TFSA vs RRSP- Which One is Better?

Canadians have fantastic options when it comes to registered accounts. Registered accounts are beneficial for many reasons, the main reason being that they are tax advantaged. Tax advantage accounts are those that allow you to grow your money tax-free or allow you to defer paying taxes until later.

However, all registered accounts are not created equal, and before you invest, you want to read our detailed TFSA vs RRSP guide to better understand what these two registered accounts can do for you, as well as decide which would be a better fit for your current financial situation. We’ll also lay out detailed scenarios to help you understand how your wealth could grow within each of these accounts over time.

Read on to find out more about which Canadian registered account is right for you in our TFSA vs RRSP comparison.

Why RRSPs or TFSAs?

Let’s start with the basics. Why use RRSPs or TFSAs in the first place? Why not a regular saving or investment account?

The simple answer is tax-free compounding. This means your money does not get taxed when growing in an RRSP or TFSA. For example, any money you make on interest from GIC, bonds, or high-interest savings account, as well as on appreciation or dividends on a stock, you pay tax. Whereas, if you had held them outside of an RRSP and TFSA, all gains (interest, appreciation, or dividends) would have been taxed.

What does this look like? Let’s look at a hypothetical situation where someone who lives in Ontario and earns $80,000 per year at their job, and then earns additional money from their investments in a given year.

| Amount of Money Gained | Tax Paid If Investments are In a TFSA or RRSP | Tax Paid If Investments are in a Non-Registered Account | |

| Capital gains | $10,000 | $0 | $1,500 |

| Dividends | $10,000 | $0 | $838 |

| Non-Canadian Dividends | $10,000 | $0 | $3,074 |

| Interest | $10,000 | $0 | $3,074 |

Clearly you’re better off not having the tax man reach in to tax your investment gains if at all possible! Keep in mind that the money you’re saving will now continue to work for you year after year, earning yet more investment gains. That’s compounded growth that wouldn’t be possible without RRSPs or TFSAs.

RRSP – What is it?

RRSP (or Registered Retirement Savings Plan) is a retirement savings plan that you, your spouse, or common-law partner can contribute towards. These contributions can be in the form of cash, stocks (equities), bonds, savings (in the form of savings accounts or GICs), or a combination of the above. As of 2023, the contribution limit for an RRSP is 18% of your earned income, up to $30,780.

Think of it this way – an RRSP is a container that you can put your money in – and this money is in the form of cash or something that can grow due to interest (bonds, savings) or appreciation plus dividend payouts (stocks). This container will protect that cash and investments from government taxation.

Are You Saving Enough for Retirement?

Canadians Believe They Need a $1.7 Million Nest Egg to Retire

Is Your Retirement On Track?

Become your own financial planner with the first ever online retirement course created exclusively for Canadians.

Try Now With 100% Money Back Guarantee*Data Source: BMO Retirement Survey

Why Contribute to an RRSP?

Simply stated: RRSPs are one of the main ways to reduce the amount of tax you pay in a year by contributing to your retirement fund.

How Does it Work? Benefits of RRSP

Say you live in Canada and earn approximately $50,000 annually at your job. You proceed to save 10% of it (good job!). Let’s see how this plays out when contributing to an RRSP – or saving/investing outside of our RRSP account “container”.

Assumptions:

- An average tax rate of 22%, which is more or less an average of the average tax rate across Canada for an income of $50,000. Actual tax rates in each province can vary.

- Tax rate includes Federal and Provincial taxes, CPP deductions, and EI contributions.

- You contributed to your RRSP in the same tax year. E.g. in 2019, you contributed 10% of your net income to your RRSP (or contributed before March 2, 2020, the RRSP contribution deadline to be counted towards your 2019 income).

An estimate of RRSPs vs non-RRSP savings/investing

| RRSP | non-RRSP | ||

| 1 | Income | $50,000.00 | $50,000.00 |

| 2 | Tax* | $11,014.00 | $11,014.00 |

| 3 | Net Income* | $38,986.00 | $38,986.00 |

| 4 | Contribution / Savings | $5,847.90 | $5,847.90 |

| 5 | Revised Income* | $44,152.10 | – |

| 6 | Revised tax* | $9,325.00 | – |

| 7 | Estimated Tax Return* | $1,689.00 | N/A |

So what is happening in the table above?

Well, in rows 1 to 4, we see that things basically stay the same; you make money (1), pay your taxes (2), have money left over (3), and then save some of it (4). But, from there on, this is where things are different.

By contributing to your RRSP, the government “recalculates” your taxable income. In this case, it treats it like you only made $44,152.10 (5). And because you made less income, you pay less tax (6). Therefore, because there is a difference in how much tax you already paid (2) and what you should have paid (6), you get a tax refund (7) sometime in the spring. (Assuming you file your taxes on time!)

That sounds great, doesn’t it? But there is a caveat to RRSPs: When you retire, and you start drawing funds from your RRSP, there is a tax on what you withdraw. In other words, RRSP withdrawals are considered income (remember, RRSPs are a tax deferral mechanism, NOT a get-out-of-paying-tax mechanism). In fact, banks or financial institutions will hold funds to cover your taxes. For full details – consult Revenue Canada.

TFSA – What is it? Benefits of TFSA

Ok, so now that we’ve covered RRSP, what is a TFSA?

Well, like the RRSP, a TFSA is a container that you can put your money in. Like RRSPs, we TFSAs can store cash, stocks (equities), bonds, savings (in the form of savings accounts or GICs), or any combination of the above. But contributing to a TFSA does not allow you to deduct any tax, like an RRSP.

So then, if you can’t defer your taxes with TFSAs, then why use them?

Simply stated: you pay no taxes on any funds withdrawn from your TFSA. Both the money you put in (your principal – as you have already paid tax on this money) as well as the money you earn from interest or appreciation + dividends.

That’s right. Zero taxes.

So is TFSA Better Than an RRSP?

At first glance, you might think – “duh… who doesn’t want to pay taxes?”. But things are not so simple. In the next section, we are going to run a few scenarios to see why one might be better than the other, what the main differences are, and what to consider when contributing to RRSPs or TFSAs.

So, what is the main difference between TFSA and RRSP?

Based on what I’ve written so far, you’re probably thinking the following questions:

- “Should I max out my RRSP or TFSA?”

- “Should I max out TFSA and then RRSP? Or vice versa?”

To analyse this, I’m going to pose multiple scenarios using the following parameters:

- We will consider after-tax incomes of $30k, $60k and $90k

- We will assume incomes are steady through your lifetime, but grow at the same rate of inflation (thus removing inflation from the equation)

- Assume you put 10% of your annual income into investments.

- We are going to assume that you begin investing at the age of 30, add to your investments annually at the end of the year, invest until you at 65, and then retire.

- In retirement, assume you will withdraw the following amounts:

- In after-tax income scenarios of $30k and $60k, we will assume you will need to withdraw the same ($30k or $60k respectively) after you retire. We believe this is conservative and should be more than sufficient to maintain your lifestyle.

- In after-tax income scenarios of $90k, we will assume $70k a year in retirement will be sufficient.

- Also, in all scenarios above, we will assume the money is withdrawn at the beginning of the year.

- An 8% annual rate of return (which is slightly lower than the average of the last 20 years of the S&P 500, with dividends included). And therefore, we also will assume all holdings will be index funds.

- There are no other sources of funds, other than income, and your nest egg. Thus, we will not be considering the effects of pensions.

- Most important – all tax returns from contributing to your RRSP are put toward your retirement.

- This is the most significant point we need to stress. If you simply take your tax returns and spend it on a new TV, then you’re better off maximising your TFSAs.

- We will run a bonus analysis to illustrate this point.

Below we will see what happens when you invest 100% in RRSPs or 100% in TFSAs. Keep in mind, all numbers used in this analysis are estimates. See your tax specialist or accountant for more details.

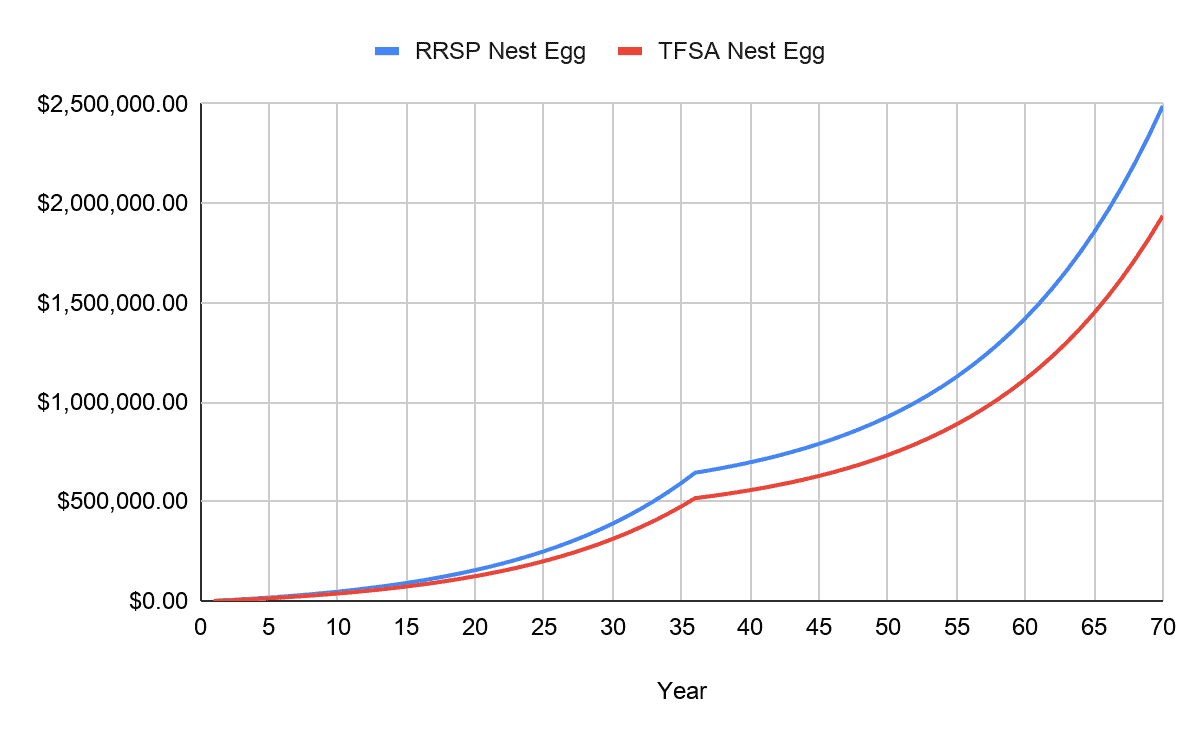

Scenario 1: RRSP vs TFSA – $30K after-tax income

In this scenario, we see that an RRSP nest egg grows almost $600k by year 35 (which at this point we are assuming you’re retiring). For TFSAs – this is about $475k. So far, RRSP wins – your diligence in reinvesting your tax returns back into your nest egg pays dividends and only goes to prove the power of compound interest further.

But when we look post-retirement, we see the RRSP and TFSA continue to grow at the same rate, even though in reality, your RRSP withdrawals will be much more than TFSA withdrawals. Why? Well, if you are in the same tax bracket when you retire as when you were working, your after tax income will actually be the same. The caveat being that this depends on you re-investing your tax refund into an RRSP.

RRSP withdrawals are taxed like income, whereas the TFSA is entirely tax-free. So, where you can simply take out the $30k you need for that year from your TFSA, you would need to take out roughly $37k from your RRSP.

Overall, we can see and learn some interesting things:

- The gap between RRSP and TFSA begins to separate at about the 15-year mark. This is because reinvesting your tax refunds maximises the power of compounding interest. In other words, while you are putting in only $3k in your investments, when you reinvest your tax refunds, those tax refunds compound overtime.

- If you live to 100, (year 70 on the charts) you will have anywhere from $2 – $2.5 million. Celebrate, because you and your family should be well taken care of.

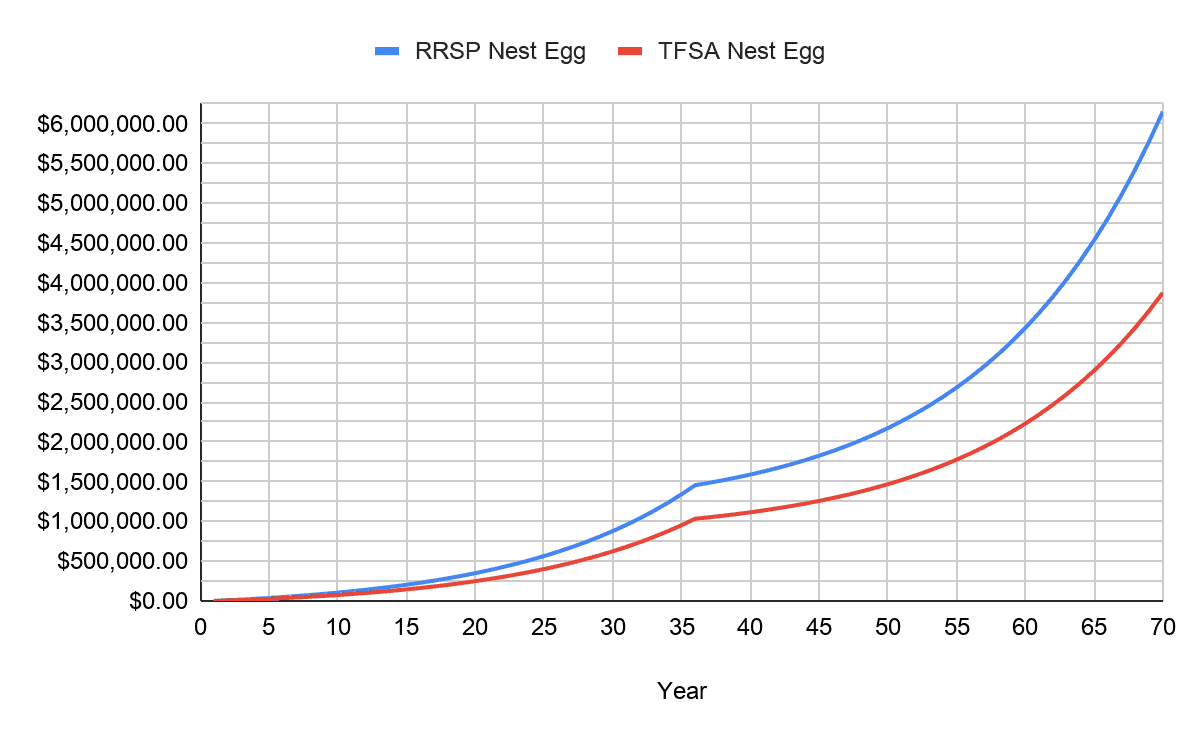

Scenario 2: RRSP vs TFSA – $60K after-tax income

This scenario is similar to scenario 1 in both trajectory and result.

- RRSPs resulted in a more significant nest egg. Congratulations, your nest egg broke the million-dollar mark, and you retired with a $1.3M nest egg. Your TFSAs are not behind, at $950k at retirement.

- Like scenario 1, the gap between RRSP and TFSA begins to separate even earlier, at about the 12-year mark. This is because the tax refunds you are reinvesting is larger than in scenario 1, and the power of compound interest magnifies this.

- The divergence between RRSP and TFSA is much more pronounced.

- If you live to 100, (year 70 on the charts) you will have anywhere from $4 – $6 million.

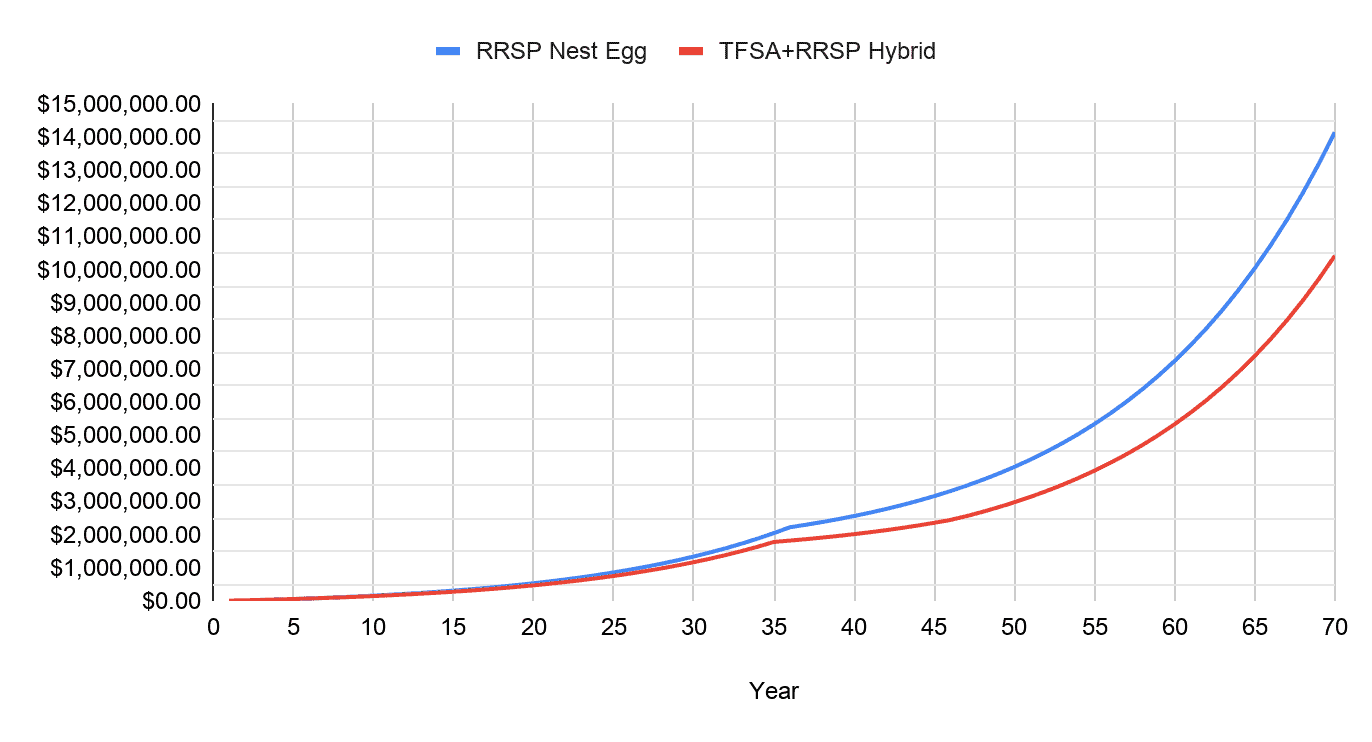

Scenario 3: RRSP vs TFSA – $90K after-tax income

This scenario is unique to scenario 2 and 3 for the following reasons:

- With $90k of income, you will max out the amount you can contribute to TFSAs (the current annual contribution limit for 2023 is $6500).

- Therefore, for this comparison, we will be considering a 100% RRSP vs a TFSA/RRSP hybrid, where you max out TFSA first then contribute to RRSP.

- Also, to minimise tax paid over your retirement period, in this scenario, we will be withdrawing just under the current amount for the lowest federal tax bracket ($48,000) and then the rest of the funds needed for retirement from TFSA.

- As a reminder, unlike scenarios 1 and 2, we will be taking out only $70k during retirement, as opposed to the equal amount made before retirement. We believe this number to be more realistic and relevant as it is likely things like mortgages and loans have been fully paid off. That said, if you do want to live a more luxurious baller lifestyle, we don’t discourage you, but you may deplete the nest egg much faster (and even cause it to stop growing), so keep that in mind.

Let’s see how this scenario plays out:

Again, we see a similar pattern to scenario 1 and 2 in both trajectory and result, but with a few minor differences.

- The gap between RRSP and TFSA begins to separate later, which is a departure from what we saw in scenario 2. In this scenario, both portfolios are almost the same until the 25-year mark. This RRSP+TFSA hybrid also takes advantage of some invested tax return.

- The divergence between RRSP and TFSA is less pronounced than in scenario 2. Still, it is interesting how the two portfolios that are very similar but diverge later on in the retirement years.

- If you live to 100, (year 70 on the charts) you will have anywhere from $10 – $14 million. Probably enough for multiple generations of families. Start to think about trust funds at this point.

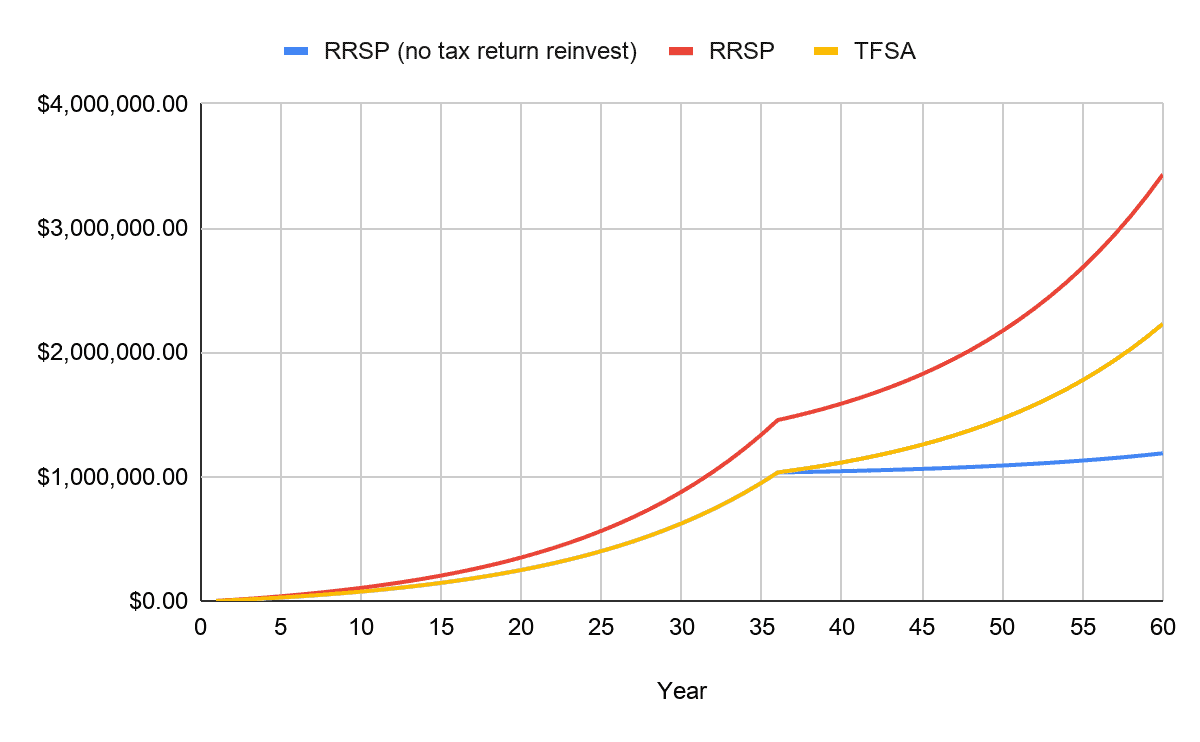

What happens if you don’t put your tax return towards your nest egg vs TFSA?

As mentioned earlier, one of the mechanisms you need to take advantage of in an RRSP is to reinvest those tax returns. Doing so will have an outsized impact when compared to RRSPs that have the tax returns invested as well as TFSAs.

For this simple exercise, we will use the $60k after-tax scenario as our basis:

From the graph, we can see the following implications:

- RRSP, when reinvesting tax returns grew faster. This is again due to the power of compound interest.

- RRSP, when not investing your tax returns, grew at the same rate as TFSAs, and well, that is to be expected, as you are putting in the same amount of money.

- Where these two types of nest eggs begin to differ is when you start withdrawing funds. Since RRSPs are taxable and assuming we want an income stream of $60k after taxes, we will need to withdraw just about $80k. This is much more than in comparison to TFSAs, where we simply need to withdraw $60k (remember, tax-free!).

- If you do invest some of your tax returns back into your nest egg some years, then you should expect trajectories between the red and blue lines

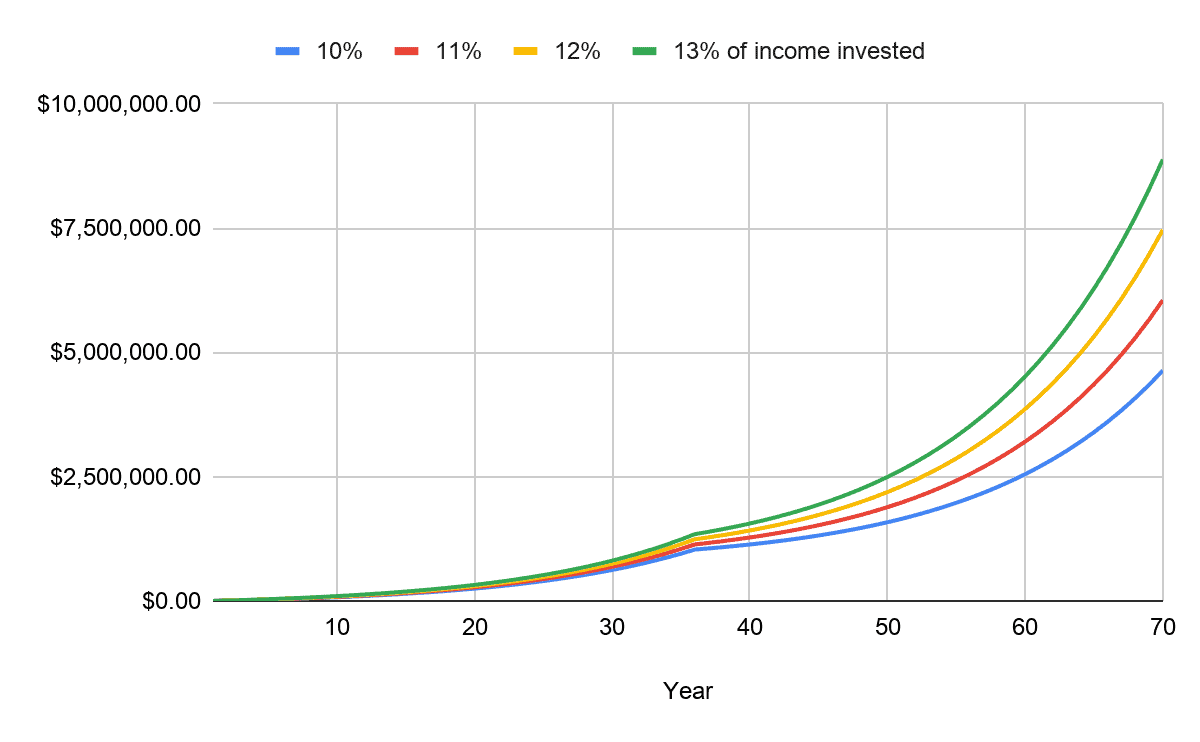

Bonus Analysis – The impact of saving more

What happens when you save more than 10% of your annual income? Well, let’s take a look.

For this exercise, we will again be using the $60k after-tax scenario as our basis. To further simplify things, we will only look at the effect of what this does to TFSA funds as it would be safe to say RRSPs will behave similarly.

What we see again is the magical powers of compound interest.

- For every 1% increase in how much of your salary you save, we see a noticeable increase in growth of your nest egg post-retirement.

- At a modest income of $60k, saving more will allow you more flexibility of using more during your retirement. Maybe you want to buy a sunny retirement home or that sports car you always wanted (in cash!). Whatever the case, saving just 1% more can give you vast amounts of flexibility.

This again is another example of the incredible powers of compound interest. Saving an additional 3% of your net incoming is not a monumental task; it merely requires a bit more discipline and planning.

Another way to get ahead of the game is to start early. Every year you start early will have a similar compounding effect on your nest egg. So why not open a trading account with any Canadian discount broker today?

Recap: RRSP or TFSA, which is the better option?

At a high level, it may seem that RRSPs are better – since, in all scenarios above, they result in much bigger nest eggs. A conclusion like that would not be wrong, but it’s also not that straight forward.

Why?

Because while RRSPs tend to get larger, the amount you withdraw is always subject to taxation.

That said, we can list some general considerations.

TFSA:

- TFSA is more flexible from a tax perspective. If at any point, you are trying to avoid being taxed or adding to your taxable income, withdrawing from your TFSA gives you that flexibility.

- If you know you are going to have a government or other type of pension when you retire, it might make more sense to have a TFSA, as pensions are taxable, and therefore will have a significant impact on the amount you are taxed on your RRSP withdrawals.

- If a significant life event occurs while you are still in the working stages of life, it might make sense to take money out of your TFSA, as this will not impact the taxation of your salary.

RRSP:

- You must be extremely disciplined with RRSPs – you need to put all your tax returns toward your nest egg. Missing even one year, especially early on, will have an outsized impact on your nest egg. For TFSA, you don’t need to worry about this.

- When your income after tax is $90k or more, it might make more sense to max out your RRSPs first, then contribute to your TFSAs. This is because tax brackets at this end of the spectrum are quite large, and by maximising your RRSP, you can defer some of those taxes and have compound interest work in your favour. That said, you need to be aware of the impact of pensions (which may make this point moot).

- The returns you get from contributing to an RRSP offer an interesting bit of flexibility when you need additional funds for life or other events.

- Imagine a situation where you receive a tax refund, and you can use it towards something important, say an RESP, additional payment towards or your mortgage or simply to cover an expense you simply could not predict. You can use funds from your tax return to cover these things, without selling from your portfolio of stocks, especially when the market is not favourable.

In the end – like almost all things in finance, it’s good to diversify. You can put 50% of your savings into an RRSP, 50% into a TFSA, and receive a little of each benefit.

All in all, the most important thing to take away is this – start saving and investing now. It is quite simple, and you can even begin today by opening up RRSP and TFSA accounts at Qtrade for example.

Can I Transfer TFSAs to RRSPs?

The short answer is no – there is no technical mechanism to transfer TFSAs into RRSPs (or vice versa).

That said, you can sell what is in your TFSAs (say sell $1000 worth of investments) and contribute this to your RRSPs, but for the most part, this won’t make a lot of sense. Overall, you are better off either contributing to your RRSPs directly by some other means (RRSP top-up loans) or saving that contribution room and using it next year.

You might be asking, “Why would selling my investments in TFSAs not be worth putting towards my RRSPs? Won’t I get a good tax refund that I can then put into my RRSP?”.

Well, it depends on many factors, including whether it’s a good/bad time to sell said investments, and what type of fees you will incur (which eats away at your investment). There are also the tax implications that result from taking funds out. In other words, funds might be taxed at a higher marginal rate since the tax rate will consider both these funds and other sources of income (like your salary if you are currently working).

Simply said, selling your investments in your TFSA depends a lot on whether selling those said investments is the right time, incurring fees (which eats away at your investment) and also the tax implications that result from taking funds out at a higher marginal rate.

If this all sounds complicated, it’s because it is. But because it is, it means you should be prudent and try to avoid any situations that might negatively impact you in the grand scheme of things.

If enough people write in about expanding on this, I will write a short article on it.

Can I Transfer RRSP to TFSA Without a Penalty?

Like with TFSAs to RRSP, the answer is unfortunately no. Being able to transfer from RRSP to TFSA would be extremely valuable since not only did you defer taxes and benefit from it, you were able to make your nest egg non-taxable when you withdraw. That would be like double-dipping (or triple dipping?).

In any case, there is no way to do this without selling your investments in your RRSP, incurring taxes, and then moving said funds to your TFSA.

Note for those technically advanced; I will not be covering setting up a Mortgage Investment Corporation (MIC) and using the complex CRA rules to set up RRIFs, borrow and then pay back your TFSA, technically making it “tax-free”. The reason being it is a bit complex; you need to have substantial assets ($1M) or a significant amount of personal/family income. If you are interested, you might want to reach out to a wealth manager who can walk you through the steps and execute on your behalf.

What if I Withdraw Less From my RRSPs?

I already anticipate comments from folks about RRSPs not lasting as long as the TFSAs. But remember, in the scenarios above, we assume that you will be taking out the same amount of money in retirement as you made during your working years.

If you take out less, you naturally increase how long your nest egg lasts. In fact, if you can limit your withdrawals to 4% of your portfolio annually, then your nest egg should technically last indefinitely. To find out why, download our free e-book. But keep in mind, this also holds for TFSAs.

TFSA vs RRSP vs RESP

By now, you should know the difference between TFSA and RRSP (TFSA = no tax when you, RRSP = tax deferral mechanism). So what is an RESP?

RESP stands for Registered Education Savings Plan. These are special accounts, like RRSP, that allow you to save for your child’s education (typically post-secondary) by contributing to a fund, much like you do for an RRSP and TFSA. Like an RRSP or TFSA, you can contribute in the form of cash, stocks (equities), bonds, savings (in the form of savings accounts or GICs), or a combination of the above.

Now, unlike RRSPs, there is no tax benefit to contributing to an RESP (you don’t receive tax credits). But when your child withdraws from the account, it is practically tax-free (your child likely is making less than the base individual amount since they are going to school) – so it’s more similar to a TFSA.

TFSA or RRSP For a Down Payment?

Can it be done? Of course. At any time, you can take money out of your TFSAs and use it toward a purchase, such as a down payment for a house.

That said, which is better? This question is a bit complex. In some ways, it depends. In other ways, it makes more sense to take money out of your RRSPs. In our opinion, it makes sense to take money out of RRSPs. Here is why at a high level:

- Remember, RRSPs allow you to defer your taxes – while using an RRSP for a down payment can be tax-free when down through the Home Buyers’ Plan (HBP).

- Under HBP, you can take out up to $35k (as of 2023) to pay towards a downpayment.

- You need to pay this back every year, for fifteen years. The amount you pay back is approximately 1/15ths of what you withdraw.

- Also, there is an added benefit of an HBP tax credit (though it’s only about $750 in tax savings, but that’s better than nothing right?)

- Remember the scenarios above? TFSAs are better kept untouched and growing since they will return the best and highest nest eggs possible.

- Furthermore, TFSAs are tax-free and flexible. It is much more prudent to use your TFSA account to tackle the unknown and unfortunate events in your life since you can take money out of this account without any worry about tax implications.

The New Tax-Free First Home Savings Account (FHSA)

If you are a first time home buyer, there is now a better option than withdrawing from your TFSA or RRSP to make your down payment.

Canada just added a new registered account specifically for folks who are saving up for a down payment on a house. In 2022, the Canadian government announced the Tax-Free First Home Savings Account or FHSA. With this account, you can contribute up to $8,000 per year, up to a maximum total of $40,000.

Not only will the capital gains and withdrawals you make to purchase your first home be tax free, any contributions you make to this account will be tax-deductible. This is a huge boost for Canadian first time home buyers. For more information, read our full FHSA guide.

TFSA or RRSP with Pension

The most significant consideration here is likely impact on taxable income, but there are other considerations that you need to account for.

First off, contributing to your TFSAs should not affect you or your company pension, nor will it affect your eligibility for government benefits like OAS. RRSPs, on the other hand, will have to coordinate with pensions as they count towards your contribution limit/room. For more information, see here.

For post-retirement with pensions, you might be better off with a TFSAs during retirement. Why? Because any pension you receive (e.g. teachers pension) is taxable income. And if you are withdrawing from an RRSP nest egg, then this can be a double whammy.

To illustrate my point, let’s look at two scenarios:

- $30k from pension and $30k from TFSA

- $30k from pension and $30k from RRSP

In scenario 1 – your taxable income is only $30k, and at the end of the day, your average tax rate will be approximately 17%, and you will receive $54,909.

In scenario 2 – both incomes are taxable and will significantly raise your average tax rate to about 23%. In the end, you will only receive $45,844, a difference of $9,065.

Simply being aware and investing in the right type of portfolio can have a significant impact on the tax you pay and your annual retirement amount.

Other minor considerations:

- Most company pension plans have liquidity risk (you are usually locked in until you retire or change jobs). Also, most company pension plans will have limited investment options (never a good thing, since most mutual funds underperform the market).

- Keep in mind that if you do have a private company pension, the amount you can contribute to your RRSP will be less than the 18% that you are typically allowed.

Are You Saving Enough for Retirement?

Canadians Believe They Need a $1.7 Million Nest Egg to Retire

Is Your Retirement On Track?

Become your own financial planner with the first ever online retirement course created exclusively for Canadians.

Try Now With 100% Money Back Guarantee*Data Source: BMO Retirement Survey

TFSA vs RRSP – Which One Should You Use?

The main thing to remember is that choosing either one of these registered accounts is a smart money move. A non-registered account is a great way to grow your wealth, but you’ll pay more in taxes later. A registered account on the other hand, could save you thousands in taxes in the long run.

As seen in the scenarios above, you should aim to invest in both the TFSA and RRSP. With the TFSA you will pay no taxes on your principal or your earnings, even when you withdraw from your account later on. When it comes to the RRSP, your contribution limits are higher, but you’ll be taxed on any funds you withdraw later down the line.

The optimal split between your TFSA and RRSP depends on your income and withdrawal rate, which you may not exactly be able to predict will be in the future. A good rule of thumb is to max out your TFSA first, then contribute any additional funds to your RRSP account. This guarantees to save you money on your tax bill, which is always a good thing.

Ready to get started? Consider Qtrade, my top recommended Canadian online brokerage. Read the full Qtrade Review to find out how you can quickly and easily set up your TFSA and RRSP accounts, and much more.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

One big difference I would guess is the growth rate of savings. If you are starting your career, chances that you are not yet in the top taxable bracket is pretty high. It would make sense to contribute in TFSA first, and then use the accumulated space in the RRSP later if you expect to be paying much more taxes in 2-3 years.

Also a great benefit of the RRSP is the way it handle canadian securities dividends vs the US stocks. Knowing that RRSP space will vastly outshine TFSA space, that Canadian equities is mostly industrials, financials, energy and utilities, paying dividends, it would make sense to invest early on in riskier american tech/discretionnary/telecom without dividend (thus no witholding tax) in your TFSA. Then, when TFSA is full, investing in canadian equities in the RRSP, thus “derisking” progressively your total portfolio through time.

Having higher expected growth stocks in a TFSA, on the long term, is a big win vs RRSP, tax wise.

So savings growth rate, urgency to HBP and assets risk/return profile in each registered accounts are three very important factors to consider in my opinion.

Nice info.

Is there calculator available, which can do similar calculation with custom values of starting value of TFSA/RRSP, yrs, marginal rate and retirement withdrawals? thanks.

Great article! I would like to see your analysis of RRSP vs. TFSA also include the complexities around RRIFs, minimum withdrawals and the impact to couples when one spouse dies. My parents had RRSPs which had converted to RRIFs and once my mother died, my father had only his personal tax credits to offset the annual withdrawals. This greatly increased his tax burden.

If I am no longer making any taxable income, early retirement though not entirely by choice, does it make sense to put my savings into an rrsp?

How about saving enough to max out contributions in both RRSP and TFSA!

Very helpful break down of a deceptively complex topic. In my situation it’s the government pension that complicates my decisions of how much to contribute. So far I’ve been contributing more to my TFSA but I’m shifting towards RRSP first for the tax refund then putting that into my TFSA to keep a bit more balance. A formula would be super helpful but I guess every situation is different.

All great info to consider. You covered off some post retirement scenarios (ie factoring in pension, CPP, OAS). What if someone owns a rental property? Assuming at retirement, the rental mortgage is paid off, and say that property generates net rental income of $30K also, this may make the RRSP scenario not as favourable.

also,what about death? Let’s say a person passes away at 85 or 90, and there is no spousal roll over anymore. I would imagine the RRSP scenario would take a huge tax hit of about 50% if there was a lot still left in the RRSP account (the scenarios above show minimum $1M+ in RRSPs by that age).

Thank you for this great article, I have been dealing with this dilemma for years. My biggest holdup is dividends, if you are planning to live on dividend income which option is best? Although you can increase your wealth faster through the RRSP, unless I am missing something, it is not optimal to generate dividend income due to taxes. Would you be able to shed some light on this?