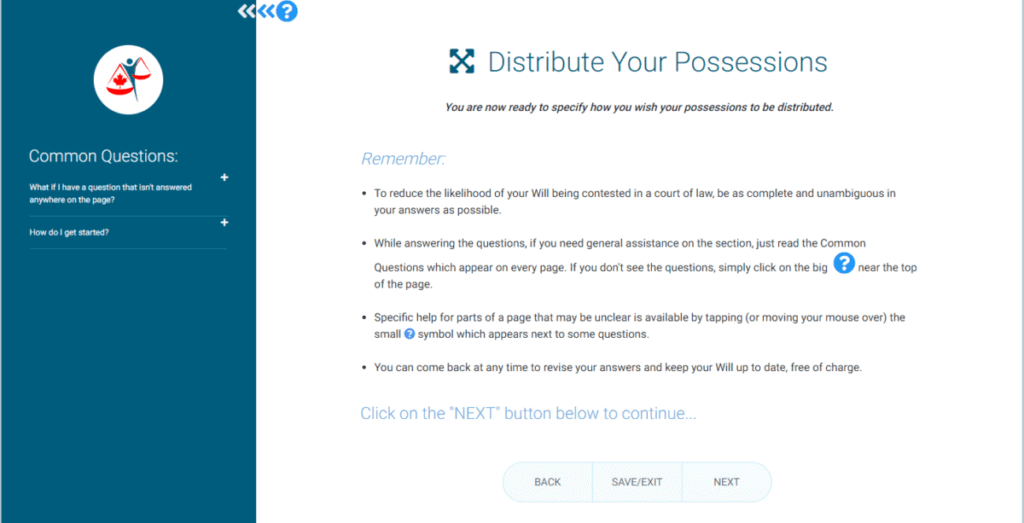

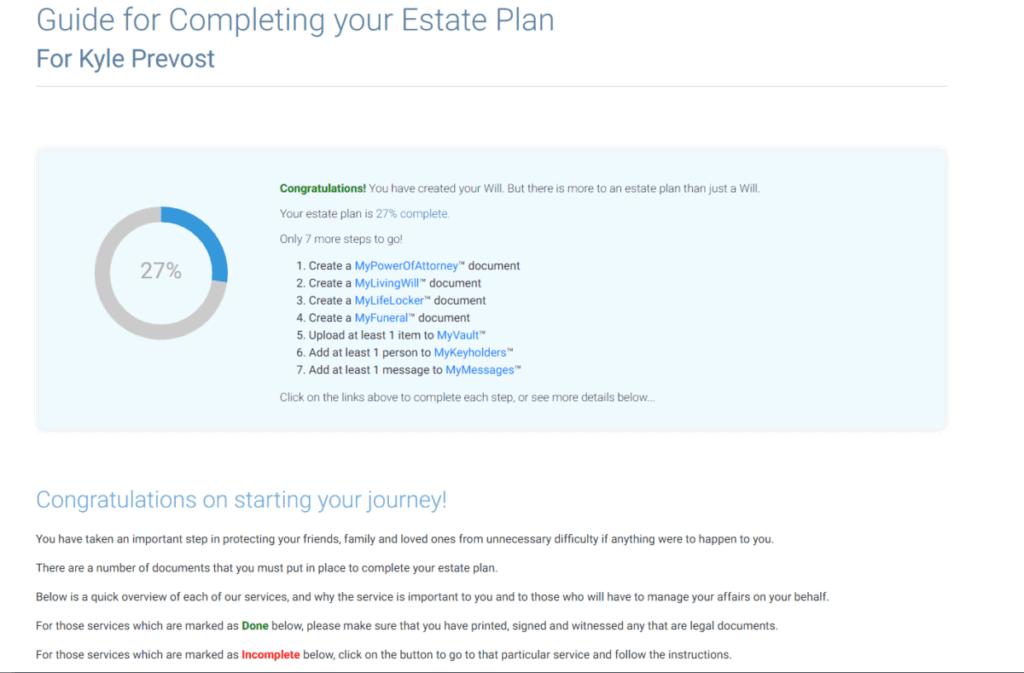

To fully illustrate just how easy the Canadian Legal Wills platform is to use, I took a variety of screenshots as I went through the online will kit process. The truth is, that if you already know the answers to unique questions such as “If your executor predeceases you, who is your backup plan?” then you could actually create this will in 10 minutes or less.

It took me 22 minutes because I hadn’t thought about questions like that. I don’t have a lot of unique assets to worry about. Family heirlooms, items of personal value, charitable requests etc. aren’t on my radar at this point in my life.

I contemplated setting up a trust for my niece and nephew – which would be the most tax-efficient route – but I decided that at this point, simply signing it over to my brother would be fine, as the amount saved on taxes likely wouldn’t be worth the added complication.

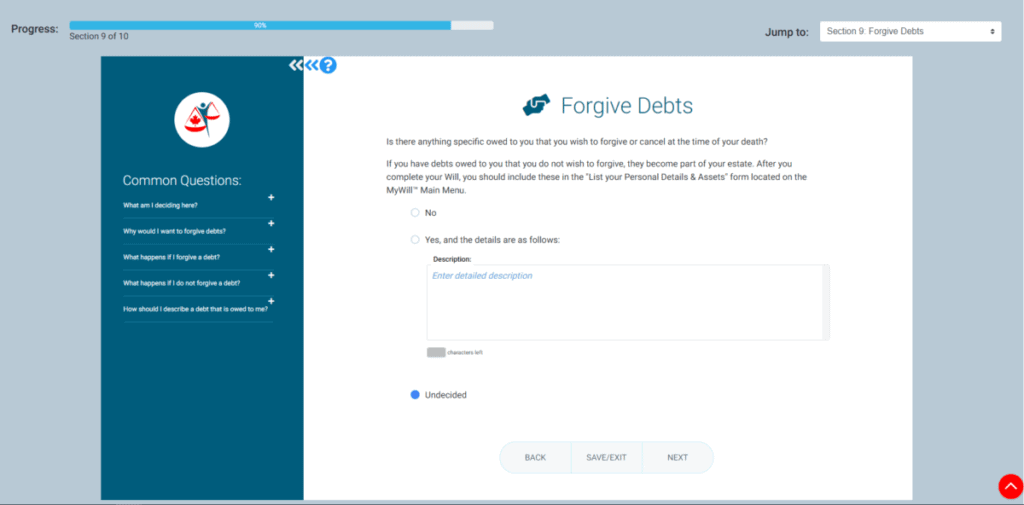

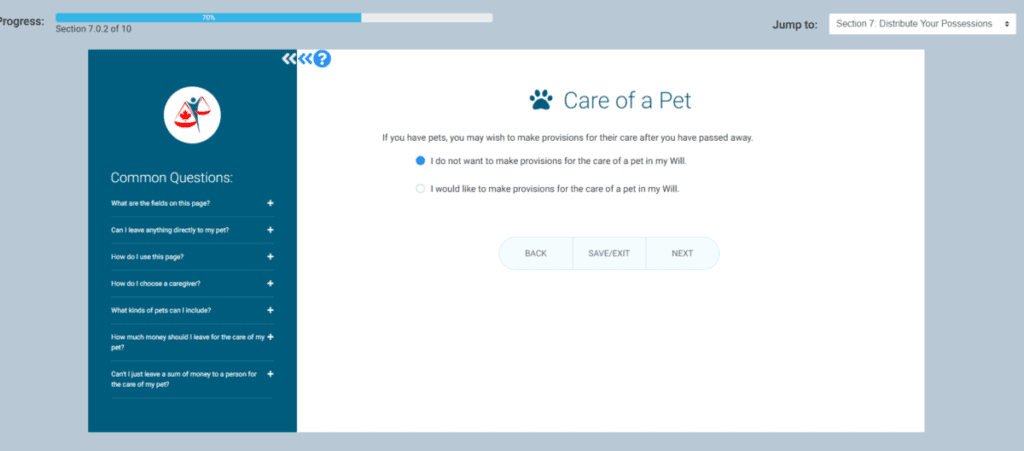

A couple of interesting prompts that I wasn’t expecting revolved around plans for pets and if I wanted to forgive any debts in the event of my passing.

You can see from the below screenshots that Canadian Legal Wills has streamlined their process and instructions over the years. I felt supported the entire way through and had no need for their online chat support, but it was comforting to know that it was there if I needed it.

Canadian Legal Wills vs Willful vs Epilogue

| Feature/Service | Willful | LegalWills.ca | Epilogue |

| Pricing | Starts around $99 for a basic will. Packages available for individuals and couples. | Starts at $31.96 for a basic will. Additional documents and services are extra. Discount packages available. | Starts around $139 for a single will, with discounts for couples. |

| Documents Offered | Last Will and Testament, Power of Attorney, Living Will. | Last Will and Testament, Power of Attorney, Living Will, and more. | Last Will and Testament, Power of Attorney, Living Will. |

| Ease of Use | User-friendly interface with guided process. | Step-by-step instructions, slightly more complex for comprehensive options. | Simplified process, designed to be quick and user-friendly. |

| Customization | High level of customization for personal circumstances. | Offers detailed options for various scenarios, including guardianship and trusts. | Focuses on straightforward estates, with some customization. |

| Legal Validity | Documents are legally valid across Canada, except Quebec for Living Wills. | Legal all across Canada; specific services tailored to each province’s laws. | Valid in all provinces except Quebec, tailored to provincial regulations. |

| Support | Email, chat, and extensive FAQ section. | Live Chat, Email support, comprehensive FAQ, and phone support for some packages. | Email and live chat support, with resources available online. |

| Updates/Revisions | Free unlimited updates to documents. | Free unlimited updates to most documents. | Free updates for a year; subscription service for ongoing changes. |

| Storage | Electronic storage available, with instructions for legally signing and storing physical copies. | Offers secure online storage and instructions for physical document storage. | Digital storage provided, alongside guidance for physical document signing and storage. |

**Note: All Canadian Legal Wills prices reflect our 20% off MDJ20 Promo Code

Legal Wills and Online Will Kits FAQ

What Are a “Power of Attorney” and “Living Will” – Do I Need Them?

Living Will: A Canadian Living Will is a bit of a misused term. The phrase “living will” has been lifted from our American cousins, and is often used to mean “Advanced Care Plan” in Canada. Basically these are instructions that doctors and courts will read if for some tragic reason you are no longer in a physical/mental state that allows you communicate your wishes a given time.

It also designates a Power of Attorney for Personal Care (often called a medical proxy or healthcare representative) who can make medical treatment decisions on your behalf.

Power of Attorney: There are various types of power attorney, but the basic premise is that you’re giving legal power to someone else to make binding legal decisions on your behalf. We discussed the Healthcare Power of Attorney above, but when most people use the phrase they are referring to a General Power of Attorney (often known as a Financial Power of Attorney).

There are many different levels and sub-settings under these categories, but the idea is that you are choosing someone to handle all of your financial affairs. You can limit this power to a specific translation (ex: selling a car for you if you move overseas).

Do you need these options?

That’s a tough one. Look, I’m not a lawyer, but here’s how I looked at it: If thinking about these documents prevents you from creating a basic will – then ignore them for now! Too much reading/thinking/decision-making often leads to paralysis-by-analysis and you NEED to get your will done ASAP.

That said, obviously in certain situations (beyond the scope of this post) having a Living Will or Power of Attorney is very important. Unfortunately the chances of us dying one day – from something – are pretty darn high. That’s why you need a will! The chances that you are left in a state of lost capacity where you would need a Living will or Power of Attorney are not nearly as high. So it’s up to you to weigh those probabilities for yourself.

Our Canadian Online Will Kit Promo Offer Code

If you click here you will automatically snag our Exclusive 20% Off will kit coupon.

You can also head over to Canadian Legal Wills and use our MDJ20 promo offer code to take advantage of that exclusive deal.

Or Use Our Promo Offer Code: MDJ20

Canadian Legal Wills Review: Final Verdict

My experience with using the Canadian Legal Wills online will kit was more pain-free and time-efficient than I could’ve imagined. I was happy to cross something off of my “to do list” that had been on there for way too long. For only $32 and with a money back guarantee, I don’t see how a person could go wrong.

Four years later, I have followed the online will kit world pretty closely since writing the original Canadian legal wills review. The only downside I have noticed that I didn’t anticipate originally, is all of the anxiety that unscrupulous lawyers across Canada have been stirring up as they try to scare people like my parents into paying $1,500+ for a service that most people could do on their own with a half hour and 32 bucks.

Don’t just take my word for it though – Robb Engen (one of my favourite Canadian personal finance writers) wrote in the Toronto Star that, “LegalWills.ca is the most affordable and comprehensive online will kit, with customers in the tens of thousands.”

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Good information on this page. Although the Updates/Revisions row in your chart for Epilogue is incorrect. They actually offer free updates to your Will.

That was a great review. Over the years I’ve created a will with two different lawyers and neither one seemed to be as thorough as this will kit. I would definitely try it.

Also, I’m currently acting as executor for the third time and having a well thought out will to work with is crucial. No one will do anything for you unless you can show them you are the designated executor or administrator.

I am tempted to order one of your will kits but I have a couple of problems I need to sort out first. Perhaps you might point me in the right direction?

My current executor is 71 and lives in England. Somehow it seems unfair to expect him to do the job. I have no other family and my friends are all the same age as me, which is 75.

Who could I get to be an executor, and perhaps fill other positions like Power of…etc.?

Thank you.

Linda

Hi Linda, I’m not totally qualified to answer this question, but you could designate an attorney or a younger family member?

Thanks Kyle but I have no attorney, hence my interest in your service. As mentioned in my question, I have no family members.

Thanks for the post!

Did you request the storage of the will (lifetime) or just the basic?

We requested the lifetime (because I got it as part of a package). I don’t think it’s a “must have” or anything like that.