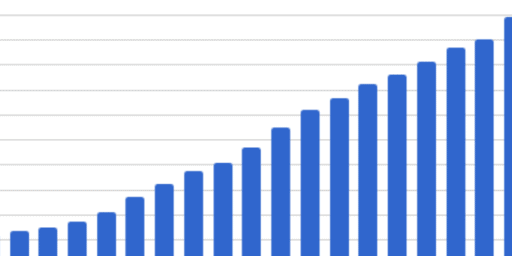

Net Worth Update Oct 2011 (+2.66%) – Market Bottom?

Welcome to the Million Dollar Journey October 2011 Net Worth Update – Market Bottom Edition. For those of you new to Million Dollar Journey, a monthly net worth update is typically posted near the end of the month (or beginning of the next) to track the progress of my journey to one million in net worth, hopefully by the time I’m 35 years old (end of 2014). If you would like to follow my journey, you can get my updates sent directly to your email or you can sign up for the Money Tips Newsletter.

August and September were tough months for the market with the expectation of October being worse. However, since October started, the Market has bounced back quite aggressively. If we have already hit bottom, the correction was much more tame that what I had hoped for. As mentioned last month, we have been slowly deploying capital into the markets, but perhaps not as much as I would have liked. In October, I added to my long term energy positions, added to our RESP indexed portfolio, and made a couple of quick trades in my “fun money” non-registered account.

With cash building up, I’ve been trying to come up with more ways to increase our income. I’ve been considering building our online business even further, to potentially getting back into the real estate investment game. I have been in talks with a friend in another province to potentially get involved with some vacation rental properties, but we’re still in the feasibility study stage.

For those of you who celebrate Halloween, have fun tonight!

On to the numbers:

Assets: $ 655,648 (+2.37%)

- Cash: $4,500 (+0.00%)

- Savings: $60,000 (+7.14%)

- Registered/Retirement Investment Accounts (RRSP): $116,000(+4.50%)

- Tax Free Savings Accounts (TFSA): $29,500 (+3.21%)

- Defined Benefit Pension: $36,400 (+1.11%)

- Non-Registered Investment Accounts: $30,000 (+1.35%)

- Smith Manoeuvre Investment Account: $87,500 (+5.29%)

- Principal Residence: $291,748 (+0.00%) (purchase price adjusted for inflation annually)

Liabilities: $81,400 (+0.37%)

- Principal Residence Mortgage (readvanceable): $0 (0.00%) (Paid off in 2010!)

- Investment LOC balance: $81,400 (+0.37%)

Total Net Worth: ~$574,248 (+2.66%)

- Started 2011 with Net Worth: $505,800

- Year to Date Gain/Loss: +13.53%

Some quick notes and explanations to net worth questions I get often:

The Cash

The $4,500 cash are held in chequing accounts to meet the minimum balance so that we pay no fees (accounting for regular bill payments – ie. our credit card bill). Yes, we do hold no fee accounts also, but I find value in having an account with a full service bank as the relationship with a banker has proven useful.

Savings

Our savings accounts are held with PC Financial and ING Direct. We usually hold a fair bit of cash in case “something” comes up. The “something” can be anything that requires cash such as an investment opportunity that requires quick cash or maybe an emergency car/home repair. We also need cash to cover any future tax liabilities.

Real Estate

Our real estate holdings consist of a primary residence and REITs plus a rental property. The value of the principal residence remains valued at the purchase price (+inflation) despite significant appreciation in the local real estate market.

Pension

The pension amount listed above is the value of both of our defined benefit pension plans. I basically take the semi annual statement and add the contribution amounts (not including employer matching) on a monthly basis. The commuted value of the pensions are not included in the statements as they are difficult to estimate.

Stock Broker Accounts

Another common question is which discount broker do I use? We actually have accounts with multiple institutions. I’m hoping to reduce the number of accounts that we hold in the near future. Here is a review of some of the more popular online stock brokers.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

I wonder why do people think that the economy is getting better. Are these people blind and not see what is happening in the world? What is happening with all this fake economy that has been kept alive for so long? I would think that people so actively participating in the market trading should know better. And seeing your ‘market has hit the bottom’ makes me smile… Or am I completely crazy?

It’s good that you manage to increase your capital. May come in handy as long as deflation hits before inflation.

I am assuming these are interest earned per year?

Registered/Retirement Investment Accounts (RRSP): $116,000(+4.50%)

Savings: $60,000 (+7.14%)

Which schemes/savings delivers such a high interest rate?

@Jungle, I’m going to keep it for now! If I find that I have the luxury of too much excess cash, then I may start paying it down. But as of right now, I’m confortable with the balance.

Thanks InsureCan. For those of you interested, here are some REIT posts:

Owning Rental Property vs Owning REITs

What are REITs?

REIT Analysis using FFO

@Frugal – I do have a dividend portfolio. These are the stocks I watch:

https://docs.google.com/spreadsheet/ccc?key=0AnU4nXDzXQaidFVhV3lUdlBucXBVdENZN3hWYk1JZXc

FT, perhaps it’s an opportune time to do some posts on REITs. I believe they’re an important part of a diverse investment strategy but most folks don’t know about them and there’s not a lot of info about investing in them.

With the Greeks going to a referendum on the bailout/austerity plan, the turnaround is by no means guaranteed. I truly believe that we’ll test 2008 lows once more before this all gets sorted out. There is still not enough political will in Europe to make the necessary changes, and the German public is getting less and less cooperative (not that I blame them). Furthermore, with the Americans headed into an election where we will hear all kinds of promises, I don’t think we’ll see the stability for a true market rebound for at least another 18 months.

Simply awesome work! I love these updates. Inspirational FT!

Great work! And it is work… people don’t just find themselves financially disciplined. So good work.

As for the bottom? Time will tell… it may be the Greek bottom, but like Jenga, there’s lots of other PIGS to still be managed and put on top.

Good job on the update! What are your plans with the tax deductible loan?