Should You Bet Your House on Blackberry?

January 25th – 29th, 2021 is the week the stock market embraced full insanity.

PhD theses will eventually be written about what just occurred in the stock market this week. One day smart people will be able to explain to what degree various factors contributed to the illogically hilarious/fun/dangerous ride that stocks such as Gamestop (GME), Blackberry (BB), NOKIA (NOK), and AMC (AMC) took us on over the past few days.

These meme stocks have seen wild intraday swings for several days, and ran up massive gains over this very short timespan, supposedly fueled up by a hoard of retail traders who have decided to buy them for many reasons that have very little to do with one another.

January 29th Update:

When you write about money stuff much at all, you get used to looking stupid once in a while if you say things like, “I honestly believe we’ll see some of these stocks go down by 70% in one day at some point.”

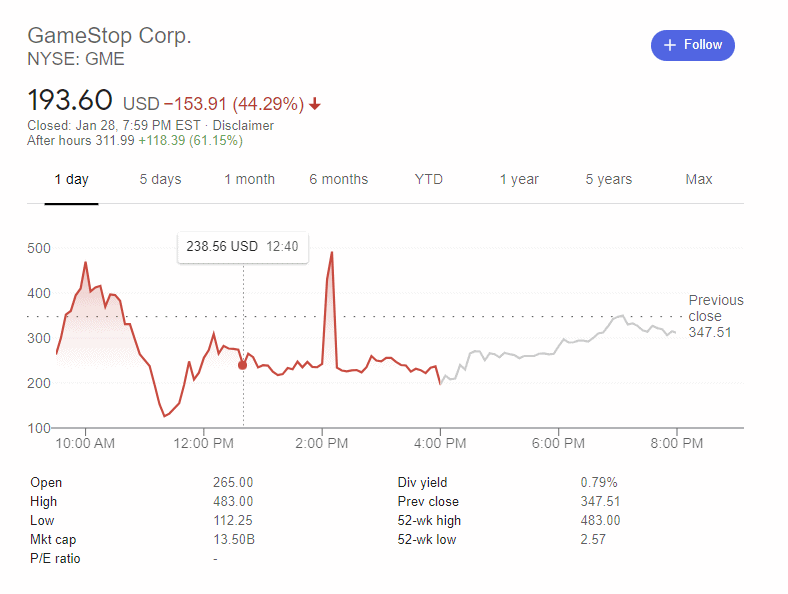

Like most, I’ve taken my fair share of uppercuts from the anonymous keyboard warriors out there when I’ve gotten something wrong. That’s why I was pleasantly surprised when roughly three hours after posting that prediction, we saw GameStop (GME) stock down more than 60% when markets opened on Thursday. Before I could even take a victory lap however, we saw the share prices begin another day of insanity.

In related news, the public – most of whom had no idea what an option or a short was less than 48 hours ago – have decided that there is a massive conspiracy at work and that either Donald Trump Junior or Democratic Rep. Alexandria Ocasio-Cortez will be the one to lead us to the truth.

Please read the rest of the article below for more explanation on what is actually going on here (warning: it’s longer than a FB meme).

As for Thursday, here is the rollercoaster that GameStop shares took us on:

And just for good measure, here’s what happened to Blackberry:

Low and behold, there were a lot of angry people left holding the bag – who would have guessed?

Now, if you guessed that after all of this insanity, the internet would come to the realization that one should use the stock market to invest in great companies for the long-term, instead of placing crazy bets against other crazy people on whether shares of a non-profitable company should be worth $500 or $20… well then you would be very wrong.

Instead, what we got was this:

The morning began with two large brokerages (Interactive Brokers and Robinhood) deciding that they would limit trading of the so-called meme stocks. Panic appeared to ensue and the stock prices collapsed. Then everyone lost their minds, millions of conspiracy theories were launched, and we all decided that a large group of people who got together on Reddit boards to manipulate the stock market were “good guys who had gotten screwed”.

It’s a nice simple narrative that feels right – so we collectively ran with it to the point where we have the most extreme fringes of each political party in the USA agreeing with each other.

The truth is that there are some bad reasons, and some good reasons for regulating trading in some way on these stocks that are clearly in the midst of non-logical trading patterns.

Bad Reasons: We got calls from rich important people, and we want to use the brokerages to cause panic and manipulate the market after investors got together to manipulate the market on us.

Good Reasons: Actually it’s terrible (and probably a crime) whenever anyone manipulates the market. So we should probably stop people (both hedge funds and Redditors) from doing that. Also, most of these people probably don’t really understand the risks they are taking – and consequently, giving them some time to move away from trading adrenaline rushes and think about things might be a good move. Also, the whole point of the stock market is to move capital to efficient business, and help all of society allocate resources efficiently so that consumers and companies enjoy the benefits. Also, brokerages might go broke and break banking rules if they lend too much money to either/both sides of this irrational investment behaviour.

The bottom line here is that nothing is as simple as the internet has decided that it is. Some food for thought:

- There are now plenty of hedge funds/rich people/Baby Boomers on both sides of this trade. There is much speculation that some hedge funds are using the Reddit boards to their advantage. So it isn’t nearly as simple “rich vs poor”.

- People getting together to manipulate the market hurts us all at the end of the day. Yes, it’s bad when hedge funds do it – and we should listen to politicians who tell us that, instead of ignoring them (until they become memes of course). This is not something we want to encourage.

- The stock market is NOT a casino no matter what your ultra right wing uncle or ultra left wing cousin tells you. It is simply a mechanism for owning parts of companies. Yes, in the short term, there will always be people who try to take advantage of inefficiencies – and we should address that – but in the long term, it’s fundamentally about buying pieces of solid companies in order to reward businesses that are doing a great job, and to make money for investors.

- Getting stuck owning a $500 share of a company that doesn’t make money will not achieve social justice or make some sort of statement. In all likelihood, you will have succeeded in taking money from old rich people, and giving most of it to younger slightly-less-rich-but-still-rich people, with a small dash of it going to lucky “little guys/gals” who got in and out at the right times. Please understand that both sides are trying to manipulate this market.

- Brokerages are companies as well. This is new for them and they are under extreme pressure from governments, users, and their shareholders. With all of the borrowing people on both sides of this insanity are doing, the brokerages need to be careful about how much money is being lent out – and to whom. The decision about what is ultimately best for the most people is not an easy one.

- Here’s the one that blows my mind: NO BROKERAGE TOLD ANYONE THEY HAD TO SELL THEIR SHARES OF GAMESTOP – UNLESS THEY DID IT WITH BORROWED MONEY!!! Yes – they did prevent people from buying more, but if everyone had simply held on to the shares they had purchased the day before with their own money – then they would have “#HeldTheLine” and continued to short squeeze their arch nemesis. It’s almost as if people didn’t really understand what they had purchased the day before, and now kind of panicked because they didn’t actually want to own a piece of the company they had purchased.

At this point, I have no clue how this situation will play out going forward.

There seems to be millions of people out there who are determined to pay $400+ per share of a company that doesn’t make money – as a way of promoting some sort of vaguely defined social justice agenda.

You’ll notice in the charts above, that in after hours trading (which uses the options markets discussed below) the brokerages have opened back up, and people are again piling into their favourite “rockets to the moon” stocks.

My only prediction is that there will continue to be a lot of internet-yelling going on by a lot of people who don’t really understand anything – but they’re at home, bored, and they have an opinion. Hopefully there will be some good to come of this as more people begin to understand how investing actually works in the long-term, and why they should begin to put in place more solid wealth-building strategies for their own life.

So What Actually Happened? Here’s a Quick Summary

For those of you who have better things to do than follow irrational behaviours in the stock market (you are better people than myself), here’s a quick summary of what started a few months ago, but really came into focus and hit a bit of a tipping point this week.

1) Over the last year, investing has become cheaper than ever before. In the USA, many well known brokers decided to follow Robinhood’s lead and drop their per-trade fees to zero. Canada’s discount brokerages (other than Wealthsimple Trade – which isn’t as reliable as the more established players in the field) have kept some small fees attached to their non-ETF buys and sells.

2) Many people smarter than myself believe that these ultra-cheap, shiny new investing platforms have “gamified” trading stocks. People with nothing to do during pandemic lockdowns have been watching their favourite online influencers and reddit subthreads brag about making money through buying and selling stocks on their cell phones throughout the day. Ultimately, when people are posting non-stop about “10x-ing their stimis” (re: investing their stimulus cheque from the government in a single stock, and then watching as the stock went up 1,000% in a relatively short time period) you know that entertainment – and not careful analysis of balance sheets – is at the root of this thing.

3) At some point, some really smart people realized the potential to take this very motivated community of new stock traders – and turn small parts of the stock market on its head. From all the binge reading that I’ve done (admittedly way too much) it appears that these traders are motivated by everything from the obvious allure of getting rich quick, to some sort of holy war against Baby Boomers (as personified by hedge funds). The main group behind this recent run-up is WallStreetBets on Reddit which has been an active community for several years, but has blown up in popularity over the previous week boasting some 4.2m members currently. Even Tesla’s Elon Musk was rooting for that and shared the community on his Twitter account.

All that to say, this is not a homogenous group of people.

4) The way that this community has realized that they can make a lot of money is by targeting short sellers. And if you don’t really know what that last sentence means, don’t worry, you’re not alone. Questions about short selling are basically trending everywhere in some variation. We’ll get to this in one second.

5) On top of this semi-legitimate strategy for making money in the stock market, there is a very thick layer of the classic “pump-and-dump” asset price manipulation scheme that human beings have done to each other for hundreds of years (Google Dutch Tulip Mania for more info), and another thick layer of pure “this-is-fun-and-I’m-bored-of-Bitcoin-ing” tossed into the mix.

6) What this has all resulted in, is a massive rush to open broker accounts and buy a few highly-touted stocks – and hopefully sell them – before the proverbial clock strikes midnight. This rush has been so sudden that several Canadian brokerages had to shut down several times this week, and several stocks had trading halted on the Toronto and New York Stock Exchanges.

7) The stocks chosen to “send to the moon” or identified as “pure rockets to bet it all on” have the unique characteristics of people betting against them (“shorting”), but are also sentimental favourites that emotionally appeal to a very specific group of new traders. Who doesn’t have fond nostalgic memories of when a “scrappy small Canadian start up named Blackberry was going to rule the cell phone world”?

What is Short in the Stock Market?

If you’ve watched the Big Short (and please don’t picture an elitist tone when I say that the book was even better!) you might know that a “short” is basically a bet against an asset. Most often a “short” is placed against a tradeable asset such as a stock.

That’s all most people really need to know.

Short = Bet against something (aka: betting the value of something will go down).

But because we want to prove our money-geek bonafides here at MDJ, let’s see if we can try and break this down quickly. If you want a more thorough explanation, please check out our options trading in Canada article.

Ok – so in addition to the basic buying and selling of shares on a stock exchange, most brokerages will allow you to purchase something called an option.

Options basically let you bet money in many different ways, but for now, let’s just look at “shorting”.

When you short a stock, you are actually borrowing a share of the company – with the obligation to return the borrowed share to the market (by buying it back by a certain date).

In practice, if you shorted a stock that costs $50, you would borrow at a $50 price tag, and hope that the stock will go down to $47 by a certain date – and it does – then you get the stock plus pocket the difference in the purchase price. If you’re more adventurous and bet that the stock will go down to $20, then a lot more money can be made.

However, if you buy one of these “short options” – and bet that a company’s stock will go down – then you can lose a lot of money quite quickly if the stock price goes up. If it goes up in a hurry – like Gamestop did this week – then you can lose an incredible amount of money quite quickly. Theoretically, you can lose an infinite amount of money because there is no real limit on what people can choose to keep bidding a stock up to. This is why the phrase “naked” is often associated with these type of bets – you are in quite a vulnerable position!

Because of how quick this type of “short investment bet” can lose money, there is substantial pressure on people who have purchased these options to “cut their losses” at a certain point. What happens in this scenario, is that the “short investor” is basically forced to buy the stock at the new higher price point – in order to avoid further losses if the stock were to keep going up.

Once a few short sellers decide to throw in the towel, it creates an odd kind of price momentum where people with “short bets” get scared because a stock price is going up – so they give up and are forced to buy at the higher price – but then that buying pushes the stock even higher – so even more “shorters” get scared and sell their stock – and then the stock price goes up so quick that it attracts an incredible amount of attention on social media – which then pushes even more new traders into the stock – which scares even the most brave “shorters”.

This cycle of momentum is often referred to as a “short squeeze” – and it has cost major hedge funds about $5 Billion over the past few days.

As you can see, much of this “betting” on which way a stock will go, has nothing to do with if the actual company makes money in the real world. Most investors would refer to this as the “fundamentals” of a stock. It’s pretty clear at this point that none of what went on this week has anything to do with fundamentals.

The Blackberry CEO came out yesterday and essentially said, “Look, we have no idea what is going on. We think we have a good company, but nothing here is materially different than it was a few days ago. There is no reason our stock should be going up in value this much.”

I mean… kudos to the guy for being honest – especially given that he is making a ton of money off of all of this craziness – but isn’t that a wild thing to say?

Why are Blackberry and Others Being Shorted?

The majority of “shorting” is done by big time hedge funds who can throw Billion Dollar+ bets into this crazy world of betting in which direction a stock will go.

So – in theory – what shorting is used for is when investors believe that a company is due to go lower for some reason. Maybe there is evidence the company has misrepresented their financial position, or they are doing something very wrong. In those cases, investors who shorted the stock would likely be trying to point out why the company is not worth as much as “the market” thinks it is. (In this case “the market” basically means everyone who buys and sells stocks, because the current price of a stock on an open market is basically the average of what all investors think it is worth.)

When it comes to companies like Gamestop and Blackberry, there were many investors who thought the company probably shouldn’t be worth the amount of money that investors were currently paying for it. That is not an illogical move considering BlackBerry has been declining in popularity for years, that GameStop is losing out to online competitors and the pandemic put a tremendous stress on its financials. AMC is even a more logical short sale candidate, the company has mentioned it’s on the verge of a bankruptcy several times in 2020, and is still not generating profits as cinemas are shut down, and Hollywood is not producing any new movies.

In addition to this large pool of “short sellers” being interested in their stock, companies such as Gamestop and Blackberry have two other criteria that appear to be important in creating this weird short squeeze momentum.

1) They are well known names to the young “new trader” group – and are in industries that lend themselves to being “meme-ified” because they are fairly easy to understand.

2) They are relatively small companies compared to the truly massive conglomerates at the top of the stock market totem pole.

For this whole crazy scheme to work, the group of traders needs to pick a stock that is cheap enough, and has few enough shares on the market, that their purchasing will have a large effect. If instead of Blackberry, the traders had picked Apple for example, they would need to buy WAY more shares in order to have the same effect on the price.

And given how motivated this group appears to be by sheer entertainment and giddiness, it appears that the more familiar a company is, the quicker it can get instant momentum. Nokia, Bed Bath and Beyond, and AMC are three other names that have popped up prominently as other examples.

Because many of these “shorts” are being held by hedge funds, the popular theory is that this movement can be characterized as: A group of little guys punching the rich big buy in the nose and taking his money.

There is some truth to the notion that many short selling hedge funds are pretty unethical actors. It is not uncommon for many of these groups to short a stock, and then launch an all-out media blitz trashing the company from every direction – in an effort to lower the stock and make a lot of money. That’s a pretty sad way to look at the stock market, and it has hurt a lot of people and businesses in the past.

On the other hand, there is no denying that short sellers as a group have a genuinely important part to play in the stock market. If we believe the ultimate goal of the stock market is to help allocate capital to the companies that can use it the best (re: most efficiently) then short sellers do the valuable work of calling out companies who are trying to hide how bad their business actually is. In some ways, one could argue they actually help protect small “retail” investors who don’t have the resources available to them to identify overvalued companies on their own.

What Does Elon Musk Have to Do With This?

As with most controversial topics these days, Elon Musk felt that he had to weigh in. Always one to poke at hedge fund types, he decided to Tweet encouragement to this “meme stocks movement”.

This of course turbocharged the momentum that was already set to ultra-high.

Why Did my Brokerage Account Quit Working?

Many Canadian investors hoping to get in on the action yesterday were shocked to find themselves unable to access their discount brokerage accounts. By all accounts there was nothing nefarious going on here (despite all conspiracy theories to the contrary). It was simply a matter of being overwhelmed. Between new account openings and new traders making user errors, it appears that many online brokers simply couldn’t handle all of the need for customer services, and it even put a strain on their digital infrastructure. Of course, this dysfunction is amplified by the fact that so many employees are working from home.

Even if they had gotten into their accounts, many of these investors would have found out that the shares they wanted to buy or sell were currently not available for trading, as the people that run the stock exchanges had paused any activity on them.

Discover the best free ETF brokers in Canada

View our detailed Canadian broker analysis

How Will This All End?

Not Well.

“Bubbles” never end gently. It’s just a question of who will be left holding the bag when the whole house of cards comes tumbling down.

No one is purchasing these shares in the stock market because they think the underlying company is going to make a lot of money and pass it along to investors.

They are purchasing with the hope of selling to “suckers” right before everything blows up and the stock price quickly goes down.. Of course who is “the sucker” and when it will blow up are for other people to worry about.

Right now, the idea that the only people losing money are these faceless hedge funds – onto which people can then project any “boogeyman” they want to, including Baby Boomers, “the 1%”, old money, Wall Street jerks, etc. – makes it all seem like a fairytale.

But at some point the music will stop. The initial short sellers will all be squeezed, and there will be a large group of people that have used money that they really need, to buy very expensive shares of a company that doesn’t actually make much of a profit. When everyone admits that the emperor isn’t actually wearing clothes, there will be a race to the exits the likes of which we’ve probably never seen. Oh – and it’s worth pointing out that there are probably many hedge funds on the other side of this “bet” as well. Professional traders that are more than willing to follow the herd and pump the stock up – until they’re not.

I honestly believe we’ll see some of these stocks go down by 70% in one day at some point.

If the music doesn’t stop on its own, governments and market regulators around the world are going to step in and turn and make sure the volume is turned way down. You might read many arguments about why this is or is not fair, but the bottom line is that regulators can’t have this happening in their markets. They will find a way to make sure it stops happening.

Ultimately, it’s really unhealthy for both investors and companies if the worth of a business is going to be determined by a bunch of people that specialize in vulgar Reddit posts and emojis of rocket ships. Many people won’t understand that this is a very small part of the stock market – and subsequently will be scared away from benefits of long-term stock market returns. Many businesses won’t get access to capital that they could have used to make products and services that consumers would have enjoyed buying. It is not unlikely to think the market’s decline over the past two days is somehow related to this and that it can eventually trigger a broad market decline. The VIX has gone up by 50% yesterday, indicating a possibility of that happening.

So while this whole week has been incredibly interesting from a human behaviour point of view – and kind of fund to cheer for the “underdogs” to turn the tables on “the rich guys” – I really hope that it doesn’t become anything close to normal. It’s eventually going to lead to a less stable investment atmosphere, and it’s going to lead to a lot of bored people who really need to save their money, losing almost all of it.

Don’t bet your house on Blackberry.

Remember that someone will be left holding this bag. If you decide to buy one of these “meme stocks” you might be one in on the joke, but just realize that on the other end of the trade is someone who is jumping for joy that they found a “sucker” to buy before the music stopped.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Hi Kyle,

But Elon Musk has much more to do with this than a single tweet. Gamestop isn’t the first company with a giant short squeeze, gamma squeeze, and mania — Tesla did it first! Many of us had never even heard of a “gamma squeeze” before Tesla’s epic run. And it was the SEC’s failure to regulate him on several occasions (most especially, “funding secured” but also the non-enforcement of the clear violations of the settlement that followed) that gave the all clear to everyone else in the market that there were no consequences to using social media to post information in the hopes of moving a stock’s price and squeezing shorts, as long as the move was up.

This is a good point John. I knew about all the people shorting Tesla stock (I believe at last count, folks had lost $40B just in 2020 alone?) I also remember the “Oh… maybe I’ll just go private” post that cost so much mayhem – right around the time he was smoking with Mr. Rogan right? Elizabeth Warren was saying a lot of smart things yesterday – generally I am a fan of any plan that she comes up with, and this is pretty squarely in her regulatory wheelhouse, so I hope that she is able to curve all of this manipulation (no matter the source).

It seems like everyone’s cheering at the parade in this point. It’s not only Elon, it’s also Mark Cuban and a lot of other influential billionaires who have no (short) stake in GME and are rooting for that short squeeze. Moreover, prominent political figures came to defend retail investors saying that they can basically do whatever they want to do. I am not seeing the end of it until the shorts go below 50% and the stock balloons up to $1,000+ on its way there, netting big dollars to a hoard of gamblers and sending several hedge funds, brokers and potentially clearing houses to bankruptcy. My biggest concern is that this will reflect on the equities market and will be the catalyst actually bursting the bubble. It’ll be glorious when the people who started the bubble, or at least contributed to it heavily, will be the ones bursting it, but not so glorious for my portfolio.