How To Retire Early in Canada

Have you ever thought about early retirement? Stopping work in your 50s (or earlier) and being able to relax and do the things you’ve always wanted to do?

The Financial Independence/Retire Early (FIRE) movement has inspired many Canadians to take a hard look at their lifestyles and figure out if they can do just that.

However, planning for retirement at any age is complicated, and it can be hard to know where to start. This post is designed to give you a starting point. We’ll dig into:

- What retirement – early or otherwise – can look like (and the variables you need to consider)

- What kinds of numbers you’re really looking at (and why rules of thumb should be taken with a grain of salt)

- How to prepare for retirement (and some guidelines for knowing when you’re financially ready)

- Why there isn’t a magic amount of money that can guarantee safe retirement at any age.

Is Your Retirement Savings On Track?

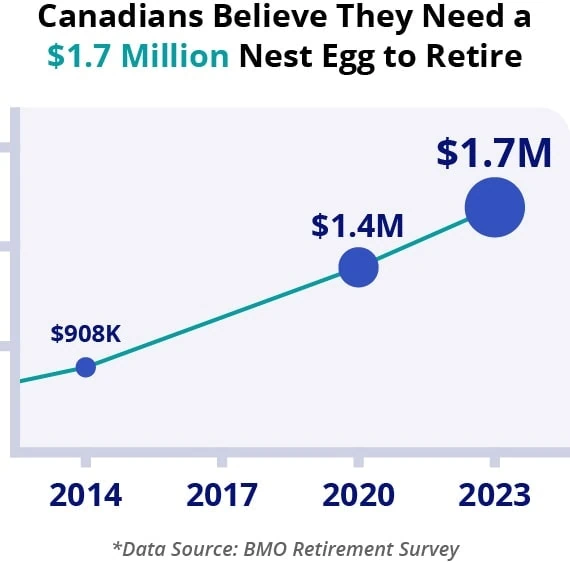

Each year BMO does a retirement survey that asks Canadians a wide range of questions. You can see more details about how they got that figure here.

The problem is that most Canadians don’t really understand how their income and expenses will interact in retirement. Are you saving enough? Find out for sure with the first online course for Canadian retirees (click here for more details).

Early Retirement in Canada

It’s possible to retire early in Canada (like anywhere else), but it takes a lot of work, planning, and aggressive saving.

And, of course, the earlier you start, the better.

Saving for extremely early retirement takes a lot of upfront sacrifice and it’s important to understand that going in. FIRE advocates recommend investing as much as 75% of your annual income – which doesn’t leave a lot to live on.

When you’re making retirement plans, it’s also important to have a solid handle on just how much you’ll need to save – and that varies widely. Why does it vary so widely? Well, here’s one reason you may not have thought of:

Retirement Looks Different to Different People

Retirement isn’t a one-size-fits all concept with a single guaranteed plan and a single magic number you need to reach. There are factors that will affect your personal financial needs… so the first thing to consider when you’re planning for retirement is what you want it to look like.

For example:

- Do you want to aim for early retirement? How early?

- Do you want to stop working altogether and keep your current lifestyle?

- Do you want to downsize and live a simpler life?

- Do you want to do something you’ve been putting off, like travel the world?

- Do you want to keep working, but have the freedom to choose your projects and dictate your schedule, possibly as a consultant or freelancer?

Answering these questions will give you a sense of:

- Approximately how long you’re aiming to live off your retirement savings

- Roughly how much income you might possibly need each year

- Whether you’re planning to bring in any additional income during retirement

Some of this information will be sketchy (no one knows how long they’re going to live, after all), but it’s still important. Your (approximate) answers to these questions will affect how much you’re going to need to save before you can retire, and knowing your end goal is the first step to creating any kind of plan.

How Much Money Do I Need in Order to Retire Early?

If we had a nickel for every time we’re asked this question, we’d all be retiring early! And, if you’ve read this far, you already know what the answer is: it depends (sorry).

Keep in mind that figuring out how much money you’ll need decades in the future is equal parts math and divination. You can’t tell the future, so you have to make educated guesses and be prepared to change course if necessary.

The key here is educated guesses – you don’t have to pull these numbers out of nowhere. Someone better at math than us came up with a now-famous guideline for retirement planning…but even that isn’t foolproof, especially not when you’re thinking about retiring early.

The 4% Rule and Early Retirement

When you’re researching retirement savings goals, you’re certain to run into the 4% rule. We’ve already written about it in depth in other posts, but the basic idea is that you could theoretically withdraw 4% of your portfolio each year and never run out of money.

So, according to the theory, the key to being able to retire worry-free is to get to the point where 4% of your portfolio equals a liveable income.

The flip side of that math is that when you have managed to save/invest your way to an online brokerage account and/or high-interest savings accounts worth 25x your predicted annual spending needs – you’re ready to retire!

It’s a wonderful concept and it’s served many retirees well… but (again, sorry) it develops some issues when you start looking at early retirement.

There are plenty of reasons for this, including:

- The fact that the 4% rule was developed based on a maximum 30-year retirement, not 50+ years for someone retiring in their 30s or early 40s.

- The fact that no one actually knows what the stock market will be doing in 50 years – they only know what’s been happening over the last 100 years or so.

- The fact that the 4% rule doesn’t take taxes or fees into consideration, so depending on where you’re investing, you might be looking at more like a 2% rule (luckily, you have some control over this one – more on this later)

- The fact that the longer your retirement, the greater the chance that you’ll run into a financial emergency and need to draw on your funds faster than expected.

But even with these uncertainties in mind, the 4% rule is still a useful tool for people considering a typical retirement age. In fact, depending on the stock market, retirees who follow the 4% rule can actually end up growing their investments! If you want to deep dive into the 4% rule, check out our Ultimate Guide to Safe Withdrawal Rates in Canada (for Any Retirement Age).

Tips To Prepare For Early Retirement

Preparing for early retirement isn’t easy. Here are some tips to get you headed in the right direction and help you stay on track.

Open an RRSP

If you’re eyeing early retirement and don’t already have an RRSP, open one immediately. These tax-deferred accounts give you a tax refund on all contributions (up to a maximum annual contribution of 18% of your earned income, or $29,210 as of 2022, whichever comes first).

If you’re late getting started, check out our post on Building a $1,000,000 RRSP Starting in Your 30s, 40s, and 50s. We’d also recommend checking out our post on withdrawing from your RRSP to fund early retirement.

Cut Your Investing Fees

When you’re investing over a period of decades, management fees can really do you in. The 4% rule becomes more like a 2% rule if you’re paying 2% annual fees to a big bank!

Consider a lower fee investment option like Weathsimple, which charges between 0.5% and 0.7% annually. If you’re knowledgeable about investing (or are a fan of the DIY approach and willing to learn), consider slashing fees to the bone by choosing one of Canada’s Online Brokers.

Keep Taxes to a Minimum

Keep taxes on your investments low by contributing as much as you can to a Tax-Free Savings Account (TFSA). While contributions to a TFSA aren’t tax-deductible like RRSP contributions, any earnings on money in a TFSA account remains tax-free even when you’re taking your money out.

The maximum annual contribution to a TFSA is generally between $5,000 and $6,000. For information on TFSA rules and investing, check out our post on TFSA Contribution Room in 2023: Rules and Limits.

If you’re saving for education (your own or a child’s), open an RESP – a special tax-deferred savings account specifically for education. You can learn more in our post about RESP Strategy.

Invest in Stocks

The 4% rule is based on a 50/50-to-60/40 split between stocks and bonds in your investment portfolio, but we’ve found that pushing your asset allocation in favour of stocks can lead to better overall returns (as long as you don’t panic during periods where the market trends downwards).

If you stay the course with stocks and consider earning some extra cash during lean periods, past math has shown that you’re less likely to run out of money in the long term.

Cut Your Budget

If you want to retire early, get into the mindset that every dollar you save now will become many dollars in the long run. Slashing your budget as much as you possibly can while you’re young and investing your savings can translate to years of extra time in retirement.

FIRE followers advocate saving as much as 70% of your income – so cut your budget… and then cut it again! You can start by reading our top 25 ways to save money in Canada.

Don’t Count on Your CPP

The amount of Canada Pension Plan payments you’re eligible to receive varies based on your age, how long you’ve worked, and your average earnings during your working life. The current maximum payment is $1,253.59… but that’s if you’re a new recipient starting retirement at age 65.

The average CPP payment as of October 2021 was $702.77 – which is a heck of a difference if you’re counting on that extra $500. Besides, if you plan on retiring well before age 60, you’re likely to receive less than the average payment when you do qualify.

Avoid Debt

Consumer debt will eat up your savings and undermine your goals. Get used to spending less (a lot less) than you make and avoiding car loans and lines of credit.

Consider Passive Income Streams

Passive income streams like dividend stocks can help grow your income with predictable payments. Learn more by checking out our post on the Best Canadian Dividend Stocks.

It’s also important to know what kind of tax situation you’ll be looking at when you retire. If you’re looking at dividend stocks, take a look at our post on Retirement on Dividend Income to get yourself in the best possible position.

Track Your Progress

Watching your savings grow can help keep you motivated as you push for your financial goals. A budgeting app can help you stay on track and make sure you’re staying on target.

What’s the Best Age for Canadians to Retire?

The FIRE method is based on a goal of extremely early retirement – but is that the best choice for everyone?

Honestly, asking this question is kind of like asking whether minimalism is for everyone.

Advocates will say yes, of course. But the reality is that it might not be. Retiring early can open you up to risks that a shorter retirement lets you avoid. Check out our post on the Biggest Risk of Early Retirement for more.

When you’re thinking about when to retire, you need to consider your personal habits, preferences, and goals. For example:

- Are you willing to make huge sacrifices now, so you don’t have to work later?

- Do you have a partner or family, and are they on board?

- What are you willing to give up in order to work towards your goal? I’m not even talking the latest gadgets, I’m talking newer cars (or any car at all), living space, leisure activities, and even some foods and coffee.

- Are you up for thinking outside the box once you do retire- continuing to cut costs and finding creative ways to earn an extra few thousand dollars if you need to?

The idea behind FIRE is inspiring, but there’s something to be said for a more balanced approach. We’re all for frugality, for minimizing debt, and for smart investing. But we’re not convinced that taking extreme measures leads to more happiness overall. The prospect of living on 30% of a full-time salary until retirement just isn’t for everyone.

How Much Do I Need in Order to Retire Safely at Any Age?

As we’ve already said, there’s no magic number at which you’re guaranteed to be able to retire. The numbers vary depending on the fees and taxes you pay, the annual income you need, whether you have a spouse and dependents, and so on. And that’s setting aside the possibility of medical emergencies, global or national disasters, or stock market downturns.

We’ve talked about the 4% rule already, and experts have built on that, trying to give us tools to crunch the numbers and come up with a solid estimate. Before we get into these tools, we want to be clear that these are not guarantees, they’re guidelines.

Do we wish we could tell you a concrete number (if you want to retire at 60 you need $X)?

Yes.

Can we?

No.

25 x Your Desired Annual Income

This is based on the 4% rule (and therefore needs to be taken with a grain of salt if you’re considering early retirement), but the basic principle is that you should take the amount you want to live on each year of your retirement and multiply it by 25 (4×25 = 100).

70% of Your Current Working Income

The theory behind this rule of thumb is that expenses should be lower when you’re retired. Your kids (if any) should be grown and financially independent. Your mortgage (if any) should be paid off. And so on. If you figure that those temporary expenses make up for about 30% of your current earnings, then you should be able to live off of 70% as a retiree.

If you combine these two rules, then theoretically you should be able to take 70% of your current income and multiply it by 25 to get the minimum amount you’ll need in order to retire safely.

However, again, we need to remind you that this doesn’t really work for early retirement. You’ll need to draw on your investments for longer, and depending on how early you retire, you may actually still have kids, a mortgage, etc.

Some other things to consider when you’re doing the math:

- Inflation (things will cost more in the future)

- Unexpected expenses (hard to factor in, but they do happen)

- Whether you’ll be willing to downsize or relocate in order to stay financially independent for longer

- Whether you’re looking to completely live off your portfolio, or whether you’d like to earn some income with passion projects or freelancing.

Retirement Calculators

Retirement calculators are a way to get a more personalized estimate of your retirement savings needs than we can give you. While they’re still estimates based on assumptions, they’re still a good (and free) way to get expert opinions on your savings goals.

We compiled a list of our favourite calculators (as well as tips for how to do the math yourself) in our post on 5 Useful Retirement Calculators.

Early Retirement For Canadians – FAQ

Summary

It is possible to retire early (sometimes extremely early) in Canada. However, it takes aggressive budgeting and smart investing in order to make it happen.

Current rules of thumb for estimating how much you’ll need weren’t designed with a 50-year retirement in mind. This means that you’re going to have to do a fair amount of guesswork before you retire. You’ll also have to keep an eye on your portfolio and be willing to get creative if the market has a bad year.

No matter what age you plan to retire at, you can reach your goals more quickly by saving aggressively, investing wisely, minimizing fees, and tracking your progress.

Now go figure out your retirement goals and get to work (if you haven’t already). You can do this!

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Hello. Why do people want to work a job they don’t like so they can save a lot of money and retire early? Why not do what you’ve always wanted to do right now? I quite my 9 to 5 office job when I was 27, and now save peoples’ lives for a living. I contribute to society, and live an intentional life. I’m still saving for retirement too, but enjoy my life much more. I’m in no hurry to retire.