Net Worth Update January 2014 ( +3.04%)

Welcome to the Million Dollar Journey January 2014 Net Worth Update – first update of the year. For those of you new to Million Dollar Journey, a monthly net worth update is typically posted near the end of the month (or beginning of the next) to track the progress of my journey to one million in net worth, hopefully by the time I’m 35 years old (end of 2014 – yes this year!). If you would like to follow my journey, you can get my updates sent directly to your email, via twitter (where I have been more active lately) and/or you can sign up for the Money Tips Newsletter.

The beginning of a new year means registered investment accounts get new contribution room. In the first week of January, we deposited $11,000 into our TFSAs ($5,500 each) and $5,000 into the TD e-Series RESP accounts ($2,500 for each child). We paid for the contributions through a combination of our monthly savings, cash from our non-registered account, and a dividend distribution from our corporate account.

With the stock market taking a breather after the monstrous gains in 2013, I’m hoping to put the new cash to good use. The S&P500 (via SPY), which returned almost 30% in 2013, retreated -3.2% in January. The MSCI EAFE (international via XIN.TO)) index followed with a -4% loss. The TSX (via XIU.TO) outperformed the rest with a small 0.4% gain. How did these returns affect my portfolio? Fortunately, my portfolios held up relatively well with my RRSP returning +0.86% (mostly US stocks and international) and my leveraged Canadian dividend portfolio gained 6.18%. Mind you, not all of the 6.18% is organic as I transferred another $5k from the HELOC into the non-registered investment account.

In the big picture, for the January 2014 update we are up 3.04% for the month (and year thus far). We are up to $965k in assets and $852k in net worth with about 11 months left in the Million Dollar Journey deadline! With the deadline looming, there is about $150k left to go until the big $1,000,000 financial milestone!

On to the net worth numbers:

Assets: $965,085 (+3.22%)

- Cash: $4,500 (+0.00%)

- Savings: $20,000 (+0.00%)

- Registered/Retirement Investment Accounts (RRSP): $175,000 (+0.86%)

- Tax Free Savings Accounts (TFSA): $63,000 (+20.00%)

- Defined Benefit Pension: $47,800 (+0.63%)

- Non-Registered Investment Accounts: $190,000 (+0.00%)

- Smith Manoeuvre Investment Account: $146,000 (+6.18%)

- Principal Residence: $318,785 (+3.00%) (purchase price adjusted for inflation annually)

Liabilities: $112,650 (+4.60%)

- Principal Residence Mortgage (readvanceable): $0 (0.00%) (Paid off in 2010!)

- Investment LOC balance: $112,650 (+4.60%)

Total Net Worth: ~$852,435 (+3.04%)

- Started 2014 with Net Worth: $827,300

- Year to Date Gain/Loss: +3.04%

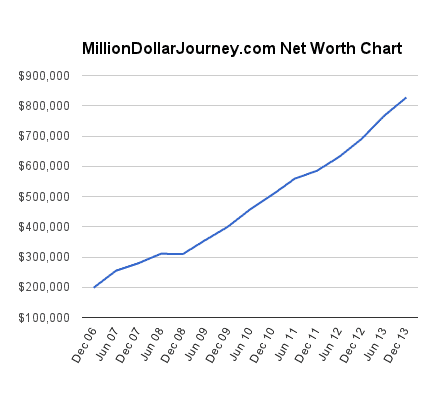

Readers suggested to chart my net worth progress over time. Below are the net worth values since Dec 2006 with data points taken semi annually.

- December 2006: $198,500

- June 2007: $254,695

- December 2007: $279,300

- June 2008: $310,483

- December 2008: $309,950 (rough second half)

- June 2009: $355,850

- December 2009: $399,600

- June 2010: $456,910

- December 2010: $505,800

- June 2011: $558,713

- December 2011: $585,228

- June 2012: $631,400

- December 2012: $690,400

- June 2013: $766,300

- December 2013: $827,300

Some quick notes and explanations to net worth questions I get often:

The Cash

The $4,500 cash are held in chequing accounts to meet the minimum balance so that we pay no fees (accounting for regular bill payments – ie. our credit card bill). Yes, we do hold no fee accounts also, but I find value in having an account with a full service bank as the relationship with a banker has proven useful.

Savings

Our savings accounts are held with PC Financial and ING Direct. We usually hold a fair bit of cash in case “something” comes up. The “something” can be anything that requires cash such as an investment opportunity that requires quick cash or maybe an emergency car/home repair. We also need cash to cover any future tax liabilities.

Where Does the Savings Come From?

We don’t live a lavish lifestyle (how we save money), and we do not carry a mortgage or any other bad debt. The only debt we have is an investment loan (which pays for itself), so we end up pocketing a majority of our earnings. Our earnings come from salaries, private business income (via dividends to shareholders), and eligible dividends from publicly traded companies.

Real Estate

Our real estate holdings consist of a primary residence and REITs plus a rental property. The value of the principal residence remains valued at the purchase price (+inflation) despite significant appreciation in the local real estate market.

Pension

The pension amount listed above is the value of both of our defined benefit pension plans. I basically take the semi annual statement and add the contribution amounts (not including employer matching) on a monthly basis. The commuted value of the pensions are not included in the statements as they are difficult to estimate.

Updated 2013 – My wife has recently changed her job position which has resulted in switching from a defined benefit plan to a defined contribution plan. This amount will be added to the RRSP totals going forward.

Stock Broker Accounts

Another common question is which discount broker do I use? We actually have accounts with multiple institutions. I’m hoping to reduce the number of accounts that we hold in the near future. Here is a review of some of the more popular online stock brokers.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

$1 million by age 35, that is amazing.

Thanks for taking the time to post all of this. I find it very encouraging and helpful to see others numbers. So, thanks for being open and honest about your money.

My wife and I started posting our numbers. It is good to see other posting number too, makes us feel not so freakish.

-Derek

@David, most of the gains are paper only (adjusting house value upwards), so not really that I can go out and spend. However, having $25k excess of consumption in a month would be nice. :)

Congrats….so you accumulated $25k in excess of consumption in a single month.

Do you ever feel like you have too much? Not judging you….just curious is all.

how do you manage tax effectiveness in your non registered accounts?

@John, i’m the buy and forever hold investor, so capital gains tax isn’t an issue. I do receive eligible dividends though, which get preferential tax treatment.

re: “Virtually every public company has massive debt, with the larger ones having debt in the billions. And you feel comfortable buying their stocks.”

But some of us don’t. ;)

ALL the Private Equity deals (4) I’ve entered into since 2009 have zero or near-zero debt and have all bested broad market returns.

(I hold only two public stocks; one has 38% long-term debt, one has 25%. Both pay an 11.5% dividend.)

If you hold public companies as you mention, you are most likely not being rewarded for the ever-increasing risk (debt load) they are assuming.

Just because people buy stocks doesn’t mean they want to or think it’s the best idea, they might just be unaware of other investment choices or think they have to.

Take a look at Warren Buffett, who most would call the most successful stock investor ever. What’s the reason he is sitting on billions in cash (10% of portfolio) instead of having it all in stocks? And why isn’t he taking out loans and margin to buy even more stocks? He’s the best, so there has to be a reason…

(BRK long-term debt is ~14% capitalization)

re: “I feel like rich people would take that offer [$1,000,000 line of credit at a rate of 7% interest] and middle class people would run away screaming.”

Maybe, maybe not.

For one, a rich person would already have the assets to back that LOC and if things went sideways they could cover themselves. Or perhaps a rich person would think 7% a ridiculous rate and most likely have the pull to broker a much better deal.

(would that rich person in their middle-class days have taken that deal?)

In addition, a good investor looks forward. Perhaps FT sees both market corrections and higher interest rates on the horizon (as well as life events), thus deploying more cash now into the market via debt would be a bad idea.

I clearly don’t understand why leveraged investing is so much different than investing with cash. Can someone please explain it to me?

If the market has a 20% correction. Aren’t your non-leveraged investments down too? FT’s net worth went up around $135,000 last year. If he had $12,000 more expense because of debt servicing last year, then if his leveraged investments somehow performed way worse than any of his previous investments the past several years and he made $0 from them, he’d have made $123,000 or maybe a little less in case that other $12,000 would have made some money. Let’s say he would have made $120,000. That hardly sounds like doomsday to me.

If the day after he invests his new $250,000, the market goes down 20%. Even still, that hardly sounds like doomsday to me either.

The $250,000 is extra money, it’s not like it’s money that he needs to pay the mortgage or buy food for his children. It’s just part of the pool of money that’s for long term investment. And just like the rest of his other invested money, over time it will increase in value again.

I feel like leveraged investing just amplifies what you already do. A good investor or lucky person makes more money. A bad investor or unlucky person loses more money. It’s just a higher amount of money and a bit of a cash flow strain as a trade off for higher net worth. So only recommended to people who have enough reliable income to take on more cash flow strains.

So what if your bank called you up and said that they have a promotional $1,000,000 line of credit at a rate of 7% interest available for you to use to invest? All of you would decline because it’s too risky?

It reminds of Ed Rempel’s “How come I’m not rich”. I feel like rich people would take that offer and middle class people would run away screaming.

Virtually every public company has massive debt, with the larger ones having debt in the billions. And you feel comfortable buying their stocks. But investing a few $100,000s with the lowest interests rates in years, the same way you’re already investing the rest of your money is somehow too risky. It’s only risky in my mind if you’re already investing the rest of your money badly, don’t add any more funds to be badly invested.

Please enlighten me. I’m very confused.

Agreed, you really need to take a look at your risk tolerance before taking the leap into leveraging. The question to ask is what you did during the 2008 correction? Did you panic and sell? Did you just hold and ride out the storm? Or did you back up the truck? If you panicked, then leveraging is likely not a good idea. Also note that I started my SM portfolio the summer of 2008, at the height of the market just before the crash, so I know first hand what a real correction can do to a portfolio.

We have not had a correction in a while. Its been over 500 trading days without a 20%+ correction. I would wait before leveraging more, if at all. It may go up for another 10 years…. but more likely to correct within the next few years. And the longer it takes for that to happen, the bigger that correction will be.

Jared, why 10% cap gains tax if you are not planning to sell at all? I would think inflation would be a bigger threat to your capital over a long retirement period (30 to 50 years). Perhaps discounting your expected increase in dividend payment by and an historical inflation rate… same with your expect capital gains minus historical inflation… they may project deflation over the next 5 years (since babyboomers spend less) but eventually it will pick up and may bite us, early 80’s style – which may balances out to historical average anyway.

@R: “For someone like you, for example, you are great at investing.”

This is dangerous thinking.

Considering the market of the last five years it might be a case of rising waters lifting all boats. What’s the old saying, don’t confuse a bull market with genius? (No offense, FT) Look at Victor Niederhoffer, for example.

As well, FT is learned in a portfolio his size, and gains experience handling defined inputs. His liquid assets are ~$600,000; he might not be as astute at managing a sudden 40% increase as he his with steady and measured contributions. By your thinking, FT should be able to handle a $100 million portfolio! (Just setting your next goal for you!)

Apart from that, I would guess that investing/trading is not what life is about for FT; it is a means to an end. Taking on added risk may also mean assuming additional stress which could negatively affect other functions of FT’s life, probably something he is not willing to do.

@Irwin, the HELOC maximum is a little over $200k, so no we have not reached the maximum. In terms of setting a limit on a HELOC, some banks allow HELOC “sub accounts”, so you could setup a sub account with a particular limit. For me, I would consider leveraging up to the maximum if there was a significant buying opportunity (ie. 2008), but realistically, I would sooner pay down the loan with cash, and reborrow to invest to keep the balance at a reasonable level.

@R, great comment and you bring out a good point that leverage can certainly amplify returns but as you mentioned, it’s about risk management – particularly risk tolerance. As the markets are known to increase over the long term, leveraging a lot now could result in a higher net worth providing that a sound investment plan is followed. The problem is that most investors don’t follow a system and buy/sell based on emotion (on occasion myself included), which will result in losing money.