Free Stock Trading in Canada 2025

The best free stock trading apps in Canada are giving DIY investors more control than ever. With no trading fees eating away at returns, it’s never been easier to build your own portfolio and keep more of what you earn.

That said, let’s be clear – “free trading app” doesn’t mean there are no costs at all. While some platforms have eliminated commissions on stock and ETF trades, there are always ways brokerages make money, whether through currency conversion fees, foreign exchange spreads, selling payment for order flow, or premium account options. The key is understanding what “free” actually means and how to pick the right platform for your needs.

Ever since platforms like Robinhood shook up the U.S. market, Canadian DIY investors have been looking for ways to ditch the high fees and take charge of their own investments. Below, you’ll find a quick comparison of Canada’s best free stock trading platforms. If you’re looking for the full, in-depth breakdown head over to our complete Best Online Brokers in Canada 2025.

Comparing The Best Free Stock Trade Brokers For Canadians

When selecting a broker, the key is to look for hidden charges and fees that might not be advertised up front. We’ll break it down below in our review of the six best zero commission online brokers in Canada.

FREE buying and selling of 100+ ETFs

$8.75 per trade or $6.95 for active investors

Free to buy and sell ETFs

Free trades + ECN Fees

$0 for TD ETFs only

$0 for the first 50 stock trades per year, $9.99 thereafter

$0 for buying or selling ETFs

$0 for buying or selling stocks

$0 for buying or selling ETFs

$0 for buying or selling stocks

No Available Promotion

$0 for buying or selling ETFs

$0 for buying or selling stocks

No Available Promotion

While there are multiple options to choose from when it comes to free stock trading in Canada, you’ll want to know about any hidden fees, what products are on offer, and most importantly, know that your money is safe and sound.

Read on to find out more about what to expect from each of our top picks, and to find out which one might be really worth it for you and your goals.

What is Free and What Still Costs Money?

We’ve given you the rundown on the free ETFs and stocks, and minimum account deposit costs, so now let’s take a look at other commissions and fees that these brokers charge. This is often a place where brokers charge more in order to make up for the lost commission on trades.

Broker | Mutual Funds | Options Trading | Annual Fee | Inactivity Fee |

Free | $8.75 + $1.25 per contract or $6.95 + $1.25 per contract for active traders | $25 per quarter (can be waived if certain requirements are met) | Charged as an administrative fee if minimum requirements are not met | |

$9.95 per trade | $9.95 per trade + $1 per contract | None | None | |

Not Available | Not Available | None | None | |

$0 for buying or selling most funds | $0 per trade + $1.25 per contract | $100 (can be waived if certain requirements are met) | Charged as an administrative fee if minimum requirements are not met | |

Not Available | Not Available | $0 | $0 | |

$0 for buying or selling most funds | $1.25 per contract, minimum $8.75 | $30 inactivity fee per quarter, waived if certain requirements are met | $100 per year for registered accounts, waived if certain requirements are met |

We can see that although some brokers are really committed to offering free services to their clients, others are making up for free in other places.

1. Qtrade – Best Free Stock Trading in Canada

One of our top recommended discount brokers in Canada, Qtrade’s got a fantastic promo offer, free portfolio simulator to help new investors learn the ropes, excellent customer service and range of account options.

- ETF Trading Fees: More than 100 free ETFs available

- Stock Trading Fees: $8.75

- Options Trading Fees: $6.95 + $1 per contract

- Annual Fees: $0

- Full Review: Qtrade Review

2. Questrade – Best For Low Fees

Questrade entered the ranks of free stock trading apps for Canadians in 2025. In other words, they now charge $0 in stock trading fees, as well as $0 for ETF trades. That said, they do include ECN fees on trades in certain situations. The excellent research options available are a step up on the other no-commission platforms out there. All that said, customer service still continues to be tough for Questrade.

- ETF Trading Fees: Free + ECN fees

- Stock Trading Fees: $0

- Options Trading Fees: $9.95/m + $1 per contract

- Annual Fees: $0

- Full Review: Questrade Review

3. TD Easy Trade – Best Big Bank Free Brokerage

TD Easy Trade, formerly TD Goal Assist, was created with the new investor in mind. It’s limited in the type of trading you can do, as well as in that it only has TD ETFs available. It’s an app-only platform that provides users with a goal planning feature, allowing them to easily track and monitor their progress. As it’s a relatively new TD product, we’ll have to wait and see how it evolves.

- ETF Trading Fees: $0 for TD ETFs, which are the only ones available on the platform

- Stock Trading Fees: $0 for the first 50 trades per year, $9.99 thereafter

- Options Trading Fees: N/A

- Annual Fees: $0

- Full Review: TD Easy Trade Review

4. Wealthsimple Trade – Best $0 Commission Broker

When it comes to free, Wealthsimple Trade delivers. It offers 100% free commissions on all trades, and is one of the few brokerages offering crypto trading. Because of its low costs, customers shouldn’t expect stellar customer service, and some will find its platform to be too basic for their needs.

- ETF Trading Fees: $0

- Stock Trading Fees: $0

- Options Trading Fees: Not Available

- Annual Fees: $0

- Full Review: Wealthsimple Trade Review

5. National Bank Direct Brokerage – Best Bank For Free Stock Trades

As far as the big banks go, National Bank Direct Brokers, or NBDB, was one of the first to offer free trading. While it is one of the few brokers with a brick and mortar presence, its trading platform definitely needs some work to compete with the other purely online brokerages offering zero fee trading.

- ETF Trading Fees: $0 for trades made online

- Stock Trading Fees: $0 for trades made online

- Options Trading Fees: $0 + $1.25 per contract

- Annual Fees: $100 if account holds less than $20,000 or fewer than 5 trades are made per month

- Full Review: National Bank Direct Brokerage Review

6. Desjardins – Best for Active Traders

Desjardins waited a while to jump into the free online trading game, and as such, they still have some work to do to get caught up. The platform leaves a lot to be desired, and even so, comes at a cost. While Disnat Classic is free of charge, Disnat Direct, which is aimed at more active traders, can cost up to $155 per month.

- ETF Trading Fees: $0

- Stock Trading Fees: $0

- Options Trading Fees: $1.25 per contract/$8.75 minimum

- Annual Fees: $0 (but keep in mind there is a $30 inactivity fee if certain requirements are not met)

- Full Review: Disnat Review

Commission Free Investing Canada: Is It Really Free?

Growing up, grandpa might have told you nothing is ever free.

While that might not be 100% true, it’s a cliché for a reason. Brokers need to make money somehow, and if it’s not from your trades, then where does it come from?

Some online brokers sell your purchase information to other Wall Street companies so that those “big fish” can then turn around and “front run” your trade – making them massive profits in the long run as they continuously skim miniscule amounts from millions of investors every day.

Another thing to be aware of is that some online brokers will purposely delay the payment for order flow – leading to slightly higher buy prices and marginally lower sell prices.

Many experts say that such practices should not be allowed, as it is allowing big investment firms access to unfair advantages. Others argue that without these methods in place, traders will not be able to access commission free ETFs or stocks, which may turn some potential investors off from jumping into the market in the first place.

Over time, we believe some of these strategies will no longer be allowed as regulators clamp down on these potentially unfair practices. Until then, it’s best to do your research and decide what you’re willing to give up to save money on your investments.

Free stock trading brokerages also make big bucks in areas like cryptocurrency trading (which has very high fees), as well as foreign exchange. You might not have realized it, but every time you buy a stock on the New York Stock Exchange or NASDAQ you’re first converting your Canadian Dollars to American Dollars. These free stock trading brokers charge a pretty sizable mark up on that exchange.

These no commission investing platforms also make money from your money – your cash that is. Having cash sitting in your brokerage account allows the brokerage to collect interest on it. That interest is way more than they’re paying you!

How to Choose a Free Trading Platform in Canada

Whether you are choosing a free trading platform in Canada or another brokerage, you want to make sure you have a variety of options, that your money and information will be safe and secure and that you can access the account when, where and how you prefer.

When looking at investment options, you should consider what free products are offered. For example, although free trading platforms like TD Easy Trade and Wealthsimple Trade are free, you won’t have the flexibility of choosing from all the available investment options out there. If you are looking for tax-advantaged accounts, such as RRSP and TFSA, you need to be sure the free stock trading platforms you’re looking at have them.

Safety and security are also top of the list when it comes to investing your precious money, so look for brokerages that are insured by Canadian regulatory bodies. Other security features such as data encryption and 2-factor authentication are definite musts. In case of any security emergency, you want to make sure that a customer service representative will be able to help. So, it’s worth looking into how the free stock trading platform you’re considering fares in that area.

Finally, with more investors relying on mobile versions of trading platforms, then it might be a deal breaker for you if the brokerage doesn’t offer a mobile app (like NBDB).

Keeping these factors in mind, you should be able to choose the best free stock trading platform in Canada for you.

How to Buy Individual Stocks in Canada for Beginners

So, you now know the stock market basics and what brokerages are out there to help you start trading. The next step, and the most important, is to choose the right brokerage and start investing!

Ready to get started? Follow these 3 simple steps.

Step #1: Open Your Brokerage Account

If you want to cut costs to the bone and decide to go with the discount brokerage route here’s how you would get started with one of our top online brokerage picks, Qtrade.

Head over to Qtrade to create a new account.

Step #2: Choose the Account Type

We recommend that you first max out your tax advantaged registered accounts first, as long as you qualify. Here are the different types of registered accounts.

In Canada, you can choose from:

- Tax Free Savings Account (TFSA)

- Registered Retirement Savings Plan (RRSP)

- Registered Education Savings Plan (RESP)

We have all the details you need to know to invest using registered accounts. Head over to our TFSA vs RRSP article to start learning more.

If you don’t yet qualify for a registered account, no problem! You can choose to open a non-registered account.

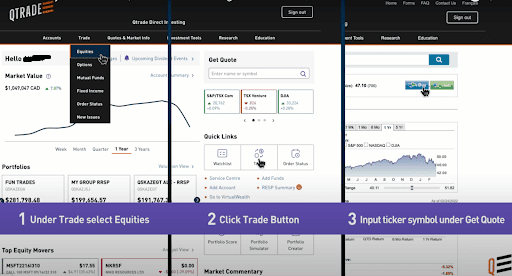

Step #3: Start Investing

Once you’ve logged in and selected the investment account you want to make a trade in, you can go ahead and start preparing to make your first trade!

We recommend doing your due diligence on the companies you are thinking of investing in. There are a lot of choices of stocks to invest in, but not all are worthy of your money. You can check out our top TSX dividend picks as a starting point, as well as by using the educational resources provided by your brokerage.

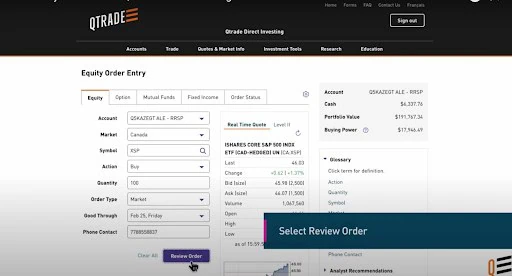

After selecting the ticker symbol for the stock you want to purchase, complete the necessary information on the next page as shown below:

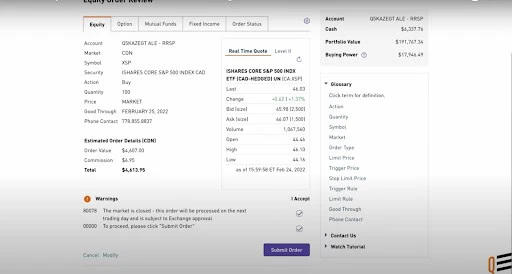

Almost there! Now, you just need to review the order. If everything looks good, you are ready to submit.

To track orders, simply click on the “Order Status” tab to check on how things are going.

For stock market beginners, the toughest trade to make is the first one, which is totally understandable as it’s all new to you.

After that, you can easily follow the same simple steps to trade again and again! Soon you will be trading with confidence as you watch your investments start to grow.

How to Build an Investment Portfolio for Beginners

Now that you know how to buy stocks in Canada, the question is just which stocks (or other investments you should buy).

Investors often refer to all the investments they own as their “portfolio”.

Most Canadians (and investors around the world for that matter) are best off if they focus on diversifying their portfolio as much as possible.

This means making sure they are invested in companies from around the world and from all the different sectors. But it also means investing in something other than stocks (because stocks can go up and down by 30%+ in a very short time). For most people this means some balance of stocks and bonds in their overall investment portfolio.

Here’s a great video describing the difference between the two:

The quickest way to buy an instantly diversified portfolio is through an all-in-one ETF. This type of investment lets you invest in many companies and many government bonds just by purchasing one single ETF using the steps above.

Here’s our Ultimate Guide to all-in-one ETFs in Canada

If you want to read more about managing risk and how much to put in bonds vs stocks, I recommend checking out our Free eBook.

Frequently Asked Questions

Selecting a the Best Free Stock Trading Broker for Me

When I first got into DIY investing nearly twenty years ago, the idea of free stock trading in Canada was laughable. If you wanted to buy or sell shares, you were stuck with the big bank brokerages, which had clunky platforms and charged around $20 per trade – a ridiculous cost that ate into small investors’ returns.

Fast forward to today, and things have changed in a big way. Thanks to competition from Qtrade, Questrade, and Wealthsimple, trading fees have plummeted.

Canadian investors finally have more choices than ever before. But here’s the key takeaway:

There’s no such thing as a truly “free stock trading broker”!

Every platform has to make money somehow. The important thing is knowing where those costs are hiding so you can minimize fees and keep more of your returns.

If you’re looking for the best balance of:

- Low-cost stock trades

- Free ETF trades

- An intuitive, easy-to-use platform (both desktop & mobile)

- Top-tier customer service

Then Qtrade is my top recommendation. It consistently ranks #1 in my Canadian brokerage reviews

Qtrade is currently running the best promo I’ve ever seen in the Canadian brokerage space. It looks like they’re making a big push right now. If you’re thinking about switching brokers, now might be the perfect time to cash in on their huge sign-up bonus. Check out my full Qtrade review for all the details.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

I am totally surprised by this list… There are ONLY three free fee brokerages in Canada, Questrade, NA and WeathSimple. Questrade is the BEST by a mile.

TD Direct is not free.

The TD Direct platform has many flaws. You can’t open a joint account. You can’t designate a beneficiary. You can’t buy ETFs from providers other than TD… Might be a “good” product for someone who doesn’t have a family or a partner.