Best Swap ETFs in Canada: Horizons Total Return Funds

In writing about corporate and expat investing over the past couple of years, I’ve come to realize just what an advantage using Canadian swap-based ETFs from Horizons can provide certain groups.

Horizons calls these exchange traded funds “Total Return ETFs” and there are three main groups of investors that really need to be paying attention to these things:

- Canadians who are investing within their corporation.

- Canadians who are residing outside of the country but still investing in Canadian Dollars (and likely using a Canadian online broker) – aka: Expats.

- Canadians who have already maxed up their RRSP/TFSA/RESP/RDSP and are now starting to invest within a non-registered account.

The reason these three groups in particular have the most to gain from looking at Horizons swap-based ETFs have to do with how investment gains are “realized”. The idea is to take potentially highly-taxed investment income such as interest and dividends, and turn them into more-advantageously-taxed capital gains.

I realize how nerdy that last sentence sounded, but by turning interest- and dividend-water into capital gains-wine, some Canadians save thousands of dollars in taxes every year!

We’re going to go over the pros and cons of total return ETFs, explain the small risks involved with these products, and then illustrate just how to best use them in your portfolio. But first, a quick look at the biggest swap-based ETFs in Canada.

Note: The capital gains advantage referenced above will be lessened by the government’s recent raising of the capital gains tax inclusion rate – but the ability to determine which year you realize investment gains can still be quite valuable. You can read my full breakdown of the new capital gains rules for more information.

What is a Swap-Based ETF? Is a Total Return ETF the Same Thing?

A swap-based ETF and a total return ETF are referring to the same product.

These products are exchange traded funds that you can buy and sell on the Toronto Stock Exchange just like any of the popular ETFs from BMO, Vanguard, or iShares.

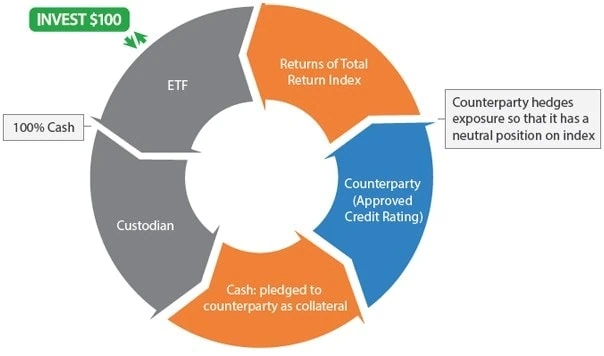

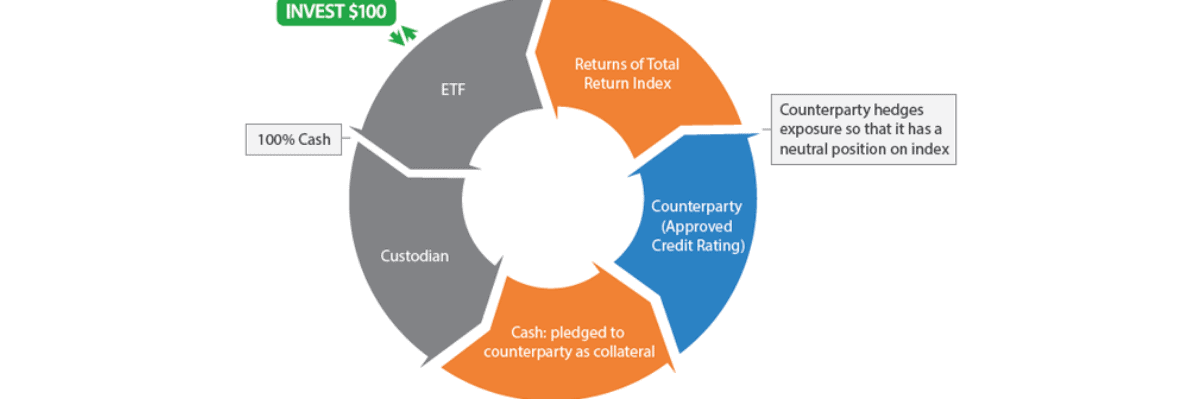

What makes swap ETFs different is that they don’t actually own any shares or bonds. Normally when you invest a hundred bucks into a TSX 60 ETF, that ETF will take your money and invest a few dollars in RBC, a few in Shopify, etc.

When you put $100 into a Horizons total return ETF though, your money is going to take a bit of a different path.

Now – I want to clarify a few things:

1) It’s important that you understand what you’re investing in. If you don’t understand the asset that you are purchasing in your online brokerage account, there is a strong likelihood that you’re going to panic when headline news gets really bad, or someone you know gives you a “hot investment tip.” You need to have conviction in the investments that you own.

2) When it comes to Horizons total return ETFs, the specific details of how they work can get really heavy with lots of acronyms and tax code references.

3) The most important thing to keep in mind as you familiarize yourself with these products is that they exist to turn 100% of your investment returns into capital gains. How this is done is a bit complex, but the end result of taking interest and dividends – then “turning them into” capital gains, can be a much lower tax bill.

4) Horizons ETFs are used by several Canadian experts such as MDJ’s own Frugal Trader and The Millionaire Teacher Andrew Hallam.

5) I also use or have used Horizons total return ETFs (full disclosure) – specifically HXT, HXS, HXDM, HXEM.

I say all of this to try to keep things in perspective as we dive into the intricate details of what swap-based ETFs are, and to lessen the intimidation that can come when discussing complex items. A big shout out to Dan Bortolotti and Dr. Mark Soth for their work in fleshing out the details on swap ETFs over the years, as well as to Horizons for creating these unique products.

Quick Compare: Horizons Total Return ETFs

| Ticker | ETF Name | Market Capitalization | MER | Investment Focus |

| HXT | Horizons S&P/TSX 60 Index ETF | $3.8 billion | 0.03% | Invests in the top 60 large-cap stocks in Canada. |

| HXS | Horizons S&P 500 Index ETF | $3.4 billion | 0.10% | Invests in the 500 largest US stocks. |

| HXDM | Horizons Intl Developed Markets Equity Index ETF | $421 million | 0.22% | Invests in the biggest companies from 21 developed countries – but excludes Canadian and American companies. |

| HXQ | Horizons NASDAQ-100 Index ETF | $623 million | 0.25% | Invests in the largest 100 companies on the NASDAQ exchange (“tech companies”). |

| HBB | Horizons CDN Select Universe Bond ETF | $3.13 billion | 0.09% | Invests in Canadian bonds, aiming for yields corresponding to the broad Canadian bond market. |

| HSAV | Horizons Cash Maximizer ETF | $2.2 billion | 0.18% | Invests in Canadian high interest savings accounts. |

| HXEM | Horizons Emerging Markets Equity Index ETF | $69 million | 0.28% | Invests in the largest companies from 26 developing countries. China, India, Taiwan, and South Korea make up about 75% of the holdings. |

How Does a Swap ETF Work?

Back to the journey your $100 will go on when it is invested in a swap ETF. Let’s use HXT as an example.

HXT is basically a contract between Horizons and National Bank. Horizons is going to take your hundred bucks (along with the other investors’ money) and put in a special custodial account. They promise National Bank that this pool of money will be used to pay National Bank at the end of the swap process.

National Bank then takes their own money and invests it in the stocks [or other assets] that Horizons wants exposure to. In the case of HXT, it would invest in the companies that make up the TSX 60 index.

At the end of the cycle, they would take the proceeds that they made (the capital gains and dividends in the case of HXT – interest payments in the case of HBB) sell them, and then trade that amount of money [minus some fees] back to Horizons.

This is all done in order to give you (the investor) a total return in the form of capital gains – effectively “turning dividends and interest into capital gains” as far as the tax man is concerned.

What are the Risks to Investing In Swap-Based ETFs?

I am inherently suspicious of any financial product that is complicated. So I’ve done quite a bit of reading when it comes to the Horizons total return ETFs. Here’s what I’ve come up with as far as possible risks. Again, I want to reiterate that for me, these risks are relatively insignificant compared to the tax efficiency these type of ETFs can bring to an investor in specific situations:

1) National Bank could go bankrupt and/or fail to pay Horizons back. People call this “counterparty risk”. Overall, this is not a big worry for me. National Bank is massive, well-capitalized, and based in Quebec. If the Federal Government ever lets this company fail, it’s likely that a nuclear war has started and we should all be worried about more important things than the intricacies of swap ETFs.

2) The government could change the tax laws. As I type this article, the government has just changed the capital gains inclusion rate. In theory, the new government could change the capital gains rate back to 50%, or it could even raise rates (especially if we re-elect the current government).

In theory, the government could also try to target the corporate-class fund structure that allows Horizons to complete their complicated maneuvering – but I’m much less worried about this one as the government has now figured out how to get their “pound of flesh” in the form of capital gains taxation.

3) Horizons could collapse as a company – thus leaving your hundred bucks in limbo. If you have used Horizons to complete your whole portfolio, this is obviously a scary thought. But, again, I’m not too worried about this one.

Horizons ETFs has more than $27 billion in assets under management – it’s a really big company. It’s owned by a much larger company called Mirae Asset Financial Group which manages over $700 billion-worth of assets across 13 countries.

Even if those companies started facing financial difficulty, it is very likely another asset management group (like Blackrock) would step in and buy out the Horizons ETF subsidiary. I would put this risk at very close to zero.

4) There is also a non-catastrophic (more like a general pain in the butt) risk of accounting details leading to you owing increased taxes at some point. The experts call this one “management risk” and it has to do with Horizons making too much money.

The details of “management risk” are a bit mind-numbing and require thousands of words to fully explain. The basic idea would be that if the swaps between Horizons and National Bank [as well as other ways the broader family of Horizons ETFs makes small profits] were to result in a tiny, but consistent profit for Horizons, then eventually the broader Horizons ETFs fund corporation would make too much money – and be legally forced to pay it out to people who owned units of Horizon ETFs.

This might sound good at first (who doesn’t want to get more money) but that small amount of money being paid out to unit holders would not be classified as capital gains. Consequently, it’s possible that if too much profit were accumulated and paid out, it would negate the tax advantages that Horizons has (which are the whole reason to invest in Horizons ETFs) for a specific period of time.

I am pretty confident Horizons has this under control (they do creative accounting things like book huge paper losses in downturns to offset gains in future years). If they don’t, you may be forced to realize some capital gains at an inopportune time – but again, there is no indication this is at all likely. Horizon has been two steps ahead on these swap ETFs for the last decade plus.

Horizons ETF Fees vs Advantages

I’m really hoping that description of risks and the complicated description of total return ETFs didn’t dissuade you from considering the product. I say this because there are some excellent tax advantages available for investors in specific situations.

After all, Horizons wouldn’t have accumulated $27 billion in assets under management if it wasn’t doing something right!

Let’s take a brief look at the main reasons you should consider investing in swap ETFs:

- Potentially a much lower tax bill due to your investments only producing capital gains and never producing dividends or interest.

- No currency conversion costs to worry about when you look at investing in markets outside of Canada. You can keep all of your money in Canadian Dollars, and it’s super simply to buy the ETF on the Toronto Stock Exchange.

- You get to sidestep a lot of the taxes associated with foreign withholding taxation of dividends leaving a country and heading into your brokerage account.

- Almost no tracking error. Most ETFs don’t precisely track their underlying index due to accounting details. With total return ETFs, the exact return of the underlying index is already known ahead of time, so there is no reason for tracking error.

But of course… Horizons must make money at some point. Here’s the Horizons total return ETF fees you should be aware of:

- There is a Management Expense Ratio (MER) – as with any ETF – but generally speaking, Horizons MER fees are very competitive as you can see from the chart of best swap ETFs that I started this article with.

- The Horizons total return ETFs that track Canadian stocks have no “swap fee”. BUT – the Horizons total return ETFs that trade in bonds, or foreign stocks do have a swap fee (0.05% to 0.30%). This swap fee is in addition to the MER.

Both the MER and the possible additional swap fee are a pretty small price to pay in my opinion for the massive advantage that swap-based ETFs provide for investors who want to avoid relatively high taxes on dividends and capital gains.

Who might those folks be…

Swap ETFs for Canadian Corporations (CCPCs)

Canadians who are investing inside their corporation have perhaps the most to gain from using Horizons total return ETFs. This is due to the complex accounting that takes place within a corporation.

Because passive income such as interest and dividends can lower the small business tax deduction – plus there is the issue of understanding the RDTOH notional account – swap ETFs can be a big deal for people who have a large investment portfolio within their corporation.

Using a combination of Horizon ETFs and a judicious use of your Capital Dividend Account (CDA) can easily save your company hundreds of thousands of dollars over the course of a lifetime.

Note: CCPC owners who were using total return ETFs are exactly the individuals that the Trudeau government was targeting with their latest capital gains tax raise. It will be interesting to see if corporation owners decide to wait it out for a couple of years in hopes that the new government reverses their new rules.

For now, I would argue that HXT no longer makes sense in most corporations if the RDTOH account is used correctly. HBB and probably HXEM are still pretty valuable because of the pros/cons tradeoffs discussed above.

Swap ETFs for Canadian Expats

When I wrote my eBook for Canadian Expats (click here to download it for free) I highlighted just how advantageous using total return ETFs could be for a Canadian that had residency abroad. That hasn’t changed with the newest capital gains tax laws, because those rules don’t apply to residents of other countries.

If you live in a place such as Georgia, Panama, or the UAE, then you can effectively pay $0 in taxes by using a total return ETF. That’s because several countries around the world don’t charge any tax on capital gains from outside of their territory.

Now some of those countries don’t charge taxes on dividends either, but the issue is that Canada (and many other countries) will charge something called a foreign withholding tax on dividends before they leave their country (and before the dividends go to your brokerage account as a foreign resident).

By trading in your dividends (and interest) for capital gains, you eliminate the need to pay this foreign withholding tax. Consequently, you owe no tax to Canada, and depending on what country you now reside in, you may owe no tax there either – what a great way to build an investment portfolio!

Swap ETFs for Non-Registered Accounts

The other group of Canadians that can really benefit from getting more of their total investment returns in the form of capital gains, than in dividends or interest is Canadians that have a healthy non-registered investment portfolio.

The main benefit to these Canadians is that if they used investments other than total return ETFs, the government would likely be taking a big tax bite every year. How big a bite depends on how much other income you were making, but if you were in the top tax bracket you’d be looking at somewhere around 40% for eligible dividends, and 50% + for interest and foreign dividends.

Because that tax would have to be paid every year, there would be less of your investments to keep compounding going forward.

On the other hand, if those investments were in a swap-based ETF, there would be no tax paid until the ETF was sold and the capital gain was “realized”. Not only does your money stay in your account, compounding for you every year without any taxation to eat away at it – you also get full control of when you have to sell the ETF.

That could be incredibly valuable to those in high tax brackets, as it allows them to realize tax gains at a time in the future (retirement!) when they are much more likely to have a lower income.

There may also be an opportunity here to use capital gains to reduce an individual’s OAS clawback, as dividend income is particularly rough on these taxpayers due to its gross up calculation for taxable income.

Note: With the new rules allowing up to $250,000 in capital gains per year before the higher 66.67% inclusion rate applies, it’s unlikely that it will affect very many folks that are using swap ETFs in their non-registered personal accounts.

Horizons Swap ETF Performance

If you’re asking what the performance has been in regards to Horizons total return ETFs – then you’re doing it wrong.

The index swap ETFs that I recommend at the beginning of this article all take advantage of the idea of “owning the whole haystack – instead of trying to stock pick the needle”. If you aren’t familiar with the index investing vs stocking picking debate I suggest that you take a step back and do some reading on that first, before selecting specific ETFs for your portfolio.

The investment return of each Horizons total return ETF will almost exactly equal the performance of the underlying index (minus the MER fees and possibly the swap fees). This is a guarantee to continue, as these funds are constructed to be passive investments. There is no one at the top trying to pick “only the best investments”.

Horizons ETF HXT Review

I thought we’d take a closer look at the three largest Horizon swap-based ETFs since so many emails (mostly expats and corporation owners) have asked about them over the past few years. If you want to know more about HSAV, take a look at my article on the best cash ETFs in Canada.

HXT Holdings: While HXT doesn’t technically have conventional holdings in specific companies like another TSX 60 ETF would (like VCN), HXT’s performance will be nearly identical.

That’s because National Bank is going to invest in Canada’s 60 largest companies (RBC, TD, Enbridge, etc) and then swap the total returns back to Horizons. So the performance of HXT will be identical nearly identical to the overall performance of the TSX 60 index.

HXT Price: $55.89

HXT Management Fee: 0.03%

HXT Tax Efficiency: HXT is very tax efficient and has particular advantages for high-earners that want to defer taxes until a later date, as well as Canadian expats who don’t want to pay Canadian withholding taxes. That said, it’s actually the least beneficial to CCPC owners as they can recoup the tax hit on eligible Canadian dividends pretty easily. It’s also probably not worth it to have in your RRSP and TFSA.

Horizons ETF HXS Review

HXS Holdings: Like HXT, HXS doesn’t actually own the underlying companies in the S&P 500, but it has a swap deal to get the same return as if it did. So, the performance of HXS will depend on the capital gains and dividends generated by the 500 largest companies on the US stock exchange (Apple, Microsoft, Facebook, Amazon, Tesla, etc).

HXS Price: $71.05

HXS Management Fee: 0.10%

HXS Swap Fee: Up to 0.30% (usually lower)

HXS Tax Efficiency: HXS tax efficiency is an interesting question. There are those that argue that you could just put your US investments in your RRSP and get the withholding tax back – but a lot of investors don’t understand how to structure all of that in their broader portfolio.

Most investors also don’t realize how much money they pay in currency conversion fees if they were to buy a US-based ETF in US Dollars. Consequently, HXS is a quick and easy way to get exposure to half of the world’s total publicly-traded markets for a very low MER and a swap fee that is usually less than the currency conversion costs would have been.

Horizons ETF HBB Review

HBB Holdings: The HBB ETF is essentially the same as investing in a bunch of Canadian bonds. Technically, HBB tracks the Solactive Canadian Select Universe Bond Index. That means that the swap with National Banks will be equal to total return (including the interest generated) by the group of bonds that make up that index.

The bonds are mostly Canadian federal and provincial government bonds, with a smattering (2-8% each) of bonds from big Canadian banks, utilities, and energy companies. About half of the bonds are rated AAA. Another 35% are AA or above. The last 15% are still investment-grade (BBB).

HBB Price: $45.76

HBB Management Fee: 0.10%

HBB Tax Efficiency: HBB is where Horizons really gets to show off when it comes to tax efficiency. Receiving investment returns in the form of interest is just a really inefficient way to receive passive income. It’s taxed at 100% of your taxable income rate (just as if you earned the money at a job).

You also don’t get to choose when you “realize” interest gains – but you do with capital gains. That means you can let your investments compound for you as you work (and hopefully earn a relatively high income) and then sell the investments (“realizing” the capital gains) when you’re earning a relatively low income in retirement.

Canadian Swap-Based ETFs – FAQ

Best 2026 Broker Promo

Up To $5,000 Cash Back + Unlimited Free Trades

Open an account with Qtrade and get the best broker promo in Canada: $250 when you invest $1,000!

The offer is time limited - get it by clicking below.

Must deposit/transfer at least $1,000 in assets within 60 days. Applies to new clients who open a new Qtrade account by March 31, 2026. Qtrade promo 2026: CLICK FOR MORE DETAILS.

Can you explain what you mean when you say HXT no longer makes sense in a corporation if the RDTOH account is used correctly?

Would swap-based ETFs be an eligible investment for a smith maneuver portfolio?

I don’t think so Jimmy. I’m not sure there is an CRA precedent on it, but by definition those ETFs don’t have a dividend so…

Has HEQT lost it’s tax advantage. I hold it in my non-registered account because I thought it was a swap based ETF to avoid extra dividends. It did some restructure last year and now pays dividends. Could you please clarify? Thank you

Hello, Is HEQT still this type of fund? I know is used to be tax efficient to hold in a taxable investment account. They made some changes a few months back and I have had trouble finding clarity on if it is still tax efficient. It now pays a monthly dividend (tax pd before distribution) but does that not negate the whole point of the majority of gains being realized as capital gains instead of dividends for tax purposes? Thank you in advance.

Hxs changed its name… maybe more to follow.

Great article pal. Thanks for taking the time to write it. My wife and I have seriously been considering the expat move….now more then ever.

Thank you for your excellent article. I was happy to see this as I’ve been looking at HXT, HXS, HXQ and HSAV over the last couple of months. My question is this….wouldn’t it be advantageous to hold HXT and HXQ in my FTSA so as to avoid the unrecoverable 15% withholding tax on foreign dividends? If I invested in XUS or VFV within my TFSA I think I would lose the withholding tax?

Thank you for this article. I am also in the process of moving assets in my non registered account to reduce dividend income.

Nicely done write-up. I doubt that the capital gains rules will change for corporations even if the government changes. Today’s deficits are tomorrow’s taxes and our deficits will take a decade to wrestle under control (even if we course correct) if history is any guide.

Still, the tax deferral of capital gains vs income over time is quite powerful. Use of capital dividends in a corporation strategically instead of some taxable income is also useful. It does make anything that pays eligible dividends more attractive than the corporate class version though. Especially when you consider the risk that Horizons has to manage the income well. Thanks for the shout-out and again – a really well done summary.