Best Canadian Robo Advisors 2025

As we look ahead to the warmer days of summer, Canada’s best robo advisors are already heating things up with some excellent offers for hands-off investors. Justwealth is leading the charge right now with a cash bonus of up to $500 when you open a new account – making it one of the best robo advisor options we’ve ever seen.

Despite more and more Canadians catching on to the high fees and mediocre returns that come with the traditional mutual funds pedaled by Big Banks, they still control far too much of our collective investment dollars. Robo advisors are doing their best to flip that script. These low-cost, fully-automated investment services use index ETFs to build efficient, diversified portfolios. The low fees keep more of your money working for you.

By far the biggest reason to recommend Canadian robo advisors: You can go from zero to fully invested in about 15 minutes. No phone calls, no pressure, and no getting sold a mutual fund that underperforms the market. It’s by far the easiest way to get started – and the investment approach (passive investing) is backed up by decades of very strong evidence.

Scroll down to check out our full comparison of Canada’s top robo advisors. We’ve laid out the fees, account options, portfolio details – and, of course, all of the current cash-back promos (because hey, free money never hurts).

Canadian Robo Advisors Quick Comparison

0.4% - 0.5%

$5,000

0.2% - 0.5%

None

0.20% - 0.28%

$1,000

No Available Promotion

0.35% - 0.55%

$2,000

No Available Promotion

0.35% - 0.60%

$1,000 For Canadian Residents

0.40% - 0.70%

$5,000

No Available Promo

0.50%

$100 - $1,500

No Available Promotion

0.35% - 0.50%

$1,000

No Available Promo

Flat rate tiered fees: $5-$150

None

No Available Promo

Before we dive into more detail in our 2025 Best Canadian Robo Advisor picks, let’s take a step back to decide if robo advisors are the best fit for you.

If you are:

1) Looking to get into investing but not sure how to start.

2) Looking for the easiest possible way to get math-backed investment returns for the long term.

3) Looking to “set it and forget it” when it comes to your investments – as opposed to checking your online brokerage account each month.

4) An experienced investor, but simply looking for a passive investment strategy that requires minimal effort.

Then Canada’s top robo advisors might be the perfect way to build your nest egg.

Best 2025 Canadian Robo Advisor Promo:

Up To $500 in Cash

Open an account with Justwealth and get the best robo advisor promo offer in Canada*.

Justwealth has the best portfolio performance out of all Canadian robo advisors + the best promo offer. Get it by clicking the button below:

* Based on investment amount ** Applies only to New clients who open and fund a new account. *** Justwealth Review: more details.

Justwealth – Canada’s Best Robo Advisor

They’re not the flashiest.

They’re simply the best.

There are five areas that separate Justwealth from the rest of Canada’s robo advisors:

1) They have the most choice when it comes to their portfolios. With over 80 portfolios to choose from, they are leaps and bounds ahead of their nearest competitor.

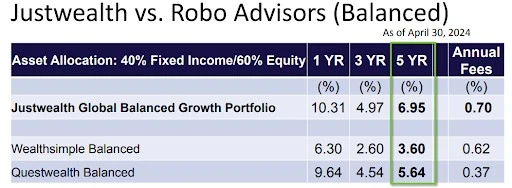

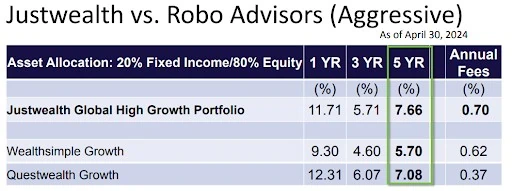

2) They have the best performance track record. Justwealth’s ability to put together ETF portfolios that deliver the best returns is unmatched. More on this later in the show.

3) Every single client that signs up with Justwealth gets assigned their own financial planner. That is super unique and super useful to most robo advisor clients. There is one single point person that can answer your questions and help you navigate the platform.

4) The Justwealth target date funds are perfect for RESPs and FHSAs. They automatically reduce risk as you get closer to needing the cash, and there is nothing else like them available amongst Canadian robo advisors at the moment.

5) They currently have by far the best promo offer – where you can get up to $500 in bonus cash. Details below.

Of course there are other reasons why Justwealth is a great platform – it’s just that they’re shared by the other robos on this list. They are super convenient. Their fees are much lower than those charged by mutual funds (and a little higher than Canadian all in one ETFs).

Finally, they are perfect for investors who just want a really good investment option that won’t require them to spend a bunch of time learning how to buy and sell stocks, as well as rebalancing their own investments.

- Account Options: RRSP, TFSA, RESP, FHSA, RRIF, LIRA, LIF, Non-registered

- Assigned a Personal Financial Planner: Yes

- Management Fees: 0.40% – 0.50%

- MER: 0.1 – 0.2% (standard ETFs), 0.25 – 0.4% (SRIs)

- Minimum Investment: $1,000

- Mobile App: Yes

- Full Review: Justwealth Review

Runner Up & Best Robo Advisor for Tech-Obsessed Investors: Wealthsimple

Wealthsimple is by far the largest of Canada’s robo advisors, and for many years I would have called the company Canada’s top robo advisor.

But the problem is that the company is no longer at all focused on robo advising. That’s a big problem!

Wealthsimple was founded about ten years ago as a company obsessed with three things:

1) Making index investing as simple as possible for Canadians.

2) Cutting fees very close to the bone.

3) Creating an online platform that was so easy and so cool to look at that it would actually encourage Canadians to get started with investing.

The problems started to come as more and more of Wealthsimple’s shares were sold to large Canadian financial companies. And then – surprise, surprise – these companies decided that they wanted to make a lot of money on their investment.

That quest for more profit wasn’t going to come from the low-fee world of robo advisors. So, they shuffled robo advising to the side (calling it “Wealthsimple Managed Investing”) and then they started focusing on flashier stuff like crypto trading, private credit, private equity, and including precious metal investments in their portfolios. As they took their eye off the ball, they made some poor investment decisions, and have constantly tinkered with the makeup of their portfolios (as outlined by Ben Felix in the Globe and Mail).

They opened a discount brokerage operation, they got into mortgages and high interest savings accounts. The problem is that they aren’t the best in any of these areas, and in their quest for more profit they have strayed pretty far from their original focus on their robo advising platform.

Oh – and they also launched big expensive expansion plans in the UK and USA… before admitting failure and collapsing those operations.

Look, there is still a lot to like about Wealthsimple. They remain by far the best robo advisor platform when it comes to aesthetic appeal and user experience. Their website has won several design awards and you can tell that they really emphasized the “technology” aspect of “fintech” – as these online financial companies are often branded.

The Wealthsimple Managed Investing platform is still a much better option than traditional mutual fund investments – I just wish they’d move away from trying to push all of this cryptocurrency trading and private equity stuff, and get back to the simple elegant low-fee solutions that they used to focus on.

- Account Options: RRSP, TFSA, RESP, FHSA, RRIF, LIRA, LIF, Non-registered

- Management Fees: 0.20% – 0.50%

- Average 5-Yr After-Fee Returns (Balanced Portfolio): 4.70%

- Assigned a Personal Financial Planner: No

- Minimum Investment: None

- Mobile App: Yes

- Full Review: Wealthsimple review

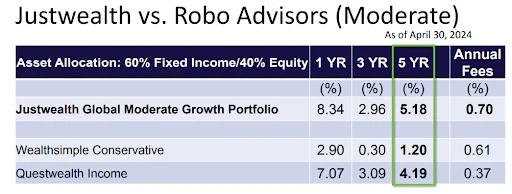

Questwealth Portfolios – The Lowest Fees

Questwealth is considered to be a hybrid robo advisor – which means their accounts are more actively managed than than a traditional robo. Personally, I’m not a big fan of active management, as the whole point of a robo advisor is supposed to be low-fee passive index investing, but it’s obviously an area that Questwealth decided they wanted to highlight in order to stand out. Their 5-yr returns are substantially below those of JustWealth and CI Direct Investing (but above Wealthsimple) so I’d say the active management approach hasn’t really proven itself.

Questwealth Portfolios have some of the lowest fees on the market. Management fees are 0.20-0.25% per year. The fact that they’re able to keep fees so low, while providing a solid platform, is evidence that they deserve their place on this list. Now they just need to offer a more passive-investing based portfolio and they’ll be a true contender.

- Account Options: TFSA, RRSP, Non-registered, FHSA, RESP

- Management Fees: 0.20%-0.25%

- Average 5-Yr After-Fee Returns (Balanced Portfolio): 6.83%

- Assigned a Personal Financial Planner: No

- Minimum Investment: $1,000

- Mobile App: Yes

- Full Review: Questwealth review

CI Direct Investing – Best For Canadian Expats

CI Direct Investing was formerly known as WealthBar, but rebranded in August of 2020. They are currently the only robo advisor in Canada that caters to expats – so they have a special place in our hearts.

Although they do require a whopping $25,000 minimum investment for expats, CI Direct Investing makes it otherwise incredibly easy to use a robo advisor while abroad.

You don’t need a Canadian address and you only have to worry about paying the same taxes as you would anywhere else as a Canadian non-resident.

Like Justwealth, CI Direct offers investors personalized financial advice. CI Direct offers five portfolio options ranging from conservative to aggressive. Their fees are higher than most of the other robo advisors (especially for investors with below half a million in assets). While CI Direct also offers private investment portfolios, I’m not a big fan of that asset class as well, and would encourage people to stay away from these high-fee products.

- Account Options: RRSP, TFSA, RESP, FHSA, RRIF, LIRA, LIF, Non-registered

- Management Fees: 0.35%-0.60%

- Average 5-Yr After-Fee Returns (Balanced Portfolio): 7.29%

- Assigned a Personal Financial Planner: Yes

- Minimum Investment: $1,000

- Mobile App: Yes

- Full Review: CI Direct Investing Review

BMO SmartFolio – Best Option Out Of The Big Banks

BMO SmartFolio is our pick for best robo advisor at a Canadian big bank. Many Canadians feel safe using the BMO robo advisor because it combines a well known brand with the new technology of the fintech world.

Due to their big bank roots, BMO SmartFolio is a little more expensive than some of the other robo advisors on this list, especially when it comes to investors with less than $100,000 to invest.

Another important factor to consider with BMO SmartFolio is that existing BMO clients can keep their whole “financial life under one roof,” so to speak.

Online banks have a lot of perks – there is no denying that – but, there is also a lot of value in simplicity and a sense of security in keeping your chequing, mortgage, loan, and investments all in the same place.

It’s a lot easier to keep tabs on all of your financial information and accounts in one place (or on one app!) than to continually toggle back and forth between multiple institutions. You simply have to decide if the higher fees and lower returns are worth the convenience for you.

- Account Options: RRSP, TFSA,, Non-registered

- Management Fees: 0.40 – 0.70%

- Average 5-Yr After-Fee Returns (Balanced Portfolio): 5.35%

- Assigned a Personal Financial Planner: No

- MER: 0.20 – 0.35%

- Minimum Investment: $1,000

- Mobile App: BMO banking app only

- Full Review: BMO Smartfolio review

RBC InvestEase – Good (But Pricey)

As Canada’s biggest company, you knew that eventually RBC was going to get into the robo advisor world. While they were a bit late to the party (about five years after the first Canadian robo advisors were founded) they obviously have a massive rolodex of Canadian clients that they can use to promote their products.

Much like BMO Smartfolio, RBC InvestEase makes the most sense for investors who really value keeping all of their different accounts under one roof (and RBC is one massive roof).

RBC collaborated with BlackRock Asset Management Canada Limited and created RBC iShares ETF which is the largest and most comprehensive ETF company in the country.

RBC InvestEase doesn’t have the most account options or the lowest fees. However, they make it really easy and straightforward to invest, plus, they have the bonus of having a well-known reputable name behind them.

I prefer SmartFolio when it comes to the head-to-head clash of big bank robos, but try them both out if you want to go the big bank route. More than anything, the massive advantage that RBC Investease has is that so many Canadians use their other products, and it’s just simply easier to go with what you know!

- Account Options: TFSA, RRSP, Non-registered

- Management Fees: 0.40-0.70%

- Average 5-Yr After-Fee Returns (Balanced Portfolio): 5.35%

- Assigned a Personal Financial Planner: No

- Minimum investment: $1,000

- Mobile app: No

- Full Review: RBC Investease review

Best Robo Advisor for Practice Account: ModernAdvisor

A great choice for people who aren’t quite sure about this whole “robo advisor” thing, ModernAdvisor is the only robo on our list that gives new users a free trial.

For 30 days ModernAdvisor gives you an account with $1,000 of their own money. If you choose to open and fund a real account within the trial period, they’ll let you keep any gains you accrued.

ModernAdvisor has a more active approach to portfolio management than many robo advisors on our list (similar to Questwealth). This may or may not appeal to you – but I would be remiss if I didn’t point out that they have the second lowest returns on their balanced 5-year portfolios, coming in at 5.00% (only ahead of Wealthsimple’s 4.70%).

- Account Options: RRSP, TFSA, RESP, LIRA, RRIF Non-registered

- Management Fees: 0.35-0.50%

- Average 5-Yr After-Fee Returns (Balanced Portfolio): 5.00%

- Assigned a Personal Financial Planner: No

- Minimum Investment: $1,000

- Mobile App: Yes

- Full Review: ModernAdvisor Review

Best Robo Advisor for Business-to-Business Model: Nest Wealth

The robo advisor known (for now) as Nest Wealth has recently been sold to an Italian company known as Objectway Group. It appears (for the time being) that not too much has changed at the platform, but Objectway has said that they are adding their own financial solutions and investment management offerings to the company (whatever that means).

Nest Wealth has really tailored their investment approach to attract independent financial advisors – as opposed to individual investors – over the last few years. The idea is that financial advisors can charge clients for their planning expertise, but use Nest Wealth to handle the client’s investment portfolio.

In any case, Nest Wealth is now more of a robo advisor designed for “white labeling” by financial advisory companies (which then layer their fees on top of Nest Wealth’s fees) than it is a serious contender for best robo advisor for individuals to use.

- Account Options: RRSP, TFSA, RESP, LIRA, RRIF Non-registered

- Management Fees: $5/month ($60/year) – $150/month ($1800/year) based on account size

- Average 5-Yr After-Fee Returns (Balanced Portfolio): 7.11%

- Assigned a Personal Financial Planner: No

- Minimum Investment: $0

- Mobile App: No

- Full Review: Nest Wealth Review

Our Battle for the Top Spot: Justwealth vs Wealthsimple

Justwealth | WealthSimple | |

Number of Portfolios Available | Over 80 different portfolios engineered to either grow your wealth, generate income, or preserve wealth. | 3 standard portfolios, plus SRI and Halal options. |

Personalized Financial Advisor | ||

5-year returns (balanced portfolio) | 8.48% | 4.70% |

Fees | 0.40%-0.50% | 0.40%-0.50% |

Target-Date RESP Funds | ||

Account Minimum | $5,000 (With exceptions for RESP and FHSA accounts) | None |

SRI Options Available | ||

Promo Offer | $100-$500 Instant Cash Back | $50 Sign-up Bonus |

Sign Up |

What is a Robo Advisor?

Nailing down a clear definition of “robo advisor” isn’t as easy as you might think.

Every Canadian company we list as a robo advisor shares a few key features:

- They are online investment platforms.

- They use broad ETFs to invest your money instead of picking stocks.

- They are much cheaper to use than traditional mutual funds from banks and credit unions.

Beyond that, things start to vary. Some offer more hands-on advice, others focus on slick app design or low fees. But that core model of automation + lower fees + simplicity is what loosely ties them together.

That said, most of these companies actually hate being called robo-anything. The term sounds like some emotionless robot is tossing your life savings into random stocks – which, understandably, makes some people nervous. In reality, the “robo” just refers to automation. You tell the platform your goals and risk tolerance, it suggests a portfolio, and then automates turning your monthly (or however often you want) deposits into a diversified investment portfolio. Every deposit gets split across your ETFs automatically. No guesswork, no micromanaging.

And no , your money isn’t being run unsupervised by a machine with no human backup. Every Canadian robo advisor on our list lets you speak to a real person if you need help. Email, chat, even phone support are available (with real people on the other end). These platforms are designed to be hands-off when you want them to be, not when you actually need answers.

That’s also why many of these companies market themselves as “digital wealth managers” or “automated investing platforms.” Same idea, just better branding.

What they really do is take your goals, pick a low-cost, diversified ETF portfolio that fits, automatically invest your deposits, and rebalance the portfolio over time in order to stay on track. You get a clean interface, low fees, and peace of mind – all without having to pick stocks or worry about timing the market.

Most Canadian robo advisors also avoid the weird stuff – no crypto allocations, no betting on gold prices – just plain vanilla index investing done right. And if they want to throw you a welcome bonus to get started? Even better.

Best 2025 Canadian Robo Advisor Promo:

Up To $500 in Cash

Open an account with Justwealth and get the best robo advisor promo offer in Canada*.

Justwealth has the best portfolio performance out of all Canadian robo advisors + the best promo offer. Get it by clicking the button below:

* Based on investment amount ** Applies only to New clients who open and fund a new account. *** Justwealth Review: more details.

Are Robo Advisors Safe?

Absolutely.

If you’re worried about handing over your investment portfolio to an online platform — that’s totally fair. But rest assured, the top robo advisors in Canada are every bit as secure as the major financial institutions you’re used to.

We’re talking bank-level encryption, two-factor authentication, and institution-grade firewalls. Most of the leading platforms are also members of the Canadian Investor Protection Fund (CIPF) and regulated by CIRO (formerly known as IIROC). That means your investments are insured — often up to $1 million per account type — and your provider is held to some of the strictest standards in the industry.

In plain terms: the major robo advisor platforms aren’t new startups. They’re established, regulated firms that serve hundreds of thousands of Canadians. They manage billions of dollars in assets and have been around for over a decade. They are well-known by Canada’s safe banking-regulators.

How Do Robo Advisors Invest Your Money?

In order to understand how robo advisors invest the money you send to them, you first have to get a bit of an understanding of what “passive” and “active” investing are.

Every day investors all over the world get up and they buy and sell stocks, bonds, and other assets. Active investors believe that they are better at investing than the huge companies that are buying and selling millions of times every day. They believe that they are better at picking the best stocks and bonds despite the other side having Ivey League graduates, the best technology in the world, inside information, and insanely high bonuses for the top performers. They actively buy and sell, rack up pretty large fees for doing so, and generally they do pretty badly. This is why the big investment banks and hedge funds make so much money!

Passive investors on the other hand believe that it is not possible to beat all of those big corporate sharks at their own game. Instead, they basically just say, “Look, I’m going to beat exactly half of you. You know how I’m going to do that? I’m going to buy a little bit of every stock or bond in this market, and I’m going to be exactly average. Average means that I beat half of you – and it also means that my investments will grow pretty darn fast over the long term.”

This “own the whole market and get average investment returns” strategy is known as index investing or “couch potato investing” and is based on the mathematical arguments developed by Nobel Prize winners.

The largest pool of money in the world (Norway’s Sovereign Wealth Fund) and nearly all major university endowments (such as the billions that Harvard manages) are invested using index investing. So not only is this approach Nobel Prize-winning, it’s trusted by major financial players worldwide.

Now, the easiest way to passively invest – to “own the whole market” – is to use a specific type of product called an Exchange Traded Fund (ETF). These ETFs are very easy ways to buy a little bit of everything. For example, if you own a Canadian stock ETF, it will likely put a little bit of your money into the 60 biggest companies in Canada. At the end of every day the math formula at the heart of your ETF will look and see which companies gained value, and which lost value. They will then put a little more of your money into the companies that gained value, and take out some of the companies that lost value. Consequently, your investment in an index ETF will always get you about the market average.

Robo advisors will simply take your money and split it into a basket of these passively-managed ETFs.

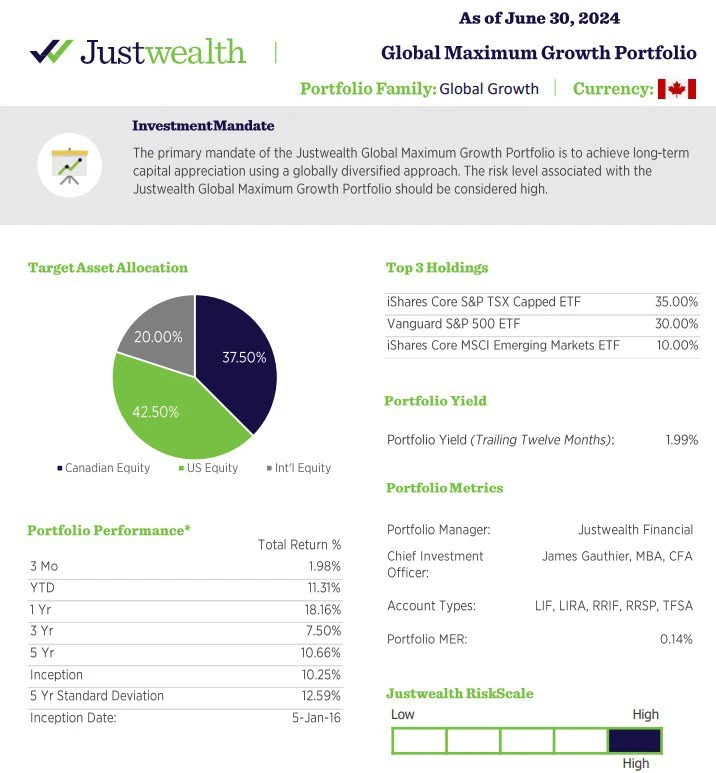

As an example, let’s take a look at the JustWealth Global Growth Portfolio.

For every $100 that you put into this portfolio, $35 is going to go towards Canadian companies, $30 towards US companies, $10 towards countries we think of as emerging markets (like South Korea and Taiwan), and then finally, $25 to other smaller slices of the global pie with a little money tossed into bonds for good measure. All of that means, that after all of that automatic splitting up of your initial $100, the top ten most important holdings in your portfolio will be:

- RBC

- Apple

- Microsoft

- NVIDIA

- TD

- Shopify

- Amazon

- Enbridge

- Canadian Natural Resources

- Taiwan Semiconductor Manufacturing

You will have between $1.00 and $2.29 invested in each of those companies. The rest of your money would be invested in hundreds of other companies from around the world, as well as a small amount of bonds from the world’s biggest countries.

All of those companies are massive profit-makers, and sell products/services all around the world. This is the ultimate example of “diversification” when it comes to your overall portfolio.

Robo Advisors use your financial goals and risk preferences to match you to the ETF portfolio that fits you best.

Now, all of the Canadian robo advisors on this list use some mixture of these ETFs. BUT – over the years, several of these robo advisors have decided they will pick and choose ETFs that are a little different. They “actively manage” the ETFs.

Some of them make quite poor decisions (such as Wealthsimple’s decision to include gold in their portfolios). But generally speaking, robo advisors use passive investing to spread your investment money out into hundreds of companies and bonds, in a way that eliminates 70-80% of the fees that Canadians are used to paying via mutual funds.

Robo Advisors or Online Brokers?

The decision between using a robo advisor or an online brokerage ultimately comes down to how much time, effort, and expertise you want to put into managing your investments.

If you prefer a hands-off approach that really takes no-time at all, robo advisors are a great choice. These platforms use very simple index ETFs to build and rebalance your portfolio based on your goals and risk tolerance. All you have to do is answer a few questions about your risk tolerance, deposit funds, and let the robo advisor handle monthly buying-and-selling work.

Most Canadian robo advisors also provide easy-to-use mobile apps and online dashboards, allowing you to track your investments at any time. If you ever need guidance, human advisors are available for support at our top recommended robo advisors.

On the flip side, the best online brokerages in Canada cater to investors who want full control over their portfolios. With a DIY brokerage account, you’re in charge of selecting individual stocks, ETFs, and other assets, as well as making decisions about buying, selling, and rebalancing.

While the potential for higher returns exists, it requires more research, market awareness, and a solid grasp of investment principles. Canadian stock trading apps sometimes overdo it when it comes to gamification of investing in my personal opinion – but maybe I’m just being an old man with a laptop!

The good news is that there’s no wrong answer here. Some investors prefer the simplicity and automation of robo advisors, while others enjoy the hands-on experience of DIY trading. Realistically, you’re looking at a difference of about .40% MER when it comes to using a robo advisor vs DIYing your portfolio through the same index ETFs.

That means you’ll save about $400 every year, per $100,000 in your portfolio. In exchange for that money, you get a super convenient way to invest money, plus help from your portfolio manager at the robo advisor.

At the end of the day, the best investing strategy is the one that aligns with your financial goals, experience level, and willingness to stay engaged with the market. Oftentime having a qualified person answer your questions via a Zoom chat or email chain can make the difference between sticking with a well thought out strategy, and letting panic dictate a bad decision-making process.

Robo Advisors vs Financial Advisors and Mutual Funds

Robo advisors represent an excellent “middle of the road” option between the super high fees associated with traditional mutual funds + your bank’s financial advisor, and cutting fees to the bone by completely DIYing your own investment portfolio.

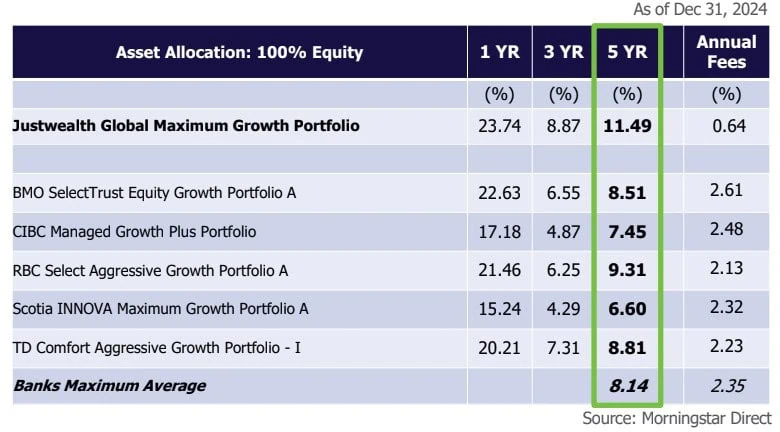

In order to truly understand the value of Canadian robo advisors, you first have to understand how Canadians have usually paid for financial advice. You can read our article on the best financial advisors in Canada if you really want to understand just how bad most financial advice is in Canada, and why it is so unethical to link that advice to the sale of the world’s most expensive mutual funds. Here’s a direct comparison of JustWealth’s after-fee investment returns (our pick for best Canadian robo advisor) vs the Big Banks.

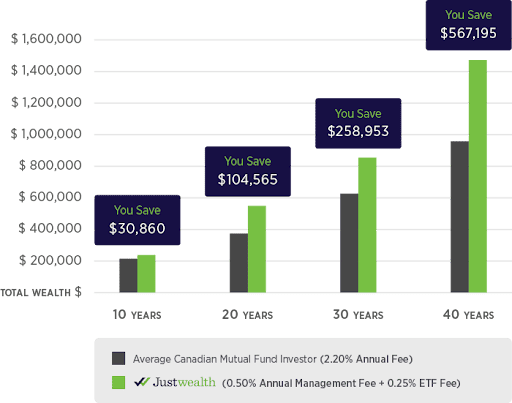

It’s important to note here that when we’re dealing with really small numbers such as 0.64% and 2.6%, that it can be easy to disregard some really important math.

See, most people look at those two numbers and say, “Well, they’re both really small numbers, how much difference can 2% be anyway – 2% isn’t much?”

2% makes a massive difference!

That 2% is going to make hundreds of thousands of dollars’ worth of difference over your lifetime. To put it another way – mutual funds are charging you FOUR TIMES as much money to invest in a worse product (mutual funds – on average – lose to passive investing approaches even before fees are considered).

Now if you bring this math to the bank’s financial advisor that you’re dealing with, they’re going to say something like, “First of all, I would never put you in those funds, here’s another fund that’s better. Also, those fees are the mutual fund company paying me, so that I can provide you with all of this valuable advice – that way it’s free to you.”

Here’s the thing:

1) It’s not “free” to me – it’s going to cost me 2% of my entire investment portfolio every single year (even if the market loses money). That’s going to add up to hundreds of thousands of dollars that I could have had in my retirement!

2) There is no evidence that you as a Canadian financial advisor

3) By using JustWealth, I already have access to a financial professional that can answer all of my questions for me. So for much lower fees, I can get financial advice.

4) Your title of “financial advisor” actually has no legal meaning in Canada. Instead, the financial professional that I speak with at JustWealth actually has a fiduciary responsibility to me. That’s because JustWealth (as well as Canada’s other robo advisors) are legally classified as portfolio managers. That means that they can be held legally responsible if they provide advice that advances their interests, and not my own. You – as a bank/credit union financial advisor – can’t say that.

How to Choose the Best Robo Advisor For You

We’ve already given you details on each of the best robo advisors in Canada, but here’s why we measured those robo advisors in the specific areas that we did, and a rough idea of how we arrived at those numbers.

Robo Advisor Fees In Canada

When it comes to robo advisor fees, it’s important to understand that there are basically two layers of expenses that have to be aware of. Some robos will show them both at the same time, others will not (buy they still exist). So make sure to compare apples-to-apples.

1) The robo advisor’s fee: This is what the platform charges for building and managing your portfolio. It’s usually called a “management fee” and is expressed as a percentage of your total account balance.

2) The underlying ETF fees: These are the costs charged by the companies that create the ETFs that your robo advisor invests in. These fees are known as Management Expense Ratios (MERs), and they’re baked into the performance of the ETFs themselves.

Since nearly every Canadian robo advisor uses similar low-cost ETFs in their portfolios, the ETF MERs don’t vary that much. That’s why we focus our comparison on the robo advisor’s management fee – the part that goes directly to the platform you’re using.

Across the board, management fees in Canada range from 0.2% to 0.7%. (It’s worth noting that some platforms, like Justwealth, include a dedicated financial advisor in that price – which obviously adds substantial value.)

We don’t recommend choosing your robo advisor only based on fees, as value, investment performance, and customer service are also important. It’s definitely worth understanding what you’re paying and what you’re getting for it.

Canadian Robo Advisor Investment Returns

One might think that given all of Canada’s robo advisors are supposed to subscribe to very similar passive investing philosophies, that their overall investment returns should be similar.

However, that is not the case at all.

Most robo advisors are either owned by a big parent company, or have a side deal with a large ETF company. Those deals and ownership structures mean that their robo advisors use exclusively the ETFs put out by the parent company or partner company – even if there is a better ETF available that covers the same asset class.

Justwealth is a fully independent firm, and consequently can choose the best ETF available in each asset class no matter what company has created the ETF. These small advantages – along with superior risk management – has allowed Justwealth to achieve the best after-fee returns of any of Canada’s robo advisors (as you can see below and as reported in the Globe and Mail).

Rob Carrick wrote in regards to Wealthsimple that the “Performance of its robo advisor portfolios does not impress.”

The truth is that Wealthsimple has changed their portfolio allocation multiple times, making pretty ridiculous mistakes when it came to bond allocation strategies and adding in gold exposure (amongst other errors). They’re now focusing on cross-selling risky crypto assets and doing all kinds of other useless promotions in their focus on the bottom line.

Ben Felix as also written in the Globe and Mail about the mistakes that Wealthsimple has made over the last five years, and details all the tinkering that the company has done (thus indicating that they don’t have faith in their initial “set-it-and-leave-it-alone” investing philosophy).

Now, when comparing investment returns on robo advisor portfolios it’s very important to make sure that you’re comparing apples-to-apples. Meaning that you have to match up the style and asset allocation for each portfolio. As you can see from the case studies above, there is a big difference in how asset allocation was done between these robo advisors.

For our comparison of Canada’s Best Robo Advisors we used the 5-year returns on a balanced portfolio as reported by Moneysense.

Number of Portfolio Options

The more portfolio options that your robo advisor offers, the better the chances that your investments will most accurately reflect your specific risk tolerance and investment profile.

Increased portfolio options also allow robo advisors to create unique accounts for RESP and FHSA plans.

Why not have more choice rather than less right? No us being shoehorned into something that only “sort of” fits!

Level of Advice and Help Available

While the term “robo advisor” conjures up (inaccurate) images of robot bankers, the fact is that there are teams of real, experienced people behind each of Canada’s best robo advisors.

Most of the best robo advisors in Canada offer some form of person-to-person contact, whether that’s accredited financial advisors who are reachable by phone or customer service teams who can give you basic advice.

When you’re trying to pick the best robo advisor for you, you need to consider how much personal contact you’re going to want and whether the robo you’re considering offers that.

To the best of my knowledge, JustWealth and CI Direct Investing are the only two robo advisors who assign each client their own planner when they get started with the company. Of course, most of the robos are willing to provide more advice options to folks who have more than $500,000-worth of assets invested with them.

Customer Service

Despite the somewhat misleading name, Canada’s robo advisors aren’t actually financial companies run by robots in some futuristic investment factory. Behind every one of Canada’s top robo advisors, there’s a team of real, experienced, financial professionals working to make investing easy and efficient.

In fact, most of the leading robo platforms in Canada offer more human contact than you might expect. Whether it’s accredited financial advisors who are just a phone call away, or responsive customer service teams who can walk you through the basics of the online platform, you’re supported throughout the investment journey. The key is knowing how much personal support you want and choosing a platform that can deliver it.

When you’re trying to figure out which robo advisor is the best fit for you, it’s crucial to think about your comfort level with DIY investing and how much guidance you’ll need. Here are a few questions to help you decide:

- How complicated is your financial situation? If you have multiple income streams, a small business, or complex tax needs, you might want more hands-on advice.

- How confident are you in financial jargon? Are you comfortable reading up on financial topics on sites like Million Dollar Journey, or do you need someone to explain it to you in plain language?

- Are you comfortable learning from online resources? Most robo advisors have extensive FAQ sections and educational articles, but if you’re someone who prefers a one-on-one conversation, you’ll need to make sure that option is available.

The good news is that most of Canada’s top robo advisors do a great job of offering human support for everyday questions. Need help choosing between a TFSA and RRSP? They’ve got you covered. Confused about setting up automatic contributions or rebalancing your portfolio? No problem.

But it’s worth noting that if you’ve got really niche questions – like how to minimize taxes on income trusts or navigating complex estate planning – you might be better off consulting with a dedicated financial planner or tax expert.

From our experience, the teams behind the screens at Canada’s best robo advisors are more than capable of helping you with the vast majority of questions that come up. They may not be ready to dive into the weeds on advanced tax strategies, but for everyday investing and account setup questions, they’ve got the answers.

If personalized service is high on your priority list, make sure to check out Justwealth, which assigns a dedicated financial advisor to each client. That’s a big reason why they’re currently topping our list of the best robo advisors in Canada for 2025.

Robo Advisor Account Types

You’ll also want to take a look at the different robo advisors accounts that are offered by each of the contenders on our list, as there is quite a bit of variability.

All of the best robo advisors that we rank highly will let you open the basic registered accounts such as a TFSA or RRSP. They will allow you to open up a plain vanilla non-registered account.

Where you start to see some differentiation is when it comes to more specialized types of accounts such as the First Home Savings Account (FHSA) and Registered Education Savings Plan (RESP). Our top selections all include the ability to open Locked-in Retirement Accounts (LIRA), Registered Retirement Income Funds (RRIF) and Spousal Registered Retirement Savings Plans as well.

RBC InvestEast is notable in our Canadian robo advisor comparison for not offering as many account options at this time.

On the other side of the continuum, not only does Just Wealth offer all of these account options, they are also the only ones to offer the very cool target date RESP product, and they also give you the ability to open accounts in USD as well.

Halal, SRI (Social Responsible Investing)

Some robo advisors also offer offer values-based investing options. This includes socially responsible investing (SRI) which is an investment strategy that considers both your financial returns, and the social/environmental impact of the industries involved.

Wealthsimple Invest also offers halal investing which follows Islamic principles.

Platform User Experience

People are more likely to use a platform that they enjoy using.

So while the beauty and ease of using a robo advisor might not directly contribute to building your money, it sort of does in an indirect way. After all, if you never get started or complete the initial setting up phase, then

If being able to access your robo advisor via your mobile app is important to you, remember to make sure that your preferred robo advisor

In my opinion, Wealthsimple really shines in this area. Their platform is flawless on both desktop and mobile. Everything looks like an artist created it. The only flaw is that they’re going to use that bright shiny platform to cross-sell you on more profitable products than their robo advisor.

Canadian Robo Advisor Promotions

Finally, it’s always worth your while to keep an eye on any promotions being offered by robo advisors.

Similar to how credit cards offer occasional incentives and bonuses for people to sign up to their cards, robo advisors also have added perks to entice you to choose them. Typically, when it comes to robo advisor promotions, you’ll see cash bonuses or some of your investment (up to a certain amount) managed for free for a period of time (normally a year).

Like everything on this list, a promotion on its own isn’t enough to validate choosing a specific robo advisor. But, if you can get some extra perks thrown in then you may as well take advantage!

Our Best 2025 Canadian Robo Advisor Promotion is featured below!

Best 2025 Canadian Robo Advisor Promo:

Up To $500 in Cash

Open an account with Justwealth and get the best robo advisor promo offer in Canada*.

Justwealth has the best portfolio performance out of all Canadian robo advisors + the best promo offer. Get it by clicking the button below:

* Based on investment amount ** Applies only to New clients who open and fund a new account. *** Justwealth Review: more details.

Robo Advisor Pros and Cons

Many Canadians are turned off from investing (with robo advisors and otherwise) because they either don’t know how and think they need to be an expert, or they assume they need a big chunk of cash to get started.

Robo advisors take these barriers away by making investing accessible and easy for everyone. Minimums are low. Investing is automated. It’s straightforward without any of the intimidating factors. Here’s a look at the pros and cons of investing with the best robo advisors in Canada:

Now, robo advisors are great, but they aren’t perfect. There are definitely a few downsides to robo advisors that, perhaps, will be rectified in the future but, for now, are something to be aware of. Here’s a breakdown of the main pros and cons of robo advisors.

| Pros | Cons |

| Super easy to get started | While robo advisors do answer 98%+ of the personal finance questions that Canadians have, they don’t offer full financial planning. |

| MUCH better than Canadian mutual funds | Slightly more expensive than managing your own passive ETF portfolio through a Canadian discount brokerage. |

| You can fully automate the wealth-building process. Just “set it and forget it” | |

| Questions answered quickly and efficiently – no need to meet up in person. | |

| Low Fees | |

| Low Investing Minimums | |

| Robo advisors are not ‘one size fits all’ | |

| Very easy to use |

Basically, robo advisors take care of wealth-building for you. They do what they’re designed to do extremely well, and they’re perfect for investors who just want to grow their wealth without worrying about the nuts and bolts.

Robo advisors aren’t designed to handle extremely complex financial planning issues (in that case it’s best to consult a financial advisor). And if you want to dig in and make your own decisions on a DIY trading platform, they’re not the best option for you. But otherwise, we don’t hesitate to recommend passive investing with one of the robo advisors on this list.

Robo Advisors In Canada – FAQ

American Robo Advisors: Betterment vs Wealthfront

I remember going to a trade show back in 2014, and being amazed at this relatively new company called Betterment. I loved the ideas that American robo advisors were bringing to the table and I asked when they were coming to Canada. They said they had actually had preliminary discussions with the folks behind Power Financial up in Canada.

Well, we now know how that one turned out. Power decided to throw its considerable weight behind Wealthsimple, and that company grew in leaps and bounds.

Unfortunately, at this time, Canadian residents cannot invest in Betterment or Wealthfront unless they are an American Citizen with a US address and a Social Security Number. Even in that situation, I wouldn’t advise heading down the path due to tax complications.

Canada Robo Advisors in 2025 – Final Thoughts

As we look ahead to the second half of 2025, one thing is obvious: you no longer need to pay sky-high mutual fund fees just to get convenient investing solutions in Canada. If you like the idea of hands-off investing – and you’re tired of the Big Bank branch song and dance – then a robo advisor might be exactly what you’ve been waiting for.

Canada’s top robo advisors use passive investing strategies rooted in decades of academic research (including some with Nobel Prizes behind them). They help you build and maintain a low-cost, globally diversified ETF portfolio without having to spend your weekends with a calculator and a spreadsheet.

And let’s be honest: Most folks trying to beat the market simply don’t!

History tells us that patient investors in broad stock and bond markets have done very well over time. A good robo advisor helps you tap into that long-term success without the stress of stock picking or the temptation to time the market. They’ll even walk you through basic questions about TFSAs, RRSPs, and which account to fund first.

If you’ve been sitting on the fence, now’s a smart time to start. Justwealth – our top-rated robo advisor in 2025 – is offering up to $500 in cash back when you open a new account or transfer an existing one. It’s a solid offer to kickstart your long-term investing journey.

One of the most common mistakes I see Canadians make is thinking they need to become investing experts before they ever get started. That mindset keeps way too much money parked in low-interest savings accounts. You don’t need a background in finance – you need a plan you’ll actually stick with. That’s what robo advisors do best: simple, consistent investing, backed by research and built for real life.

To be fair, robo advisors aren’t the solution for everything. If you’re dealing with more complex financial planning – like managing a business, estate planning, or multi-generational wealth – one of Canada’s best financial advisors might be a better fit. But if you’re looking for a cost-effective, evidence-based way to grow your money? Robo advisors are very tough to beat.

You can also check out my article comparing Canada’s top wealth management companies to get a better sense of what you’re actually paying for when you go the traditional route. (Spoiler: You’re probably not getting full value – and you’re probably paying more than you think!)

I keep our 2025 Canadian Robo Advisor rankings updated every month. Between my own Justwealth and Wealthsimple accounts – and the experiences of the entire Million Dollar Journey team – we’re always watching for changes within the sector.

Justwealth holds the crown right now thanks to great returns, personalized financial advice, and ultra-competitive pricing. But if you’ve had a recent experience – good, bad, or somewhere in between – let me know in the comments or shoot me an email. Your insights help us keep our robo advisor comparison accurate and useful for fellow Canadian investors.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

If I have all my funds with WealthSimple, it is worth it to switch over to JustWealth. The difference in returns is quite substantial, seems like it would make sense. I don’t have a complicated situation. Are there fees associated with transfering from WealthSimple to JustWealth. Secondly, if I have some managed and some self managed, so you recommend staying with Wealth Simple for self managed accounts?

Hi Jorge,

You can check out our online brokerage reviews for how we think WS stacks up versus other providers. In regards to the Justwealth move, if you talk to them, I bet they’ll pay your fees to move over (usually these platforms charge $100 or so to transfer out). Tough to deny that performance difference!

A friend of mine mention JustWealth to me, have you looked at that, what did you think?

Just added on https://milliondollarjourney.com/justwealth-review.htm

I joined JustWealth a few months ago and from my limited time with them I must say that their communication and response time was top-notch. I sought them out as they were recommended from various blogs to use for non-registered accounts, which is primarily what I was looking for.