Home Equity in Retirement – Reverse Mortgages vs HELOCs vs Downsizing

Many retiring Canadians have a huge chunk of their net worth tied up in their housing equity. Deciding whether to tap into that housing equity through a reverse mortgage or a home equity line of credit (HELOC) as they transition through different phases of retirement can be a tricky decision.

The alternative option of selling a family home and downsizing is also fraught with emotional peril and high fees if not handled correctly.

A lot of Canadian seniors love the idea that the family home will be the financial legacy they leave behind for their loved ones to enjoy. They also treasure the idea of being able to stay in their most familiar surroundings for as long as possible.

And, hey, if you have ways of generating enough income to support your chosen retirement lifestyle through pensions, private investments, CPP, and OAS – then all the power to you. Keeping your home and leaving a tax-free gift to your family is certainly a lovely option and a thoughtful gift.

For the purposes of considering all of our options though, I just want to encourage folks to think about how they could use their home equity in retirement.

Editor’s Note: This article is a small part of the online course that has helped hundreds of Canadians plan their own retirement. It’s called 4 Steps to a Worry-Free Retirement and you can check it out by clicking here.

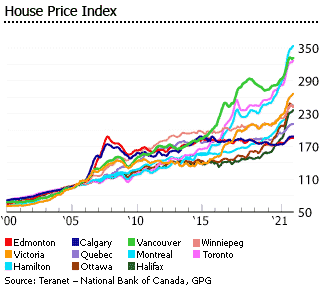

Given the skyrocketing housing equity that we’ve seen over the last 15 years in the majority of Canada’s real estate markets, deciding how to use your housing equity could mean a drastic difference in your quality of life as a retiree.

At the very least, let’s consider how we might use home equity in later life, if we simply ran out of investable assets, and didn’t have a pension or annuities to depend on. We’ll look at three main options when it comes to tapping our home equity.

1) Downsizing in order to fund retirement.

2) Selling our real estate and investing that money in order to provide money for renting in retirement.

3) Using a reverse mortgage or Home Equity Line of Credit (HELOC).

I know that when we talk about our homes that hold decades of memories, we’re not just talking math here. It’s impossible to quantify the psychological considerations for each retiree, but I hope to at least illustrate what options are on the table, so that people can make informed decisions about living their best life in their golden years.

Home Equity in Canada

Seniors have about 68% of their net worth made up of their home’s value according to a 2022 Ipsos poll of 18,000 Canadians. The average for all Canadians was 77%. Statistics Canada, on the other hand, stated that back in 2019, Canadians aged 65 or older had about 37% of their net worth tied up in their residence on average.

You might notice there is a pretty gap in those two estimates. The discrepancy is partially due to the real estate boom (and subsequent pull back) that we saw during the pandemic. It’s also because StatCan takes assets such as private pensions and private corporations into account when calculating net worth.

My educated guess is that the typical Canadian probably didn’t think about the full value of their private pensions and/or corporations when they took the Ipsos survey. But regardless of which statistic is closest to the mark…

That means that for an average Canadian retiree, how to use their home equity in retirement is potentially a more important decision than what they do with their investment portfolio.

If we split the difference between Ipsos and Stats Canada, we come up with an estimate of about $1.15 million in networth for the average Canadian senior, with about half of that tied up in their housing equity.

Quick Note: Given that the StatCan numbers above were gathered before the pandemic-fuelled asset boom, I decided to apply a conservative 25% overall asset-value gain from the beginning of 2020 to the beginning of 2024.

Of course, the average net worth number doesn’t tell us a whole lot. That’s because it is skewed much higher due to a few multi-millionaires and billionaires at the very top. For reference, that same Statistics Canada data set references a median net worth of Canada’s seniors as $543,200 back in 2019. With a 25%-asset inflation to approximate 2024 numbers, that’s about $679,000.

That median net worth represents the Canadian senior right in the middle of the list, if we ranked all Canadian seniors by net worth. It probably comes closer to representing the amount of assets most Canadians have in retirement. It also means that a higher percentage of their net worth is locked up in their housing equity.

Are You Saving Enough for Retirement?

Canadians Believe They Need a $1.7 Million Nest Egg to Retire

Is Your Retirement On Track?

Become your own financial planner with the first ever online retirement course created exclusively for Canadians.

Get $50 Discount With Promo Code MDJ50

*100% Money Back Guarantee

*Data Source: BMO Retirement Survey

Reverse Mortgage vs HELOC vs Downsizing

Downsizing your home in retirement:

The idea here is to sell the family home that has more space than you might need, and then purchase a cheaper home (perhaps smaller, or in a more affordable location). With the gains from your real estate sale, you can free up cash to purchase some “bucket list” experiences in retirement, and/or invest it in order to provide cash flow throughout your Golden Years.

Selling your home and investing the home equity + renting:

Similar to the downsizing solution above, but in this situation we’re not going to purchase a new home. Instead, we’ll use some of the cash flow from our old house sale to fund a rent cheque each month.

The added advantage here is a complete erasure of home-related expenses, such as insurance, maintenance, and property taxes, as well as closing costs on a new property. This often appeals to folks who want to getaway and enjoy a snowbird-type of lifestyle several months a year.

Borrowing through a reverse mortgage or a HELOC:

If the goal is to live off the equity in your home – without having to move – then the two options available are a reverse mortgage or a Home Equity Line of Credit (HELOC). A lot of Canadians find these options repulsive – but they can have a time and a place when used correctly.

Should I Downsize My Home In Retirement?

If you are fortunate enough to have purchased a house in one of Canada’s most attractive cities back in 2000, then you have done very well for yourself. If we look at raw price appreciation, you could probably sell your house for 4x or 5x what you paid for it over 20 years ago. Even once we adjust for general inflation, you’re probably still looking at a “real” value gain of more than three times the original value from your home.

It’s interesting to note, from the data that I’ve looked at, there wasn’t always this great a discrepancy in housing prices in Canadian cities – and they didn’t always appreciate faster than general inflation either. So real estate value growth like that isn’t a prediction for the future, it’s just to set the table to better understand just how much wealth is under your roof.

Of course, if you bought a Toronto home in 1989 and watched prices fall 23% over six years (a lost decade of home value) you likely feel slightly different about the value of real estate.

Now, just because the average Canadian home value went up significantly doesn’t mean that every Canadian has benefited equally, but it certainly provides interesting options for many retirees.

A few key points to consider when looking at selling your current residence (before buying a cheaper one) in order to convert your housing equity into cold hard cash.

- Remember, if you want to live in the same community – so that you can keep your doctor, dentist, social circles, and so on – then you could be buying into the same hot market you’re selling into.

- Closing costs on selling and buying homes aren’t cheap. You’ve got realtor fees, legal costs, land-transfer taxes, title insurance, and more. Perhaps you want some quick renovations on the house to maximize the final sale value? That’ll cost you. By the time that you buy your new place, you could easily be looking at having to spend 4% to 5% of your current home’s equity in order to facilitate the move to a less expensive residence.

- Don’t forget to factor in changes to your monthly budget. It’s probably true that you’ll owe less each month with a smaller and less expensive home when you account for lower maintenance costs, less land taxes, lower utility costs, and lower home insurance premiums. Your bills may not all decrease, however, so do your homework when it comes to condo fees and geographically-impacted cost of living changes, such as grocery prices and increased transportation costs.

Finally, what you do with the money you free up when you’re done selling your old home and buying your new one, is really key. You really want to get the most out of your home equity solution.

If you simply take the money and put it in a high-interest savings account or use it to buy GICs outside of an RRSP or TFSA, then you’re going to pay a lot of taxes and will get relatively low investment returns.

If you have room left in your TFSA, then downsizing to free up home equity becomes more attractive, as your investments can spin off tax-free cash within that tax shelter. Alternatively, I seriously recommend thinking about using the proceeds of your home sale to invest in a Canadian annuity.

Here’s an example: If Jon and Jean sell their mortgage-free 40-year-old family home for $850,000 and move into a $400,000 condo, they might be left with about $400,000 after paying their closing fees and moving costs. Depending on the factors below, the optimal decision for Jon and Jean isn’t an obvious one.

1) If they want to keep their money liquid, and in a very simple mix of high interest savings accounts and low risk investments, they might be able to get a 3% return or so over the next 30 years until they turn 95. If those assumptions are true, then they should be able to pull out about $19,000 per year for the next 30 years. Remember, that $19,000 is not yet taxed and may be lower in value due to inflation. Of course, it’s really hard to know what interest rates will do over the next 30 years!

2) If, instead, John and Jane were to look at getting a joint lifetime annuity at age 65 (giving them the peace of mind that a steady paycheque would be coming in until the day the second partner passed away), then they could count on $24,000 per year for the rest of their lives.

Again, that’s looking at annuity rates in early 2024. You can check out more on investing in annuities in Canada for more information.

In return for the annuitized peace of mind, John and Jane are going to forgo the ability to pass any of that $400,000 downsizing profit on to their heirs – but they would still have the $400,000 condo that their beneficiaries could enjoy tax-free.

Finally, John and Jane could always invest their money into a mix of stocks and bonds, and sell some of those investments each year.

Should I Sell My Home and Rent?

The sell-your-home-and-rent retirement strategy is basically the same as the sell-and-downsize strategy – but on steroids. This would often be considered a little later in retirement, when a retiree is looking to perhaps move closer to family and/or medical care, or into a type of seniors living community.

You’ll likely pay less in closing costs. Now, though, there are no costs associated with buying a home. But in exchange for no closing costs, you’re completely sacrificing home equity in the name of generating income.

One underrated aspect of this strategy is that your net worth is no longer subject to the whims of a local housing market. I’ve long argued that Canadians put way too much faith in the idea that housing markets will always go up.

With the sell-and-then-rent strategy specifically, putting as much effort as you can into reducing realtor fees and then finding the best way to invest your money becomes paramount. That reduction in fees and optimizing your investment decisions becomes essential because the percentages are now being applied to such a large amount of your net worth.

As Globe & Mail finance columnist Rob Carrick pointed out that while GIC rates and annuity rates have climbed quite a lot in the past year, rents in many Canadian cities have increased at an even faster pace.

On a practical level, choosing to sell-and-rent a little earlier in retirement life can mean a decreased workload at a later age, when one might be forced to downsize and move to assisted living. Taking care of the decumulation of possessions and heirlooms might be a relevant consideration for some families.

Additionally, some folks find a lot of value in selling + renting, or selling + downsizing if they still have a mortgage on their home as they enter retirement. Many people experience lower levels of stress by completely paying off debt.

There’s nothing wrong with those choices or priorities, it’s a matter of being honest with yourself, and choosing the option that will allow you to enjoy your hard-earned retirement to the utmost!

Are You Saving Enough for Retirement?

Canadians Believe They Need a $1.7 Million Nest Egg to Retire

Is Your Retirement On Track?

Become your own financial planner with the first ever online retirement course created exclusively for Canadians.

Get $50 Discount With Promo Code MDJ50

*100% Money Back Guarantee

*Data Source: BMO Retirement Survey

HELOC vs Reverse Mortgage

Before we go into reverse mortgages, let’s take a look at an option that many Canadians instinctively reach for when they want to spend some of their housing wealth: The Home Equity Line of Credit – or HELOC.

Canadians who want to borrow quick cash at a low-interest rate to, say, complete a renovation or pay for an unexpected expense, like a broken furnace, are quite familiar with HELOCs. On the surface, using this line of credit seems to make sense for retirees who need a bit of extra cash. They can borrow money at a relatively low interest rate, while at the same time staying in their home. Going forward, perhaps they take some part-time work or cut a little spending to pay down the HELOC. If eventually they feel they’re getting too far behind and the HELOC balance is getting too high, they could always sell their home and immediately pay off the low-interest loan that they had enjoyed, right?

Well… probably not.

It’s possible that a home equity line of credit might work for you, especially if you got it in place before you retired and your bank never bothered to close it or reduce the amount you can borrow. If not, and you still earn an income in retirement, the bank might take that into consideration when deciding if you will be granted HELOC. That said, it’s usually quite difficult for retired Canadians to get access to a HELOC.

Even if you manage to hang on to a HELOC that you set up during your working years, there are some trade-offs to make in exchange for the lower interest rate when compared to the reverse mortgage option.

- Reverse mortgage interest rates can be fixed for 5-year terms, and will give guaranteed amounts that can easily be slotted into a budget. HELOCs’ rates are usually variable, meaning they will go up or down depending on the bank’s prime lending rate. While you can get a home equity line of credit for a specific term, it is fairly uncommon. As many folks have found over the last couple of years, this variability in interest rates means that the interest-only payments can suddenly chew up a much larger amount of your monthly budget than it was supposed to!

- Paying back a reverse mortgage is generally deferred until after death, when the house is sold. Most HELOCs can be called in by the bank (which means immediate forced payment of the debt), have the limit reduced, or have other changes made at any time. (This is often a surprise to many Canadians who don’t understand the fine print that allows banks to do this.)

- With a reverse mortgage, your interest payments can be rolled into the overall loan, whereas HELOCs require interest to be paid monthly – which can put a strain on a retiree’s monthly budget.

- Depending on the terms of your HELOC, if you miss a payment and/or default on the loan, it’s possible you’ll be forced to sell your home, regardless of if you want to leave or not. Reverse mortgages, however, do not include such worst-case circumstances. The reality of being forced to sell your home can leave you or your partner in a tough position if either of you passes away. Such a tragic event could end OAS contribution to the family finances and likely reduce the overall CPP amount you enjoyed to this point, as well.

All of that said, there’s no denying the day-to-day flexibility, low setup costs and 2% to 3% lower interest rate (compared to a reverse mortgage) all make a HELOC the preferred solution for folks who have access to one. Plus it allows them to free up a minor amount of their home equity for short-term use.

Reverse Mortgage vs HELOC Quick Comparison

Let’s compare the similarities and differences between reverse mortgages and HELOCs:

| Reverse Mortgage | HELOC | |

| Can I even get this type of loan in retirement? | Very likely approved – as long as you own your home. | It’s unlikely that a bank will approve a HELOC without being able to verify a source of income. It’s possible that you had a HELOC before retiring and can retain access to that HELOC once you retire. Retirees with defined benefit pension payments might have an easier time qualifying. |

| Variable interest rate (as of 2024) | 9.45% | 7% |

| Setup costs | Approx. $2,500 | $0 |

| Can the bank force an immediate repayment of the loan (possibly forcing a selling of the house)? | No. | Yes – and may require selling of the home. |

| Do I need to make interest payments each month? | No. | Yes. |

| Can I set up convenient monthly “retirement paycheque” payments that arrive like clockwork in my chequing account – making monthly budgeting a lot easier? | Yes. | No. |

Reverse Mortgages in Canada

I have to admit that I came to the idea of reverse mortgages with typical Canadian skepticism.

Canadian Financial Summit guest Robb Engen basically summed up the Canadian stereotype of reverse mortgages by saying they were, “viewed as a financial sin”.

While I’m still partial to the sell-plus-downsize solution in most cases, I’ve been convinced that the reverse mortgage option is a valid one for Canadians in very particular circumstances.

Before we dive in on which situations a reverse mortgage is acceptable, let’s look at what exactly a reverse mortgage is:

- There are two companies in Canada who offer a variety of reverse mortgage options: HomeEquity Bank and Equitable Bank. The “Big Banks” don’t offer reverse mortgages.

- The goal for someone using a reverse mortgage is to be able to spend some of the value that they have “locked in” their primary residence – while still “aging in place” or living in their home for as long as possible.

- In order to facilitate “freeing up your cash”, the two financial institutions listed above present you with a mortgage contract stating you can borrow up to 55% of the value of your home from them. Exactly how much of that maximum you’re allowed to borrow is determined by your age, the home’s value, and which of the two lenders you choose.

- You can choose to take all of the maximum loan offered right away as a lump sum, or you can choose a contract that lends you a little bit at a time through sending you a monthly payment. You can also choose a combination of the two options. If you take the lump sum payment, remember that you now need to pay those substantial interest rates on that larger amount of money. So, one is almost always better off choosing the monthly payment option. These monthly payments are a tax-free source of income.

- You can pay back the money you borrow at any time (more details below), but generally, most people who access a reverse mortgage choose to pay the interest by borrowing even more house equity. This final outcome for the borrower means they get a cheque each month and don’t have to worry about interest rates going up or down, or paying interest out of their monthly budget.

- The lender cannot sell your house out from under your feet, even if you reach your borrowing limit. Instead, the loan comes due and must be repaid if you move out, sell the home, pass away or you fail to pay your property taxes.

- If your spouse passes away before you, you will continue to be the borrower and not much changes as long as you continue to live in the house.

- However, if your spouse moves into long-term care, that could trigger a repayment of the reverse mortgage, as per a clause in the contract. That’s a unique situation that deserves significant consideration, as it can essentially force the spouse who did not need assisted living care to sell the home within a relatively short period of time. The same principle applies in divorce scenarios.

- Generally, reverse mortgage contracts last for five years and will need to be refinanced, but like your regular mortgage terms, you can decide on a shorter term if you wish.

Setting up a reverse mortgage in Canada isn’t free. The lender charges about $2,500 in planning and legal fees to set up the agreement. I have heard anecdotally about individuals negotiating the removal of these upfront costs, so it doesn’t hurt to ask.

The real overall cost of the reverse mortgage (and the number you need to pay particular attention to) is going to be determined by the interest rate. That rate dictates how much of your money goes to the bank each month, and how much of your hard-won home equity you’ll be sent.

In 2024, 5-year reverse mortgage rates were around 8%.

So, for example, if you were 80-years-old, owned a home worth $700,000 and took out a reverse mortgage, you might be eligible to borrow up to $385,000. If you opted to have $2,000 sent to your chequing account each month (with no lump sum upfront), at the end of the 5-year term, you’d have received $120,000, but you would have racked up about $28,000 in interest costs – meaning that you’d have about $237,000 of borrowing room left. That’s “ assuming your house didn’t go up in value during those five years.

Reverse Mortgages: The Pros

- If your goal is to stay in your home as long as possible, a reverse mortgage might be worth paying the higher interest rate. It’s a question of how much value you put on staying in your current home – no matter what.

- Reverse mortgages can allow you to have a higher standard of living in your Golden Years.

- Unlike a HELOC, you don’t have to pay the interest on the loan each month.

- The money you get from a reverse mortgage is not taxed and it does not affect your OAS or GIS eligibility.

- The lump-sum versus annual versus monthly payment possibilities (or a combination of the two) are a nice flexible option to have.

- Once set up, a reverse mortgage is very simple (at least until it comes time for the new term). This ease of use increases in value as we age.

- If your house value goes up as you are receiving payments, you benefit from increased housing equity, because you still own your home. This means that, due to the eventual house sale being worth more, you can either borrow more, and/or that your estate will be worth more.

- If you end up staying in your house for quite a long time after maxing out your reverse mortgage loan, it’s possible that the interest you’re charged could end up being more than the house is actually worth. In that situation, you would benefit from the law that your estate will never have to repay more than the total value of the house.

Reverse Mortgages in Canada: The Cons

- The interest rate! There is just no way around this one. Reverse mortgage loans charge a premium interest rate due to their unique nature. It’s also likely due to the fact there isn’t much competition for reverse mortgages in Canada. Usually they’re going to charge 2% to 3% more than a HELOC would.

- Set up costs are a decent chunk of change – $2,500 and up.

- You must stay on top of the maintenance, property tax, and housing insurance for your home, or it can void your reverse mortgage contract. That could cause you to be on the book for the entire loan much sooner than expected!

- Remember, that just like with a typical mortgage, you could be at the mercy of higher interest rates depending on the length of your initial mortgage term and if you chose a variable interest rate.

- Let’s assume you choose the payments option (instead of a larger lump sum) the longer you keep the reverse mortgage, the more those interest rates are going to bite. That’s because they’ll be applied to a bigger and bigger amount of money borrowed.

- If you take the lump sum up front, pay particular attention to that interest rate because it’s going to cost your estate a substantial amount of money. There are very, very few situations when taking the lump sum makes sense. Perhaps one such situation would be if the borrower has high-interest credit card debt that needs to be paid off quickly or another high-interest debt situation.

- Once you set up a reverse mortgage, the HELOC option is off the table. You won’t be approved for a HELOC with a reverse mortgage.

- It may take longer to completely settle your estate given the added layer of complexity with a reverse mortgage.

- You and/or your estate are at the mercy of the local market when it comes to the value of your house sale. If you’re forced to sell for medical reasons or pass away, the market doesn’t care about your timing. If the local house prices are low, your house may have to be sold for a less than favourable price.

How Do I Pay Back a Reverse Mortgage Loan?

When it comes to paying back a reverse mortgage loan in Canada you and/or your heirs basically have three options:

1) You can write a cheque at any time to pay off the loan. There are prepayment penalties (similar to those found in regular mortgages) which might be applied. This is especially true if you wish to fully repay everything in the first few years of a long reverse mortgage term.

2) The lender can step in and force the sale of the house once you pass away or move away.

3) The most common way to pay back a reverse mortgage loan is to make the choice to sell the property once you either move or pass away. At that point the lender would step in and take the amount you had borrowed (including interest) before you or your estate would get the proceeds of the house sale.

One of the obvious major benefits of a reverse mortgage is that you don’t have to make any mortgage and/or interest payments for the rest of your life. However, you need to keep in mind that the entire value of your loan will need to be repaid right away, if you are forced to move for any reason, such as family circumstances, health concerns, and so on.

Final Thoughts on Canadian Reverse Mortgages

While I’m still not a fan of reverse mortgages for the majority of Canadians, I have to say that I’m less of a skeptic after thoroughly researching the product.

Wade Pfau, a retirement expert down in the US has written a ton on reverse mortgages, and most of the principles can be applied to Canadians as well. At the end of the day, he takes the approach that your house is no different than any other asset you have worked hard for – it should be yours to do with as you want – guilt free.

When deciding how to best use your home equity, pay attention to the numbers, and don’t be afraid to put the same (or more!) value and attention on personal enjoyment of life, as you do on leaving a generous inheritance.

I believe the ideal usage scenario for a reverse mortgage is to leave the option as a “break-in-case-of-emergency asset.” If the higher interest rates only have five years or less to bite, the tradeoff of paying more interest – but getting to stay in your own home and not pay realtor fees – is not a bad deal.

In other words, if I was creating my retirement plan, I’d feel comfortable creating a plan that could leave me with $0 at the age of 90 or so – if I had some home equity that I could tap into over the next 5-10 years. Realistically, it’s quite likely that if I did not pass away during that time period, I would need to move into some sort of assisted living facility and would need to sell the house anyway.

If you think that you might need some income help for more than the next 5-10 years, I’d look at an option that involves selling the home first. The compounding interest rate will just have too much time to gobble up your home equity at that point. And the risks of the interest rate going up a lot between reverse mortgage terms are quite real.

Because of how quickly compound interest can add up, I wouldn’t recommend reverse mortgages for younger retirees or retirees with substantial longevity expectations.

Having a plan for how you will budget and spend the reverse mortgage money, as well as a thorough understanding of the potential worst-case scenario are essential before you sign on the dotted line.

Three More Home Equity Option

A few other unique solutions that I’ve come across include:

Rent out your old home and use the rent money to pay for a cheaper place:

I’m not a huge fan of this one, as being a landlord in your later years is not a great idea for most Canadians. People fail to appreciate the risk of having so much of your net worth still tied up in a single asset, and then you have to worry about all the potential problems that renters bring to the table as well.

That said, for folks determined to preserve the family home as an asset to be passed down, this option might work. CFP and financial columnist Jason Heath outlines in this article how the proceeds of the eventual house sale might still be allowed to bypass capital gains taxation.

Propose a “sell-and-leaseback”:

If you know someone wanting to invest in real estate, looking for a low-risk way to get their feet wet, then it’s possible an ideal solution can be reached for both parties. This way, rather than pay the bank interest rate, you can get access to all of your home equity up front. Plus, you can give the trusted new landlord a great deal on a housing purchase.

This setup can also be used to eliminate almost all of the closing cost issues that can go with selling a home. You get to stay in your home community where you’ve built your life, and the new landlord gets a low-risk long-term client that they know can make rent payments right from day one.

Of course in a situation like this, it’s essential for both sides to do their due diligence, as it can be a major mental shift to go from homeowner to renter. Details of the rental contract – such conditions for raising rent, maintenance responsibilities, long-term visitor rules and terms of eviction – should all be laid out in advance of making this irreversible decision.

Build a laneway house or granny suite:

There are many ways to describe building a small detached house on your property. Sometimes referred to as laneway houses, granny suites, or simply “infill housing,” these all mean the same thing.

Whatever you call it, this is when someone builds a smaller house on the property they already own with the intent to move into it when they retire. They would continue to own both buildings, and use the cash flow from renting out their original house to pay for their day-to-day living expenses.

This solution generally works best for folks who are handy, or are friendly with someone in the construction business, and consequently can keep building costs down.

On the bright side, you get to pick your neighbours. You’ll find out what the dark side looks like if you choose wrong, and now have not only awful neighbours next door, but also awful tenants that you can watch someone destroy the home you lovingly crafted over the years? You also really put all your eggs in one basket, as far as your net worth being tied to the value of one specific property.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?